Lord knows I love playing around with new apps on my phone, especially in the interest of free, passive cashback just for linking my cards one time.

And other apps can save you money too, but require more interaction. I’m happy to click a few buttons to earn a few free bucks.

There are a LOT of card-linked and cashback apps out there. Here are the 6 best card-linked apps, and 6 best cashback apps.

Between the 12, you stand to gain $95+ right out the gate!

These apps get you ongoing rewards for linking your cards. Set and forget!

Between them all, I’ve gotten back $100s in free rewards in the form of cash and gift cards.

12 Best Apps for Free Rewards

First, a distinction. Card-linked apps require you to link your cards and/or your bank credentials one time. From that point forward, you don’t have to interact with the app ever again if you so choose, except to get your rewards. They’re literally set-and-forget.

The other cashback apps do require interaction, whether that’s activating offers, scanning receipts, or some other task. So while not entirely effortless, I find they’re worth poking around.

Here are my picks!

6 card-linked apps

Acorns

Acorns is an investing app that costs $1 a month. Within it, there’s a feature called Found Money, which lets you earn extra investment money from partners. Some of them are card-linked.

Found Money is mostly a click-through shopping portal, but does have a few card-linked partners

They’re always rotating, but I’ve gotten free cash just for having my cards linked in my profile. Nothing to activate – the cash literally just appears.

~$53 free for doin’ nothin’

While not a crazy amount, I’ve earned ~$53 so far for making normal purchases I didn’t even know would trigger cashback.

Plus, the returns I’m getting from my “Aggressive” blend portfolio are ~7%, which is right where I wanna be when I invest.

Dosh

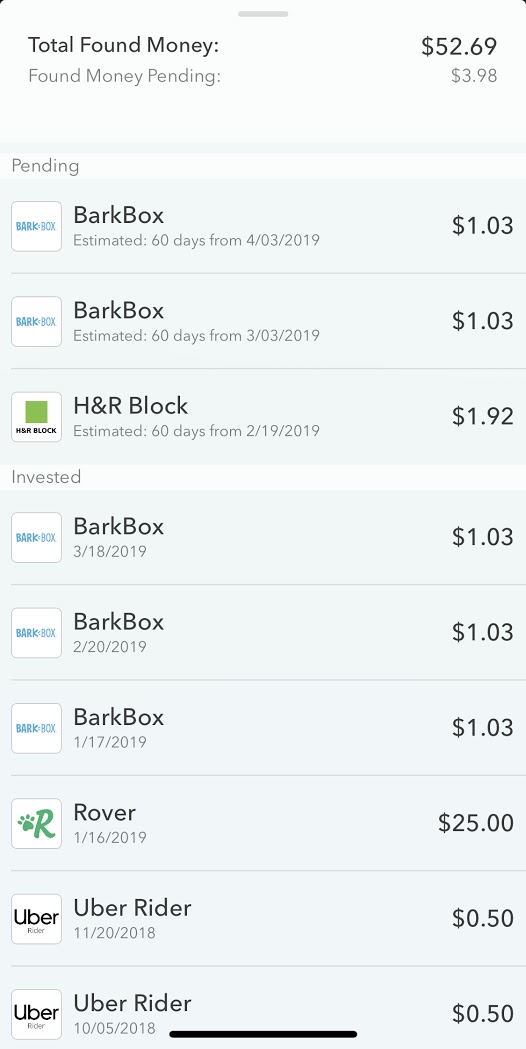

Dosh brands itself as “effortless cash back” and that’s really the case. It’s one of my favorite apps because it’s always popping random cash into my account.

