This one’s for peeps who think they can’t earn signup bonuses because the minimum spending requirements are too dang high.

When you think about, spending $3,000 (the usual spending requirement) is, of course, $1,000 per month for 3 months – or $250 per week. These cards tend to have the highest bonuses.

The problem with bank marketing is they throw out huge numbers and scare people off. But when you break it down, it appears way more manageable.

In any regard, there are plenty of cards with much lower minimum spending requirements. And some of them are genuine keepers!

Or rather, they look high – but most of them aren’t that bad once you break it down

Let’s look at 10 of the easiest signup bonuses you can earn.

10 cards with low spending requirements

If you’re in the “no way, no how” camp for spending $1,000+ to earn a signup bonus, you can still earn miles or cashback. If anything, you’ll see how easy it can be. And when you feel more comfortable, or you’re able to spend more (or have to spend, oy), you can go for a bigger offer that’s way more valuable.

But for now, these deals are easy and/or a great place to begin.

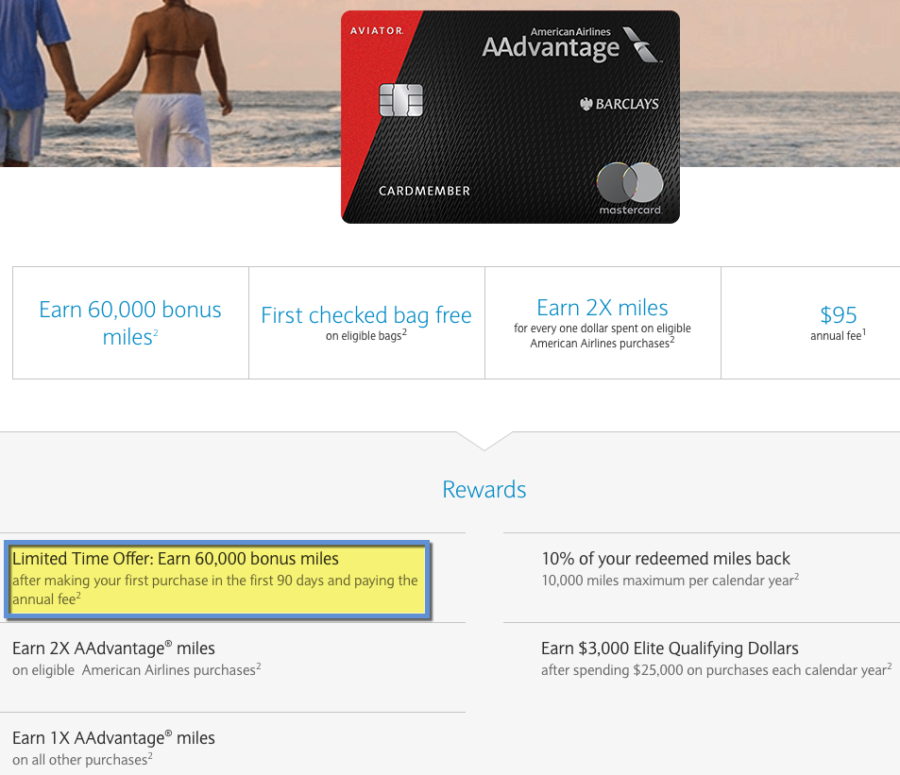

1 and 2. Barclays American Airlines cards – personal and small business

- Link: Barclays American Airlines personal and small business card

This is just too good. Best-ever offers and only 1 purchase required. You can earn these bonuses for buying literally any item from any store – a bottle of water, a parking pass, whatever.

Then you’ll have 60,000 American Airlines miles to play with. That’s enough for a one-way Business Class ticket to Japan! 😲

It doesn’t even any easier – or better – than this! A huge amount of valuable miles for a cup of coffee – enough for 2 round-trip domestic award flights

I value this bonus for an astounding $1,200 – and potentially much more.

Keep in mind, Barclays will only approve you for 1 or 2 cards per year. And if you’ve had either card before, you can earn the bonus again. Just be sure the card is closed before you open it again.

3. Citi American Airlines MileUp

That’s enough for a one-way short-haul flight under 500 miles. And nearly enough for a one-way anywhere in the mainland US.

I’d peg this bonus for $200, which isn’t bad considering there’s also no annual fee.

You’ll earn 2X American miles per $1 spent at grocery stores. And 1X everywhere else. So it’s a great card to use for grocery shopping, especially if you don’t have another card that earns more.

