I’ve been wanting to talk about personal money stuff for the longest time. After all, my tagline has always been “Investing. Positivity. Oh, and travel.”

Fear held me back because I didn’t want to sound like I didn’t know what I was talking about. I was afraid of impostor syndrome. And revealing financial details can introduce shame because you’re officially throwing out your yard stick for everyone to see.

But you know what? I started this blog over six years ago before I knew what I was doing with miles and points and learned as I went along. I got a lot of stuff wrong, things changed, and I grew. I was scared then too. But also:

- YOLO

- Eff it

- Jump in both feet first

- Learn as you go

- Start somewhere

- Do it ugly

- Nothing is ever lost by creating

The biggest point of contention was that – I’m 35 now – a strapping young buck to be sure, but when I see other financial bloggers retiring at 30 and I still have student loans and credit card debt I’m like… feeling so behind.

This is me 10 years ago in LA. I wish I’d done more to help him (he wasn’t thinking about FIRE) – but I can start helping future me right now

But by what measurement? I can’t – and shouldn’t – compare someone else’s end point to my in-process. Although I wonder… what the hell have I been doing for the last 15 years? 😵

In the spirit of starting somewhere and being where you are, I want to keep myself accounted for and confess my dirtiest financial deeds.

November 2019 Freedom update

First of all, I don’t think of money as money. I call it freedom.

Money is the key to my freedom – a tool for an outcome. So when I spend, I understand I’m trading something from my future for something in my present. And most of the time, I’m OK with that. I like to be happy now AND I want to make sure I’m responsible for later.

In that vein, I want to start doing these Freedom updates. I want to talk about money and how it makes me feel and what I’m doing to plan for myself.

Here goes nothing.

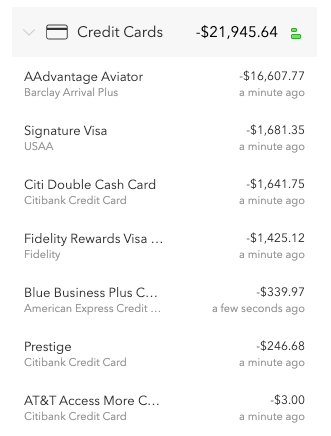

I have $20,000 in credit card debt 💥

Yeah. Ouch. How’d that happen?

I mean, as a semi-famous points blogger (💅) who espouses payments in full, am I just a big hypocrite for having a balance on my cards?

I don’t know how it happened. I mean I do, but there was a moment where the hits kept on coming:

- My AC broke in July in TEXAS and I had to get a whole new unit – $5,000+

- I got dumped and moved back to Dallas from Austin – $2,000+

- Then took a trip to Iceland and Greenland, and on to Mexico City and just charged it all – another $3,000+

- A freaking assessment from my HOA for a new roof – $2,000

A look at the carnage. It crushes me every day

All the while, paying rent plus a mortgage, switching jobs, back and forth between Dallas and Austin… not to be a sob story or a COMPLAINYPANTS but shit was shitty for a second there.

You’ll be happy to know I’m not paying a dime of interest on my balances. I did a 0% APR balance transfer offer with an extremely reasonable 1% fee and consolidated all my cards into one place. I have until April 2020 to pay it off, and I will.

If one thing’s for certain, it’s that I will never pay a dime in interest to a bank on my credit card reward earnings. So that’s the ace in my hole – and thank gods that option was available to me as a financial tool.

But those 0% APR offers are slippery slope if you don’t watch it. They’re designed to keep you down. But I moved, got a new job, and am aggressively making payments.

I’m anxious to save for my future

Having credit card debt – any debt – prevents you from truly planning your future.

If you’re paying back what you owe, you’re never moving forward. I hate that I’m spending my time and money making up for how despondent and hopeless I felt earlier this year. I could get down on myself, and I did – but I’m letting it go and taking action.

While I do feel empowered, I must say, paying off debt feels like postponing your life. It sucks.

I can’t wait to put this energy into saving, cutting costs, and finally getting ahead. Hence my audacious plan.

