Dear light of heaven, I love Costco. Whereas to some it can seem like a gigantic warehouse with narrow aisles stacked to the ceiling with pallets, to me it’s a veritable wonderland.

I love a good deal, and the best deals are often buying in bulk. When I mention I’m a Costco member, I’ve gotten scoffs and “Yeah but I don’t need 25 rolls of paper towels and 8 dozen eggs [or some other exaggeration]. Plus, where would I put it all?”

Ummmm… Costco was the cheapest place to shop in New York City, honey. If I can find space in a tiny Brooklyn apartment to store extra items and save some cash, you can too. And that’s what it’s all about: saving cash.

In my element

Admittedly, Costco isn’t always the best deal. Sometimes they try to pull one over on ya and slip in some regular-priced stuff. But I don’t blame ’em for trying to make profit. Because when the deals are good, hoooo boy are they stellar (find me a cheaper avocado and I’ll eat my hat, and bananas cheaper than Trader Joe’s). That’s what keeps me shopping at Costco year after year: THE DEALS.

On top of already great prices, I’ve found ways to push them even further by making sure I always get a discount. 2% off, 5% back, even 10% rebates in some cases when I’m in the mood to plan a big shopping trip.

Here’s how I save every time I shop at Costco.

Stack these offers to build your own discounts at Costco

Y’all know I love a good stack (that means combining a bunch of small discounts that add up to BIG discounts). The more you stack, the more you save.

You got this! Save that money!

You’ll be happy to know a lot of these offers are completely automated after you set them up just once.

1. Save 1% with the Spent app

- Link: Download Spent

Y’all prolly think I just sit around with a ton of apps on my phone cuz I’m always recommending them. But free money for downloading something? I’ll never turn that down.

