Nav is a service that’s primarily set up to match small businesses to financing options, loans, and credit cards. And as an added resource, they let you pull your small business credit report for free.

If you’ve ever opened a small business credit card, you probably have a business credit score. Through Nav, you can see your business risk grade from Experian, Equifax, and Dun & Bradstreet.

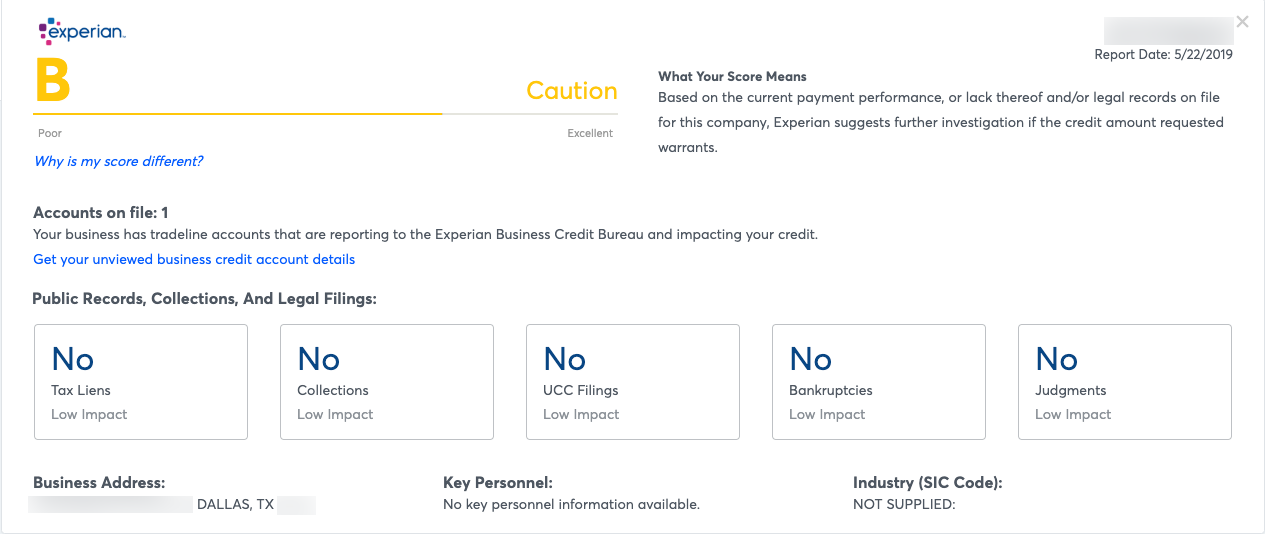

Experian and Equifax give you a grade of A through F, while Dun & Bradstreet use their own scoring model with a rank between 0 and 100.

But small business credit reporting is still the Wild West, because they match business names and addresses – and these aren’t always unique, so they do a lot of “near matching.” It’s a good idea to check the information that’s out there, particularly if you have a generic business name.

Plus, it’s free to check with Nav, so why not?

I still rent my spare room on Airbnb, and use the income I make to apply for small business credit cards. My Experian credit grade is a B

Here’s more about your business credit score.

Nav credit report – pull it for free

- Link: Sign-up for Nav

As mentioned, business credit models can be wonky. In the past, it’s been expensive to get a credit score for your small business.

When I first wrote about Nav in October 2018, they only offered score from 2 sources. Since then, they’re added a third. And all 3 are free to check.

My Experian business risk results

For each, you can check for:

- Tax liens

- Collections

- UCC filings

- Bankruptcies

- Judgements

While these are specific to your business, if you used your SSN to apply for a business credit card, they could also appear on your personal credit report.

Why to check

The main reason to check your business credit report is that lots of business have similar names – and they’re not always linked by SSN or EIN.

For example, if your business name is “Joe’s Coffee Shop,” you might be mistaken for “Cup of Joe Coffee” or “Joe’s Coffee Stand” or some other similar sounding name – particularly if two near-sounding businesses are in the same city or zip code.

The good thing is you can claim your small business if you’re sure it’s the right one, and link it to your Nav account.

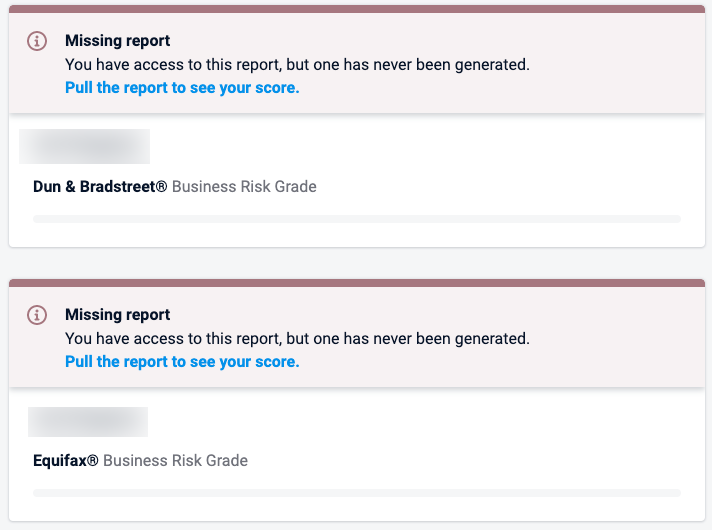

Experian says I only have 1 account on file, and there’s nothing on me with Equifax or Dun & Bradstreet. I find that surprising with as many small business cards as I’ve had – and currently have.

There’s nothing for Equifax or Dun & Bradstreet, which I’m hoping is a good thing

If you find incorrect information, like if your business became intertwined with another one along the way, you can file a dispute to sort it out – just like with personal reports.

If you have a sole proprietorship, your business name is probably your name. Still, it’s worth a peek to see what’s out there.

Bottom line

I’m glad Nav continues to expand their services. My score hasn’t budged since I originally checked ~8 months ago – and that’s a good thing!

Having an A or B with Experian/Equifax, or 80+ with Dun & Bradstreet, is considered a good score. Many credit cards don’t appear on your personal credit report, but they don’t disappear. They go to a separate small business report. And it’s free to check your standing.

I like seeing the metrics and keeping track of things like this, so thought I’d share.

Have you heard of Nav? Did you have a similar experience checking your business credit report?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great article. My impression was that calling D&B every time they sent a notification about business credit was that D&B wanted to charge a significant subscription fee, with all of the urgency in their mailings.