It’s been a weird month. Financially, things have been great. But I’m getting antsy about the next life phase and been doing a lot of “hanging in there” recently.

I had the idea to buy a little house in the Memphis area and move closer to family. But waiting for things to reopen. And keeping an eye on the upcoming election. And hoping to keep my job for a bit longer.

If I can make it through September, October will be a lost month (2020 is already a lost year, so it’s almost moot). There’s going to be so much election stuff that I wonder if anything will get done. And then the results will be explosive no matter what happens. Then holidays. And my lease in Dallas is up in February 2021.

Meditating until 2021

I’m over Dallas. I’m only here to live in an apartment and drive to an office one or two days a week. If anything, this pandemic has shown me what I want – and don’t want.

There’s a lot of wait and see going on from every angle. But time passes, as it does. Despite everything, I’ve been socking funds away for my near- and long-term future. So I’ll be prepared for whatever that might mean for this Freedom journey I put myself on.

And tomorrow’s my birthday. 36 years on planet Earth! 👽

August 2020 Freedom Update

Ever notice how these updates are mostly meditative? Of course there are hard numbers I’m tracking, but abstract ideas pull me back.

Like how money is a tool – and I’m still figuring out my why and how I want to use it. I am so enjoying this chronicle and just simply writing here – I reference these posts often like snapshots along a very long road trip, to remember how far I’ve come compared to when I started. And the snags and how they ended up not mattering despite all my fretting!

I have a plant to take care of now. I think her name is Jane

Each month continues to top the one before – so each month (each day, really) is my new best. I’m realizing the benefits of a strong market, compound interest, and automatic savings – the pillars that lead to rapid accumulation.

Now that I have systems in place, I want to keep the factory running (the spice must flow!). But in the background, I feel changes. It bugs me that I don’t know what they are yet. But that’s the universe at play, right? We must keep playing. Childlike wonder. ✨

This whole thing is a continuation of lessons. As within, so without – internal changes reflected in the world around me. Really cool stuff, these manifestations. This play.

Focus on cash and 401k

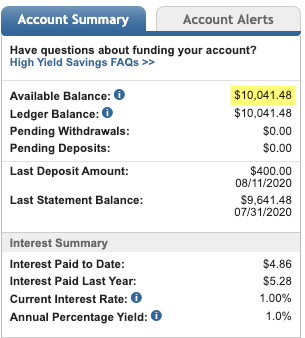

I reached my goal of having $20,000 in an emergency fund (with my Citi Accelerate high-yield savings account). But then I put a little more in my PNC high-yield savings account.

I love this lil account

I’d opened it a while ago because of a bonus and it was sitting there unused with a 1% APY so I’ve been socking cash away in there. Now there’s a little over $10,000. I will keep adding to it. With all the uncertainty in literally every facet of my future [plans], I’ve continued to value a cash position over everything.

Come January, I can always move $6,000 to my Roth IRA and max it out early in the year. ✔️

Speaking of retirement accounts, I upped my 401k contribution to 30% of my paycheck. So I’m adding a couple thousand each month now. Between that and what I’m adding to savings, I’m putting away about 50% of my overall income. Pretty easy to do when there’s nowhere to go – the one benefit of being “stuck” inside.

Everything is mostly breezy tho

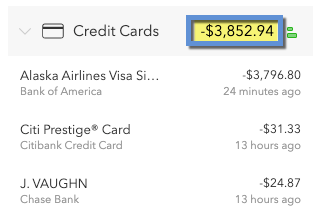

I made a $1,000 payment toward my credit cards, and now owe $3,853 on them.

Woot woot

This is excellent progress, especially considering the 0% APR rate I have is valid through September 2021. I have over a year to pay this. But I want it gone.

Yussss

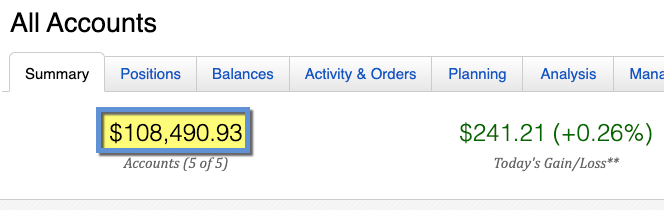

My investments are chugging right along. I recently hit my first $100K invested, and every day it grows a little bit more. Even with setbacks, I’m so dang proud I hit this milestone.