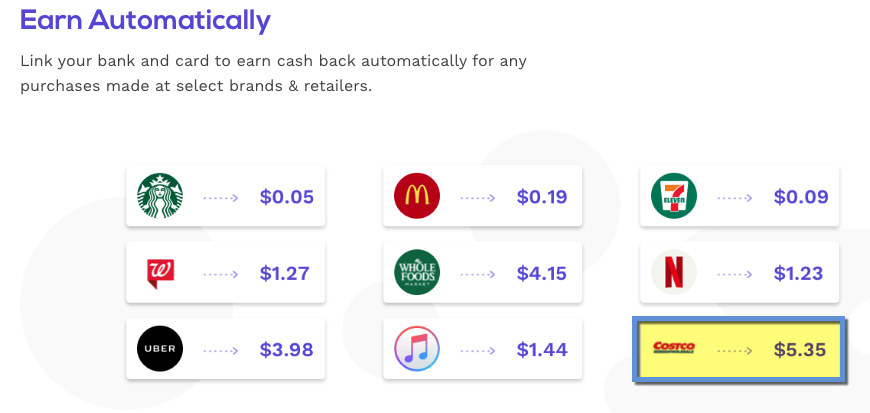

You can get 1% back at many popular retailers, including Costco

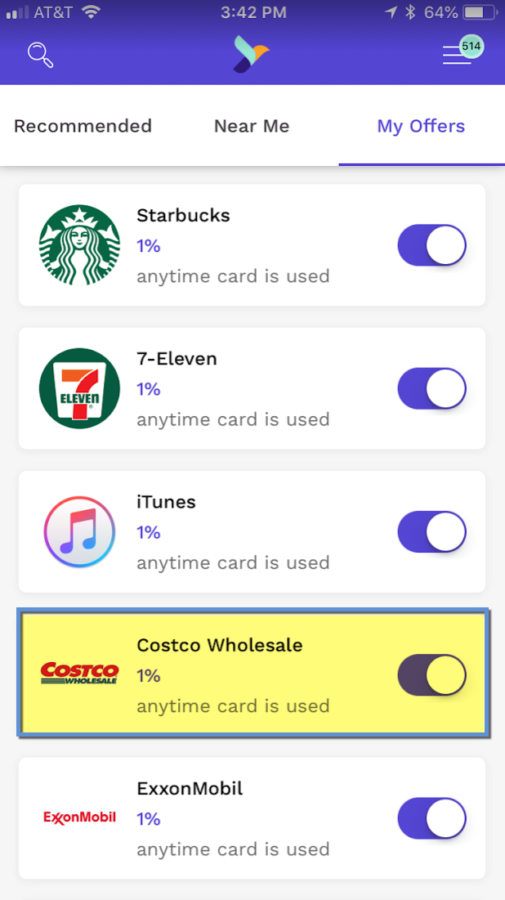

With the Spent app, you need to plug-in your banking information one time. It will track your transactions and add 1% cashback when you activate offers on the app for popular merchants, including Starbucks, Uber, Whole Foods, Netflix, and Costco.

(I also have 1% cashback at Kroger, Shell, Chick-fil-A, and Home Depot in my offers.)

Be sure to activate the offer in-app

You can withdraw your earnings when you hit $20. At a 1% earn rate, you’ll need to spend $2,000 to get $20 back.

But:

- It all adds up

- It’s free money

- You only need to set it up one time

If you spend a lot at Costco, getting a 1% rebate on every shopping trip is pretty sweet. Plus, with all the other cashback retailers, you can sit back and count your $20s as they roll in. 😎

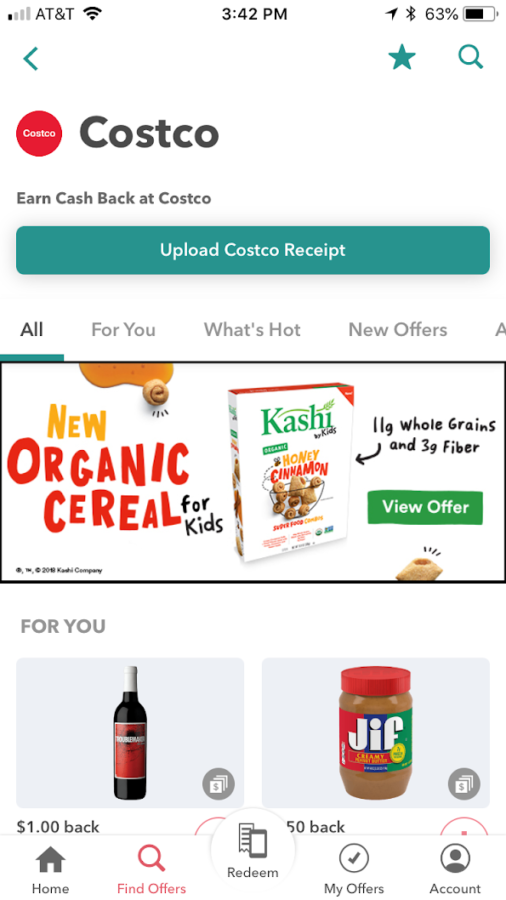

2. Discounts with Ibotta

Ibotta is another total gem. You can earn cashback on a ton of household goods (I recently got a nice haul for my organic protein, liquor, beer, and some produce).

Costco is a retailer on the Ibotta app and the cashback is NICE

This one’s more involved because you have to activate every discount and upload your receipt. But I love scanning the list of deals – plus, they regularly run bonuses so you can earn even more.

When you accrue $20, they’ll send the cash directly to your PayPal or Venmo account – how cool is that? I always take a peek at the app while I’m shopping. If I’m gonna buy something anyway, might as well get something back for it. And if I’m torn between 2 similar items, the Ibotta cashback is always the tie-breaker.

I’ve always gotten my cash credited within a few hours – sometimes minutes. And some of the discounts are several bucks, which is nothing to sniff at.

You’re already saving buying in bulk. Getting more money back on top of that is just awesome.

