Update: This offer is no longer available. Click here for the best current offers!

Lord help me, I just got another new credit card. This one’s too good to pass up if you’re over 5/24 and have small business income.

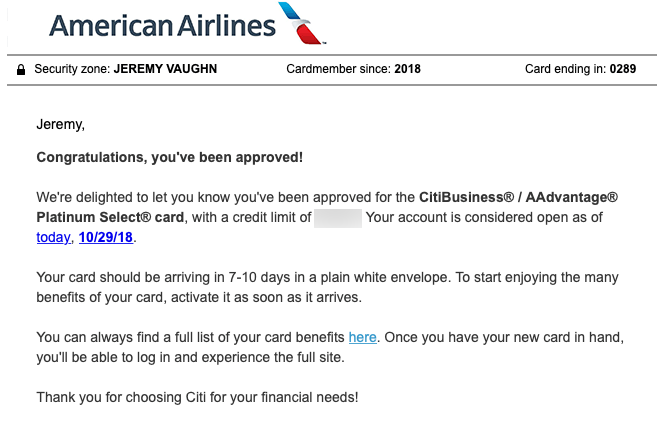

You can earn 70,000 American Airlines miles with the CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® after meeting reasonable minimum spending requirements. I just signed up and got instant approval!

70,000 American Airlines miles is enough to visit:

- 4 countries in Asia (China, Hong Kong, Japan, South Korea)

- Northern South America

- Literally anywhere in Europe

- The Caribbean, Mexico, or Central America

And it’s nearly enough for 2 round-trip coach award flights to Hawaii!

That fateful moment when you open yet another new credit card

I was running low on AA miles. But now that you can book Air Tahiti Nui and Qatar flights on the AA website (along with other partners), it’s easier than ever to use your miles. You do NOT have to fly on American Airlines – use your miles for partner flights instead!

I’m so close to an around-the-world trip on Cathay Pacific with Alaska miles, and Qatar with American Airlines miles, that I can taste it.

Plus, you can make mortgage payments via Plastiq with this card because it’s a MasterCard, so it’s easy to meet the minimum spending in no time! (That’s how I plan to complete the spending requirements.)

Citi AA 70K miles with the CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

For a limited time, you can earn 70,000 American Airlines miles after making $4,000 in purchases within the first 4 months of account opening. That breaks down to $1,000 per month for 4 months, which is totally doable.

My mortgage is $1,500, so I’ll easily meet this minimum spending in under 3 months by making the payments through Plastiq. (You get $500 fee-free dollars if you sign up with my link.)

You’ll also get:

- 2X American Airlines miles per $1 spent on American Airlines flights

- 2X American Airlines miles per $1 spent at telecommunications merchants, cable and satellite providers, car rental merchants, and at gas stations

- 1X American Airlines mile per $1 spent on other purchases

The $99 annual fee is waived the first year. And there are no foreign transaction fees.

Realistically, I don’t see myself keeping this card long-term. But it doesn’t count toward 5/24. And if you’ve opened OR closed other Citi personal AA cards in the last 2 years, you can still earn the bonus on this card.

Plus, it’s the highest bonus of ANY AA co-branded card right now. I mentioned back in July this is a good card to get if you’re LOL/24, and now, I’ve just gotten it myself.

I love instant approvals

This is my first Citi small business card, and the application was super simple. I applied as a sole proprietor with my SSN, and was instantly approved.

Oops

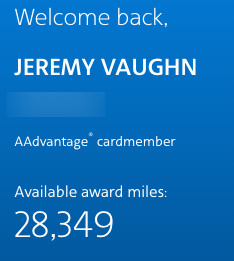

I’m low on AA miles at the moment after using 54,000 miles to fly to Japan in Business Class earlier this year. And after earning the bonus, I’ll have 74,000 more AA miles (including the minimum spending), for a total of over 100,000 miles to burn.

What can you do with 70,000 American Airlines miles?

- Link: AA award chart

American’s been on a roll with adding partners for online bookings. Directly on the AA site, you can book:

- Air Tahiti Nui

- Alaska Airlines

- Fiji Airways

- Finnair

- Hawaiian Airlines

- Iberia

- Qantas

- Qatar

- Royal Jordanian

- and more!

