October – chilly autumn air, pumpkins, scary movies, the inevitable return of the holidays, then a new year. And for many cards, mainly the Amex Platinum and Gold cards, the last opportunity to use your statement credits. Such is Q4.

And if there’s a card you want, you still have enough time to apply, use the credits for 2018 – then get a fresh batch of credits to use in 2019. You effectively get double the credits for 1 annual fee, which is awesome.

Treat yo self to an upgrade, checked bag, or something extra this year AND next for 1 annual fee!

Here are cards for an end of the year double-dip.

Get an Amex statement credit 2X in 2018 and 2019

1. Amex Platinum Cards

| The Platinum Card® from American Express | 100,000 Amex Membership Rewards points |

|---|---|

| • $200 annual airline incidental credit • $200 in Uber credits annually • Enroll in $240 in digital entertainment credits annually for Peacock, Audible, SiriusXM, and The NYT • 5X points on flights up to $500,000 per calendar year and travel booked through Amex • Access to the fantastic Centurion Lounges, Delta SkyClubs, and Priority Pass network • Enroll to get up to $179 back as a statement credit each year for CLEAR membership • Terms apply |

| • $695 annual fee (See Rates & Fees) | • Spend $6,000 on purchases in the first 6 months from account opening |

| • Learn more here |

First up is the Amex Platinum Card. It’s a behemoth of a card with a nearly endless list of benefits – including a $200 annual airline incidental credit on an airline of your choice, including:

- Alaska Airlines

- American Airlines

- Delta

- Frontier

- Hawaiian Airlines

- JetBlue

- Spirit

- Southwest

- United Airlines

I always pick Southwest as my airline to upgrade my boarding position, buy drinks in-flight, and more

Though there’s a $550 annual fee, the $200 airline credit certainly helps make up for it. And if you’re new to the card, you can use the credit in 2018 – then again beginning January 1, 2019.

Remember to select an airline before you use the credit

This is also a great card to have around the holidays for lounge access to get away from crowded and noisy gates, and to check bags full of gifts to give or that you received, without thinking about which card to use. Get it all credited back, usually within a few business days. You can select your airline here.

You also get Uber credits – $15 per month, except for December when you get $35. That could be useful to get to the airport for a flight home for the holidays. And it’s a nice end of year bump.

Finally, there’s the $50 Saks credit you get every 6 months (January through June, and July through December). You could use it for a gift, or just treat yourself to something nice.

If you use all your credits between October 2018 and October 2019, you could get:

- $400 in airline incidental credits ($200 in 2018 and $200 in 2019)

- $200 in Uber credits

- $150 in Saks credits (July through December, January through June, then July through December again)

For a total of $750. So the credits outweigh far the annual fee – and doesn’t include the welcome bonus, lounge access, 5X on airfare, and tons of other perks.

By the way, here’s a FlyerTalk forum where peeps share exactly what purchases trigger the airline credit – just search for your preferred airline. And FYI – ALL these credits are use it or lose it. They do NOT roll over!

2. Amex Gold Card

| American Express® Gold Card | 60,000 Amex Membership Rewards points |

|---|---|

| • 4X Amex points on dining at restaurants • 4X Amex points on up to $25,000 per year at US supermarkets • 3X Amex points on airfare booked directly or travel booked through Amex • $100 airline incidental credit per calendar year • Terms apply |

| • $250 annual fee (See Rates & Fees) | • $4,000 on purchases in the first 6 months from account opening |

| • Learn more here |

This credit works the same as the Platinum Card, but it’s $100 per calendar year. If you use the credits in 2018, and again in 2019, that’s $200 to make a dent in the $250 annual fee.

I must say, I’m impressed with the 4X bonus categories on this card. Though I wish they weren’t limited to US-only. That seems terribly short-sighted for a travel card.

But if you dine a lot, or want a card with a huge return at grocery stores, this one is definitely worth a look. The $200 airline incidental credits can easily recoup the annual fee.

3. Amex cards with spending thresholds

| Blue Business Plus Credit Card | 10,000 Amex Membership Rewards points |

|---|---|

| • 2X Amex Membership Rewards points on all purchases on up to $50,000 in spending per calendar year • No bonus categories to think about or activate and NO annual fee • Can transfer the points you earn to Amex travel partners |

| • $0 annual fee (See Rates & Fees | • $3,000 in eligible purchases on the Card within your first 3 months of Card Membership |

| • This is by far the best card for 2X points on all spending | • Learn more here |

Some Amex cards don’t have statement credits, but rather, limits on the number of bonus points you can earn. Think of them as rebates.

For example, with the Blue Business Plus Amex (check it out here), you can earn 2X Amex points on up to $50,000 spent per calendar year. After that, you’ll earn 1X.

