Credit card spending requirements are getting higher all the time. Not only that, but banks also want you to use your cards for ongoing spending to meet spending thresholds to earn elite status, bonus miles, and other rewards.

“Top of wallet” is a term we hear a lot in this industry because every issuer wants their card to be, literally, at the top of your wallet. So they incentivize spending with category bonuses, special offers, and promotions.

To meet credit card spending requirements, use your card for:

- Everyday expenses like utilities, groceries, eating out, cell phone service, oil changes, and subscription services

- Semi-regular expenses including dental cleanings, home warranties, memberships, and club dues

- Gifts for birthdays, graduation, weddings, and holidays

- Charitable contributions

- Business expenses if your employer will reimburse them

- Nearly any bill or service from a company or individual via Plastiq

- Annual and quarterly tax payments

Meeting minimum spending requirements is top of mind for lots of peeps – and top of wallet for credit card companies

I’ll expand on these categories and give you 40+ ideas to meet your spending in a flash!

The sooner you get your spending done, the faster you’ll get your rewards

It sounds daunting to spend $1,000s in a short timeframe to trigger a sign-up bonus. But, like anything, once you break it down into small steps, it doesn’t seem as bad.

The biggest thing to keep in mind about credit cards is to never spend more than you have. And to pay your bill in full at the end of each billing cycle. Basically, treat your credit card like a debit card.

If you have trouble managing, there’s a service called Debitize that will literally turn your credit card into a debit card.

The gist is to use your new credit card for all your expenses, because it adds up fast. And you can use Mint.com to see how far along you are with your spending at any time.

I always recommend spending slightly more than you need to account for any refunds or returns.

Use your card for daily expenses including your voodoo supplies to meet spending requirements faster

And remember, annual fees and statement credits do NOT count your minimum spending requirement!

Finally, the clock starts ticking the moment you are approved for a card. Not when you activate it, not when it comes in the mail, not upon your first purchase. When you’re approved.

With all this in mind, here are ways to get that spending done!

Everyday expenses

1. Utilities

Many utility companies let you pay for electricity, gas, water, sewage, trash pickup, and much more with a credit card.

I pay my electric bill with a credit card each month

And if they don’t, Plastiq will send a paper check on your behalf for a 2.5% fee (more on that later). If you go this route, be sure to give it enough time to post before your due date.

2. Groceries

Make a run to Costco or Sam’s Club, or stock up at your local grocery store, and take your new card with you. Most folks spend between $200 to $500+ (depending on family size) on groceries each month – capture this spending!

Take your new card on a grocery trip (remember, Costco only accepts Visa cards in-store)

Remember to use Ibotta and Dosh for cash rebates while you’re at it!

3. Dining

Eating out is one of my biggest expenses, as it is for lots of peeps. If you’re out with others who pay with cash, offer to put the whole tab on card and put the cash in your pocket.

When your meal tastes like your next award trip

Don’t forget to signup for a dining rewards program to earn free cashback, points, or miles, on your check – including tax and tip!

4. Cell, cable, and internet service

Use your card to pay (or pre-pay) for the wires that keep you connected to the outside world.

Most media companies let you pay online or over the phone. These are easy ways to get a little closer to your minimum spending requirements.

5. Take care of your car

Time for a tuneup and oil change? If you’ve been meaning to get your car detailed, washed, or serviced, use your card to pay for it.

You could even get new tires or a fun accessory like a cell phone clip to help you navigate or hold your phone for Bluetooth tunes.

6. Netflix, Hulu, Spotify, and other subscriptions

Separately, these subscriptions aren’t much. And together, they add up.

Put your subscriptions on autopay

Keep your accounts up-to-date with the card you’re earning a bonus on.

7. Gym membership

If you pay for yoga classes, Peloton, Orange Theory, CrossFit, Camp Gladiator, or any other workout regiment, put the expense on your credit card. And please go often to get your money’s worth!

8. Health insurance

I’m a freelancer, so I’m on the ACA plan. I switch payment to whichever card I’m working with to whittle down that minimum spending.

If you have health insurance through an employer, this won’t apply. But you can always pay for expenses through your FSA or HSA with a credit card, and get reimbursed for it. Those expenses can add up fast.

9. Tollways

Here in Dallas, we have the NTTA (North Texas Tollway Authority) that operates toll roads, like the Dallas North Tollway. You can load your transponder with a credit card, and set it to auto-load once you fall below a certain amount.

If you have to pay for tolls to commute, might as well earn some points for it. 🤮

Semiannual expenses

10. Dental work

Every 6 months, right? 😁

Get those chompers cleaned and x-rayed, and pay for the service with your credit card.