Where I’ve been

So now you know I’m not a millionaire or anywhere close. I actually come from a pretty poor family in rural Mississippi. As long as I can remember, I’ve always wanted to travel. Travel is my biggest passion in life.

Starting this blog and being able to write about all the cool places I’ve been and talking about miles and points is seriously such a luxury.

And now I want to chronicle my journey into having a $500K net worth – because it was negative for so, so long. I wasn’t even worth zero, but less than zero.

First of all, student loan debt – a whole other issue – has kept me down and hangs over me every day of my life.

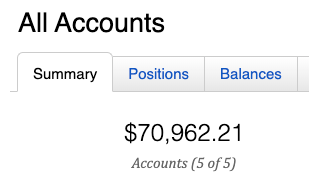

But somewhere along the line, I opened an IRA with Fidelity and maxed it out a few years in a row. I had a 401k with my last company and again with my current one.

It added up. I saved when I could. Over time, I managed to squirrel away nearly $71,000 in investment accounts. A good beginning.

I’ve always tried to at least max out my IRA accounts

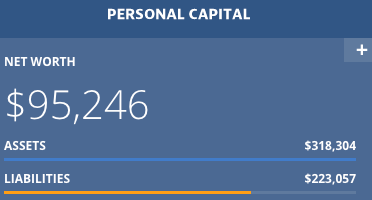

Then I bought a condo here in Dallas. I paid $173K for it back in 2015, have it paid down to $145K, and now it’s worth about $205K. So ~$60,000 in equity lives in my primary residence.

Of course, I still owe ~$47,000 in student loans. Plus I have a car payment and the aforementioned mortgage. And all the credit cards.

But even still, I’m currently a little under $100K net worth. That’s with my investments and equity, and also takes into account my student loans and what I owe on the credit cards.

This number is about to get a workout

I anticipate I can pay off my credit cards in another 4 or 5 months. And I plan to just make the minimum payments on my student loans and let them fester.

Also see:

So that’s my base point.

My plan to be worth $500,000 in 5 years

In the next five years, I will:

- Buy as many investment properties as I can (probably two) – $TBD

- Max out my 401k every year – $95,000 ($19K x 5)

- Max out my IRA every year – $30,000 ($6K x 5)

- Save $20,000 in a savings account

- Pay aggressively toward my mortgage and build more equity – $50,000

- Pay off my car loan – $10,000 (my car is holding its value really well)

- Hope for continued appreciation on my condo and returns on my investments – $???

- Save and/or invest my bonuses, any blog income, and tax refunds – $???

Of course any 5-year plan is going to have missing variables. There’s a lot I can control – and a lot I can’t. 🔮

I don’t know how the housing market will perform. Will it soften? Will Dallas skyrocket? Will I just level out, or need tons of repairs and maintenance?

How will the stock market go? More continued bull run, or will it tank?

And of course I’d like to buy investment properties, but they’re just an idea right now. The exact numbers will come into play down the road.

I’ll save and invest as much as I possibly can. In the numbers above, I’ve accounted for a bit over $200,000 in increased net worth. With my current ~$100,000, that still leaves a gap of $200,000.

Within that gap, I will fill it with investment properties, taxable brokerage accounts, and savings. And by the end of 5 years, my net worth will be at least $500,000.

My first Freedom update

As part of tracking my goals, I need to share where I’m starting from so I can chart my progress. So here’s how my numbers look as I head into November 2019:

| Last month | Current | Goal | ||

|---|---|---|---|---|

| Credit cards | xx | $21,945 | $0 | |

| Mortgage | xx | $144,952 | $0 | |

| Car | xx | $6,688 | $0 | |

| Roth IRA 2019 | xx | $0 | $6,000 | |

| Roth IRA 2020 | xx | $0 | $6,000 | |

| 401k | xx | $2,333 | As much as possible | |

| Overall investments | xx | $70,962 | As much as possible | |

| Savings | xx | $529 | $20,000 | |

| Net worth in Personal Capital | xx | $95,246 | $500,000 | Track your net worth with Personal Capital |

This will track my credit card payoffs, savings, loans, retirement accounts, and of course net worth.