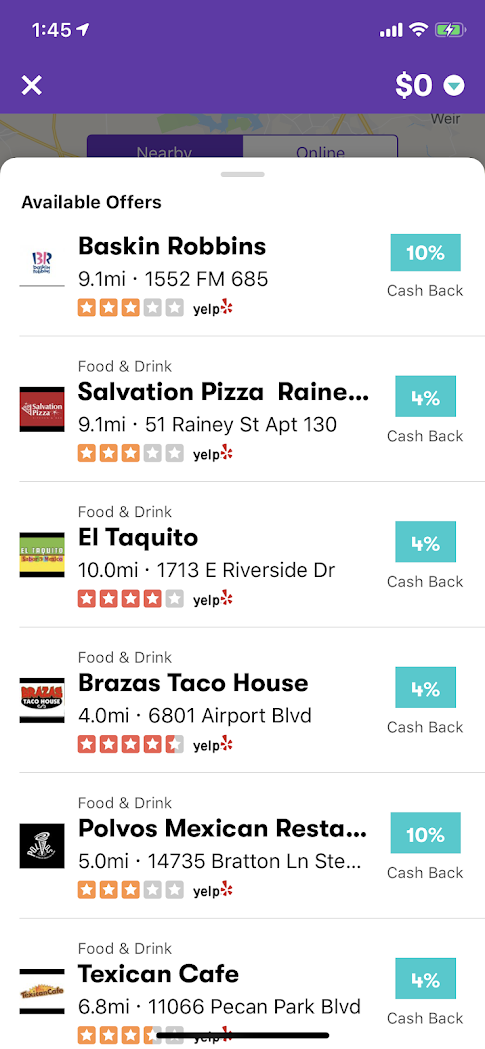

While there’s a shopping portal component to it, you can also earn at nearby businesses when you spend on a card that’s linked to Dosh.

Dosh has a varied selection of merchants

And it’s not just restaurants. I have World Market, Sephora, Sam’s Club, and The Body Shop showing up near me. In the past, they’ve had gas stations. And sometimes have promotions to get 5% cashback at Sam’s Club (which is one of the ways to save every time you shop there), and at other stores.