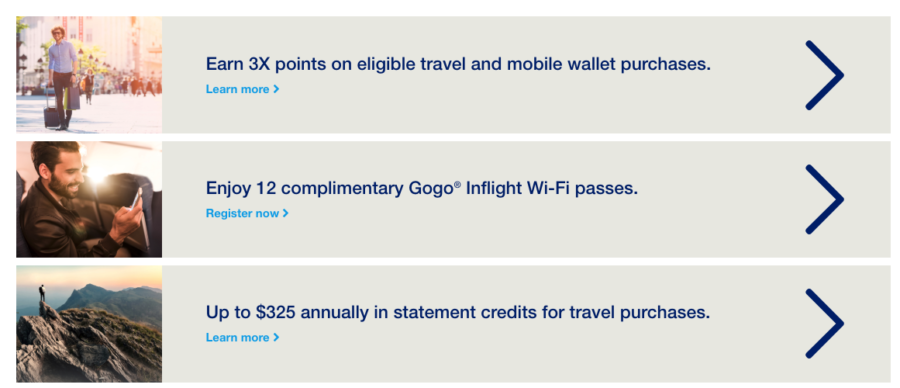

3. Get 4.5% back every time with the US Bank Altitude Reserve!

- Link: US Bank Altitude Reserve

Whoa, wait. Did the US Bank Altitude Reserve card just become the best card to use at Costco? *gasp* I think it did!

Why? Because every Costco store just added the ability to use mobile payments in late August 2018. And the US Bank Altitude Reserve earns 3X points per $1 spent on mobile payments. Each point is worth 1.5 cents toward travel (which you can redeem instantly via text), so getting 3X is effectively a 4.5% discount (3 X 1.5)!

Now that Costco accepts mobile payments, this card just skyrocketed and became a forever keeper for me. No other card has this kind of return at Costco. Full stop.

It’s official – keeping my US Bank Altitude Reserve card forever now

It has a $400 annual fee. But you get $325 in annual travel credits, 12 Gogo wifi passes to use inflight (worth at least $10 each), and now, 3X shopping at Costco. So it’s easier than ever to recoup the annual fee – and earn the best possible return of any card when you shop at Costco.

Note you won’t get the 3X rate when you shop online. For that, the best card is Chase Freedom (learn more here) when warehouse stores are a quarterly 5X category. And if you have the Citi AT&T Access More card, you can still earn 3X Citi ThankYou points at Costco.com. (You can use any card when you shop online.)

But in-person? You betcha I’ll be taking my US Bank Altitude Reserve with me on every Costco trip now. This is an incredible development, IMO.

Note: You need a banking relationship with US Bank to open this card. Even just a checking account counts. And checking accounts are free when you have US Bank credit card.

4. Or get a 2% cashback card

- Link: Cashback rewards cards

You don’t need a fancy metal card to save at Costco. A simple 2% cashback card will also get you instant built-in discounts every time you shop at Costco, or anywhere else for that matter.

I recommend the Fidelity Visa, but there are many, many options. The point is, if you’re not getting rewards with how you pay at Costco, you’re missing out big time.

Always looking for a deal

Lots of cashback cards come without annual fees, so they’re free to keep. That’s literally free money on the table. Keep in mind Costco only accepts Visa cards in-store, but they’ll take any major credit card online for cash cards that you can spend online or in any Costco store.

You can always get a Citi Costco Visa and get 2% back to spend at the stores every year in the form of a check… and it has no annual fee. 😙

5. Gold Star Executive membership

This here is the upgrade that earns an additional 2% every time you shop at Costco in-store OR online. It’s $120 a year vs $60 a year for a regular membership.

So here’s the number to know: $3,000. Because if you earn 2% cashback on $3,000, that’s $60 – which completely covers the price of upgrading over the regular membership.

Beyond that, it’s all 2% gravy. If you spend at least $250 per month at Costco ($3,000 / 12), upgrading is a no-brainer. You’ll earn your 2% back as a check every year.

When you stack this 2% back with a credit card, you’re looking at 4% back (with a 2% cashback card) or nearly 7% back (with the US Bank Altitude Reserve card). That’s a nice savings when you spread it out over a year. Especially if Costco is your go-to for food staples.

