Everyone should have at least 1 credit card without an annual fee. When a card is free to keep forever, you never have to second-guess it. And the card works its powers on your credit report to increase available limits, decrease utilization, and help boost the average age of all your accounts.

My oldest credit card is from 2002 and has no annual fee. No matter how many new cards I open, I’ll always have a 16-year-old card to raise the average age of my accounts higher and therefore, my credit score.

When a card has a fee, it’s harder to justify keeping it – unless you get outsized value.

But having a card without an annual fee doesn’t mean you have to give up solid returns. All of the cards on this list can get you 2% back or better.

Chase Freedom is one of the best no annual fee cards – up to 30,000 Chase Ultimate Rewards points per year from 5X earning! I’ll share my top faves

Here’s my list.

9 best no annual fee credit cards

For the purpose of this list, I only included cards with the best rewards. Getting 1.5% cashback isn’t good enough for a card to get a spot – unless you can somehow increase the value.

A few of these cards earn points or miles. So know I personally value all my points and miles at 2 cents each, or a 2% return on spending.

That’s because I’d never use my points for award travel if they’re not worth at least that much against the paid price. No points “valuations” here like The Points Guy and others 🙄 – it’s a flat 2 cents, except for certain hotel points (like Hilton and Marriott).

So that’s my spiel. Onward!

Personal cards

The first 7 are personal cards.

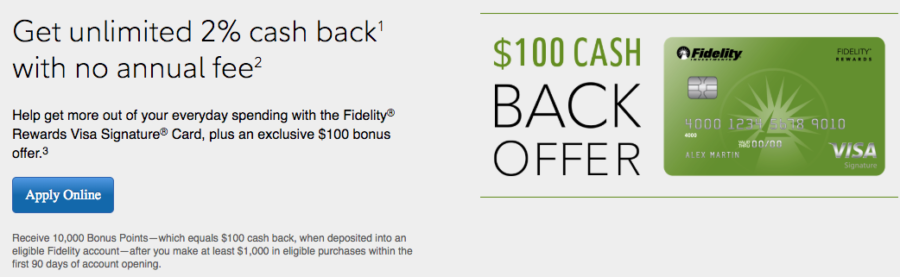

1. Fidelity Visa

| Fidelity Visa | $100 cash |

|---|---|

| |

| • No annual fee | • $1,000 on purchases within 90 days from account opening |

| The best cashback card out there | • Learn more here |

This is my favorite cashback card – period.

It earns 2% cashback on every purchase. The catch, if you’d call it that, is you have to deposit rewards into a Fidelity account. But considering Fidelity has some of the best index funds around, the cashback you earn can grow for years and years – tax-free, even, if you place them in a Roth IRA account.

Or, you can get a Fidelity Cash Management account for completely free and cash them out any time.

I love this card because of the simplicity: 2% back, send rewards in your account, and earn rewards at the close of each billing cycle. If you want a straightforward rewards program and don’t want to deal with points or award bookings, this card is amazing. And it has a $100 sign-up bonus right now!

2. Citi Double Cash

Some peeps like this card better than the Fidelity Visa. They both have their quirks, but work out to have the same rewards rate. It just depends if you want to transfer rewards to a Fidelity account or wait to get the full 2% back. As they say, potato… oh, you know the rest. 😉

3. Citi American Airlines MileUp

There’s the Citi American Airlines MileUp card, which earns 2X American miles per $1 spent at grocery stores. And 1X everywhere else.

It has a sign-up offer for 10,000 American miles, and a $50 statement credit, after making $500 in purchases within the first 3 months of account opening. That’s a good deal for a card with no annual fee!

4. Delta Blue Amex

| Blue Delta SkyMiles® Credit Card from American Express | 10,000 Delta miles |

|---|---|

| • 2X Delta miles per dollar spent at restaurants worldwide, and on Delta purchases |

| • $0 annual fee | • $500 in purchases on your new Card in your first 3 months |

| • Learn more here |

If you prefer Delta miles, consider this one instead. You’ll earn 2X Delta miles when you dine at US restaurants, and when making a Delta purchase (and 1X Delta mile on other purchases).

There’s also a welcome offer for 10,000 Delta miles after spending $500 in purchases on your new card in your first 3 months. You can always upgrade the card down the road if you want to earn more/do more with it.

At this point, I want to mention why I’m NOT including more airline cards:

- United has a no fee option, the TravelBank card, but the returns don’t earn it a spot on this list

- Southwest doesn’t have a no-fee option

- Neither does Alaska

- JetBlue does, but their route network is limited

That said, the 2 I’ve included have good returns considering there’s no fee to keep them. Plus, the sign-up bonuses are actually pretty good. I value them at $200 each.

5 and 6. Chase Freedom Flex℠ or Chase Freedom Unlimited®

Both of these cards are great. You might even consider getting them both. Chase won’t approve you, though, if you’ve opened 5+ cards from any bank in the last 2 years.

If I could have them both, I would. As it stands, I have the Chase Freedom Flex℠ – which is actually my oldest card (the one from 2002). It earns 5X Chase points in rotating quarterly categories, which in the past have included gas stations, restaurants, Amazon, and currently include wholesale clubs and department stores through the end of 2018.

If you don’t like categories or keeping track, the Chase Freedom Unlimited® earns a flat 1.5X Chase points on all purchases, which you’ll notice is under my 2% return threshold.