11. Home warranties

If you own a home or condo, chances are you have a home warranty contract. Most give you the option to pay monthly or annually.

I pay my home warranty in full each December

If you can handle it, paying it all in one chunk is an easy way to lop off your spending requirement – and your home is covered for the year.

If you’re shopping for a home warranty, I have American Home Shield and have always had a good experience, so I recommend them.

12. Memberships and club dues

If you’re part of a club or group, most membership dues are paid annually.

For example, I have my FoundersCard membership that I pay once per year.

I love my FoundersCard membership

And in another life, I was a member of a private club in Manhattan. Those days are long gone – but I always used a credit card to pay for membership.

13. Car, home, and renters insurance

I pay my car insurance every 6 months, and my renters insurance once a year. My insurance company (USAA) allows me to pay with a credit card, and it’s easy to switch which one is auto-charged for the insurance payments.

My home insurance is wrapped up in my mortgage, but if you pay out-of-pocket for yours, this would be an easy way to meet a lot of minimum spending at once.

Gifts for others

14. Holiday and graduation gifts

These expenses are predictable, because you know the date well in advance. Consider buying Christmas presents ahead of time with your new credit card.

Who doesn’t love a gift in a beautiful package?

And be sure to signup for Earny and Paribus in case of price drops and for late shipping protection!

15. Birthday and anniversary presents

This one’s a little more variable, because, well, people have birthdays and anniversaries all year round. With some planning, you can be on top of your gift game and meet your minimum spending at the same time.

My tip: save these tasks in Todoist to keep track of them all.

16. Charitable giving

Don’t forget your favorite charity! They’ll accept credit card donations, more than likely.

Even better, you get to write these off at tax time. So it’s a win-win for your minimum spending.

17. Religious giving / tithes

If you’re a member of a church, temple, meditation center, etc., you can give regular contributions or tithes via credit card.

In fact, it’s easier to keep tracking of ongoing giving with a credit card as opposed to keeping paper receipts for cash giving because everything is tracked online. All you have to do to claim a tax write-off is go through and add them up one time – nothing to keep track of.

Other spending that pops up

18. Pet food and treats

My pup tends to eat a 30-pound bag of dog food every 2 months. If you have a new credit card, stock up on pet food and treats. I keep my extras in the laundry room because it’s dark and cool there, so his food stays fresh.

My sweet boy loves his treats

I also get him a monthly BarkBox, which he absolutely loves.

19. Home remodeling or updates

Lord help me, I am going to need a new HVAC system in the next year or two for my condo, and it’s probably going to cost ~$6,000. 😭

You bet your tuchus I’ll be getting a brand new credit card expressly to pay for this.

If you need to remodel or upgrade your home, you can easily get a vacation out of it. You’ll probably need one after it’s done! 🏝

20. Contractor supplies

You usually can’t pay the labor portion with a credit card, but many contractors will let you use a credit card for the supplies. Never hurts to ask – because this could mean $1,000s toward minimum spending!

21. Upkeep services

Do you pay a housekeeper, gardener, landscaper, or other maintenance professional? See if they’ll accept a credit card – or if their company will put a card on file to charge when you need services.

22. Weddings

Weddings are expensive, man. Whether you’re tying the knot or just attending, there are definitely going to be expenses. Tux rental, new dress, travel, gifts for the couple, the list goes on.

This one’s a super easy way to meet the minimum spending on one – or several – credit cards all in one go.

23. Car inspection and registration

For some states, this is every year. For others, it’s every few years. Pay for your state inspection and vehicle registration with a credit card.

24. Licensing and continuing education fees

If you work with food, real estate, cosmetology, medicine, machinery, or dozens of other things, you need a license on file to do your job.

Once upon a time, I was a realtor in Manhattan. And I always paid for my licensing with a credit card

And some jobs require you to maintain your licensure with continuing education classes and credits. If you can time your licensing with a new credit card, this is an easy way to “get the job done.” (Couldn’t help myself.)

By the way, these activities can qualify you for a small business credit card!