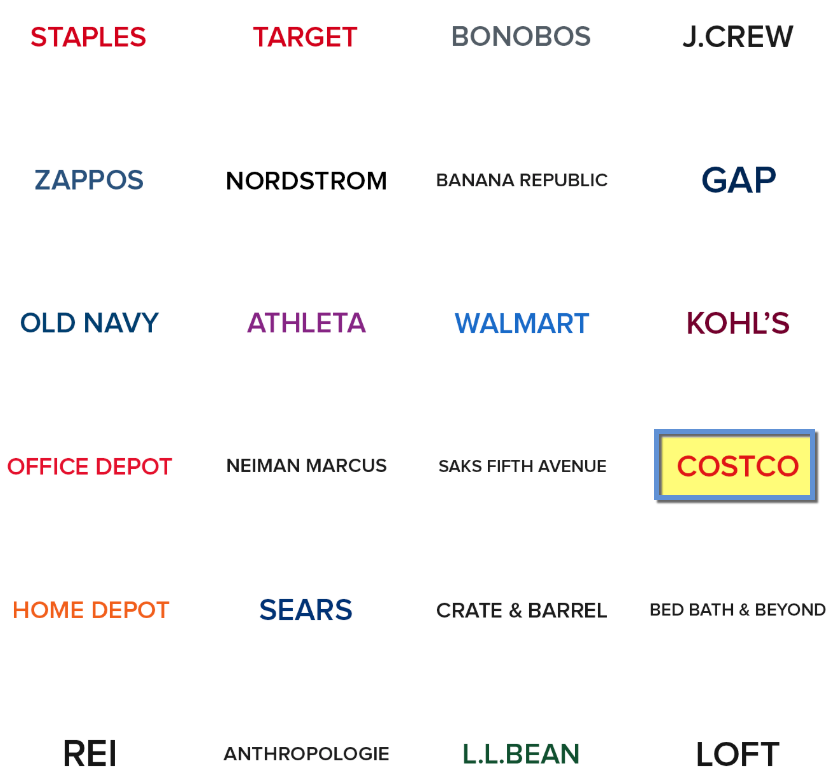

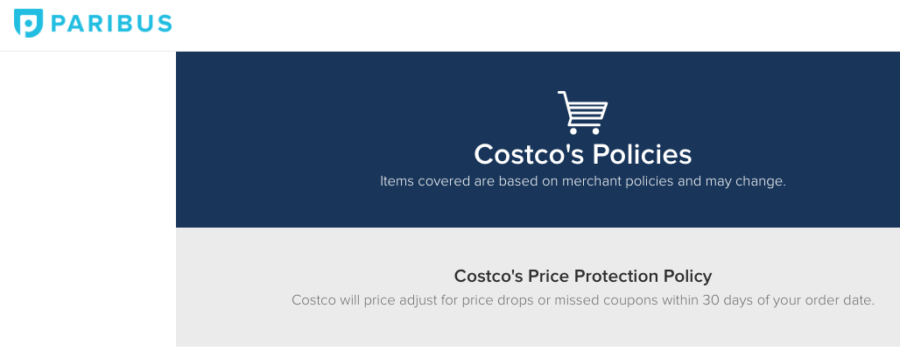

6. Track price drops with Paribus

Link: Paribus

If you shop at Costco online, you need to sign-up for Paribus immediately.

Paribus tracks price drops at all these retailers

It’s a free service that tracks price drops for dozens of merchants, including Target, Amazon, Sears, and Costco.

This is only helpful if you shop their site because it’s an online service. That said, Costco will refund you within 30 days if Paribus finds a lower price – which it will scan for automatically. Just add the email address where you get your receipts when you shop online.

Paribus will file a claim for a Costco price drop if it happens within 30 days of your online order

If Paribus finds a price drop, you’ll get the difference refunded to your payment card. Did I mention it’s completely free? You can sign-up here.