Bottom line

I started tracking this is August 2019. This will come to fruition in August 2024. I will be 40 by then.

That seems so late to “only” have a net worth of $500,000 (but why? I really wonder). I don’t think I’ll ever stop comparing myself to my financial blogger heroes, but I will keep working every month toward my goals.

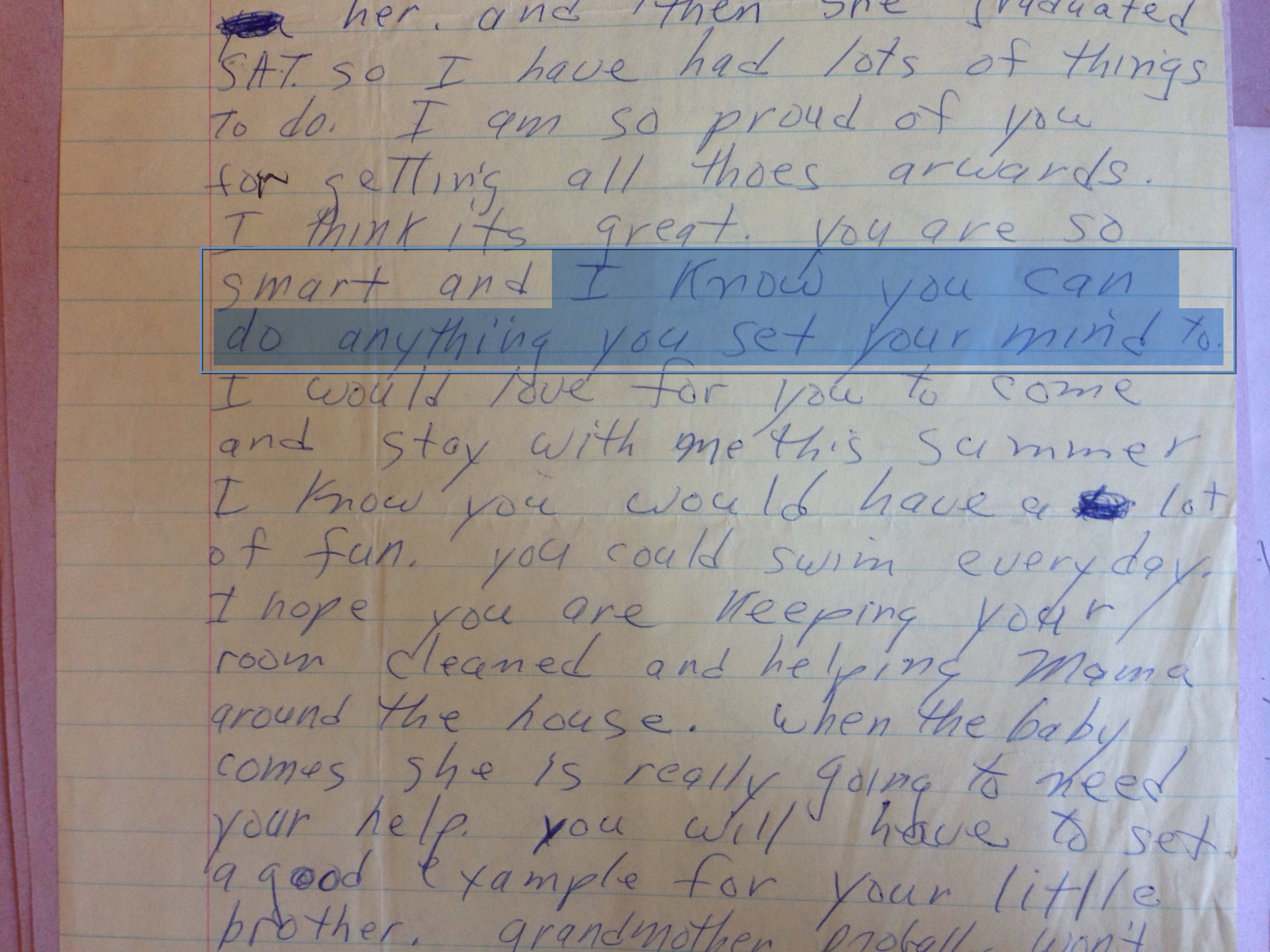

It seems lofty, but I have a great track record of achieving what I set out to do, ever since my grandmother told me I can do anything I set my mind to when I was little.

