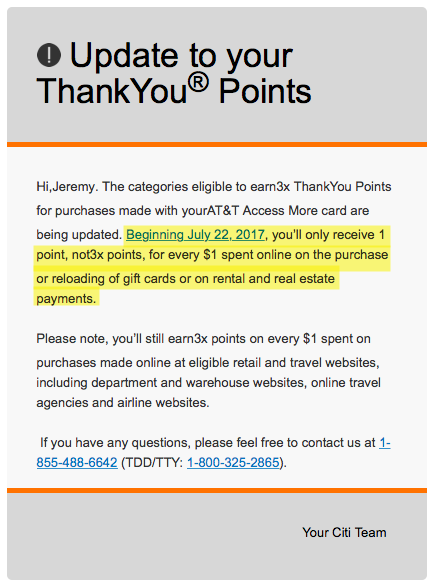

I am in a slough of despond. Following this morning’s depressing news that you can no longer use Visa cards for Plastiq rent and mortgage payments, I received the following email from Citi:

As of July 22nd, 2017, “rental and real estate” payments will only earn 1 point per $1 spent instead of the current 3X points. This was definitely going to be my backup for Visa cards.

And, given that Citi Prestige is getting poopier on July 23rd, 2017, I am suddenly rethinking my entire relationship with Citi cards.

If only 1X, which 1X?

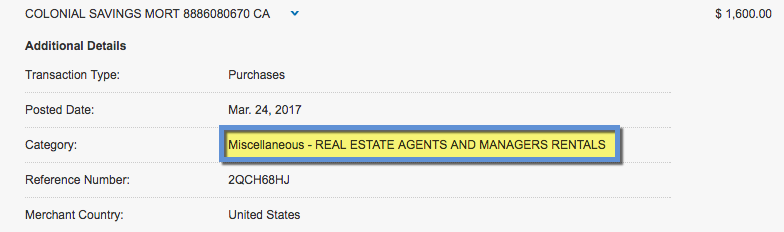

I reported some rental payments were earning 3X with the Chase Sapphire Reserve. And then noticed the same payments only earned 1X with the US Bank Altitude Reserve.

Well, as of today, you can’t use any Visa credit cards for these payments. Which was fine, as I had my trusty Citi AT&T Access More card for 3X.

I was a bit on the fence anyway because I combine the points with my Citi Prestige where they’re worth 1.6 each toward American Airlines flights – that’s going down to 1.25 cents (for all airlines) on July 23rd, 2017.

My other Citi ThankYou card, the ThankYou Premier, hasn’t seen much any use since the Chase Sapphire Reserve came out.

With Visa cards – and now the Citi AT&T Access More card – gone as rent & mortgage payment options, it looks like these payments are going to get 1X from now on from any card you use.

So now I’m wondering which 1X I’d like. There’s always Starwood points, though that will also likely come to a screeching halt early next year.

And even at 1X, I could always use an American Airlines card to rack up some miles (I have a MasterCard and Amex version of their cards).

The bigger issue, though, is if it’s worth paying Plastiq’s 2.5% fee to earn 1X. I’ve been hitting 3 to 4 cents per point with a few of my award bookings lately. But paying the fee would make me have to hit that benchmark for it to be worth it. Now I’m wondering if it’s worth it at all. Even a 2% cashback card wouldn’t cut it.

I know deals come and go, but this one is hitting me a lot more than the usual loophole closures.

Bottom line

It’s been a phenomenal ride with the Citi AT&T Access More card – I’m sad to see this one go. And a bit surprised, considering it’s no longer available for new sign-ups.

Next month, this card and Citi Prestige will both become a lot less valuable than they currently are. I’ll do one more round of payments. And then maybe make a test payment to make sure it is indeed coding as 1X. Because, who knows, maybe it’ll slide under the radar.

I’m seriously rethinking my relationship with Citi, too. Maybe I’ll transfer all my ThankYou points to Etihad and make a clean break. Because it looks like we are definitely breaking up next month. :/

Is Chase winning the flexible bank points game now by default? Or is it time to take another look at Amex Membership Rewards? That new 2X card is looking mighty attractive right about now…

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

So what do you think we should do going forward when it comes to paying rent, suck it up and just get 1x or scratch paying rent with any cards anymore? Also can you downgrade the ATT Card?

I’m not sure right now, honestly. I need to sit and evaluate my plan moving forward because this changes a lot for me.

You can downgrade that card to the no AF version. I might do that just to keep the credit line open.

I’ll def have another post about my strategy moving forward. But seriously considering that Amex 2X card that just came out. That might be worth it.

Yea thats a good idea for me to maybe get that to, but you cap at 50k a year. I send way more than that a year on rent. I send like 7k+ a month in rent.

Me too 🙁 But at least that’ll get you through a good portion of the year. Still trying to figure out what comes after I hit the cap. This news is kinda rocking my little boat!

Amex Blue Business Plus gets 2x up to 50k/year.

Exactly! That might be the ace in the hole – I am strongly considering getting that card now.

It’s all my fault…sorry everyone! Just when I go to get a Buxx card, they nerf the program. The week my PayPal BDMC card arrives, MyCash reloads disappear. I just closed on a house and was going to set up auto payments and this news comes out.

On a serious note, I did get the Blue for Biz card in Feb. All the rage is the new Blue Biz card but the former gives 2.3% for the first year, if you have another MR card (and who doesn’t). Not as great as 3X for TYP but at least it’s on the positive.

Harlan, you mentioned transferring your TYP for Ethiad, while some people go for KrisAir transfers. I’m considering closing out all my TYP as well. I would be curious to hear more about your analysis on best options to transfer once the shock clears:) Thanks!

Well, I held off on refinancing my mortgage because my current servicer worked with Plastiq. Now I have no reason not to refinance.

I don’t see any reason either. Unless the servicer you have in mind also works with Plastiq and something else comes along?