You know how bloggers say they started their site because their friends kept asking for pointers? This post on how to start investing is exactly that.

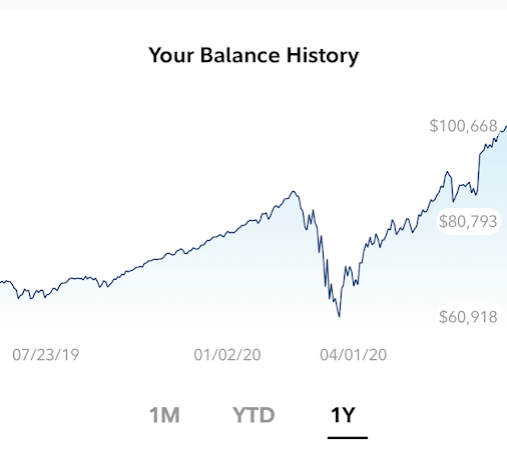

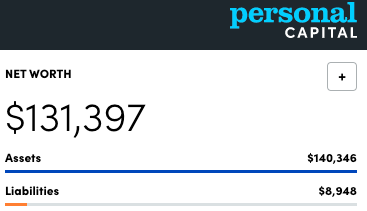

I posted on Insta and Facebook about my first $100K invested in the stock market for my retirement – separate from the cash I’m setting aside.

This milestone happened yesterday! For the first time in my life, seeing six digits when looking at my accounts – finally – was exciting.

It didn’t happen fast for me. But once I buckled down, momentum built and I nearly doubled what I had in just the past year.

This pandemic, horrible as it is, has been an advantage for saving. I’m not traveling any time soon after my weird vacation earlier this month, can’t go to happy hour because bars are closed, and have most meals at home. So my “fun slash going out” and travel budgets are going directly to savings.

If you’re in a similar spot, this is an excellent time to begin investing for your future.

Money Alley is a great place to be

So here’s my mini-guide. Written especially for my friends and those looking for direction. 🤑

How to start investing

1. Get started

I don’t really care where you start or how big you start – so long as you do. If I told you to start with $5, would that sound too small?

Because it’s not. The thing about investing to remember: it’s a long game. Your portfolio isn’t going to magically appear with a “big enough” starting amount.

So start somewhere right now – you can always changes things later once you know more.

I plan to leave my money alone for the next 30 years. I’m 35 now, so I’ll be 65 when I would even think about dipping in to it. If your horizon is 20+ years, you’re likely in a similar spot.

It’s that old saying: the best time to plant a tree was 20 years ago. The next best time is right now.

ACORNS

Which, coincidentally, ties into my first recommendation: Acorns, whose tagline is “Grow your oak.”

Acorns is a fine place to cut your investing teeth

I’ve had an Acorns account since 2017. What I like about them is they ask you questions when you sign up and it’s all taken care of.

You can auto-draft to add to your account every week, paycheck, month, or whatever works for your schedule.

In that way, it’s all hands-off and there’s nothing to think about. There’s a $3 a month fee for an IRA (individual retirement account) which I’m not thrilled about – but if this gets you started, it’s worth all that and more. Or pay $1 a month for a regular ol’ brokerage account. For retirement, you want the IRA.

They have a slick app and website, and I like “Found Money” which can give you a few extra bucks here and there. It’s an excellent place to begin, especially if you know nothing about investing.

BETTERMENT

This is actually where I started many moons ago. Like Acorns, they set it all up for you and charge a small percentage as a fee – a quarter of 1%, or .25%, which again, I’m not thrilled about but it’s so small that you can start now and decide if you like them after your first free year.

I have personally met the founders back when I lived in Brooklyn and have had a soft spot for Betterment since. They’re working hard to make investing simple and accessible – and doing a great job of it.

I learned a lot from their tools and resources, and used them as an entry point.

