Upon logging into my US Bank online account, I noticed something weird.

I have a decent amount of points from using mobile pay at Costco for 3X points (a 4.5% return because each point is worth 1.5 cents toward travel). And I have my Real-time Rewards threshold set to $10.

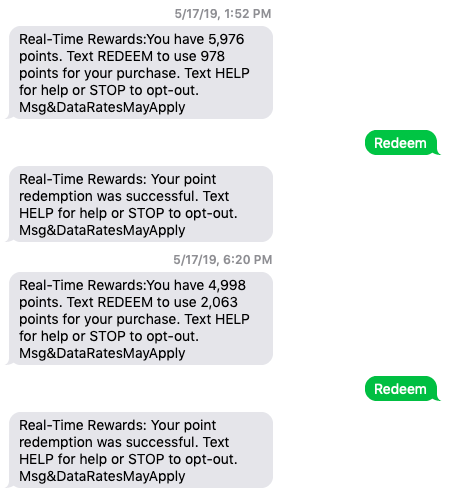

So when I make a travel charge over $10, I get a text asking if I’d like to redeem points to “erase” it.

Just say the magic word and your charge is gone. (The magic word is “Redeem”)

I used this for a few Uber rides recently. Great, great, love it.

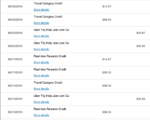

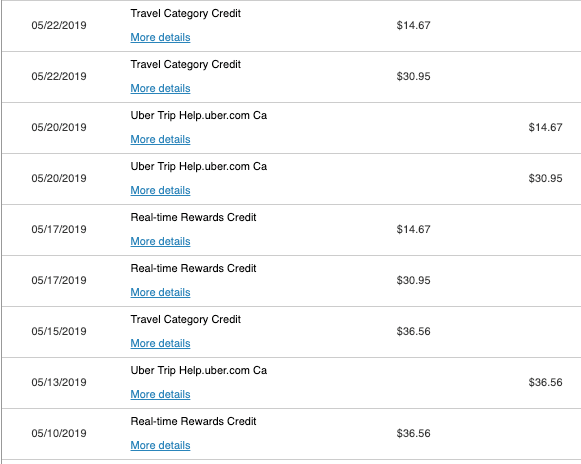

But then… I noticed my $325 annual travel credit had recently reset – and doubly covered the charges.

~$82 of charges got double credited – one from Real-time Rewards, the other from my travel credits

Not only did I redeem points for those charges, but somehow it ate up ~$82 worth of my travel credits, too. If I’d known this would happen, I would’ve saved my points.

So when your travel credits reset, DO NOT use Real-time Rewards to erase your charges. You’ll end up paying double!

Oh, and US Bank was beyond lame when I alerted them to what happened. So lame that I’m thinking of dumping this card altogether – after I drain the remaining credits and points, of course.