This letter from my Gramma is almost 30 years old by now, and I still have it

I have a huge gap to fill between what’s planned ($300K) and what the end goal is ($500K). I attribute that gap to equity, capital gains, forthcoming investment properties, and whatever else pops up. I can’t see all of it clearly now, but that’s not the point. Taking big steps is the point, even if I can’t see the entire staircase.

I don’t know whether I’m early or late, too old or too young, thinking too idealistically or not big enough.

But I’m happy about putting my goals into words, tracking them, and starting to share. Whatever happens will have to be good enough. If anything, I have to learn to be gentler with myself.

So that’s my first Freedom update!

Whew. I’m nervous about sending this particular missive into the universe, but nothing ventured, nothing gained, right?

And if you want to start your financial journey:

- Track your net worth with Personal Capital

- Start a blog and learn how to monetize it

- Get a travel rewards card

- Open a SoFi Money account to distribute your funds – it’s the best checking account out there right now (here’s my review)

More to come next month. Thank you for sticking with me through this!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Glad to see another miles and points blogger join the FIRE! Best of luck!

I’ve been there for a while, just too nervous to track my journey! Thank you for your support, Ben! Checking out your site now – thanks for the support!

Good luck to you! First time on your blog and will come back

Awesome! Welcome back any time! 🙂

Bravo! I commend you for your plan. Absolutely DO NOT, and NEVER compare yourself with others. When I was your age, unlike you I had no savings, investments, or retirement funds. My house was worth less than what I owed on it. I had 30K in CC debt, and I had a wife and 2 kids to feed. I honestly was very down on myself at that time. I felt like such a failure. I tried so hard to get ahead. Everytime I made 1 step forward, I experienced a setback that set me 1 step back. It was super frustrating. I did what you did and made a plan to get ahead. It was gruelling but here I am today, much older than you but financially independent. I am in the FIRBS group (Financially Independent Retired By Sixty) and get to do everything that I want to do today.

That is awesome, Jason! Sounds like making a plan and sticking to it is the way to go. Really appreciate hearing this and your outcome. Congrats on being financially independent! Hope to be joining you soon.

Through different circumstances I found myself with little net worth in 1999 (age 44). Then in 2018 I retired at 63 with a net worth in excess of 1.3 mil. (home is about 125K with no mortgage – otherwise pretty liquid) Your goal is more aggressive, but you’re also more aggressive in investing, so I see you having a shot. My gain was no special big gains – just living below my means and saving aggressively.

I know it’s hard, but try your best not to compare yourself to others. You tend to only think of those “above” you and it might demotivate you. If you hit 40 with a NW of 500K, you’re ahead of most, and certainly ahead of where I was.

That’s awesome that you pulled yourself up so much – I love it! And also love an aggressive goal. As for comparing, that’ll be tough. You’re right – it’s demotivating and counterproductive. I will keep learning and going. Thank you for reading and sharing your journey – congrats on your huge progress.

It’s possible. I was broke at 40 and a millionaire plus within 7 years. Five years on and I am financially free and love nothing more than to spend time with my wife travelling and seeing the world as much as we can. Consider starting your own business.

More practically, put your SLs on an income contingent plan. You didn’t mention a company 401K match. Do they have one? Finally, if you are single what about a side hustle somewhere — use those funds to target one specific debt. I met many a date in my 20s at side hustles!

One of the most important things in life is that you don’t waste your youth. I know 30-year-olds who spent their entire 20s in their parent’s house in their basement room playing video games. You are doing fine.

