On March 21, 2021 (3/21 – like a countdown), I put all my stuff in storage and headed out on the road as a digital nomad. I spent the first month in Memphis to be near family and find my road legs.

Today, I’m in Asheville, North Carolina, after spending a couple of months in Tennessee, including Nashville (where I earned Hyatt Globalist status with my stay) and Knoxville (at an Airbnb).

I’ve been hiking so much and it’s been so so nice

I can already tell that where I’ll stay will be a combination of:

- Award stays with points

- Paid hotel stays

- Alternative booking sites (Booking.com, Hotels.com, etc.)

- Airbnb

- Stays with friends

- And maybe even some camping

There’s no set way I’m doing this other than I’m trying to stay around $1,500 per month for my accommodations.

And when I pay, I’m always trying to get something back: elite status, a booking rebate, more points, redeeming an Amex Offer, or meeting minimum spending on a new card (or ALL of these with a single stay like I’m doing right now in Asheville – y’all know I LOVE a good stack).

So I’m really using every trick in the ol’ trick sack to maximize this lifestyle – and help it perpetuate itself.

I have no idea how long I’ll do this. I guess for as long as it feels good. After all, I know I can always get my stuff out of storage and rent an apartment again. But now that I’ve pared down my possessions to a few bags, I don’t see myself doing that any time soon.

Digital nomad finances and how I’m managing them

First of all, I work backwards. Meaning I’m not choosing places based on prices or deals – yet.

Right now, I pick the place I want to go and then figure out how to make it work.

For example, Asheville is actually a pretty expensive place. I could’ve gone someplace cheaper by seeking deals, but I didn’t do that because I’ve always wanted to spend time here. So I am.

Choose first, figure out how to make it work later – all while sticking to my $1,500 monthly budget.

Nashville was a total blast

It won’t always be like this, but for now I’m doing this lifestyle the way I want and actively picking my destinations. Perhaps later, I’ll let the destinations guide me. 🧘🏻♂️

My always-rough itinerary

I try to make everything as “cancelable” as possible. That means giving myself the flexibility to stay a little longer if I really like a place.

I also try to not book more than 1.5 months out – I literally make it up as I go along. But I know my strategies are there to support me.

It’s incredible to live so loosely. It also makes it hard to commit to future events because I don’t know where I’ll be. Rough targets, rough dates, rough ideas.

After Asheville I’m thinking:

- West Virginia near New River Gorge National Park – the newest National Park!

- Pittsburgh

- Upstate New York in the Catskills

- Toronto (if Canada opens this summer)

- Vermont for fall

- New Mexico

- Down South for winter

- Maybe Central or South America instead?

- Maybe some other country if international travel opens?

I’m also sorta guided by the current covid situation. As soon as international travel levels out, I’ll see if I can live and work in another country for a while.

Making the most of points and money

For my Airbnb in Knoxville, I booked through Acorns to get 1.8% cash back invested in my account. (Side note: Acorns is great for their Found Money! It’s only $1 per month and totally worth it for the card-linked and portal offers that are automatically invested for you!)

In Nashville, I earned top-tier Globalist status with my stay and stacked a bunch of promotions to get all my points back.

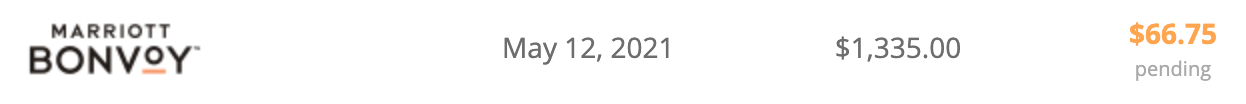

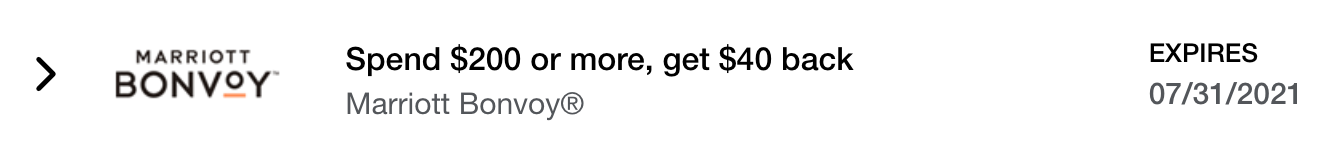

Now in Asheville, I’m using 15 paid nights to earn Marriott Platinum status from a challenge I got through FoundersCard. I also booked through TopCashback for 3% cashback and will use an Amex Offer for $40 back.

$67 back from TopCashback

And another $40 back from Amex

So I’ll get:

- Marriott Platinum status

- $67 from TopCashback

- $40 from Amex Offer

- More Marriott points from the paid stay (I’m currently Gold)

- Minimum spending done on my new Bank of America Premium Rewards card ($500 that I’ll invest through Merrill Edge plus my bonus earnings from being Platinum Honors)

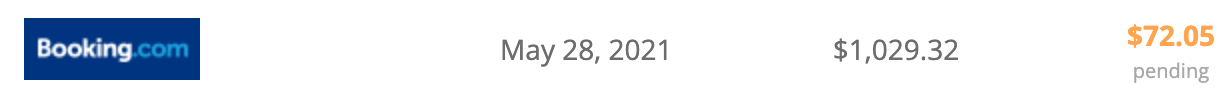

For West Virginia, I couldn’t find any chain hotels or Airbnbs, so I used Booking.com but clicked through TopCashback for 7% cashback (can you tell I love TopCashback?).