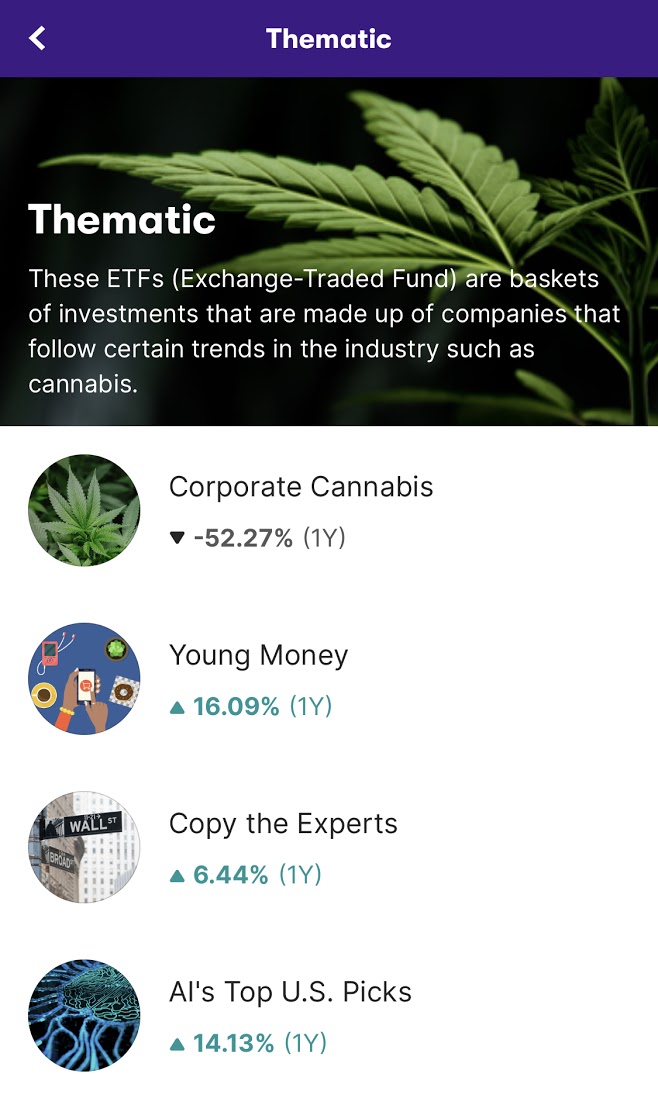

STASH

Like Acorns, they charge $3 a month for an IRA.

Or if you just want a place a start, you can claim $20 free, pay $1 a month for a regular account, and consider it fun money while you learn. Maybe put it in one of their thematic funds like women-owned business or medical weed and see how it stacks up to the overall stock market. Nothing to lose with free money.

Stash is a little fancier than Acorns

It’s a great sandbox for experimenting. I see them innovating curious where they’ll go, especially to differentiate themselves from Acorns, so I keep my account and try new things with it.

Through your current bank, or an investment firm like Fidelity, Schwab, Vanguard (Pro option)

If you have a big bank you like, chances are they offer an IRA. This is great for keeping everything in one place. Or you might prefer to have your investments elsewhere – out of sight, out of mind!

Merrill Edge is Bank of America’s investing arm

Big banks tend to be more hands-on and require you to select your own funds or pay some banker schmoe wayyyy too much to do it for you. If you’re comfortable picking your own funds, by all means go for it. And if not, the three options above are all fantastic – you can’t go wrong.

And again, none of this is permanent. You can always change things later.

Just remember when it comes to picking funds: keep it simple, low-cost, and boring. Total market index funds are proven winners. I recommend FSKAX, FZROX, or VTI.

Also if you go this route: remember to actually buy the funds. It’s not enough to just stick cash in the account. The account is the container. You have to purchase the index funds for them to start working their magic inside of it. 💫

2. Choose your allocation and account type

If you go with Acorns, Betterment, or Stash, they’ll ask questions and take care of this for you – so easy.

I recommend some version of an aggressive or moderate portfolio. With a horizon of 20+ years, you can weather market dips and the riskier allocations tend to perform better over time – which means more money for future you! 📈

Now that you’ve started, you’ve actually done 90% of the work. The rest is all little nit-picky stuff. So, congrats! 🥳

Be aggressive! Be, be aggressive! (in your IRA)

As for account type, you probably are gonna want an IRA. There are two versions: Traditional and Roth. Which one is better is an eternal debate in personal finance. The basic difference is:

Traditional IRAs get you a tax break when you file taxes next year, and you pay taxes when you withdraw 20+ years from now at whatever tax bracket you’re in when you retire

WHEREAS

Roth IRAs are funded with after-tax money, so you get no tax break when you file taxes next year but you won’t pay any tax with you withdraw, so all your earnings grow tax-free

There are other differences, too. For that, I’ll guide you to my blogger heroes at Bitches Get Riches to explain.

I personally fund my 401k with pre-tax dollars and have a Roth IRA on the side. So I have a little of both.

The good news is you can mix n match. The IRA contribution limit is $6,000 for 2020. So pick one and start filling it up!

If you get a regular brokerage account, you will pay taxes on the dividends (earnings) each tax year, whereas you don’t have to worry about that with an IRA.

3. Compound interest is a force of nature

$5 a week is $260 a year. I bet you can commit to $5 a week.

$10 a week is $520 a year.

And at $20 a week, you’re saving over $1,000 a year. How cool is that?

But unlike a savings account, your money isn’t just sitting there dormant.

No, it’s moving around the stock market and all the companies it touches, constantly in flux. Sometimes you’ll see your money has grown. Other times, like earlier this year, you’ll actually lose money. The instinct is to recoil when this happens. But never pull your money out when this happens. Stay the course.

See that valley right around April 2020? Yeah, that wasn’t fun

Because for the most part, you’re on the up and up because of compound interest. Your money earns money. And the earned money gets folded back in to earn even more money. This process repeats over and over until you’re ready to withdraw it – which will be much more in 20+ years (this has historically been the case).

For this reason, you want to reinvest your dividends. Acorns, Betterment, and Stash will take care of this for you. If you do the Pro option, it’s usually a setting somewhere – but an important one.

