Last month sure felt dismal. Felt like throwing money into a fire pit, like I wasn’t catching up to my effort. There have been so many ups and down this year that I should’ve known better. But sometimes doubt gets the best of us and it’s hard to keep riding the wave.

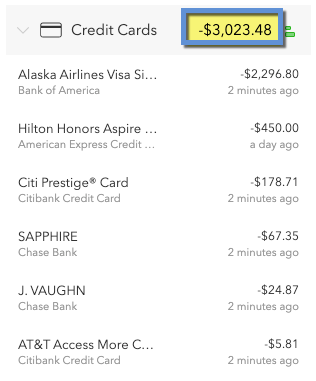

October was much better. I am putting 30% of my paychecks into my 401k and aggressively paying down my credit cards. As of this month, I only have $3,000 to go! I’m challenging myself to pay them off completely by the end of 2020.

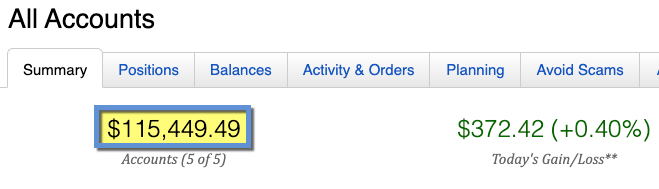

So I’m saving heavily and getting into excellent financial shape – as of right now, the best of my entire life. My net worth is currently $148,641. That’s 30% of the way toward my $500,000 goal!

I hope the next couple of months treat me as favorably, though that might be tough with the election coming up in a couple of weeks. We will see how the stock market reacts. I kind of expect it to dip, no matter the outcome.

Sign o’ the times

But I’m keeping myself occupied. Working, writing, talking to friends. Looking forward to my Big Bend trip next weekend. Being present has emerged as a major theme for me lately. That and connection. ⚡️

October 2020 Freedom Update

When I wrote the last Freedom update post, I was going through it.

Big ouch

See that arrow in the picture? I was down there. Then last week I briefly hit over $150,000 net worth. That was pretty cool. But the next day, the market fell again and I’ve been at ~$149,000, give or take. Which is still great. It’s the highest net worth I’ve ever had.

I’ll likely leave Dallas in the next few months, and would love to preserve my $30,000 savings. Hitting $250,000 net worth is going to feel so good. That’s 50% of my target – and I just hit 30%. It’s starting to look like my goal is attainable. Net worth might fluctuate depending on if I buy another house or not wherever I land.

I’ve tentatively been looking at relocating to Knoxville, TN. 🏞

Credit cards in the crosshairs

Now that I’m down to $3,000 in credit card debt, it is feeling so close. The $450 annual fee just hit on my Amex Hilton Aspire, which stung. But it’s worth it. I just hope I can use all the benefits in the next year. Because right now, every charge feels like a step in the wrong direction – so I need the fee to repay itself many times over, which I’m sure it will.

I think I can

Between my upcoming road trip and the holidays, it’ll be a stretch – but I’m going to try my hardest to pay off all my credit cards before the end of the year.

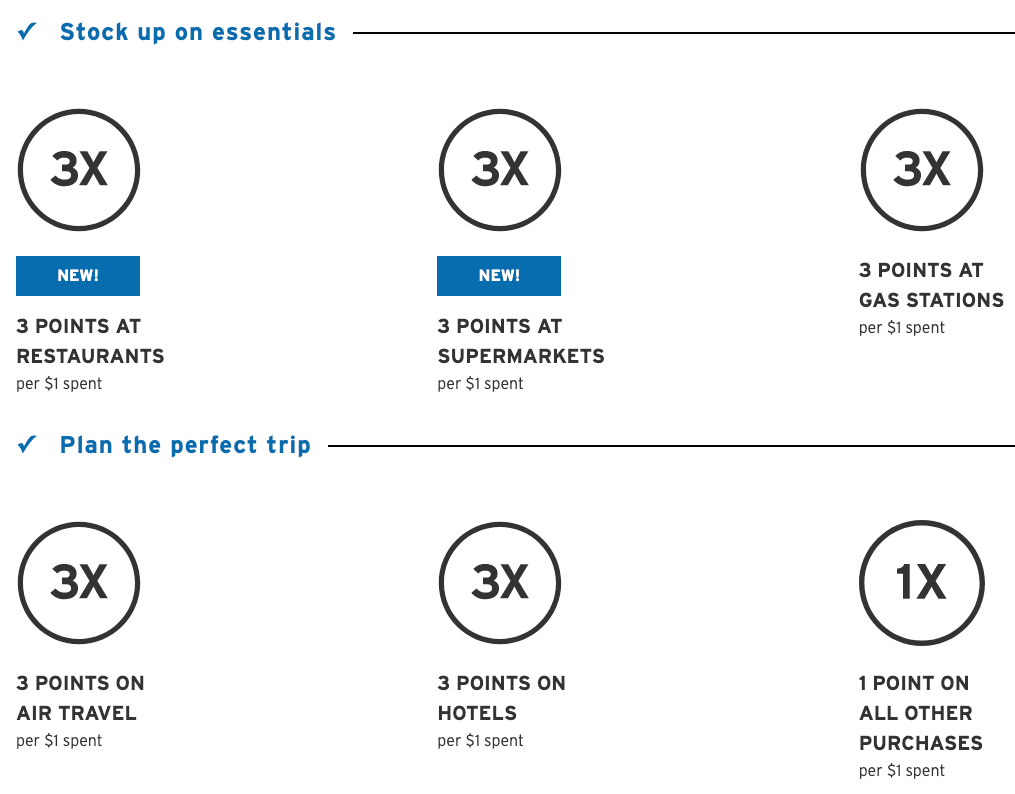

Citi Prestige dilemma

I have to talk about Citi cards in their own section because of ~*~compliance~*~ but the $495 annual fee on my Citi Prestige is coming due in December. I’m leaning heavily toward NOT renewing it.

