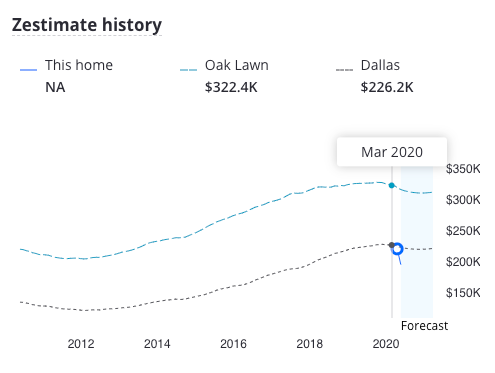

Selling my Dallas condo has consumed most of my energy this month. Every time I check the Zestimate on Zillow, it falls a little more (yeah, I know it’s not reliable, but seeing the number go down gets me in the worst way). The value was above $200K for a few years, and now it’s dipped below that.

I get the resale certificate tomorrow. At this point, I’m seriously considering offloading to a cash for homes place just to get rid of it so I can move on with my life.

Because of Covid-19, I was able to get a 90-day forbearance on the mortgage. So I’m hoping that whatever’s going to happen will work itself out in the next three months. Cuz it’s seriously stressing me out.

What good has come from this situation? I’m meditating again and preparing for life’s next chapter

In the background, I’ve taken time to reconnect to my meditation practice (remember when I did that 10-day meditation retreat when I first got to Dallas?). And I’m seriously considering going full digital nomad when I no longer have a mortgage pinning me down. I want to travel again – this time, for a long time.

I’m also cutting my losses. Mourning in advance, if you will. So while my numbers are down this month, it means I’m going to have to work that much harder (or smarter) to keep my goals on track. Either way, I feel I am winding down my time in Dallas.

May 2020 Freedom Update

It’s wild that I started tracking net worth a few months before a historic pandemic.

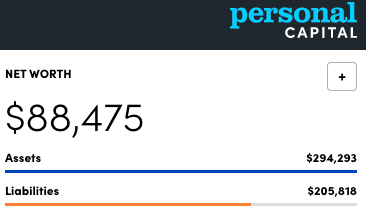

Right now, I’m having to pay for a mortgage and rent while my condo is for sale – so things are mostly steady, although my overall net worth is down again. With all the ups and downs in the market and selling, I wondered if it’s even worth it to keep tracking every month. But I want to. Because I know where I am right now won’t always be this way, and I’d like to have the document to reflect on later.

I desperately want to get rid of my condo

And I will never ever live anywhere with an HOA ever again as long as I live. I have been so soured on this whole experience. We’ll see what happens, but I’m nearly to the point where I’ll do whatever I have to do to finish this thing off.

It was such a great home for so long… and then it wasn’t. I just hope that, despite the HOA, someone will still want to buy it.

With the Zestimate down (which is what Personal Capital uses to estimate value and project net worth), I’m at the lowest I’ve been so far on my journey.

Projected value history and forecast

I considered NOT including my home’s value in net worth calculations But there is always some value in a home. I’ve heard both sides and decided to include it mostly because, for a while, it seemed Dallas real estate would go up (or at least hold steady) long-term. I need to think this over more, but the pandemic has certainly changed that last sentence. That’s for sure.

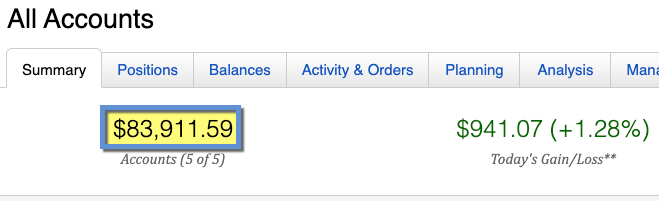

My stocks are surging back

I’m glad something’s going well.

Even small wins feel uncertain

At my peak, I had $87K in stocks. As of today, I’m back at $84K. All this time, I’ve continued to sock away 10% of my salary in my 401k.

Would love to see this hold steady for a while

After I sell this condo and get my credit cards paid down, I’ll amp this number up and finish maxing out my 2020 Roth IRA. And add to my savings account. I’ll likely take a hybrid approach and work on them all a little at a time. #babysteps

But overall, the drop in property value has tanked me

When I started tracking my net worth, it was ~$95K. And now it’s $88K. Even though my stocks are around the same level, cards and mortgage are paid down more, and I have more savings, I’m lower.

What happened?

Did I lean too much on my primary residence’s value?

Well, back in November, my place was “worth” around $230K. Now it’s “worth” around $194K. That’s a difference of $30,000 to $40,000 dollars, depending.

And even though estimates aren’t entirely accurate, it’s true property values are falling in Dallas. Some say a new housing crisis with a flood of delinquencies and foreclosures is about to ensue nationwide.

So was I wrong to include my primary residence in my net worth calculations? A few months ago, I had an asset – now I have a liability.

I guess it goes to show how fast things can change/are changing. If I wanted to stay in Dallas through this correction, I’d keep the place and ride it out. Maybe even refi with rates so low right now. All’s I know is I’m ready to sell now.

If I buy a single-family home in the future, will I include it in my net worth? Even if the value decreases and I go underwater on the mortgage? I think I will.

Net worth is always asset vs. liability – and homes are an example of both in one vehicle. On one hand, your property value could shoot up. On the other, you may get a bigger tax bill or have to make a huge, expensive repair. Either way, it’s going to affect your net worth. It’s the line we walk with homeownership.

