In general, I tell most peeps to start with the Chase Sapphire Preferred® Card. It’s the quintessential points card, even after all these years. And you can transfer the points you earn directly to airline and hotel partners at a 1:1 ratio – most of them instantly.

If you spend a lot in travel & dining, or if you want lounge access, spring for the Chase Sapphire Reserve®. Here’s how to find the break even point with the annual fees ($95 for the Preferred and $550 for the Reserve, but you get a $300 annual travel credit).

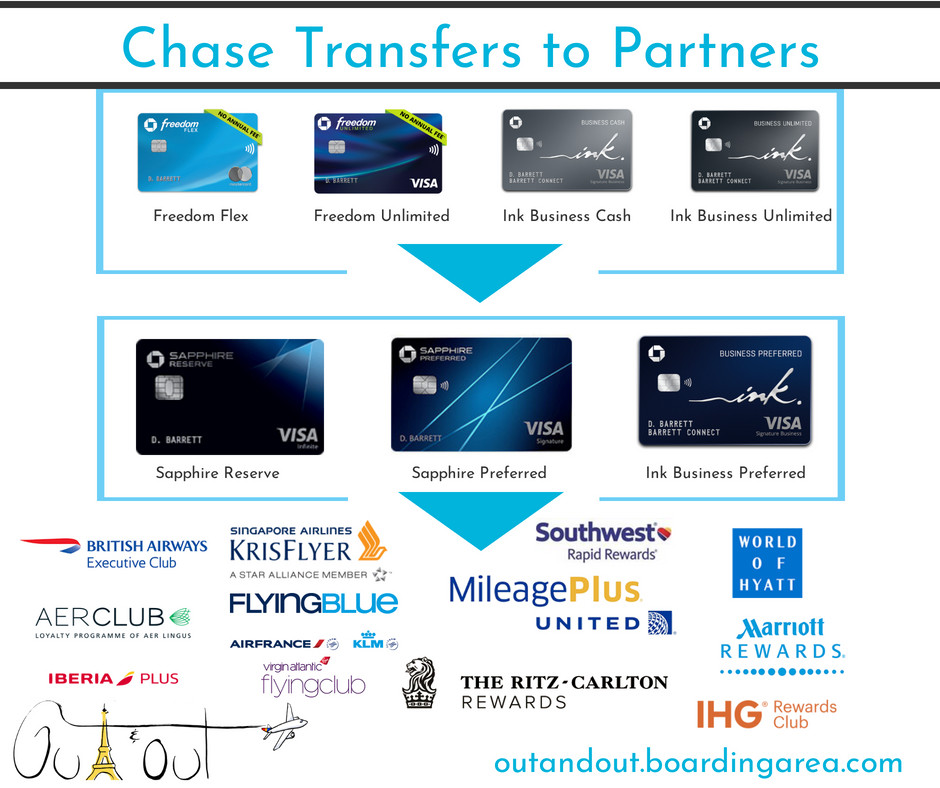

Already have one or the other? Then get the Chase Freedom Flex℠ or Chase Freedom Unlimited®. The only difference is the bonus categories. Chase Freedom Flex℠ has 5% rotating quarterly categories. Chase Freedom Unlimited® earns 1.5 points per $1 spent – and you can combine the points with your Sapphire card points. So they’re an easy way to boost your Ultimate Rewards points balance fast. And both cards have a $0 annual fee!

If you’re looking for a small business card, get the Ink Business Preferred® Credit Card or Ink Business Cash® Credit Card. The former earns points that transfer directly to travel partners and has a $95 annual fee; the latter requires you to have a premium Chase card to access travel partners, but a $0 annual fee.

If you just want to earn cashback, spring for any of the cards with a $0 annual fee (Chase Freedom Flex℠, Chase Freedom Unlimited®, or Ink Business Cash® Credit Card).