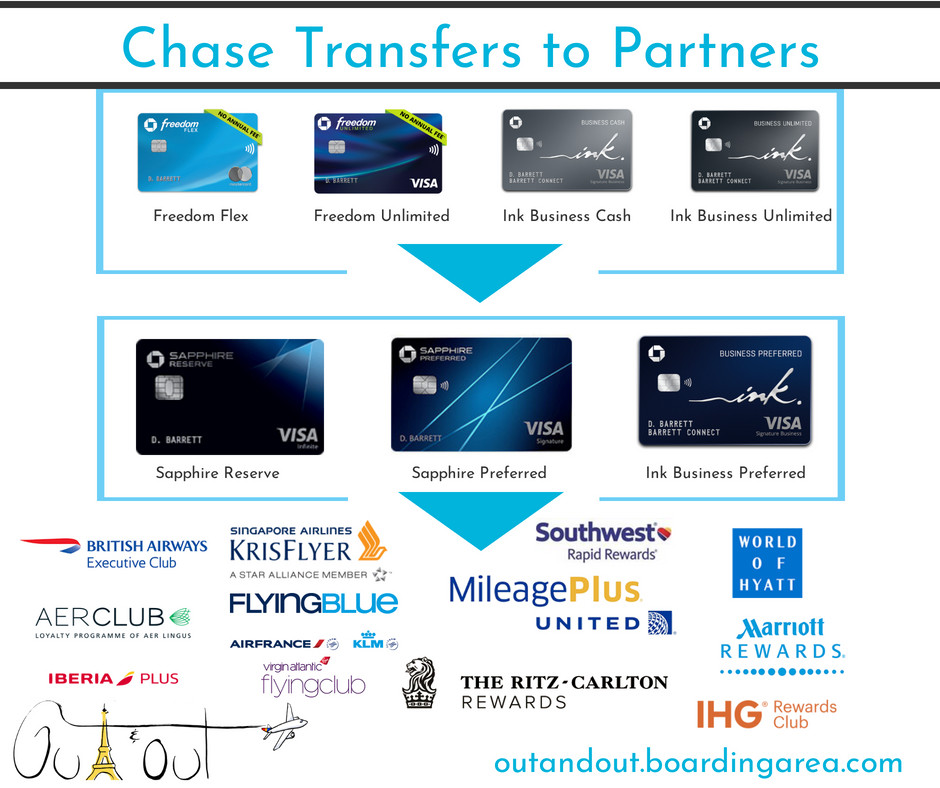

Pair Chase cards to earn even more points

But when you pair it with other Chase cards, you can transfer those points to travel partners. Which, at a 2 cent per point rate, makes the return more like 3% back on every purchase, and that’s incredible.

Even if you only keep the Chase Freedom Flex℠ card for its 5X categories, that’s reason enough – earning 5% back in popular categories when you activate the bonus is freaking awesome.

If you had to pick just one, I’d say go for the Chase Freedom Flex℠ if you like the 5X categories, or the Chase Freedom Unlimited® if you prefer a simpler rewards structure.

Small business cards

I’d be remiss if I didn’t mention these 3 excellent small business cards.

7. Blue Business Plus Amex

| Blue Business Plus Credit Card | 10,000 Amex Membership Rewards points |

|---|---|

| • 2X Amex Membership Rewards points on all purchases on up to $50,000 in spending per calendar year • No bonus categories to think about or activate and NO annual fee • Can transfer the points you earn to Amex travel partners |

| • $0 annual fee (See Rates & Fees | • $3,000 in eligible purchases on the Card within your first 3 months of Card Membership |

| • This is by far the best card for 2X points on all spending | • Learn more here |

This card earns a flat 2X Amex Membership Rewards points on every purchase, up to $50,000 per calendar year. And you can transfer them to travel partners like Air Canada, ANA, Delta, and Singapore Airlines. I use it for all my non-bonus spending. It’s a mainstay in my wallet and I love love love this card.

The rewards structure is strong and simple, and Amex Membership Rewards points have a gazillion amazing uses. The fact that it has no annual fee AND lets you access travel partners is awesome. A forever keeper.

And, it won’t count against your Chase 5/24 status when you open it!

8 and 9. Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card

Think of these as being the same as the Freedom Flex and Freedom Unlimited (5X on the Cash and 1.5X on the Unlimited), but for small businesses.

The Ink Business Cash® Credit Card earns:

- 5X Chase Ultimate Rewards points on the first $25,000 spent on internet, cable, phone service, and at office supply stores, each account anniversary year

- 2X Chase Ultimate Rewards points on the first $25,000 spent at gas stations and restaurants, each account anniversary year

- 1X Chase Ultimate Rewards point on all other purchases

And the Ink Business Unlimited® Credit Card earns 1.5% cashback on every purchase.

Again, it just comes down to if you like the bonus categories, or want an easier rewards program. Both are excellent cards, and again – the sign-up bonuses are incredible. And you can pair these cards with other Chase cards to amplify the rewards and access travel partners, which raises their earning levels to well over 2% back.

Bottom line

I have 3 of the cards on this list: Fidelity Visa, Chase Freedom Flex, and Blue Business Plus Amex. I keep them all because they’re free to keep. But more importantly, I use them to access great rewards on my spending.

Ignore other cashback cards that limit you to under 2% returns. There’s no reason you can’t get 2+% back on every purchase.

If want a card without an annual fee, I’d heartily recommend:

- Fidelity Visa – Learn more here

- Delta Blue Amex – Learn more here

- Chase Freedom Flex℠ or Chase Freedom Unlimited®

- Blue Business Plus Amex – Learn more here

- Ink Business Cash® Credit Card or Ink Business Unlimited® Credit Card

These are the best out there. No Wells Fargo Cash Wise, no USAA Rewards. Just these.

Do you agree with my picks? Are there any you’d add to the list?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] In any regard, there are plenty of cards with much lower minimum spending requirements. And some of them are genuine keepers! […]