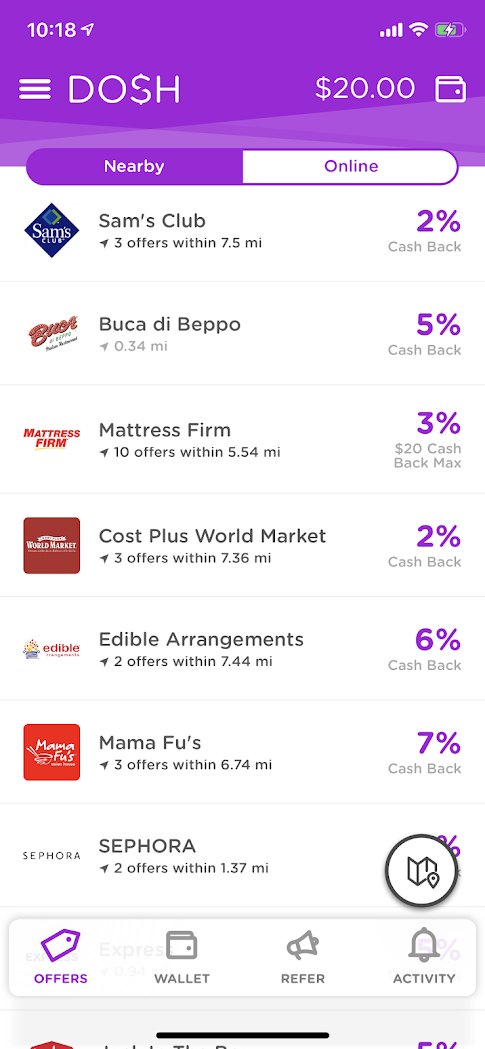

Drop

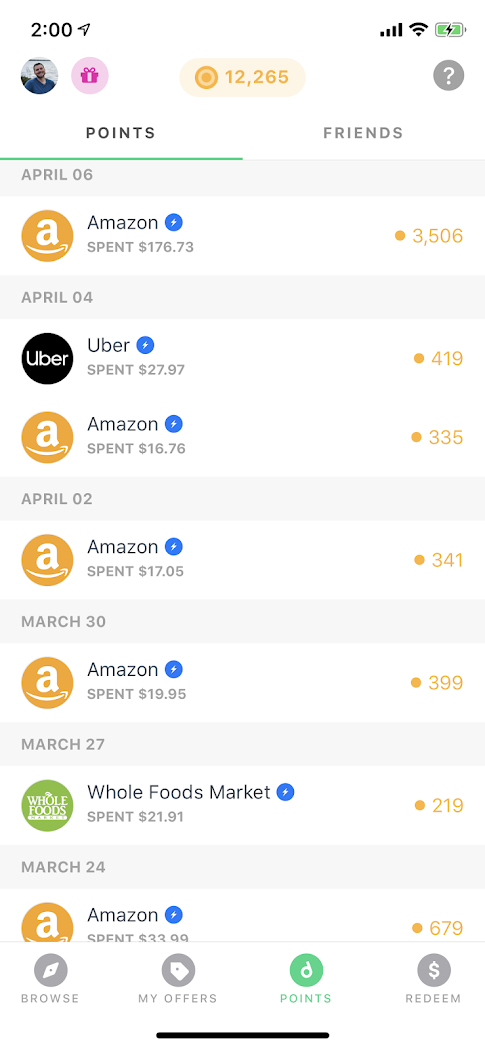

Drop lets you pick your 5 favorite merchants to earn between 8 and 12 Drop points per $1 you spend. 10,000 points is worth $10. And you can only redeem for gift cards.

I actually spend quite a bit at my top 5 merchants

That said, the merchants and gift card selections are super useful. And the app is free to have.

Drop is always depositing points – I use them for free stuff at Amazon

You can activate other offers and bonuses if you want, but I open it up every few months to cash in for Amazon gift cards and get on with it. Though you need a lot of points to redeem, they really do add up fast – especially if you leave it alone for a while.

Hooch

I wrote about Hooch back when their dealio was a free drink every day for $10 a month. While that’s still on the go, they’ve also added automatic 1% earnings with several national brands, including Netflix, Spotify, and Uber.

Get 1% cashback on many popular categories

While 1% isn’t anything radical on a $10 subscription or cup of coffee, like everything else on this list – it all adds up.