But to get awesome travel (think international Business Class flights, upscale hotels, and cheap flights to Hawaii), you want one of the annual fee cards (Sapphire Preferred, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card). The annual fees are worth it for the huge travel savings you can get. It’s how I got a $2,000+ Mexican vacation for $90!

Which Chase card?

Here’s how it works and which partners you can access:

Pair Chase cards to earn even more points

Of course, ALL of these cards are subject to Chase’s 5/24 rule. That means if you’ve opened 5+ cards from any bank in the past 24 months, you will likely NOT be approved (although some small business credit cards don’t count).

And because Chase has the best travel rewards cards on the market, you want to get as many as you can before you hit that limit. Because after that… you’re basically locked out from getting most Chase cards (with a few exceptions for some co-branded cards).

Sapphire Preferred or Reserve?

The Chase Sapphire Reserve® has a $550 annual fee. Woof, right?

But consider you get:

- $300 annual travel credit per cardmember year

- Unlimited visits to Priority Pass airport lounges

- 3X points on travel & dining

The $300 travel credit alone brings the annual fee down to $150, assuming you’re going to spend on travel anyway.

I visited the Wingtips Lounge at JFK Terminal 4 before a Virgin Atlantic flight for free with my Priority Pass

In that light, $150 isn’t much more than the $95 annual fee on the Chase Sapphire Preferred® Card – plus you earn 3X on travel & dining (as opposed to 2X) and get a Priority Pass Select membership, which is incredibly useful if you don’t already have one.

But if you don’t want to commit to the bigger annual fee, the Chase Sapphire Preferred® Card is still the best card for beginners.

Do you prefer cashback?

The Chase Freedom Flex℠ and Chase Freedom Unlimited® are both excellent supplements to either Sapphire card. Because you can combine all your points and send them to travel partners.

But, if you really just want to earn cashback, I’d go with the Chase Freedom Flex℠ over the Chase Freedom Unlimited®. Only reason being there are 2% cashback cards out there, so you can do better than Freedom Unlimited’s 1.5% cashback rate.

Want a card for your small business?

If you want a small business card, the Ink Business cards are both excellent. But the bonus categories and annual fees are very different.

With the Ink Business Preferred® Credit Card, you earn 3X points on the first $150,000 spent in combined purchases in the following categories each account anniversary year in:

- Travel

- Shipping

- Internet

- Cable

- Phone services

- Advertising

And 1X everywhere else. There’s a $95 annual fee.

You can buy a ton of stuff at office supply stores. Or you might spend more on advertising or shipping

With the Ink Business Cash® Credit Card, you earn 5X points on the first $25,000 spent in combined purchases for:

- Office supply stores

- Internet

- Cable

- Phone services

And 1X everywhere else. There is NO annual fee on this card.

So evaluate which categories are most useful and how much you spend in them per year. You can’t go wrong with either – it comes down to how useful the bonus categories are for you.

Don’t forget the signup bonus!

All of these cards have nice bonuses when you meet the minimum spending requirements.

It’s always nice to earn extra points when you open a card. But it’s worth considering the minimum spending, too. Right now, both Ink cards have best-ever welcome offers. So it’s definitely a good time to pick up either of those.

The bonus and minimum spending on the Sapphire cards are the same – so it’s really about which card is better for your spending habits. Ditto for the Freedom cards.

Bottom line

Chase cards are a huge part of every points collector’s wallet for ongoing spending. Here are links to learn more about each of the Ultimate Rewards cards:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Chase Freedom Flex℠

- Chase Freedom Unlimited®

- Ink Business Preferred® Credit Card

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

Again, I usually recommend starting with a Sapphire Card, adding a Freedom or Freedom Unlimited (or both!), then a small business card. Everyone has different goals, but all of these cards are a great place to start. And actually, the best place to start – because once you open 5 cards in a 2-year period, you can’t get them any more.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] Chase Sapphire Preferred– Earn50,000 Chase pointswiththe BEST card for beginners […]