This year has already been difficult in many ways. So I’ll have to unleash a whole lot of not great news. Of course, everything is down right now. And I’m fighting my HOA about a roof repair and thinking about renting an apartment nearby and trying to sell my current place.

All that’s been going on in the background as everything I’ve worked to save in the past year or two has been wiped out in the stock market. I’m hoping I can sell before my property value suffers too much. I will never, NEVER live in a place with an HOA EVER again.

That said, I’m grateful to have a job that’s allowing us to work from home. But this – all of this – moving, renting, selling, and making repairs to my current place (including the roof and ceiling!) are going to cost me everything I have. Like, everything.

But I have to try.

I few weeks ago, we lived in a different world and I was in Cabo. How quickly things change

For a second, my finances are going to spin out of control. And oddly enough, it’ll all be OK.

March 2020 Freedom update

It’s totally unreal everything that’s happened since my last Freedom update. Things were on the up and up. And now… who knows what’s going on.

While I’m still contributing to my 401k, I’ve resorted to paying the minimums on my credit cards until some dust settles.

You see, I’m trying to rent an apartment nearby, repair and sell my condo, and move. And contractors and movers want cash. But once I sell my condo, I *should* have enough to pay it all back and then some.

I’ve missed writing here. Most days and nights, I’m consumed with thoughts about money and my living situation, and of course… the pandemic. I oscillate between living in fear, wanting to fight back, and a slough of despond. But I bucked up and:

- Started a petition to impeach the entire board 💪

- Got my realtor on board 🏡

- Looked at apartments around Dallas 👀

- Contacted movers 📦

The ceiling leak of my nightmares that I’ve been dealing with for two months

I still need to repair the ceiling and a few things around my condo and move and rent an apartment and all the fees that requires. 😰

And god, I just want out of here. 😔

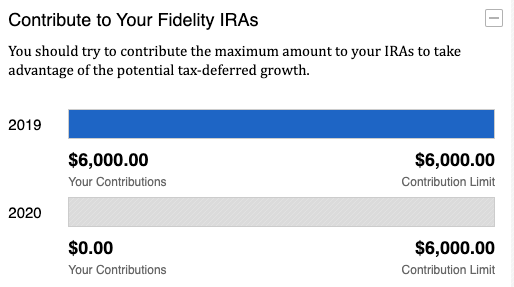

Maxed out my 2019 Roth IRA

Before this virus saga, I managed to max out my 2019 Roth IRA. And then promptly lost all of my contributions. 🤦🏻♂️

Finally did it!

After I sell my place, I’ll use the money to:

- Max out my 2020 Roth IRA

- Pay off all my credit cards

- Fill up my savings account with an emergency fund of $20,000

In essence, selling will give me all the money I need to fulfill my financial goals for the year – and hopefully with a little left over to buy a single family home in the Memphis area. But like so many things right now, the situation is fluid – and time will tell. It may even be a pipe dream.

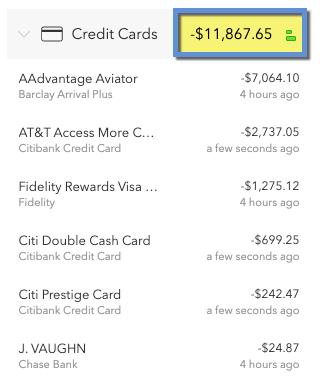

Credit cards on the wayside, cash is king

Until everything is fixed, I’m moved into a new place, and everyone is paid, I’m letting myself carry some credit card debt. These are fees I’ll have to eat, as much as it pains me. But everyone wants cash, so it’s the thing I need most to rearrange my life right now.

In a few weeks, I can get back to this. But for now… it’s on hold

So I’m saving my paychecks. And I’ll use the remainder to make payments later.

I feel like I’m trying to stop spending, but it’s hemorrhaging, and I’m sliding into a tailspin. Which means, ugh, this next chapter is going to cost me.

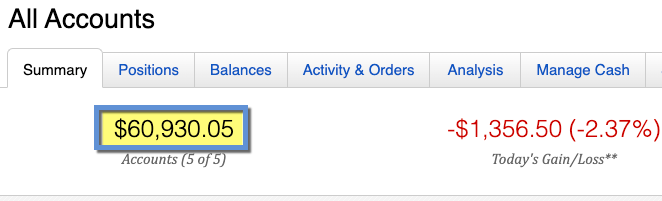

Down down down

Time for the good bits. Let’s see how fast and far I’ve fallen since this same day last month.