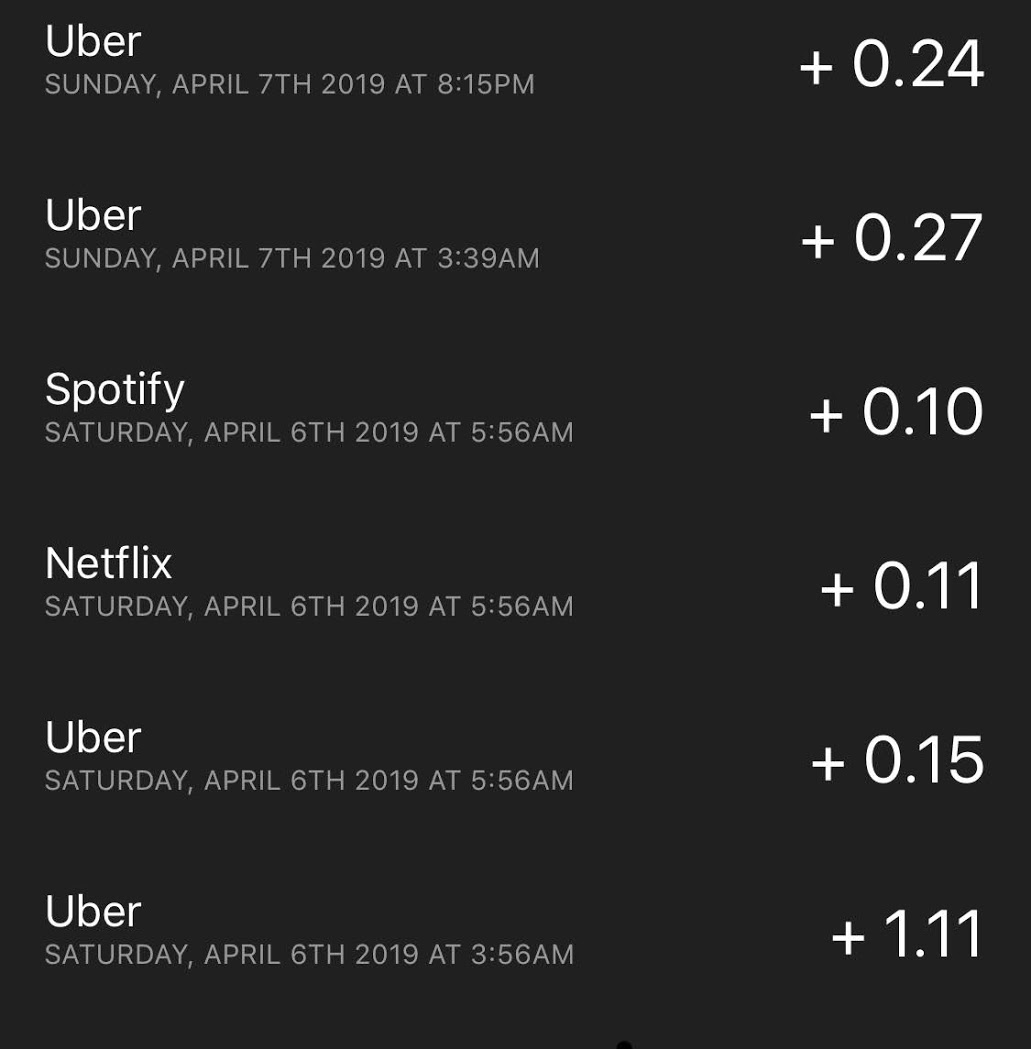

I did not take a $111 Uber ride, for the record

This offering is still new, so I’m not entirely sure how to redeem the rewards or what the minimum is, although it looks like you can get free cocktails, gift cards, or dining certificates. I’m gonna roll with it and see how it goes – but mark this one as very “in progress.”

