Considering all the things I’m juggling all the time, my accuracy rate is pretty high. But more to keep track of means more things fall through the cracks.

Before I moved to Dallas ~7 months ago, I changed all my addresses to my new address. During this, I paused the shipping on my Dollar Shave Club account.

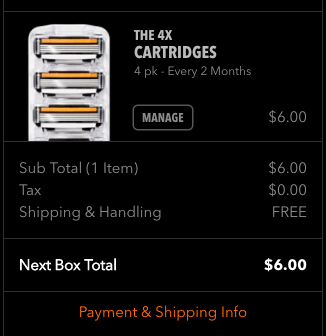

And somewhere along the line, I canceled my Amex EveryDay Preferred card because I wasn’t making 30 transactions on it per month. To help with the transactions, and because it was so low, I made it my primary card for Dollar Shave Club’s recurring $6 monthly charge.

You can guess what happened. Somewhere in the middle of everything, the shipping resumed.

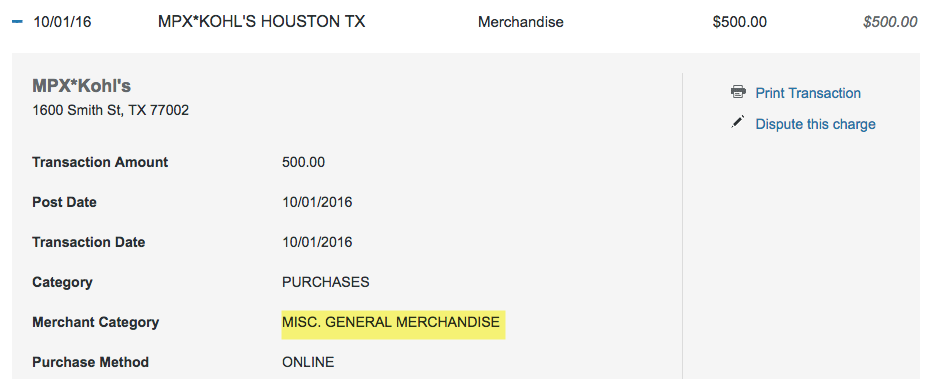

And somehow, the charge cleared. Usually, when a card is closed, you’ll get an email from the merchant saying the payment failed so that you can protect your credit score. Not so with this one.

Amex cleared the charge. And I never got an email from or letter from them. Until one day, I saw my credit score dropped from 803 to 702 – because of non-payment of the $6 charge.