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $11,868 | $10,006 | +$1,862 | $0 | |

| Mortgage | $142,556 | $143,019 | -$553 | $0 | |

| Car | $5,780 | $5,965 | -$185 | $0 | |

| Roth IRA 2019 | $6,000 | $5,180 | +$820 | $6,000 | COMPLETE! |

| Roth IRA 2020 | $0 | $0 | xx | $6,000 | |

| 401k | $5,155 | $6,673 | -$1,518 | As much as possible | |

| Overall investments | $60,924 | $88,151 | -$27,227 | As much as possible | |

| Savings | $533 | $533 | xx | $20,000 | |

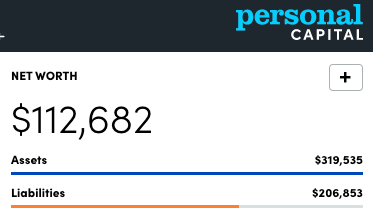

| Net worth in Personal Capital | $112,682 | $137,885 | -$25,203 | $500,000 | Track your net worth with Personal Capital |

Oooof, this hurts

Nothing here is surprising. It does sting to backslide so much after trying so hard. But this is temporary and it will bounce back. (Right?)

I’m going to get back to where I was over these next months. It’s gonna be sloppy and won’t look good – on paper or in reality – but that’s what it is.

I’m banking, literally, on selling this condo to normalize my finances. Praying to all the gods it sells fast in this current environment. I’m prepared to give someone the deal of a lifetime.

Then I’ll:

- Pay off my credit cards, once and for all

- Supplant my savings

- Max out that 2020 Roth IRA

- Ramp up my 401k savings, provided I still have a job by then

- Keep on keeping on

It ain’t where I began, and sure ain’t where I end

And if I can’t sell it, then I’ll deal with that when it happens.

In any regard, I’m so glad to be writing here tonight. It feels so incredibly good to write. I’ll have a lot to report over the next little bit. All the good stuff and all the bad. This is my chronicle and my witness.

March 2020 Freedom update bottom line

If I had to summarize this entire post, it would be:

Literally below where I started from

I’m in a rough patch (like so many others) and the next few months are going to be more rough patchiness. You know those long hikes that have an infamous section known for being super shitty, but afterward the views are amazing? That’s how I feel right now.

Ultimately, I have to do what makes me happy. And I keep reminding myself: it’s just money. At its core, money is a tool to move situations along to their conclusion. That’s how I’m viewing all this. And I can always make more of it.

It does feel so good to write. I promised myself I would write my way through this, and then I just… didn’t. Energy has been so low. My writing means to much to me and I never want to write if it’s not going to be energetic. I’m glad it’s here to ground me now.

Money aside, I am safe and healthy. And in the end, that means more than any stock market crash ever could. I will pay some fees and interest, which I promised myself I’d never do. But we’re in uncharted waters and I need cash on hand. That’s just how it’s gotta be.

So I’m sure this crash in my Freedom update isn’t surprising. But I’m counting my blessings anyway. Once this all blows over, I can recollect, turn around, and enjoy the view from how far I got. This is just the super shitty part of that amazing hike into the mountains.

I’ll keep writing my way through this. Thank you for being here. Sending love and light to your home – may you be safe and blessed. ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Imho I disagree w the strategy. You should pay off (cc) debt before saving. Credit card interest rates accrue faster than your market returns in most cases.

Hi Tri! As soon as I get moved and make the repairs to my condo (ceiling and general touchups), credit cards are the absolute first thing I will tackle. Until then, I need to hang on to any cash that comes in because the movers and contractors only accept cash – and I don’t exactly have many options due to the virus going on now.

I definitely agree with you and this will be the first thing I do as soon as the dust settles.

A couple of things. The market has dropped around 25% so a lot of people fully invested have seen a sizable drop in net worth. If you are older you shouldn’t be 100% in the market but if you are younger you have a long time ahead and it is ok. Of course the market should be secondary after you have a 6-12 month emergency fund in order to cover unexpected home, health and job issues.