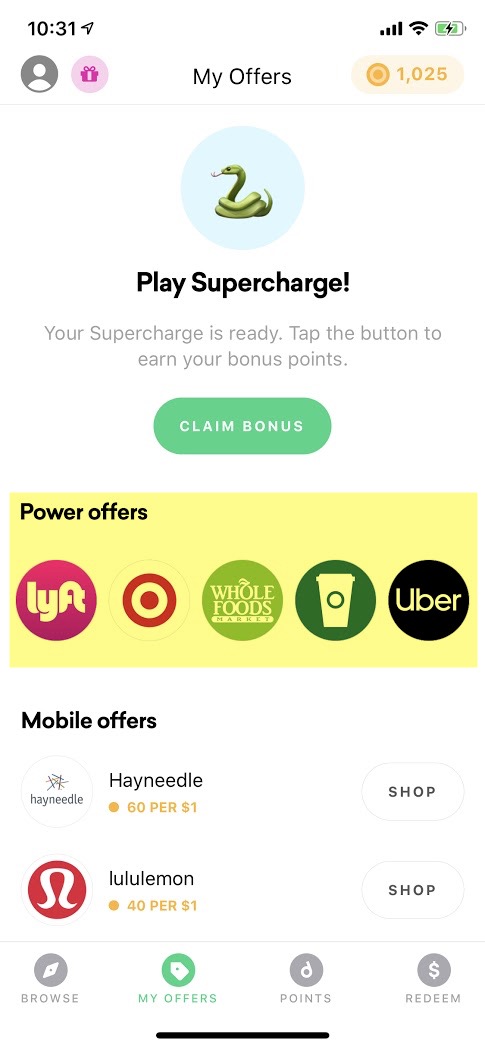

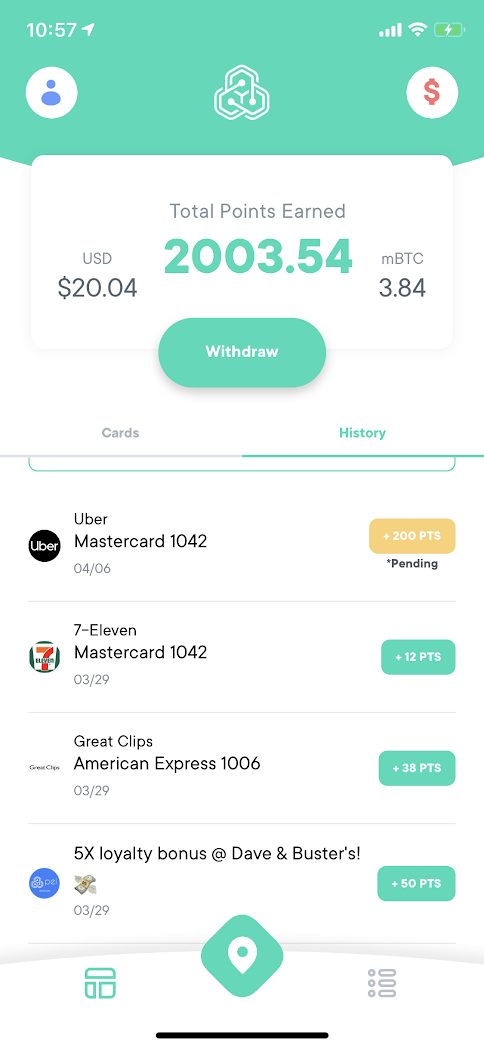

Pei

- Pei – Get 500 points ($5) – My code is “2pur1z”

Pei wasn’t doing much when I first installed it, but all of a sudden, I’m earning points like crazy on nearly everything I buy. I’ve gotten $43 in free cash so far, and it’s only been a couple of months. Pretty cool for a free app.

For real, just points rolling in everywhere

Pei’s big thing is you can choose between cash or Bitcoin, but duh, I’ll take the cash.

Earning rates are between 1% and 5% back, depending on the merchant. But wow, there are a LOT of them. I highly recommend giving this one an install. It’s perhaps the most rewarding of them all as of late.

Stash

I mostly have Stash to compare them with Acorns, but manage to earn enough in dividends to justify the $1 monthly fee. They now have a debit card offering (which isn’t that great). I’m interested to see where Stash goes, and how they’ll differentiate themselves from similar services.

Stash cashback is mostly for restaurants

Anyhoo, they have a card-linked offering with decent cashback rates. I only see restaurants in my area – and a few of them are pretty good. Whatever you earn gets folded into your investment account, so it’s worth linking your cards and getting a free boost here and there.

6 more best cashback apps

The apps above are basically effortless: link your cards and let the rewards build up.

There are others that are equally rewarding, but require more participation. For your consideration…

Cash App

The Cash App is from Square, and a fee-free way to transfer funds between bank accounts. Kinda like PayPal or Venmo, but even simpler.

When you request their free debit card, you can get “boosts” and cashback for using the card. I prefer points & miles (obvi), but will definitely use the app for quick cash transfers to friends.

And you can get $5 in your account when you sign-up and send $5+ to anyone. So you could send $5 to a friend, get $5 instantly in your account, and your friend could send the $5 right back.

Pretty neat app, even if you just get it for the free $5. I ordered the debit card out of pure curiosity, so might write about it more in the near future.

Ebates

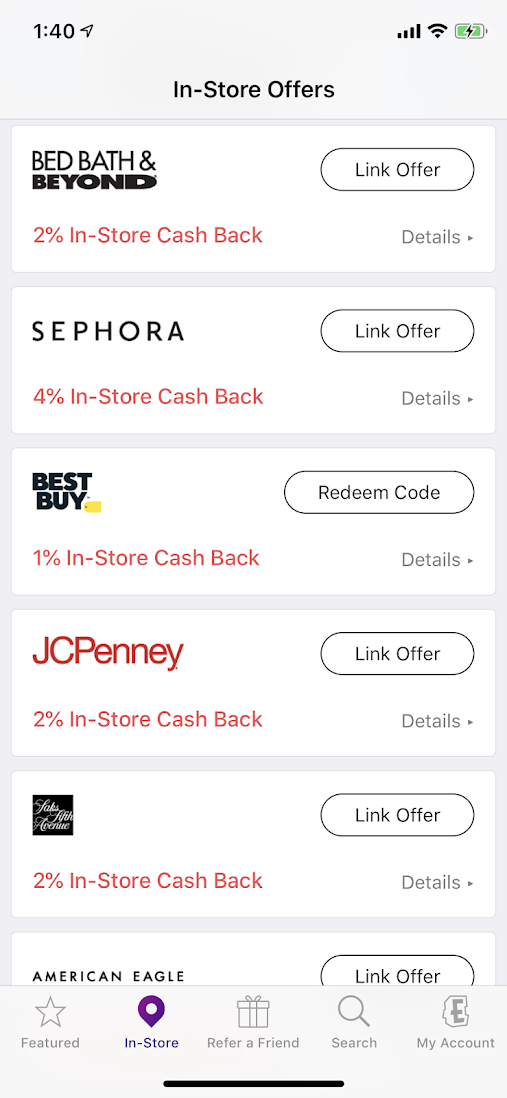

While mostly a shopping portal, Ebates (or Rakuten as they want to be called now 🙄) also has an in-store component.