That dip felt like forever

Compared to a year ago, I’ve come so far. That’s part of what makes these snapshots so interesting. In the moment, it feels like baby steps. And they are. But they’re adding up in a hugely cumulative way. These posts are a remembrance to stop and celebrate a little. 🥳

By the numbers

Soon, I’ll have to come up with new goals to achieve in 2021. But for now, I’m maxed out my 2019 and 2020 Roth IRAs, built up my emergency fund, and sold my condo.

That’s plenty for one year, but I’m also up $18,000+ since this time last month:

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $3,853 | $4,898 | -$1,045 | $0 | |

| Mortgage | $0 | $0 | xx | $0 | COMPLETE! |

| Car | $3,888 | $3,888 | xx | $0 | |

| Roth IRA 2019 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| Roth IRA 2020 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| 401k | $17,206 | $12,874 | +$4,332 | As much as possible | |

| Overall investments | $108,491 | $98,615 | +$9,876 | As much as possible | |

| Savings | $30,101 | $24,095 | +$6,006 | $20,000 | COMPLETE! |

| Net worth in Personal Capital | $141,954 | $123,577 | +$18,377 | $500,000 | Track your net worth with Personal Capital |

Wow. I haven’t touched my car payment, so that’s stagnant. But I made progress on my credit cards – and investments + savings grew in a huge way.

The investments were due to market gains and adding $6,000 to my 2020 Roth IRA. And I got a $5,000 check from my condo’s escrow account that went right into savings.

So I don’t expect this much growth again next month now that things are done shifting post-sale.

Would love to get to $150K net worth in September!

What I’ll focus on next month is maxing out my 2020 401k and adding to the savings account. Then I’ll get back to the credit cards and paying down my car note (although both are pretty low priority tbh).

Finally reached a period of financial calm and that letter from the collection agency comes screaming through. But we’re meditating, right? 🧘🏻♂️ Yes – om.

August 2020 Freedom update bottom line

All (mostly) quiet on the Western front, oh by jingo. With regard to the stirrings of a wandering soul that wants to wander, I’m thinking next year I’ll leave Dallas.

I don’t know what that means for the Freedom journey, but I’d like to reach at least $200K net worth before I go. $250K would be even better – that’d be half of my goal.

Why do I keep getting setbacks? I can’t personalize it as so many are going through so much more right now. Still, it’s like… another thing to deal with. Sigh.

Despite it, I’m still optimistic and glad everything shook out so well over the past month. You know what though? If I do end up having to pay that collection agency, they accept credit cards so I might just snap and get a new Chase Sapphire Preferred and at least get a sign-up bonus out of it. Silver linings, right? 🤷🏻♂️

And while my 2020 travel plans have gone to pot, I’m starting to think a LOT about 2021. For now, I’m hanging in there, grateful, and still here – and right now, that is enough.

Hope everyone is doing great! Tell me about your upcoming travel plans – I’ll live vicariously. To be continued.

Just for a smile 🙂

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Glad to hear you are doing alright Harlan. Certainly looking forward to post-covid times when we can get back to exploring more of the world we live in. If things are ok in the fall, I’m planning a road trip to see some fall colors (not sure whether it will be to the East or the West).

That sounds so nice, Teja. If you’ve never been to Vermont I *highly* recommend it for fall. There’s nowhere in the world quite like it and a road trip there is pure medicine for the soul! Hope you are doing great!

We have had a few setbacks this month with regards to our freedom fund as well.

A fridge that needs repairing, certain stuff in our rental that also needs repair, but it wasn’t as bad as April’s 🙂

Seems like Murphy’s Law has a way of finding us when we’re slowly getting ahead by giving us a little bump but it’s how we get through these setbacks that makes us stronger (and better!)

Yesss I hear you! I just need a smooth patch where nothing happens. For like three months. Even two would be great. Getting ready to do my final Q4 push – we got this!

Happy birthday Harlan!!

Thank you so much, Audrey. Being 36 is actually kinda rad. :)~

Happy Bday! Aug is the month of birthdays 🙂

Get ready for this crazy market bubble to pop sometime soon. Fundamentals will catch up sooner rather than later, and a horrible economy will catch up with markets setting all time highs.

Thank you, Ken! Is it bursting… right now? Like, in slow motion? Sure feels like it this month. Hope you and Kim are doing well!

Not quite yet, but fundamentals will eventually catch up. Things tend to get a little weird around presidential elections so anything is possible.

We keep on keepin’ on. Ready for things to get better.