I really liked flying on Fiji Airways to the South Pacific

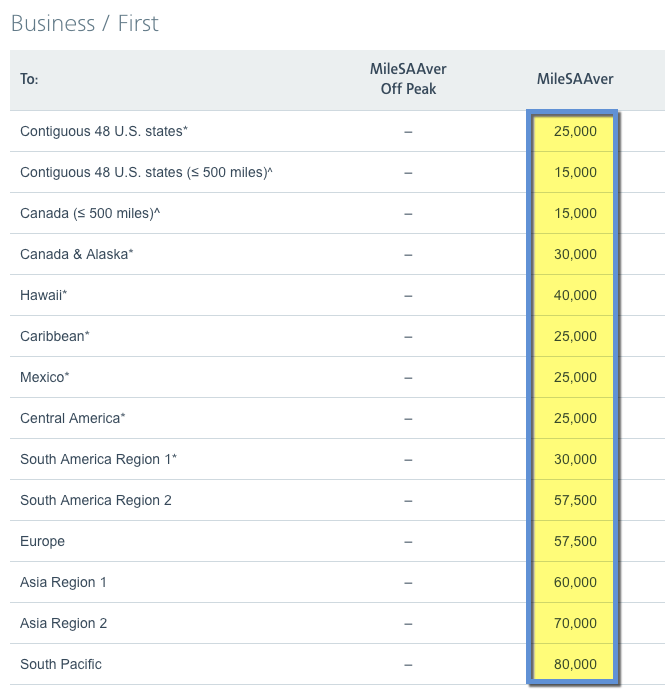

70,000 American Airlines miles is enough for a one-way Business Class class flight to nearly ANYWHERE in the world:

You can fly pretty much anywhere with this 1 sign-up bonus

Considering these flights can cost $1,000s if you pay cash, this is a screamingly good deal. My Business Class flights to Tokyo would’ve cost $15,000 had I paid out-of pocket.

As it stands, you can fly to:

- China, Hong Kong, Japan, or South Korea for 65,000 American Airlines miles off-peak round-trip in coach

- One-way to Northern South America for 60,000 American Airlines miles in Business Class (or 40,000 American Airlines miles in coach)

- Anywhere in Europe for 60,000 American Airlines miles round-trip in coach

- The Caribbean, Mexico, or Central America (like Costa Rica, Guatemala, Nicaragua, or Panama) for 25,000 American Airlines miles off-peak round-trip in coach!!!

- Anywhere in Hawaii for 40,000 American Airlines miles round-trip in coach during off-peak

Feeling like a trip to Venice? You can do that with this 1 sign-up bonus. Then take the train to Florence or Milan!

