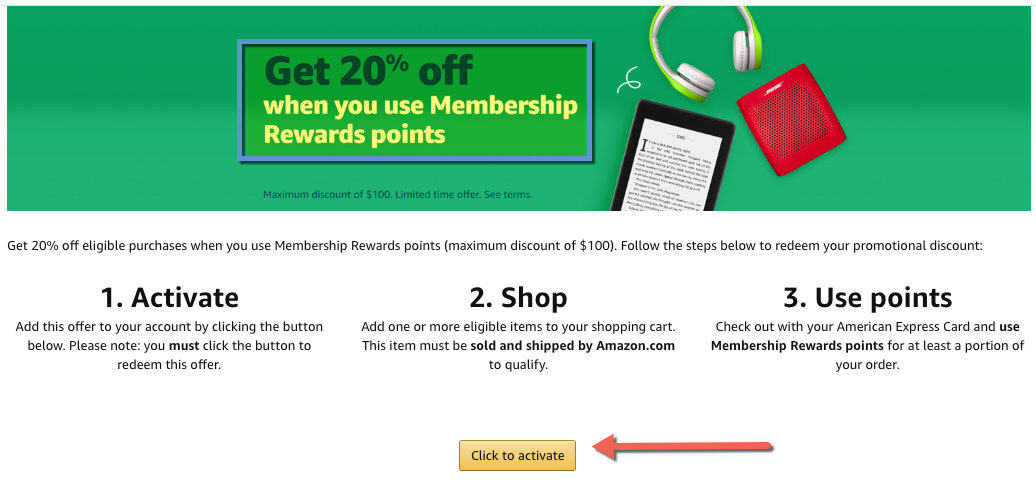

Talk about an amazing deal – you can get $30 off a $60+ Amazon purchase when you use 1 Amex Membership Rewards point and put the rest on a qualifying Amex card.

This deal is targeted. You can check your account at this link to see if you’re eligible.

It was in my account, so I immediately got a $60 Whole Foods gift card for only $29.99. That’s 50% off!

The deal works on items sold and shipped by Amazon, and excludes digital content. I love easy wins like this.

I can get everything I need for my heavy metal detox smoothie for 50% off with this latest Amazon Amex promotion

Here are more deets!