And yeah, HOAs suck. My current house is the only one that has been in one. And while it is a beautiful part of Scottsdale, I may sell it, that may depend on what the virus does to the real estate market. If people are losing jobs, they aren’t going to be buying homes.

Finally avoid condos, they are usually terrible investments because you can have neighbor issues and maintenance issues since they are out of your control. Stick to renting or buying a single family home.

Good luck. If you have your health you can fix the other issues.

Thank you for your insights, Rich. The HOA/condo thing has been a hard lesson to learn. I just hope to god I can offload this place quickly and move on. Agree with you about health – it’s by far the most important thing. Without it, you really have nothing. I need to make these changes fast or I’m gonna drive myself crazy.

Wish I had you around to tell me these things five years ago. 🙂 Live and learn. Thank you for reading and commenting!

I had thought of you and your financial quest recently. It’s bad times in may ways. If it’s any consolation the market drop from 2007 to 2009 had a full recovery of 2012. The from was similar percent-wise but not a quick as the recent developments. I am hopeful, and believe, that this recovery will be much faster. With covid-19 it’s a whole different situation than the problems with banks, mortgages, auto dealers, etc. like then

I see you show February investment dollars and likely have taken more of a hit since since then (if you stayed in). If you’re still in the market today’s 10% increase may have offered a little hope, though I wouldn’t count on all

I retired a little over a year and a half ago. When I converted my 401k to an IRA I found myself being very cautious and went all into CDs. It has remained there since. You can imagine I kicked myself many times seeing the market rise I missed. Of course all that gain and more would have now been taken away. I certainly didn’t see covid-19 coming, so I can’t claim it was a genius move – but it worked out. It has also given great peace of mind.

I started to wade back in from my all cash position Monday night with a small S&P 500 index investment (SWPPX). That made for a pleasant day Tuesday with the 10% increase, but I emphasize it was just a toe in the water.

I’ll keep wading in, but have no certainty of things to come, and I won;t go crazy with it, Peace of mind is important – especially these days

Of course at the age 65 a big loss would have been extremely worrisome for me (if I had stayed in and taken the hit). You’ll look back one day not believing the dow average was just 20,000. When I was 30 (1985) the DJIA was less than 1,500. I had to look it up as I can’t honestly remember much below 10,000.

Didn’t mean to rattle on some much. Perhaps the isolation is showing. The main thing is STAY SAFE!, With what you have learned the financial comeback will be easier than getting there the first time.

Absolutely. And I’m learning so much. Now I know a lot more about what I want and don’t want, how to prioritize, and the value of being tenacious and responsive while also keeping a slow and steady pace. It’s such a fine line.

I’m certain everything will bounce back once the economy “opens up” again. It will all be OK – this is just a rough patch. Can’t wait to see where I am in a month or two and can look back to now and laugh about how worried I was. (Please please let that be true!)

Thanks for thinking of me – still hanging in there. Already looks like April will be a much better month. Praying my job will keep us on throughout all of this!

Skip the part about February investments. I missed the “current” investment column.

Hey Harlan,

Feeling your pain here! I hope your condo sells fast.

Financial constraints are incredibly difficult for me (as for most, I imagine) but I really loved your analogy about the hike with beautiful views at the end. A good reminder to “keep your eyes on the prize” during tough times.

Hang in there.

Thank you, Audrey! It sure feels like a slow road and an uphill climb at the moment. But I have a plan and a good team of people helping me, so there’s no reason why this can’t have a good result. Just need a buyer willing to purchase. Once I have that, I’ll be golden.

Thanks for the good vibes, and for reading – as always. Stay safe and take care of yourself. Wishing you goodness.

Good post on real life. I think you should have a few big take away’s from all this.

1. HOA’s are bad but they are micro-sample of what socialism is like. Imagine it on a large scale. I know this sounds corny but many never get to see how it can get applied in a real daily situation like you have. This was your roof, imagine if you had government run healthcare and couldn’t get them to pay or how about putting a quasi-government agency in charge of your kids or car or job. Oh and take them to court on this and file an insurance claim against the HOA’s insurance policy. The best is yet to come on this. Just wait until you sell the property and to close you have to send some third party a check for $100, $200 etc. to verify that your payments to the HOA are current, fun times.