If you find yourself in a store, see if you can get something from Ebates

For these deals, you need to link each offer to the card you want to use. You can also usually get 25 cents back per Lyft ride, which requires clicking through the app. Not much, but most people would pick up a quarter off the ground, eh?

Freebird

Freebird has continually impressed me with their plethora of promotion codes for cashback on Uber and Lyft rides. You need to link your rideshare accounts and book through their app to earn points and cashback on your rides, but man – it adds up quick.

And you can get up to $30 cashback if you’re new to Freebird. Here’s how:

- Download Freebird

- Enter promo codes:

- “OUTANDOUT” – $10 cashback ($5 for each of your first 2 rides)

- “GO2TEN” – $20 cashback ($10 for each of your first 2 rides)

Plus, you can use any coupons or credits in your respective Uber or Lyft account – it all stacks! This is my new favorite way to hail a ride. Highly recommend downloading this one if you ride with Uber or Lyft with any regularity.

Ibotta

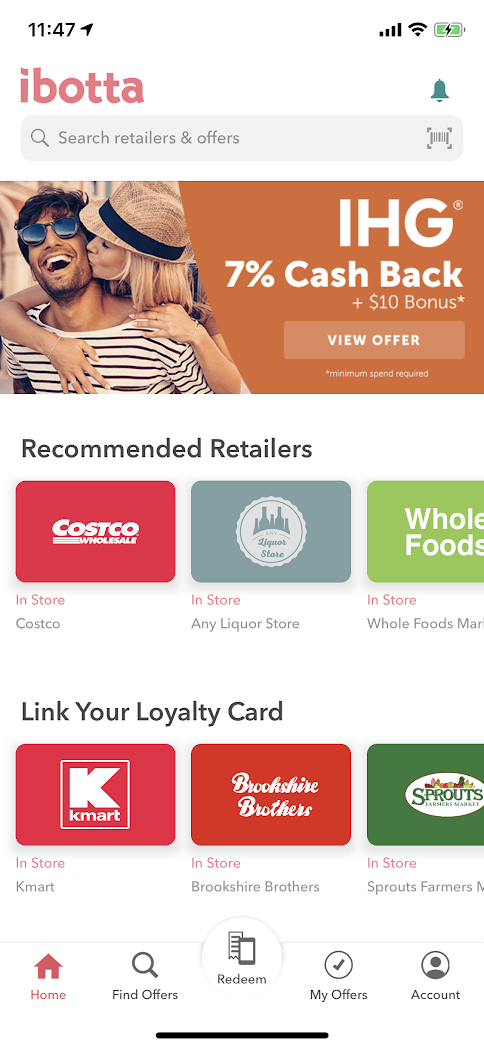

I’m way into the Ibotta app to stack additional savings on top of earning points and getting rewards from other card-linked deals. There are many similar apps, like Checkout 51, Receipt Hog, and Shopkick, but I find Ibotta the most useful of them all.

Ibotta almost always has something useful on their app

I like saving at Whole Foods and Costco, specifically. Saving at Costco, where prices are already low, is a cherry on top.

Ibotta also has frequent bonuses and promotions – and does require you to upload your receipts (it really only takes a few seconds) after activating offers. I find earnings post either instantly, or within an hour, and I like exploring the app. The more you use it, the better they get at recommending ways to save.

Oh! And it works on beer and liquor so yeah – sign me up!

MileagePlus X

While NOT a cashback app, you can purchase gift cards here to earn extra United miles. The downside is gift card purchases don’t get any price protection or extended warranties offered by credit cards. But if you’re buying a few items and know you won’t have an issue, might as well rake in some extra miles while you’re at it!

