There are lots of targeted Amazon promotions out there now. Which is awesome, because Black Friday are Cyber Monday are next week! When you combine these deals with inevitable sale prices, you stand to save buku bucks this holiday season. Or you can do like I did, and stock up on dog food. 😹

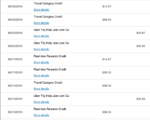

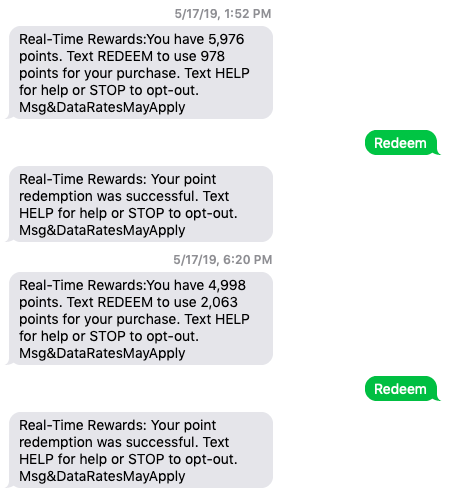

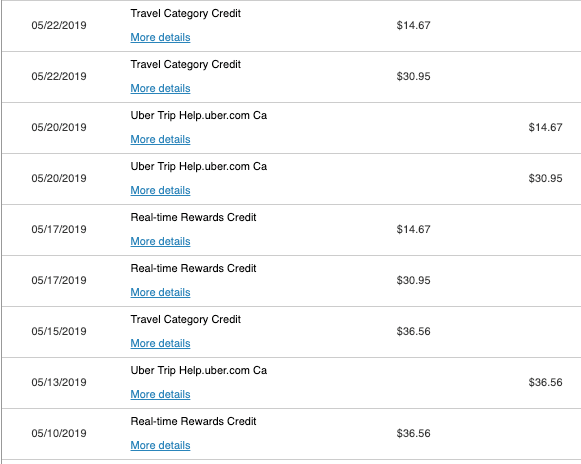

With all of them, you’ll save either a percentage or dollar amount off your purchase – and you only have to use a single bank point to trigger the deal. This year, you can use 1 point from the following programs:

- Amex Membership Rewards points

- Chase Ultimate Rewards points

- Citi ThankYou points

- Discover It or It Miles points/miles

So if you have any travel rewards credit cards, dust ’em off and check if any of these deals are targeted for your Amazon account.

Save on Amazon shopping when you use a single bank point and get a targeted offer. I got several this year!

I’ll share the current promotions, tricks to get them to appear, and my usual bits and baubles. 🧿