Hi from Memphis! The last month has been an absolute whirlwind. I intended to do an update in late March, as usual, but then decided it would be better to do these updates near the beginning of the month instead.

The start of this month was Easter – and I was in Oklahoma meeting my bio-son for the first time, which was incredible. When I got back, I was exhausted – still am. But wanted to get this posted.

And just like that… I’m gone

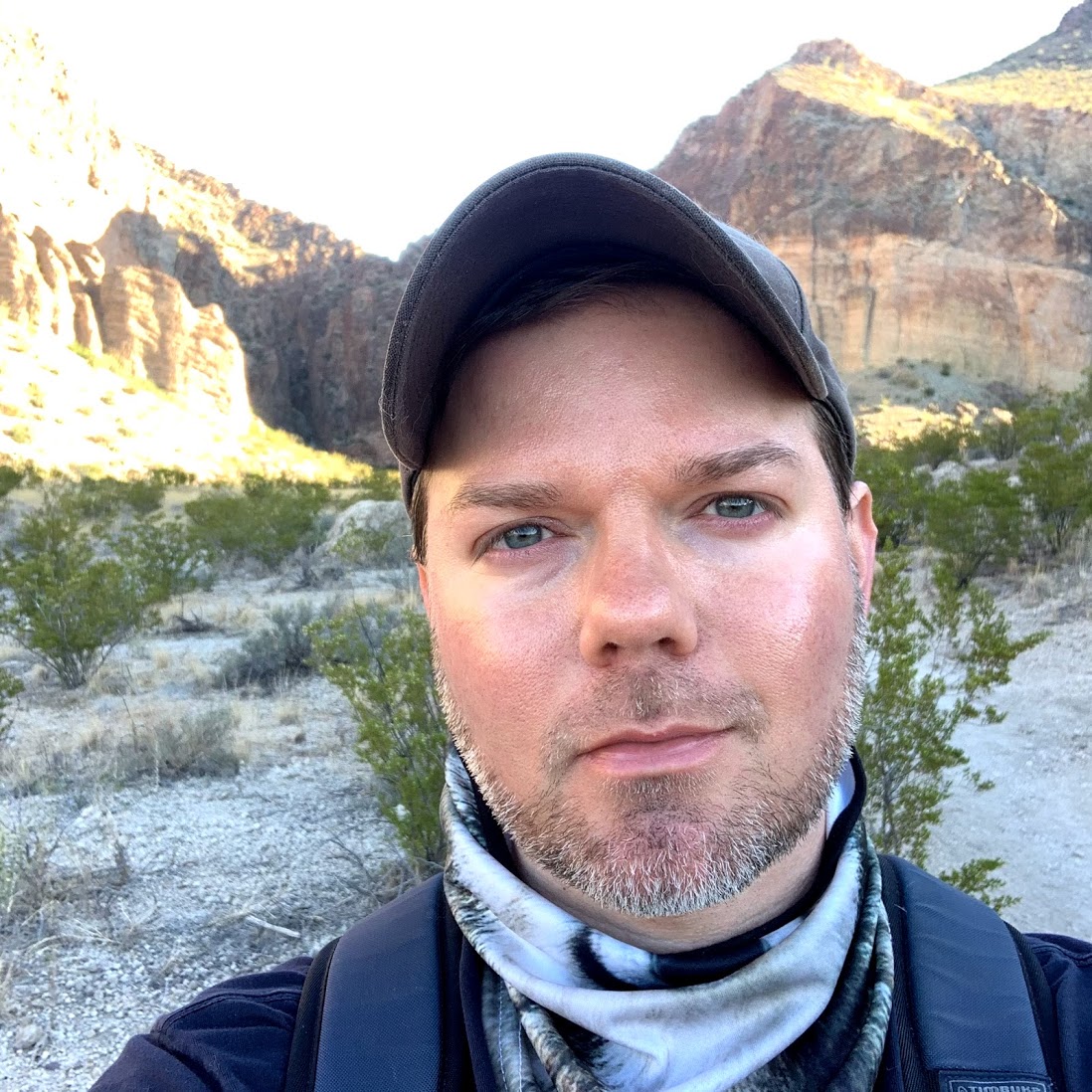

Also at the end of March, I rented a truck and put all my stuff in storage. I’m now living on the road for an indefinite amount of time. I’ll be in Memphis for a few more weeks. Then Nashville for a month, Knoxville for two weeks, and Asheville, NC, for two weeks. And northeast for the summer.

And I dare say I’m saving more money than before? I’m getting close to a $200,000 net worth.

Living debt-free on the road: so far, so good.