What a month for my April 2020 Freedom update. My condo is on the market now (!). COVID-19. I moved into an apartment around the corner. And I’m still employed – for now.

I’m concerned my property value is going to drop like a stone.

I always thought I was doing the right thing by investing in property. I had no idea how much control an HOA would have and how much they can affect your asset. I just want to offload this thing as quickly as possible – and I’m willing to give somebody the deal of a lifetime if it means I can get out.

Would anyone like to buy a perfectly good condo in Dallas?

This experience has soured me on condos (specifically HOAs), and to some extent, Dallas. I’m just ready move on with my life.

I will never buy property with an HOA ever again. And this whole thing really makes me wonder if I really want to deal with owning property at all. I love my new apartment – everything works and I’m not responsible for anything. I can cancel my lease and be out of here with a 60-day notice. It’s so… unattached. So freeing.

Although with COVID-19 happening, I definitely see the value of living in a paid-off house, especially with money being uncertain.

So a lot has happened in these last four weeks. And I really hope even more happens in the next four.

For starters, my investments have started to recover. But the idea of “normality” still seems very far away.

April 2020 Freedom update

The gyrations continue. Hopefully I can get cash from selling soon. I don’t want this thing to sit on the market forever. Been feeling nervous about that.

If I can’t sell, perhaps it can be an Airbnb or I could rent it. But I’d rather just sell it because I no longer want to be attached to it.

I moved into my apartment last Friday and with the way time is moving these daze, it feels like forever ago. So yup, I now have a mortgage and rent. I don’t expect to get ahead until the sale is done or I can figure something out.

But we have a special meeting coming up to remove the current board and I’m confident things will change at the complex. I have already mentally detached and am ready for the next chapter in my life.

I am free associating like crazy so thanks if you’ve made it this far. On to the money stuff. And maybe more stream of consciousness.

Cash is everything rn

I did a balance transfer and have my credit card debt sitting with a 0% APR rate until September 2021. So hopefully I can sell before then lol.

Because of that, I’m trying to stay head above water with a mortgage AND rent, so any extra cash I get is going directly to my savings account. I’m going to try my best not to touch it. But until the threat of this pandemic wanes, cash is absolutely king.

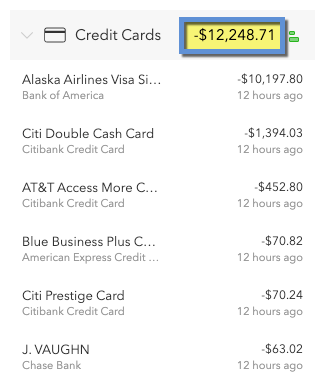

My credit card debt has gone up a bit because of the move

Because of the move and sale, I had to buy materials to make repairs and pay movers. So that cost a fair bit. But I get three paychecks in May, so I think I can catch up and make progress next month.

Investments are recovering

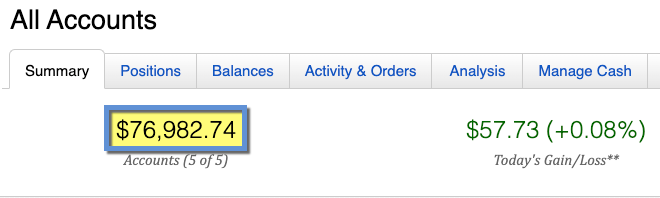

Last month was a huge jolt to my portfolio. But in April, it started to come back.

Thank gods

This is really just a loss “on paper” but pretty soon these investments will be all of my net worth. Very soon, I hope.

This is $16K higher than last month

I’m still contributing 10% of my salary toward my 401k. I figure I should get it in there while I have it. Because yes, I’m low-key worried about getting laid off. My company is struggling for business. But we’re OK… for now.

I haven’t filed taxes yet (I owe), and haven’t started contributing to my 2020 Roth IRA. Those things will have to wait until later this summer.

I’m up $11,000

Despite everything, I’m getting closer to my best-ever net worth. That’s no doubt going to change once I no longer have a mortgage in the mix. And the pandemic will affect the value of my property. So I expect this number to fall, then swoop up again over the next few months. But whatever, I just have to roll with it.