4. Set and forget – until you’re ready

Once you set it up, do your best to NOT look at it for a while. This is especially important when you’re starting and even more so if you think you’re “starting small.” (You are not starting small, by the way – you’re actually taking a gigantic step.)

Why? If you save $5 a week and look in there after four weeks and see $20, you’re not going to feel the full effect of compound interest and moving markets. You might have earned a dollar or two – or worse, you might have actually LOST money in that time. It’s not going to feel powerful or effective for you yet.

Contrast that with waiting a year to look. Not only will you see the $260 you’ve ferreted away, but very likely you’ll see gains. Maybe a lot of gains.

Point is, it’s going to feel a lot better and like it’s “working” if you can resist the urge to look for about a year.

These days, if the market goes up or down even a fraction of 1%, I see my balances rise or drop dramatically by $1,000s of dollars. But I’m used to that by now.

With my first 401k, I put 4% of my check in there and looked about a year later and was shocked to see over $1,000 in the account. That feeling of “wow, this stuff works” taught me a LOT more than if I’d tracked it every pay period. Try it, you’ll love it. ✨

5. Track your net worth

If you’re gonna ignore my sage advice and check your accounts, at least track things properly. I highly recommend Personal Capital because they put your net worth front and center and it’s extremely customizable. I love the layout and the way it tracks all my dozens of various accounts in ONE place.

Bet

Net worth is all your assets minus all your liabilities. People debate what qualifies as an asset or a liability.

With Personal Capital, you decide. Want to include your home equity? You can. Want to exclude something from the calculations? Then don’t add it.

While you can be selective, you’ll get the best overall view if you add everything. That means checking, savings, IRAs, loans, credit cards, 401ks, HSAs, if it’s financial then add it.

Knowing your overall net worth – however YOU define that because personal finance is personal, after all – is a good way to track your progress toward your financial goals.

6. Read FIRE / personal finance blogs

FIRE stands for Financial Independence, Retire Early. So there are two piece to it – FI and RE.

FI – Financial Independence – means if you lost all your income (AKA your job) you’d still have enough to support your life. RE – Retire Early – means you stop working when you reach that point.

Most people combine them because they go together well, don’t you think? But others, like me, focus on the FI part because we don’t want to necessarily retire early. There are a few versions of FIRE including fat FIRE, lean FIRE, and a couple others. It’s fun. People debate the minutia of literally everything you can think of, including:

- Tax efficiency

- Is your home an asset?

- Traditional vs Roth 401k/IRA

- Tax loopholes

- Which asset allocation is best?

- Which financial institution is best?

- These 80 or so index funds are exactly the same with tiny differences – let’s debate which is better until we retire or one of us dies

- Did you know if you do these 21 precise steps in this order with perfect timing, you can save on your taxes but take 10 years off your lifespan in the process?

Along the way, you’ll form your own opinions about stuff and do whatever works for you. You’ll also find voices you like from people whose opinions you respect and who discuss topics you find interesting – bloggers! Here are some of my very favorite personal finance bloggers in NO particular order.

- I simply adore Paula from Afford Anything

- Bitches Get Riches

- I Will Teach You to Be Rich

- Financial Samurai

- A Purple Life

- My Debt Epiphany

- And I’d be remiss if I didn’t include the classic Mr. Money Mustache

I’ve learned a ton from all of these wonderful people and hope you do too. Plus reading is fun. 📚

How to start investing

- I recommend Acorns, Betterment, or Stash to begin – in that order.

- Choose an aggressive or moderate allocation if you have a long horizon (20+ years).

- Choose a Traditional or Roth IRA to save for retirement, or a regular brokerage account to learn on. Keep fees low.

- Even $5 is enough to start with.

- Sign up for Personal Capital to track your net worth. But try not to check all the time.

- Reinvest your dividends. In a few years, compound interest is going to blow your mind.

- Read blogs to keep learning. Get lots of voices and then decide for yourself. Most answers are generally correct.

You can’t screw this up because you can change anything at any time.

The most important thing is to get started NOW. You are only “too late” to begin if you keep waiting.

The most important tip? Have fun investing! Future you will thank you. 💸

Any questions? Feel free to leave a comment below or reach out directly. I’ll do my best to guide you or point you in the right direction.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Such a great read, and easy to follow! Thank you for laying this out for all of us to see. I am excited to modify my portfolio using some of your tips and tricks! You are amazing! Much love! -Winter

Awwww yay! Glad it’s helpful and actionable! Let me know if you want any guidance or if something looks confusing. I have a theory that banks intentionally make investing look hard so they can sell their services, when in reality it’s easy once you slice through the marketing and presentation. Keep it simple and boring with low-cost index funds set to moderate or aggressive and be sure to reinvest the dividends – and you’ll be all set. 🙂

Thanks for reading and commenting! Much love! <3

@Harlan,

Awesome milestone! Now take advantage of a Merrill Edge transfer bonus and get your Platinum Honors Status with Bank of America!

I have my eye on that! I think I have a bit more to go as some of it is wrapped up in my company 401k that I can’t transfer just yet. Been thinking about it though. Is that 2.65% really worth it? So torn.