I know a home is harder to liquidate than stocks, but the fact remains that you can. You can always get something for a house if you have to. That’s also why I include my car. I can always sell it and get some sort of cash. It might be less than ideal, but it’s still an asset I have that’s worth real cash. The level of liquidity doesn’t matter so much as your own personal risk tolerance.

The cold numbers

Numbers never lie. And while I don’t like this big of a dip, it’s only temporary. With so much in flux, this can look radically different this time next month. In the past, it’s gone up $20K in a month and dropped $25K in a month.

I’ll just have to do everything I can to offload that condo and stay focused on the final goal: get my net worth up to $500,000.

Considering stocks are $80K+ of that number right now, I can still get there if things continue upward. Though with everything going on right now, that’s anyone’s guess. That’s why we must do our best and forget the rest. Running so many mental models will only make a person go crazy.

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $12,042 | $12,149 | -$107 | $0 | |

| Mortgage | $141,782 | $142,091 | -$309 | $0 | |

| Car | $5,526 | $5,595 | -$69 | $0 | |

| Roth IRA 2019 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| Roth IRA 2020 | $0 | $0 | xx | $6,000 | |

| 401k | $9,515 | $7,907 | +$1,608 | As much as possible | |

| Overall investments | $83,912 | $76,983 | +$6,929 | As much as possible | |

| Savings | $1,535 | $1,534 | +$1 | $20,000 | |

| Net worth in Personal Capital | $88,475 | $123,560 | -$35,085 | $500,000 | Track your net worth with Personal Capital |

In a month, and in a year, everything will certainly be different. I just have to keep making these entries and plotting the course. Slow and steady wins the race. 🐢

May 2020 Freedom update bottom line

I also have thoughts on the travel industry I need to record. What a weird time to be a travel blogger. But so much is happening. Too much, maybe. Too fast to really analyze.

I wonder what will become of miles & points once the dust settles a bit. My hunch is cashback cards will come back in a big way – especially if flights remain cheap.

I’ve been so down about the condo situation this month and it’s been a big effort to keep my chin up. I almost didn’t post this because it feels like admitting failure. But it’s OK if I fail. I’m learning. And there’s always more money to make and save.

At this point, I’m just trying to keep my job and capture as much cash as I can while I still have it. I suspect many are in the same boat. I’m doing all I can to keep things afloat and that just has to be good enough for now.

I do hope I’m at a turning point though. And already can’t wait to see where I’ll be this time next month. Crossing everything crossable (fingers, toes, eyes, and all the rest).

Thanks to everyone for reading and keeping the good vibes going. Sending love and goodness into the world this evening. May we all get the healing we need. ✨💫⚡️

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

What stocks do you like?

Fidelity’s Total Market index funds FTW! I’ve got FSKAX and FZROX in my IRAs (and a little FNBGX), and FXAIX in my 401k (because it’s the best they offer). I also have one share of BRKB because I’d like to go to Omaha for the annual meeting someday.

Don’t forget when you’re “Zillowing” that home value, factor in your 6% commission. when you sell.

Absolutely. I actually lean more toward 10% to account for the title transfer and all the other little fees they stick you with. And hoping to pay that 10% one day in the very near future!

What’s the issue with issue HOA

I wish I could reveal all the deets but I’ve been advised to not talk about it for the time being. There’s a new board coming soon and then I can speak more openly. I’m sure things will start to turn around with the HOA and go in a better direction. But I’m just ready to go. It will be a great home for the next person. I just don’t want to stay and ride it out this time around.

Hang in there. God’s got your back.

Thank you so much. I have been praying every night to find a way forward. Really appreciate the kind words, Andre!

I haven’t read your posts for quite a while so maybe I missed it but what in the heck does any of what you posted have to do with travel?

I started documenting my journey to financial independence so I could travel more – and was even thinking of being a digital nomad and recording the lifestyle. That of course is sidetracked with Covid-19, but I committed to keeping this record so wanted to keep my word – especially to myself. I know I haven’t written much lately so it may seem out of the blue, but there is definitely a bigger travel-related plan in mind. Thank you for checking back in after a while! Hopefully there are good developments on the way and I can get back to pondering miles, points, and my next trip – that would be amazing!

Thank again for reading and commenting. I hope you’ll check back and stick with me!

I really enjoy reading your Financial Freedom updates! I think you do a great job of being transparent and you are very relatable, so I appreciate that and definitively has got me thinking about doing the same to order my finances and maybe even all of my points.

You are on a good path and your condo situation will be resolved soon! Good luck!

Thank you, Frank! I’m finding it incredibly inspiring to have a record. It’s so easy to look back and see how much progress you’ve really made. I also find writing it down helps me see the bigger picture, which is such a godsend when I feel lost in all the details. It’s been pretty rad and helpful – give it a try and see how it works for you! 🙂

And thanks for the kind words. Really appreciate you reading and commenting.

HOAs are awful for a condo or townhouse since you don’t own the exterior structure of the building, only from the rafters in. For a single family house they can only tell you the color of paint and veto exterior changes that could affect home values. Not so bad if it keeps your neighbor from parking their old Camaro on the front lawn while they take the hood off and grind it for days. Or paint their entire Camaro on the front lawn so the Krylon overspray goes everywhere. Or when they have 5 cars and an obnoxious motorcycle parked on the front lawn and blocking driveways. An HOA wouldn’t allow any of that.

Remember Harlan, it’s not that life will always go smoothly but that you can handle it when it doesn’t- and I’m sure you’ve got this!

Hang in there!