Another $72 I’ll get back in my pocket

I’m also using points to cover some of my nights. I used Hyatt points for 14 of my 29 Nashville nights and Marriott points for 5 of my 20 Asheville nights (transferred with a 40% bonus from Amex to top up my account and fifth night free on award stays).

I also plan to keep opening new credit cards to earn new bonuses along the way.

AND I’m keeping my eye out for lucrative hotel promotions. Because I’m so flexible, I can easily make the most of a good promotion if it fits within my budget.

For my stay in Upstate New York, I’ll be in a friend’s guesthouse. And I can always stay with my family when I swing through Memphis.

I’m really putting everything together however it makes sense to save the most and get back whatever I can along the way.

Looking to the future

I’ve been playing with Google Hotels to see where I can stay cheaply – an amazing tool, by the way. I found incredible rates at Hyatt hotels in Denver, Phoenix, and Virginia. And as tempting as those were, I’m still actively picking my destinations.

However, I can totally see myself taking advantage of cheap rates to keep my adventure going – especially if there are good hotel promos.

The goodest good boy

My other big consideration is my dog. That means everywhere I go has to be pet-friendly and I probably have to pay a pet fee. I’m not in love with that expense, but I have to have him.

I thought this would be rough on him, but he is absolutely loving it. Actually, I think he’s having more fun than me – so many new sniffs!

I had him completely checked out by his vet before we headed out (teeth cleaned, up-to-date on all shots, extra supplies of his heartworm medicine, and got copies of all his records).

If I want to go international, my mom and “babymama” already said they would watch him for me. But I wouldn’t leave him for too long. He is my constant companion and my friend. Plus he’s 11, so he’s getting older.

Not everyone has pets with them on the road, but I do, so I factor that into all my calculations and plotting.

The biggest considerations so far

Right now, my Marriott room has a fridge, sink, and microwave, but no stove or freezer. I didn’t realize how much I’d miss a stove and freezer! I have my blender, so I can make basic smoothies, but I miss having frozen fruit in them. And I like steaming veggies for my salads.

However, I have a fitness room and laundry on-site. So far, I haven’t found a place that has everything I want. Here’s how I rank my preferences:

- All-suites chain hotel with full kitchen (Hyatt House, TownePlace Suites, etc.)

- All-suites chain hotel with laundry and fitness room (Hyatt Place, SpringHill Suites, etc.)

- Other chain hotel room (Hyatt or Hilton, with Marriott as a backup)

- Airbnb with full kitchen and laundry

- Airbnb with kitchenette

- Non-chain hotel from Hotels.com, Booking.com, or similar

Surprisingly, laundry hasn’t been an issue at all so far. I have plenty of outfits and book places with a laundry room or some kind of access. I wash clothes about every two weeks and try to mix up what I wear as much as I can.

Also, for everything on this list, LOCATION trumps them all. I choose where I want to be first, and take the closest option. This keeps me out and mobile, which is ultimately the point of this whole thing.

Digital nomad finances bottom line

So that’s how I’ve been managing my finances and using my points as a supportive tool for the last few months. So far, I have no plans to stop doing this any time soon. I also wanted to share about my philosophy of how I’m approaching this adventure, how it might change in the future, and what I look for in a place.

I’m mostly guided by my own whims and predilections. And I’m so blessed to have friends in almost every place I’ve gone or want to visit, so I don’t feel lonely while doing this. That was a big concern, but it hasn’t happened yet. Maybe it will start to wear on me. I’ve gotten really good at checking in with myself.

Doing this would certainly be cheaper with a partner, but I just didn’t want to wait any longer. So here I am, out on my own.

Hopefully that provides insight on what makes this digital nomad lifestyle work (for me, anyway).

Would you live on the road? Have you done it before (or are you now)? If there’s anything I didn’t cover, leave a comment below.

Hope everything is staying safe and healthy out there! Thank you for following along this journey! ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Having a stovetop is so important to eat well and keep costs low while living out of hotels. Have you considered a hot plate and pan or an Instant Pot? We never did this, but many others have. It’s easy when you have a car. Put your kitchen kit in a small rolling bag or a small duffel bag that has all your cooking necessities. Upfront cost isn’t super low, but the amount you’ll save on cooking instead of eating out will add up real quick.

I love reading these, because it brings back some great memories. You have a national parks pass right? If not you need to get one. The western half of the country is incredible.

Ughhhh yes I should get a hot plate or Instant Pot, it’s just one more THING to have to transport. But you’re right. I may go ahead and do that. They’re pretty cheap, really.

And yup, got the parks pass! I’m gonna try to hit up as many as I can, but don’t plan on going out west for a little while. I’ll actually be in the newest national park later this month – excitedddd!

Thanks for the motivation re: cooking supplies!

WV has some natural beauty for sure. We used to snowboard at Snowshoe Mtn when we lived in NC.

My wife and I have been nomads for 8 years, leaving the USA for 6 – 8 months at a time. We always travel from country to the next closest country to make it cheaper on airfare,etc, Being on the road gives you so much freedom, it’s amazing the sense of freedom it brings.

That sounds so amazing! I keep saying I’ll stop doing this when I get tired of it. I keep checking in with myself and I’m not tired of it yet! I just started, but who knows where I’ll be in 8 years – maybe still on the road. 😉

Thank you for sharing your story! It’s so inspiring to hear from others who make this a way of life!