Update: This offer is no longer available. Check here to see the latest card offers!

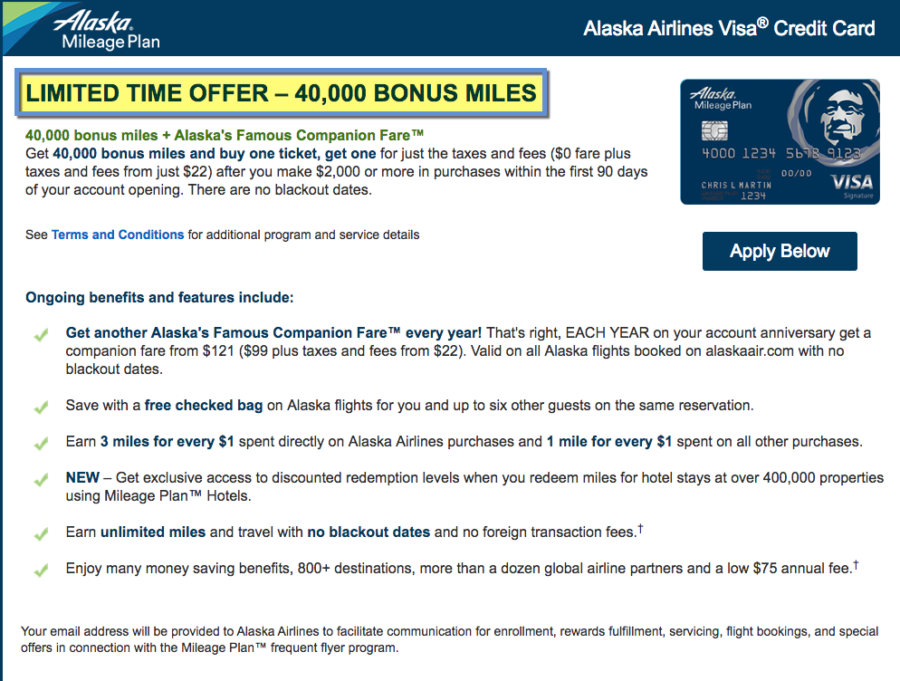

Capital One shook things up this week when they announced mondo 200,000-mile sign-up offers on their Spark Miles and Spark Cash cards. And on the Spark Miles card, those rewards will become transferable to 12 airlines starting December 2018, which is stellar. It’s always good to have more options – especially with flexible rewards programs.

In fact, peeps looking for a single-card solution to most points dilemmas finally found their match. You can redeem the points for 1 cent each, and with the Spark miles card, transfer them at a 2:1.5 ratio to useful airlines like Air Canada, Etihad, and Qantas.

They’re excellent deals if you want a rewarding small business card without hassle. You’ll end up with $3,000 or 225,000 airline miles after the minimum spending is complete.

The required spending and opportunity cost are high with this one

But they’re NOT for everyone. I’ll explain why.