I’ve saved hundreds of dollars with Paribus between late shipment tracking and price drops from so many retailers. Getting some cash back only adds to the discounts you already got with all the tactics above.

7. Check for discounted memberships

- Link: Costco on Groupon

- Link: Costco on LivingSocial

Occasionally, you can find membership deals on coupon websites like Groupon or LivingSocial. In the past, you could get a free rotisserie chicken, batteries, a gift card, or a few other items to offset the membership cost. While this is a one-time savings, it’s worth mentioning because it might just be your gateway into the world of Costco.

If there’s a good deal, I’ll post about it but honestly… I’d be a Costco member without any incentives. That you can get anything at all for signing-up is pure icing.

But yes, worth a peek if you’re uninitiated. 👊

Bottom line

By now, we’ve learned:

- You can always get 1% cashback at Costco with the Spent app

- Ibotta is worth having in your artillery for more rebates

- You can get 4.5% back toward travel via mobile pay with the US Bank Altitude Reserve card

- Having a 2% cashback card only adds to your savings – and many have no annual fee

- Gold Star Executive membership is worth it if you spend $250 a month at Costco

- Paribus is a total GOAT if you shop online at dozens of retailers, including Costco

- You can occasionally find discounted memberships on Groupon or LivingSocial

Remember, you can stack these savings to save 2% on the low end, and 10+% on the higher end. Considering you’re already buying in bulk, these tricks only make good deals all the better.

Do you have any other ways to save at Costco? You know I want to hear everything!

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You had me at OKURRRR!! A Cardi fan is a fan of mine…

Yassss!!!!! I’m so happy you got the reference!!!! Thank you for reading! :p

This is the best post I have read on BA in a long time. Also a big fan of Costco and while I book cruises on board to select the best cabin and receive extra perks, within 60 days I move that reservation over to Costco Travel for all the cash card benefits that can range from $600 to $900 and that does not even include the 5% cash back thanks to the Exec Card at the end of the year on the total price of the cruise.

Thank you for reading and commenting, Henry!

Yes, Costco Travel is amazing if you like cruises – and what a cool trick with moving the reservation after booking onboard. Huge value!

That’s why Samsung Pay rocked at Costco until they had contactless transactions. You got 4.5% on the Altitude card all day long. I have been using it at Costco since inception of the Altitude card and would get funny looks and always and admonishment that it wouldn’t work. Twice I had managers come out because they thought I was stealing when the transaction went through! I bought my wife a $5K 25 year anniversary ring using Samsung Pay and Altitude. She politely told me she wanted something else so I took it back. They asked if I wanted it returned to the card or a check. Hmmmmmmmmmmmmmm…….guess which I picked.

That’s the very reason I was so tempted to get a Samsung phone. I never did, but with the recent changes to mobile payments at Costco, now pretty much anyone is able to get that rate, which is awesome.

Sounds like you have a good plan… and a LOT of Altitude points racked up. 😉

Thanks for sharing your story!

Define “nice haul” – at 1%, you must have bought a few thousand dollars worth to get more than $10 dollars. Surely you define “nice haul” as saving $10 or more. Else it’s just Wanna Be extreme couponing at the drug store.

Hey Leo! The “nice haul” was in the Ibotta section – and the discounts can easily be 20%, which I’d definitely consider a nice haul.

But even with the 1% free, heck yeah, I’ll take free money for spending I’m gonna do anyway… why not? Free money, even $10, is, well – free! I’d consider that a nice haul too!

Love Costo and was able to use Apple Pay with the USB Altitude Reserve this past weekend. It is definitely a keeper just with Costco spend.

Couldn’t agree with you more, Josh!

BoA Cash Rewards gets 2% at Costco plus any bonus you are entitled to up to 3.5%. This isn’t as good as 4.5%, but it’s no annual fee.

That’s a great point – I often forget about their cards with the bonuses for having money with Merrill Lynch. Still a pretty good return, considering you’re already buying in bulk. Thanks for the reminder!