2. Hysteria is what is causing the short term impact to travel, stocks, jobs, etc. People are in a panic over a new seasonal flu virus that there is no cure for. The people supporting this panic say it’s different since there is no cure and people die. Any new seasonal flu virus that comes along has no cure and no vaccine. This virus will get added to the long term flu vaccines like all the ones before. Every year when you get a flu shot (and you should) they tell you that it should work on “most” flu viruses this year because they have to guess what exact vaccine will work best. Nothing is 100%.

3. Now would be a good time to buy stocks but paying off high interest credit cards is just about as good right now and better during normal times. Any investments you have sitting in 401k’s etc. will go back up so don’t even pay attention to those for now, let them sit.

I am wondering about the movers that only take cash. I know some will only take checks or cash but you can hire via third party and pay with a credit card. Even Uhaul has a way to hire local (2 men and truck) kinda people to include or add on with your truck rental.

Anyway hang in there and good luck with the HOA mess.

Thanks, Dan. Now I hear they want to raise dues and give us more special assessments – get me outta here! This has been one big lesson learned. I will never ever deal with an HOA ever again after I rid myself of this.

I’m gonna get back to paying off my credit cards, then focus on padding out my emergency fund. If anything, this current mess has shown me the power of having cash on hand. I sure am learning a lot of tough financial lessons all at once lol. I’ll continue to invest in my 401k but put my other money to work in other ways while that happens in the background. And once I sell, I can use the cash to accomplish a whole lot more.

There are tons of movers around, but not as many are working because of the virus – and some are closed indefinitely for now. So I have to deal with what’s available and that’s inflated prices and they want cash in hand. I’ll look into more options when it’s closer to time, but the consensus seemed to be cash payments. Will keep working on it.

Stay safe out there. Thanks for reading and commenting!

This will pass and you’ll be good to go again. At least you’re not in our shoes… We haven’t had any job income since July 2018 and we’re “homeless” to boot. All my monthly bank interest has been recently halved, and at least 1 of my dividend payers have suspended their dividend. We’re totally debt free, so there’s that 🙂

TOTALLY debt free is amazing. I might not get there for the next dozen years, considering my level of student loan debt – so that’s really something to be grateful for. The values have already started making their way back up, but I’m keep an eye on the virus situation and hoping to move and sell ASAP. Please send me good vibes, cuz when I’m ready to go I’m READY TO GO!

Y’all are homeless but where are you for now? Is your nomad-ing on hold for the time being?

We changed our strategy a bit and putting more money in emergency funds. Once we have 12 mos saved up, we’ll then invest a little bit more – after all, it is a sale, so might as well buy while it’s a bit lower.

Hang in there, we’ll all get out of this financial rut… it may take a few years or so, but as long as we don’t touch the investments, they’re all paper losses.

Exactly! I am wondering now how the current market will affect my strategy going forward. I definitely want to sell my place ASAP before real estate values fall too much, pay off my credit cards, and pad out my emergency fund. Hoping once I sell a few of these things will resolve themselves.

Thank you for the encouragement. Stay safe and healthy out there!

A couple of serious questions (not attacking you). #1 Why are you contributing to a 401k if you have CC debt and dont have a 3mo emergency fund? #2 Why are you in Cabo a few weeks ago when you are in CC debt/dont have an emergency fund?

Hey Travelista! Awesome questions. I put the focus on maxing out my 2019 Roth IRA because the deadline is April 15. So I hit the pause on making aggressive credit card payments so I could max it out. I was OK doing this because my cards currently have a 0% APR rate on them so they’re not accruing any interest. If they were, I definitely would have prioritized them. Now that the IRA is maxed, I’m going back to my strategy of eliminating all credit card debt and saving up a $20,000 emergency fund before I ramp up any other investing.

And yes, I was in Cabo in early March – that now seems like several lifetimes ago with everything that’s happened since. I only paid $100 for the trip thanks to points (https://outandout.boardingarea.com/los-cabos-points/) and had a lot of PTO, so I let myself enjoy a few days there.

In the next little bit, moving, selling my condo (and repairing it), and getting back to my CC debt and emergency fund will occupy my time. Thank you for reading and for the thoughtful questions!