Wow, that’s incredible. Very inspiring.

So I consider this lil blog as my own business! It performs fairly well and reliably which is a huge honor. Of course, I always want to build it but then my “real job” keeps me busy and tired. But I’m here as much as I can. And I just met you here, so that’s awesome – new friends are always welcome! 🙂

My student loans are on the IBR plan – so they shift up and down every year when I submit my tax returns. My company has a 4% match and I am taking full advantage of that. I’m for sure NOT wasting my youth or being overly frugal for the sake of saving. Yes, I’m doing fine. It feels healthy and good to stretch myself into these new goals. I’m going to make sure to savor the process.

Thanks for the inspiration!

I wish you well. You’re younger than I was when I ‘saw the light’ but don’t let that mean you can relax even a little if you really want to achieve your goal. In your case, time really is money. One advantage I had is that I was uninterested in the present great time sucks (i.e.,computer gaming and social media) that are limiting so many people around your age and younger. If you are afflicted with either then you can easily find that you will instead ‘fritter and waste the hours in an offhand way’. I hope you avoid those traps and all others and reach your goal.

You are so right – one must remain constantly vigilant not to slip up – and it’s easy to slip with so many distractions. Once I get the credit cards paid off and I can see my other balances start to grow, I’ll be super encouraged. Until then, head down and doing my work. I plan to put any extra cash that comes my way into paying them off until they’re gone. Thanks for the reminder!

My friend you have little to complain about. Go look up stats, 2/3rd of americans are one paycheck away from being bankrupt. To compare yourself to others who’ve reached financial independence by 30 is dumb. As someone who knows how to surgically ask questions to get down to the bottom of peoples statements, I’ve found MORE OFTEN THEN NOT those people had a head start by being born into a decent situation. You wanna talk broke my guy. I literally got a $1.37 in my bank account right now. I dont go out drinking or partying, I dont spend time with people besides maybe getting some food or a movie and I eat at home most days. Why because I’m working to be my own boss and building my amazon business. I see the long run and I’m determined, more than anyone gifted money. And lemme tell you as someone whos driven over 5000 people for uber and lyft, when someone tells you their doing good for some reason, theres strings attached. Tell me how may people you know under 30 who are retired or financially well off that DONT have parents that are doing well or someone who at someone point never took a hand out. I was in debt $20k a year and a half a go and you know how I got out, driving uber at 3 in the morning and delivering packages for amazon in the rain making less than $120 a day and you here complaining about its gonna take less than half a year, big deal. My bills are $2300 a month and I’m only clearing $3200 PRE TAX. With the BS that comes up daily in life thats about $500 extra I have to try invest in my business every month. How much you make, lets be candid. point of all this, be grateful, you hardly grinding.

Def hear you. Right now, I’m doing well for myself. Last year, not so much. But I bucked up and got stuff done. I’m not complaining about how long everything will take, just observing mostly. Of course it’s dumb to compare yourself to other people – that’s something I’ll have to learn as I go along.

I’ve lived check to check and eaten pasta with butter for dinner more times than I can count. It’s been a long road to get here. But yes, I’m doing well now and this is my plan to optimize to make it all work even better.

Huge congrats for getting out there and hustling. You should be proud of yourself – you got this. Once the end is in sight, it’ll all be worth it. Thanks for sharing your story!

I like that you have a plan, and a very aggressive one at that. My wife and I are both 50 and are working our way to financial freedom. If you do achieve your goal of 500k NW at 40 years of age, tour well on your way of becoming a millionaire. Stay focused and you will succeed. Best of luck Harlan

Thank you, Rick! I like to keep it a little aggressive – having a challenge will keep me going. Hope to see you again soon!

Don’t have kids. Worst financial investment ever. Almost $100k for daycare alone.

Oh crap! I don’t think I’ll have kids of my own – but it’s cool knowing I have a bio-son out there in the world from donating. This path would probably be easier if I had someone to split costs with, but now for I’m riding solo.