4. Delta Blue Amex

| Blue Delta SkyMiles® Credit Card from American Express | 10,000 Delta miles |

|---|---|

| • 2X Delta miles per dollar spent at restaurants worldwide, and on Delta purchases |

| • $0 annual fee | • $500 in purchases on your new Card in your first 3 months |

| • Learn more here |

Same deal here: 10,000 Delta miles after spending $500 in purchases on your new card in your first 3 months. There’s no annual fee, and you get access to valuable Amex Offers.

Plus, Amex sometimes awards bonus miles for upgrading. Or you can keep the card forever to help age your credit accounts.

You’ll earn 2X Delta miles when you dine at US restaurants, and when making a Delta purchase (and 1X Delta mile on other purchases). The welcome bonus is sometimes enough for a one-way award flight. And considering Delta miles never expire, you can hold on to them for as long as you want.

5 and 6. Chase Freedom or Chase Freedom Unlimited

Both of these cards are excellent gateway cards for, and pair amazingly with, other premium Chase cards.

I’ve used Chase points with premium Chase cards to stay in Hyatt hotels all over the world, including Puerto Vallarta. The Freedom and Freedom Unlimited are a great place to start with Chase

Chase won’t approve you for either one if you’ve opened 5+ cards from any bank in the last 2 years.

Both are relatively easy to get approved for if you’re concerned Chase won’t give you, say, a Sapphire card. Chase is definitely a bank you want to get on good terms with, because they tend to have the best rewards cards on the market.

7. Capital One Quicksilver Cash Rewards

- Link: Capital One Quicksilver Cash Rewards card – learn more here

You’ll earn a $150 cash bonus after you spend $500 on purchases within 3 months from account opening. This card also earns a flat 1.5% cashback on all purchases, and there’s no annual fee. While that’s not as stellar as some 2% cashback cards, it’s a decent place to begin if you’re new to cards, and want to start building your credit.

Plus, $150 is a good bonus for a card that’s free to keep long-term. You also can’t beat the simplicity of Capital One rewards, which lots of folks value for a lot.

8 and 9. US Bank Cash+ or Cash 365

- Link: US Bank Cash+ card

- Link: US Bank Cash 365 card

Both of these cards come with a $150 bonus after spending $500 on purchases in the first 90 days of account opening.

The Cash+ card earns:

- 5% cashback on the first $2,000 in eligible purchases each quarter on the 2 categories of your choice

- 2% cashback on 1 everyday category of your choice

- 1% cashback on all other purchases

These free-to-keep cards can be your gateway to the incredible US Bank Altitude Reserve card and a free checking account

And the Cash 365 card earns a straight 1.5% cashback on every purchase.

And while the signup bonus is nice, it’s more about the long play with US Bank.

Because you need an existing relationship to apply for the US Bank Altitude Reserve card, which has a sign-up bonus worth $750 toward travel, a $325 annual travel credit, and earns 3X points worth 1.5 cents each (4.5% cashback) on mobile purchases (including at Costco) and travel.

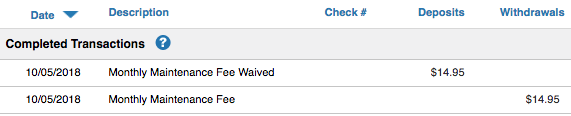

I’ve never paid a checking account fee with US Bank thanks to having their cards

Plus, checking account fees are waived when you have a US Bank credit card – and you can sometimes get a bonus just for opening one.

If your end goal is the Altitude Reserve card, these cards are a great place to start. US Bank actually has a few worthwhile cards, and they’re good options if you’re tapped out with other banks (like me 😫).

Bottom line

The other great thing about these cards is you can often get approval with limited credit history. For example, one of my friends with a short credit history was instantly approved for a Chase Freedom card. And they’re a good way to start a relationship with their respective banks:

- Barclays American Airlines personal and small business card

- Delta Blue Amex – Learn more here

- Chase Freedom or Chase Freedom Unlimited

- Capital One Quicksilver Cash Rewards card – learn more here

- US Bank Cash+ or Cash 365 card

Only the cards from Barclays have an annual fee – all the others have a $0 annual fee. If you can only spend $500 (or just make a purchase), getting 60,000 American Airlines miles, or a bonus worth $200 in miles or $150 cashback as a reward is pretty sweet.

I actually have 2 of the cards on this list (Barclays American Airlines Red and Chase Freedom) and keep them year after year. So it’s possible to get more than one.

What’s your favorite card on the list? Are there any you’d add?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

regarding the barclays…did you mean can – or can’t – ? :

“And if you’ve had either card before, you can earn the bonus again.”

thanks!

You ARE able to earn the bonus again. 🙂 If you already have the card, just be sure to close it before you apply again.