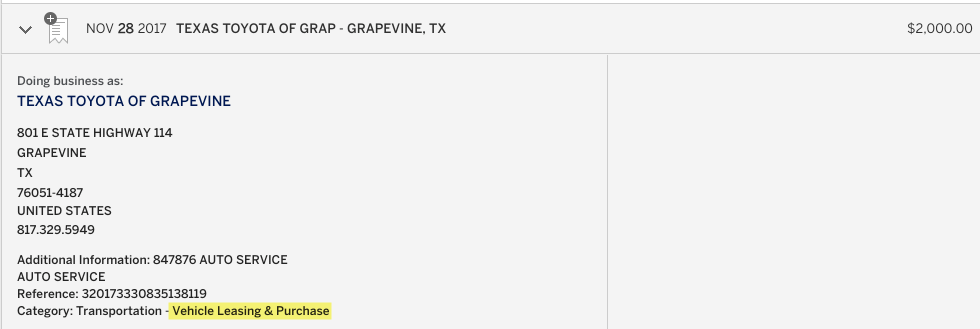

25. Down payment on a new car

I actually bought an entire car with credit cards. Then bought my current car with a $2,000 down payment charged to my Amex Blue Business Plus card – which earned me the welcome offer. Learn more about that card here.

Make a down payment on a new car with a credit card

It’s always worth asking how much you can put on a credit card when purchasing a vehicle. Just be sure to agree on the price first. #protip

Pay the bills

Pay your monthly bills with a credit card with Plastiq. Even if the merchant doesn’t accept credit cards, Plastiq will send them a paper check on your behalf.

I’ve used Plastiq to pay my bills for years and never had a single issue. There’s a 2.5% fee for the service, but when you’re meeting minimum spending, it’s usually worth it.

Right now, they’re having issues with Visa personal credit cards charging cash advance fees (always set your cash advance limit to $0 to be on the safe side!). But other cards still work to pay pretty much any bill you have.

If you signup with my link, you can make $500 in payments without any fees.

26. Rent or mortgage

This is the biggest expense for most folks, and you can use Plastiq to pay it! Note you can only use MasterCard or Discover cards for mortgage payments as of right now.

I’m using my CitiBusiness American Airlines card for mortgage payments – and earning 70,000 American Airlines miles in the process.

27. Car payments

I also use Plastiq to pay my monthly car payment. It’s only $160, but it all adds up! I always send a little extra for early payoff.

28. College or education expenses

Some universities will let you pay tuition with a credit card. If there’s a small fee, it might be worthwhile to meet a lot of minimum spending.

And if you need to purchase books, supplies, or other materials related to your education, definitely use a credit card to earn a break down the road when you’ll really need it.

29. Student loan payments

I even use Plastiq to pay my student loans. They’re the bane of my existence, but I feel a *little* better knowing I’m earning some points for it. #grumble

30. Annual tax payments

Yup, you can even use Plastiq to pay Uncle Sam. I’ve done this a few times and my payments posted perfectly – and quickly.

31. Quarterly tax payments

If you run a small business, you might even make quarterly tax payments to the federal gov. Definitely use a small business credit card – and remember, you can write-off any service fees you incur as part of your business expenses!

I was paying $1,000s every few months at one point and earning a new sign-up bonus each time. It was pretty nice, although paying taxes is always a necessary evil.

32. State and local taxes

If you pay property tax, or municipality taxes, you can even use a credit card for those, too.

Running a small business

- Key link: Get a small business credit card

Small businesses have a boatload of expenses. If you don’t already have a small business credit card, they’re an easy way to keep those expenses separate from your personal spending.

And lots of activities qualify you for a small business credit card. If you don’t already have one, start putting your skills to work!

I run Airbnbs to make extra cash and keep the points rolling in – and it qualifies me for small business cards

Lots of peeps call this a “side hustle,” but I call it making more money! As you scale up, you’ll likely earn more and spend more.

I highly recommend the Chase Ink Business Preferred because of its huge 80,000-point signup bonus worth $1,000 toward travel.

33. Travel expenses

If you travel for consulting, seminars, conferences, or other professional development, you can expense the the cost and earn points and miles at the same time.

34. Conference and workshop tickets

While you’re at it, pay for your entrance fees with a credit card to meet minimum spending. I always charge my FinCon tickets to a credit card to help with this (FinCon is my favorite conference!).

35. Reselling

Lots of peeps in the points hobby buy items at a discount and resell them for profit. Depending on how you scale this, you can spend a LOT each month.

It’s a proper small business, and it requires finding a niche – but once you do, you basically have a points-generating machine going nonstop. It’s pretty great.

36. Regular small business expenses

When I worked in real estate, I was always paying for ad services. With my Airbnbs, I constantly buy cleaning supplies and replace sheets and towels.

Every small business has regular expenses. Using a credit card for them is an easy way to work toward minimum spending requirements.