Even still, it’s absolutely criminal to charge that much for daycare. There must come a breaking point sooner or later, cuz that’s insane.

I love your Gramma’s letter. 🙂 Skip the comparisons and focus hard on YOUR goals. Good luck!

Gramma never steered me wrong. I absolutely adore her. Not comparing is hard but yup – now’s the time to tune it out and focus. Thank you so much, Terry!

Please beef up the savings before you start you real estate empire. Call it your emergency fund or your crap happens fund (ie air conditioner breaking fund). You will feel more secure. I did not get paid during the government shut down though I was working everyday. I had very little stress during that time period as I had enough cash to last four or five months with out really making any financial changes. Having some cash is very freeing. Good luck on your trip to FIRE

Absolutely – I’ll simply have to. The goal is $20K in a place that’s fairly difficult to access and go from there. I want the security of knowing it’s there, and agree it’s very freeing.

Thanks for the tip and for the well wishes, I really appreciate it!

Thank you for your vulnerability and honesty. We had a financial wake up call about 2 years ago, and we’re well beyond 35. It’s never too late to get your shit together. I look forward to seeing your progress. Expect minor bumps in the road but know that you can and will do it.

Thank you, Taryn! I think sharing the details will get easier over time, especially as I grow more confident in myself in this area. Totally agree that it’s never too late. I’ve done “just OK” with my finances this far (and taken oodles of free or nearly free trips all over the world) but yeah… it’s time to buckle down and rock it in this area.

Thank you for the vote of confidence!

Howdy from another blogger in the Dallas area! 🙂 You have some great goals, and I’m looking forward to seeing your progress. I used to read personal finance blogs all the time, but then we had 3 kids and got caught up in travel.

Hey Nancy! How cool – checking out your blog now! I have meetups from time to time – perhaps we can stay in touch and meet one of these days. I got caught up in travel too – big time. And now realizing I should give myself a little more padding. Been “flying” by the seat of my pants for too long. Will follow you so we can keep up – thanks for stopping by!

@Harlan “I don’t know how the housing market will perform. […] How will the stock market go?”

First, I commend you for making a plan and for deciding to increase your savings. You’re already ahead of the vast majority of people.

However, I’m very skeptical of the idea of growing your net worth based on what the housing market and the stock market will do in the next 5 years. Both markets have been on a tear for the past few years and they simply can’t grow to the moon. Unless you know exactly what you’re doing and choosing your investments based on specific opportunities you identify (as opposed to expecting the entire market to go up), you’ll take a lot of risk without realizing it.

Best of luck and don’t forget to report back on your progress 🙂

Absolutely, Nancy! Dallas has been on the up and up for the past few years – and it looks like that trend will continue. And of course, the long-term stock market has been historically the best way to grow wealth.

As long as I get out of my primary residence what I put into it, that will be good enough for me – appreciation would be a nice cherry on top. As for stocks, I go with a total market fund and call it a day. There’s definitely risk involved, and it may go down the tubes in the next five years, but my ultimate horizon is much longer than that. I’ll just have to stay nimble enough to change course and keep a vigilant eye on how the assets perform. I’m kinda super excited about the risk.

Will def be reporting back – it’s the checking in that will keep me on a timeline. Thank you for reading and commenting!

Harlan, I’m rooting for you buddy! I do think financial freedom takes a whole load off one’s back. I hope you succeed in your goal but even if you do not, make sure to learn from it and to never lose hope.

We’re roughly the same age and I’ve recently started retirement planning (I only did the 401k and roth IRA but never really had an established plan. In Jan 2020 I plan to start actively doing a revised version of FIRE so I can be financially independent and retire on my own terms.)

Oh and sorry about the breakup. Totally his loss buddy!

Thank you, Joey! I had a rough financial plan – and always known I “should” have a plan – but finally had to sit down and break it into numbers and what I think I can accomplish. Putting numbers and a timeline on your goals is empowering. Retiring on your own terms is even more empowering.