And if you have a Chase United card, like the Chase United Explorer card, you get 25% bonus miles instantly posted to your account and automatic card-linked offers for spending at certain merchants.

I know United miles are having a “moment” right now with the recent devaluation, so I’m still mulling it over… but partner awards are still a great deal, and that’s all I really ever redeemed for anyway. As long as that holds, I’ll continue to earn United miles. And this app is an easy way to keep them rolling in on top of other rewards you earn.

Spent

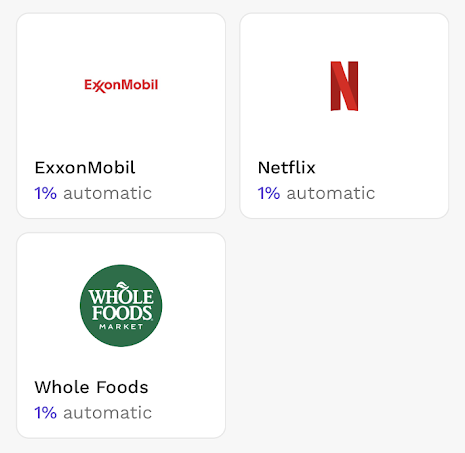

With Spent, you can choose three 1% earning parters each month. This month, I chose:

Seems reliable

Beyond that, it’s card-linked. You need to hit $20 to withdraw to your bank. Spent also has local offers – but nothing you can’t get with Dosh or Pei.

This one is perhaps the weakest on the list, but if you want to maximize every buck you spend, might be worth a download to see if it’s worth it for you. I spend a fair amount at Whole Foods, so if it’s free cashback I mean, yeah, I’ll take it.

Bottom line

By now, you probably have this vision of me drowning in apps. And while I do have a lot, most of them are card-linked and are there purely to rake in extra rewards on my natural spending. I’ve earned literally $100s just by keeping them installed – and in some cases, interacting with them here and there.

My top picks for card-linked (AKA effortless) apps are:

- Acorns – $5 free to invest

- Dosh – $5 free

- Drop – $5 free

- Hooch – $5 free

- Pei – 500 points ($5) free with code “2pur1z“

- Stash – $5 free to invest

That’s $30 to start putting toward the withdrawal minimums (or investments in the case of Acorns and Stash).

And other faves are:

- Cash App – $5 free when you send $5+

- Ebates – $10 when you make your first purchase

- Freebird – Up to $30 back from Uber and Lyft rides

- Ibotta – $5 with first redemption

- MileagePlus X

- Spent

These apps require your interaction beyond just linking your cards, but at the max, you stand to gain $65 extra.

Even though each app and deal isn’t much individually, when you maximize them toward your normal expenses, they really do synergize and become worthwhile. If anything, the 6 card-linked apps are set-and-forget, and offer free rewards for setting up once.

Thought I’d share and hope this helps you save!

What’s your fave app on the list?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

great article.

Question: are these apps stackable in terms of rewards? I.e. if all apps had, let’s say, Home depot as a location to earn points/cashback, can i get credits on all the apps?

That’s a good question–I want to know too!

I have had positive experience with Drop and Dosh stacking but IDK about the others

I my experience – YES! For example, I get credit for Uber rides across multiple apps regularly. The only exception is Stash, which doesn’t seem to play nice with Dosh. But that’s not every time. For the most part, it all stacks – especially if they’re card-linked offers.

If you have to click through and shop online, essentially using the app as a shopping portal, that will NOT stack as you can only click through from one place. Hope that makes sense!

Wow! Amazing compendium.

Have had a lot of hiccups with the MileagePlusX app lately’

Impossible to get support.

Oy, sorry to hear that. It’s been OK for me. There’s definitely support for it. Hope nothing has been too major for you, or you haven’t lost any money!

Have you done anything with TruNow or Get Upside for fuel?

Never heard of either one! I’ll have to check them out. Haven’t gotten much into gas apps as I get most of my gas from Costco. Do you use ’em?

@Harlan – I listened to Richard Kerr’s podcast on gas savings and he mentioned those. Scan receipt apps. I doubt Costco participates, which is my usual go to for my occasional rental cars. His stuff involves varous Fuel Rewards and other stacking not appealing to me based on my spend patterns.