A few more ideas

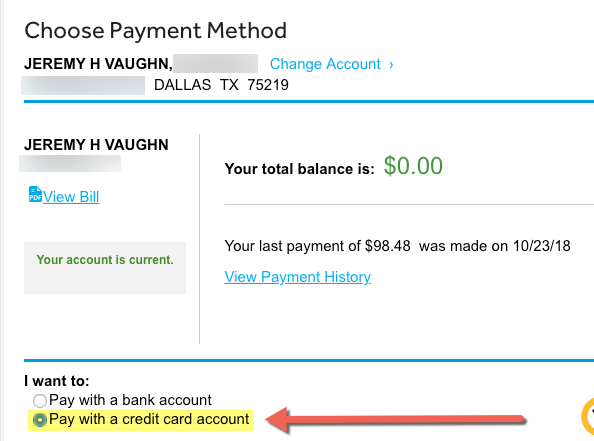

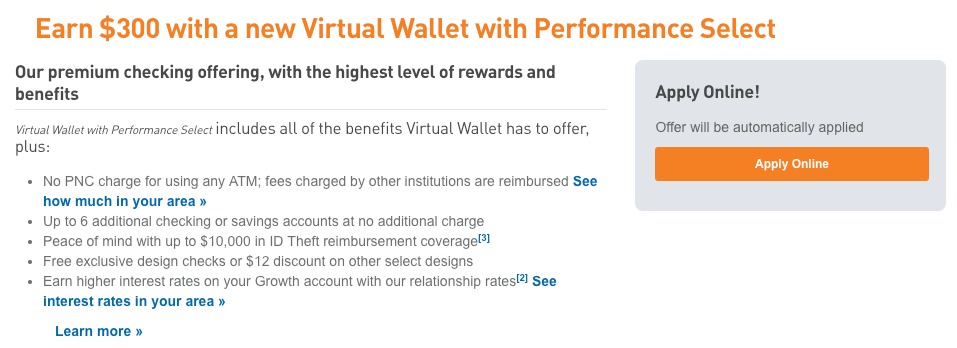

37. Fund a new checking or savings account

Some banks will let you open a new account and fund it with a credit card.

Earn checking account bonuses AND meet minimum spending at the same time

For example, I opened a PNC checking account with $2,000 charged to my credit card. This counts as a purchase and can often be the thing that puts you within striking distance of a big sign-up bonus. And I earned a bonus for opening it!

If you’re looking for an account, consider this PNC savings account if you qualify. You can fund it with a credit card up to $2,000. And the APY is a staggering 2.35% – one of the best in the industry right now.

Note: This doesn’t work with every account, so set your cash advance limit to $0 to avoid any fees before you do it.

38. Add an authorized user

If you know someone who doesn’t mind helping you earn points, add them to your new card account and let them spend for you.

Only do this with someone you trust to repay you, because you are on the hook for those expenses. As an added bonus, you can also help their credit score go up.

My little brother’s score when up 100+ points when I added him to one of my Amex cards! This is another win-win.

39. Buy stuff for family or friends

When my grandmother wanted a new mattress, I bought it for her and had her write me a check – a check she would’ve otherwise given to the mattress store.

If you know someone shopping for a big-ticket item with cash or a debit card, offer to intercept the charge and have them pay you directly. With the mattress and frame, I got most of my minimum spending done thanks to my grandmother’s purchase.

40. Split payments

In that $6,000 HVAC replacement scenario I mentioned earlier, I could ask the merchant to put $3,000 on one card and $3,000 on another. Why meet one minimum spending requirement when you can meet more?

If you have a couple of cards you’re working with, ask if you can split tender to earn more bonuses at once.

41. Prepay for travel

Many hotels give you a discount for prepaying for a room (as opposed to getting a bill when you check out). Often, he cancellation policies are not great when you prepay.

I prepaid for my hotel room in Martinique because I was sure I’d be there

But if your dates are firm and you’re sure you’ll use the room, go ahead and knock out some minimum spending.

42. Book travel for others

I took a road trip earlier this year with a couple of friends. I paid for the Airbnb, hotels, gas, and all other expenses and kept track of them. Once home, they sent me Venmo payments for their part of the trip – and I banked all the points & miles.

If you can organize group travel and request payment through Venmo, PayPal, or Facebook, this is a super easy – and fun – way to meet minimum spending. Earn points for another trip while you’re on a trip with friends! #circleoflife

Bottom line

Hopefully this gives you plenty of ideas for meeting those minimum spending requirements! Or for meeting spending thresholds to earn big rewards like elite status, free weekend nights in hotels, and more.

If you’re looking for a new card, thank you for using my links. It helps this blog more than I can properly express.

I’ll keep this page updated as I think of new ways to meet minimum spending. And of course, I’ll share any great deals I find here on the blog. 🙏

What other ways do you use to meet credit card spending requirements? 🤓

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Thank you for your inspiration.

Thank you for reading and commenting, Frank!