Where I wanna go

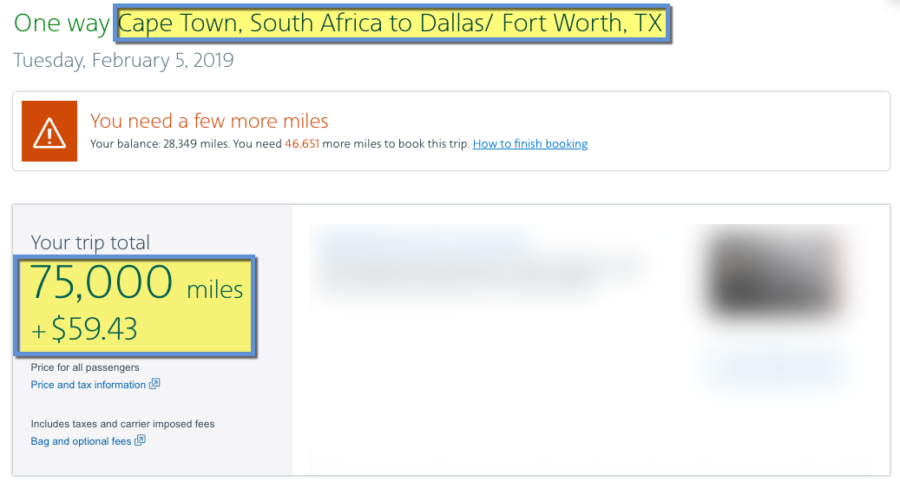

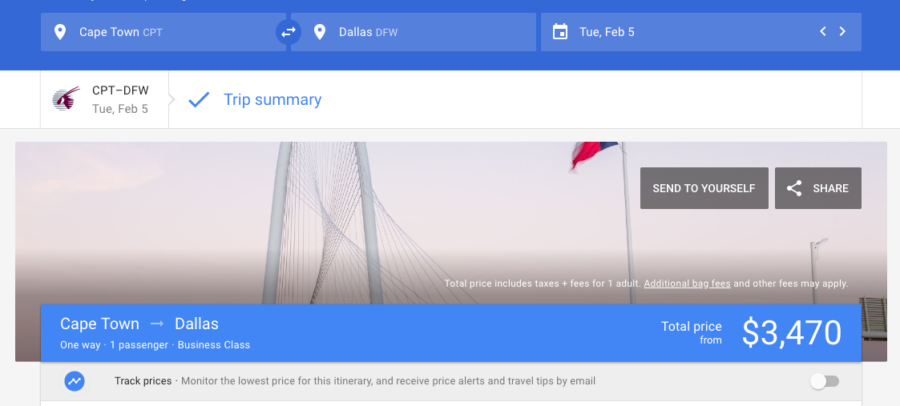

You can fly all the way from Africa to the US on Qatar in Business Class for only 75,000 American Airlines miles. This bonus is almost enough to fly between the 2 zones (only 1,000 miles short)!

Fly in Qatar Business Class to or from Africa for only 75,000 AA miles

Because you’ll have at least 74,000 American Airlines miles after meeting the minimum spending requirements (and more if you spend in the bonus categories).

This flight would cost $3,400+

It’s actually pretty cheap to fly all that way, considering. But I’d much rather use miles than pay $3,470 – and in this case, the miles are worth nearly 5 cents each, which is a stellar value.

I’ve been dreaming of piecing together a trip to Hong Kong and Cape Town on Cathay Pacific and Qatar, so this bonus finally puts that goal within reach.

Getting flights like this and being able to book them directly online from one sign-up bonus is amazing. I can’t wait to see Africa for the first time with my own eyes.

Walk along the shores of Mexico (and take 2 peeps with you) with one excellent sign-up bonus

Or you could get 3 trips to the Caribbean or Mexico in coach – or anywhere in the mainland US!

There’s no reason why this one sign-up bonus can’t be worth $1,000+ if you use it judiciously – or even a few thousand.

I personally don’t like getting low on AA miles. And with this bonus, you only have to spend $1,000 a month ($250 per week) to trigger the sign-up offer, which is easy for most people.

Bottom line

Being able to earn 70,000 American Airlines miles with only $4,000 in spending spread over 4 months is easy (especially with Plastiq payments for rent or mortgage payments) – and the bonus can be worth several thousand bucks.

Squeee!

I just got card today with instant approval and want to plan a trip to South Africa in Qatar Business Class!

As long as you have a side hustle aiming to earn a profit, you can apply with your SSN as a sole proprietor. I’ve found AA miles easy to use, especially now that you can book most airline partners directly on their website.

If you’re looking for a great offer and an easy bonus to earn – this is it. It’s for a “limited time” so I’d recommend getting it sooner rather than later to be on the safe side.

How would you use 70,000 AA miles?

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Thank you so much for this post. Sometimes, I just want the what to do when you’re feeling low on options kind of post. So thank you for making it simple!

100%! Thank you for reading and commenting – this truly is the best offer for those of us who are low on options!

Question: Why spend $4k to meet minimum requirements to get 70k points, when AA regularly has bonuses on purchased miles? I think the last time around you could purchase a total of 250k points (inc. bonus) for ~$4100.

Because when you’re spending $4k to meet spend requirements you get more than just the AA miles? You get your mortgage paid in the blog post. Or you get $4,000 of hookers and blow in my case.

If you were planning on spending it anyway, I’m all for it!

What JRL said! The minimum spending should be met with things you need to buy or pay anyway. Otherwise you’re just spending money you weren’t planning on spending.

Hey Harlan! Is this as easy/good chance for approval as it is with Chase business cards? Or do they request supporting documentation? And are you planning on another meet up in Dallas?

Hey there! Absolutely! I was approved instantly with no call/documentation at all. Super easy – took seconds!

Also: https://www.meetup.com/outformiles/events/256055456/

11/13! I hope you can make it!

Did you ever book a round the world flight?

We are doing IAD-HKG-SIN on CX (50 AS), and then KUL-DOH-IAD (40 and 70 = 110 AA). KUL-DOH leg was 40K but we have the AA miles so we’re fine with it!

I have! A long time ago. It was crazy but soooo fun. I think it took 2 weeks! How long is your trip? That sounds fab!