Other Amex cards have similar setups, like:

- Amex EveryDay card – 2X Amex points at US supermarkets, up to $6,000 per year

- Amex EveryDay Preferred card – 3X Amex points at US supermarkets, up to $6,000 per year

- Blue Cash Preferred – 6% cashback at US supermarkets, up to $6,000 per year – learn more about the card here

If you want to earn elite status through spending to score upgrades and free breakfast, you have a few more months to do it

And if you’re gunning to earn elite status credit, or other bonuses for spending, that’s coming to close at the end of December as well. Many Amex cards let you spend your way to elite status, like:

- Hilton Honors Ascend Credit Card from American Express – Get a free weekend night when you spend $15,000 in a calendar year and get Hilton Diamond elite status when you spend $40,000 in a calendar year – learn more about the card here

- Delta Reserve for Business Credit Card from American Express – Earn 15,000 MQMs toward Delta status and 15,000 bonus miles when you spent $30,000 in a calendar year – learn more about the card here

Other Amex cards have similar rewards for spending, or thresholds for bonus points, so you have a few more months if you’re close to the line.

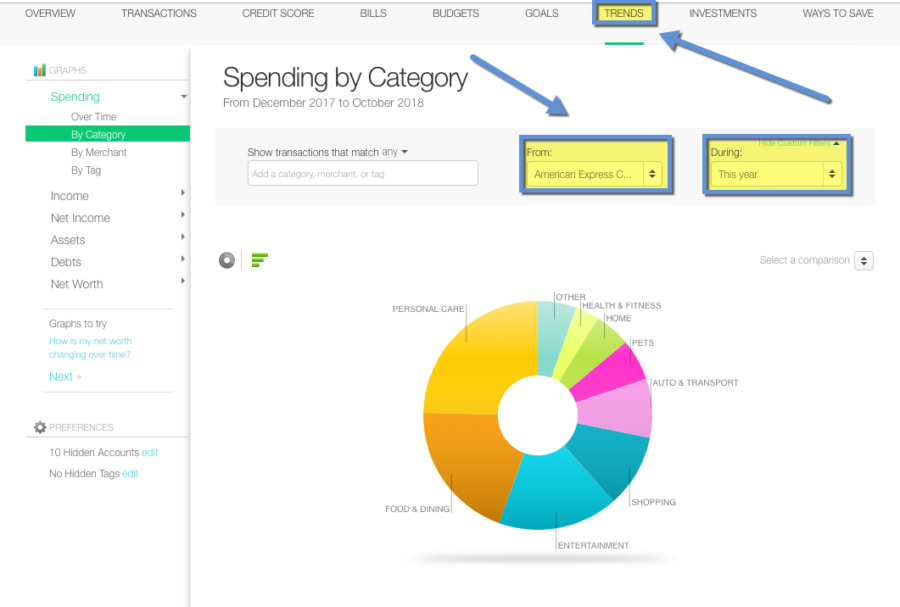

Mint.com will tell you how much you’ve spent this year on any card

I wrote how to use Mint.com to track your spending on any credit card. You can check by clicking “Trends” then filtering by card, and “This year.”

That way you can see exactly how much you have left to go to earn bonus points or meet a spending threshold for a reward. 👊

Other cards have credits resetting, too

1. Citi Prestige

So I dunno what Citi is planning with the Prestige card, but it’s not open to new applicants. However, if you have the card, the annual $250 travel credit resets after your December billing statement.

Just in case you haven’t maxed it out yet.

2. Barclays and Citi American Airlines cards

Most of these cards include a 10% mileage rebate when you redeem American Airlines miles. You can get up to 10,000 miles back on award flights per calendar year.

This will reset in January, so if you have an award flight in mind, you can get points back instantly when you book.

Instantly get up to 10,000 AA miles rebated per year with most AA co-brand cards

For example, I booked a Business Class flight to Tokyo for 60,000 American Airlines miles. But got 6,000 miles back (10%) put back in my account right away.

So while you need all the miles in your account to book, the total cost for this flight was only 54,000 American Airlines miles, which is a stellar deal.

2. Chase Ritz-Carlton

This card isn’t open for new applicants, but has a $300 travel credit per year. You have to call in to have credits applied, which is a pain.

The good news is you have 4 billing cycles to claim the credits. So if you’ve been waiting around on this, you have plenty of time to use it before it resets next year.

Bottom line

- Link: Amex Platinum Card – learn more here

- Link: Amex Gold Card – learn more here

Q4 is actually a great time to open new cards. Of particular interest at the Amex Platinum and Gold cards, with a $200 and $100 airline incidental credit per calendar year, respectively.

You’re likely spending more and planning travel through the end of the year, so meeting the minimum spends is easier.

And you get a running start on using credits and earning rewards for spending – all to have it reset in a few months. In this way, it’s easier to offset the first years’ annual fee.

If you have a card you’re already spending on, here’s how to use Mint.com to check your spending. And in general, it’s a good idea to do a card inventory every once in a while to make sure you’re using all the benefits. Annual credits are low-hanging fruit – and easy wins are the best.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Are you sure the Ritz Carlton Card’s $300 is per calendar year? Last time I checked is seems as it’s by card membership year.

Yes, the T&Cs say:

Maximum statement credit accumulation for this offer is $300 per calendar year. Annual credit will be issued for the calendar year in which the transaction posts to your account.

https://www.ritzcarltonrewardscard.com/terms-and-conditions