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $12,149 | $11,868 | +$281 | $0 | |

| Mortgage | $142,091 | $142,556 | -$465 | $0 | |

| Car | $5,595 | $5,780 | -$185 | $0 | |

| Roth IRA 2019 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| Roth IRA 2020 | $0 | $0 | xx | $6,000 | |

| 401k | $7,907 | $5,155 | +$2,752 | As much as possible | |

| Overall investments | $76,983 | $60,924 | +$16,059 | As much as possible | |

| Savings | $1,534 | $533 | +$1,001 | $20,000 | |

| Net worth in Personal Capital | $123,560 | $112,682 | +$10,878 | $500,000 | Track your net worth with Personal Capital |

The most notable thing this month is the recovery of my investments and the fact that I was finally able to sock $1,000 into my savings account. I’m actually really proud about that.

I’m not going to get too attached to outcomes here because the numbers are about to fly all over the place. But as long as I’m generally trending up, I can still meet my goal.

Which is this: in 1,583 days, I’ll be 40. That’s when I’d like my net worth to be $500,000. In the end, this pandemic will be a blip on the radar. But living through the blip, right now – it’s a wild ride, man.

April 2020 Freedom update bottom line

Things are all up in the air now because of:

- My pending condo sale (pray I can sell it)

- Job uncertainty 😬

- Having to pay mortgage and rent for the next little bit

- Not knowing what’s going to happen next with COVID-19

So there’s a lot of uncertainty. When things are uncertain, I tend to create my own narratives. They are free-flowing and might NOT be entirely rooted in reality.

Suffice it to say, I’m ready to sell my old place and get back to work. But in these next few weeks, anything can happen and I have to be willing to roll with that.

There will be hesitation and second-guessing, but this is where I’m at in April 2020. I’m guessing a lot of people are in a similar place. It sucks (for now), but we must roll on.

Really really looking forward to sharing good news in my next update. Cross your fingers and hope I can offload that condo ASAP.

How’s everyone out there holding up? Sending out goodness to you tonight. Stay safe and healthy. Thanks as always for reading. I’m very much transitioning right now, but [insert analogy about cocoons making butterflies and how pressure improves outcomes, etc]. ✨🦋

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Dallas is beautiful from the sky! Whats HOA doing that Davis-Sterling disallows?

Living with 2 HOAs!

That sounds like a Cali regulation. They are doing so much. I can’t really talk about it at the moment but wow – it sucks how much power they have over you. Never again.

Good luck on the sale of your condo and it’s good to hear that you’re at the very least healthy and safe.

As for me, I was laid off back in 2008 and recall what it was like to live in unemployment. Thus, I’m thankful to have a job right now but I have redone my monthly budget such that my monthly expenses do not go over $2000 (which is roughly one’s income through unemployment without the federal aid.) I then save the rest since, as you said, cash is king during times of crises.

Thank you so much, Joey! I might have to sell to a cash for homes place if I really want to get rid of it. I’ve been pretty down about the situation, but like you said being healthy and safe is the biggest blessing.

My industry is taking a big hit right now, so I’m also feeling the pressure to downsize while I’m still employed. What a crazy time to be alive. Sure hope you’re doing well. Thanks for reading and stopping by. <3

Our rental properties and our current home all have HOAs. Properties without HOAs do exist in FL but they’re a bit harder to find. We had an issue with 1 rental’s HOA but thank goodness the board got fired the first year and have a better board now.

Husband and I are still employed, we had to lower rent on one of our tenants but she’s still trying to pay, and our side hustles have taken a beating. I’m never as thankful as I am now for our full time jobs as that pays for our bills.

Have also realized how much we really need at a bare minimum to survive, and we’re on track to have around 10 months of emergency funds. Need to bulk it up to around 12.

Our business income is taking a hit so we’ll also need to bulk up the reserves whenever we can. Currently at 2 months but will probably need to put it to 12 mos as well because of the uncertainty.

Oh man, I can’t ever deal with an HOA again after what I’ve been through. It’s absolutely sucked the life out of me. And I totally agree – I am so very grateful to have a full-time job with a dependable paycheck and health insurance. I don’t know what I’d do without it right now.

Definitely feel you about the emergency funds. I have basically nothing saved and am trying to change my finances in a big way. I was making so much progress until this pandemic hit. But will keep doing what I can because what will be will just have to be – wherever we end up.

Are you going to FinCon this year (if they still have it)? Really curious to see how it goes given everything that’s happened so far in 2020. Always a joy to hear from you – hope you and family are doing great.