I’m definitely having some “oh shit” moments with getting the credit cards off my plate and building up the savings account, but now that I’m committed to the plan, I’ll get it done. Learning along the way will be part of it – just have to remember it’s OK to make mistakes and get things wrong. Most everything is reversible.

Thanks for being in touch all the time. Looking forward to growing alongside each other. <3

I received a card from my grandmother when I was young that I still treasure 30-some-odd years later. Hold on to that as it’s more valuable than any net worth goal. It’s scary but I was reading an article yesterday that said Millennials need to save 40%+ of their paychecks in order to retire at 65. Good luck on this journey.

Definitely. I have it scanned and digitized in case something happens to it. I love those letters we used to write to each other. She kept mine all these years, too – they’re in a hat box in her closet. <3

And yup, that 40% stat sounds accurate - I'm hoping to be even more aggressive than that. I'll have to be to even start making progress. Thank you for reading and commenting!

Harlan, this article is so well thought out and such an important thing to discuss! I applaud your candor and bravery! I’ve absolutely been in the everything hit the fan at once boat before and had to dig out, too! I have no doubt that you’ll hit your goal! Ive often thought about developing some sort of basic money life skills course for high school seniors, because there isn’t anything out there and we are all expected to just wing it!

Absolutely! My financial base point was beyond zero – I actually had the idea that talking about money was bad! So before I learned anything, I had to UNlearn a lot of what I knew, with poverty mindset being the biggest offender. Any talk of money and finances would’ve blown my mind. It wasn’t until much later that I started figuring it out and totally messing it up along the way (and I still mess up all the time!).

Thank you for the vote of confidence, sweet friend. Looking forward to hanging out again soon! <3

Committing to it is the first step. My family committed to FIRE about a year ago and we have nearly doubled our net worth in tht time (not that it was huge to begin with, but still… ).

Being intentional is the key, and if things keep going we should be retiring in about 5-7 years in our 30s!

Totally – being intentional is the key. That’s amazing that you’ve made so much progress in such a short amount of time. Time is on your side – congrats on starting young and having your goal in sight. That’s amazing!

Thank you for reading and commenting!

And most importantly… don’t get it confused with the earn and burn credo.

Earn and turn? Earn and discern? Earn and learn? Def NOT earn and burn – that’s only for points & miles!

This is great! I’m 38 and just paid off my student loans last week and it took me 14 long years to get that done. Having good employment income plus a bunch of side hustles, investments, taxable investment accounts, etc is the right direction. I’ve been doing a lot of research into dividend stocks and I’m currently at $180-$300/month in recurring dividends on a small $60k investment. I’d have a lot more but I’m waiting for stocks to drop to get better dividend rates so the rest of my cash is sitting in 2.5-3.5% bank interest accounts. No employment income now so the monthly divs/interest helps.

Keep on keepin on 🙂

Hey Ken! Hope y’all are doing super swell! Student loans are the dang devil. Of that I’m completely convinced.

I plan on working for at least a few more years and saving like a maniac. Crafting this plan is a huge goal and I want to get this done. Will do my best to track and meet goals each step of the way. The div stocks sound like an interesting strategy. Will have to look into it.

Thank you for stopping by. Your travels look incredible. Tell Kim I said hey!

Harlan, the interesting thing about “wealth” is that even if it starts out as a small sum, the more you add to it, the more it builds, and the more exponentially it grows. Most of the rapid rise occurs toward the end of the accumulation phase. If you keep at it, one day it will exceed what you expected.

I saved approximately nothing in my early years, then started investing little by little in my mid-30s. I was still able to leave the workforce early…at 59…and I live in California!

You’re on the right track, buddy!

Yes, that’s awesome! Congrats! So encouraging. I can’t wait to sock away every spare cent into a savings or investment account – once that day arrives (hopefully soon), it will be full speed ahead for a few years. Thank you for sharing your story, Cole!

Thank you for sharing your thoughts. We will follow the journey and pray for your success.

Thank you thank you thank you! That is so kind – I will take all the prayers for success! Thank you!