Instead, I think I’ll downgrade to another Rewards+ card and apply for a new Citi Premier to get the welcome bonus and its amazing 3X bonus categories which include:

- Air travel & hotels

- Gas

- Dining & takeout

- Supermarkets

It’s… it’s perfect!!!

Which like, are you kidding? Gas, dining, groceries PLUS air travel and hotels – all those get 3X points?! This card is BUILT for Covid.

I’m surprised no one is talking about it more! It’s probably because this card isn’t usually commissionable, but it’s available via my links which you can find else because I’m not allowed to add links in the same section as Citi or its products.

But this card has a 60,000-point welcome offer when you spend $4,000 in the first three months of account opening. There’s a $95 annual fee that’s not waived, however 60,000 Citi ThankYou points are worth $600 cash or potentially much more when you transfer them to one of Citi’s 15 airline partners.

I lean heavily toward Citi ThankYou points because they’re so easy to earn. Between the welcome offer and the 3X categories, I could be swimming in Citi points with this card. I wish Chase would catch up and add gas and groceries to one of their cards, but until they do the Citi Premier is an absolute banger.

The only hitch? I don’t know how I’ll use the points since international travel is mostly closed to Americans. But the annual fee isn’t that bad and the bonus is really good. And again, the bonus categories are so useful right now.

My investments did great though

I know that’s not always the case, but it ate me up last month to lose money the day after I invested. I know it can’t always be on the up and up, but it was rather demoralizing at the time and that was certainly reflected in my tone.

So while I’m pleased at the $9,000+ gain this month, I know that’s not always possible and I’m learning to temper myself. But like… when it’s bad, it’s so bad. And when it’s good… omg – the best.

Never go down again plz

I’ll prolly always be down-low emo about the ups and down, but I’ll get better at modulating. Especially now that I’m at this level this month, what happened last month seems minor and histrionic. Another lesson learned.

By the numbers

They say your first $100K is the hardest

Overall, I’m happy with how this month turned out. I’m up ~$11K, investments did well, sent an extra car payment, and made great progress on my credit cards:

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| LIABILITIES | |||||

| Credit cards | $3,023 | $4,340 | -$1,317 | $0 | |

| Mortgage | $0 | $0 | xx | $0 | COMPLETE! |

| Car | $3,422 | $3,888 | -$466 | $0 | |

| ASSETS | |||||

| Roth IRA 2019 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| Roth IRA 2020 | $6,000 | $6,000 | xx | $6,000 | COMPLETE! |

| 401k | $21,666 | $18,772 | +$2,944 | As much as possible | xx |

| Overall investments | $115,449 | $106,058 | +$9,391 | As much as possible | xx |

| Savings | $30,065 | $30,126 | -$61 | $20,000 | COMPLETE! |

| Net worth in Personal Capital | $148,641 | $137,993 | +$10,648 | $500,000 | Track your net worth with Personal Capital |

As much as I want to keep saving and scrimping, I am not going to feel an ounce of guilt for taking a trip and splurging as much as I want to during it. I am going to eat and drink, buy souvenirs, and generally lavish myself with whatever I want. After all, what am I working so hard for? I have to enjoy things now, while they’re right in front of me.

Next month, I’ll drive home to Memphis for Thanksgiving and treat my mom to a birthday dinner that weekend (her birthday is on Thanksgiving Day this year). Hopefully by that time we will know who the next president is (not to get political). I’m just so ready for the crazy media circus to end regarding that topic.

October 2020 Freedom update bottom line

It’s now Q4 and I have my work cut out for me for the rest of the year:

- Pay off all credit cards

- Assess new and current cards for adding or canceling

- Have fun and don’t feel guilty about spending on trips

- Grow or maintain current net worth, which is currently the highest it’s ever been (!)

In the meantime, I’ll be keeping an eye on the election, running to Big Bend National Park for a week, and looking at potentially moving out of Texas in Q1 2021. How excitingggg!

I’m ready to put 2020 in the can, y’all. One last little home stretch. Hanging in there.

How’s Covid treating you? Are you stir-crazy like I am? Any trips planned?

Stay safe and scrappy out there! Hope everyone is doing great! ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

First of all, glad to hear you’re in a relatively good place. That’s nice to hear!

I may be wrong about this, but – I downgraded my Citi Prestige to a Rewards+ (surprisingly hard to say goodbye to the Prestige!) and although it was a downgrade, the Rewards+ has a new number, meaning the Prestige was technically closed. meaning I’m therefore ineligible for the Premier.

Am I wrong about this?

Also, though obviously not as good as a permanent grocery bonus, at least temporarily many Chase cards are offering increased grocery earnings, as I’m sure you know. Just saying!

Stay safe and strong and enjoy your trip!