Well, this month just about broke me. There was a historic, once-in-a-generation cold snap in Texas accompanied by power outages and wind chills of -15 or more. I found myself without heat, power, water, and internet for the better part of a week.

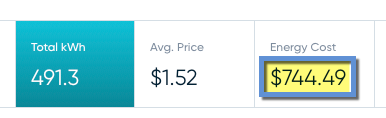

And there was nowhere to go because the roads were a slick, icy mess. Fort Worth had a 133-car pileup. I considered going to a hotel, but didn’t want to risk it. For the power I had, I paid $9/kWh and over $700 in electricity for February alone. My lease expired and I’m now paying a $400 per month upcharge.

Things are better now, but overall February was a cold, miserable month where I did work by candlelight and got price gouged out the eyeballs.

And I got new glasses for those eyeballs before the power outages

But, the positives: I had never ran out of food, work was amazingly sympathetic, and my net worth rose nearly $10,000 despite everything. I now have all the creature comforts again, but it’s too little, too late. Next month, I have some personal news to share but the gist of it is: I’m finally leaving Dallas!

More on that soon!

February 2021 Freedom update

OK, so I had to start off with histrionics. But for real, this was a challenging month. It feels like every time I get caught up, I’m having to spend extra cash on whatever decides to pop up that month. I’m grateful to have enough to handle these things, but I had to cringe as I saw my electric bill vault over the $700 mark.

But, life’s good. And I made a lot of financial progress this month.

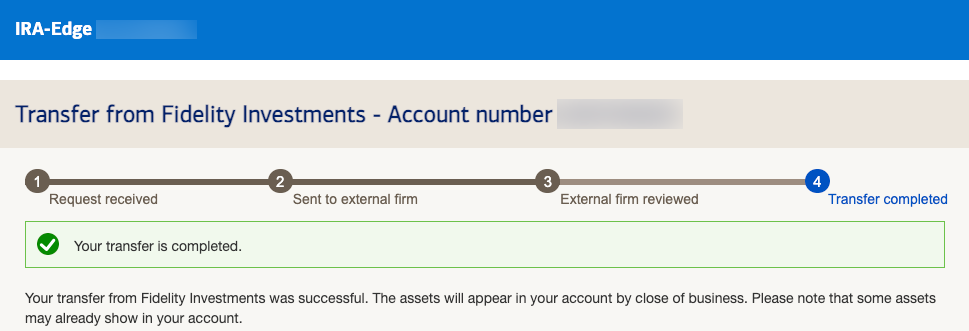

I moved my IRA to Merrill Edge!

Yeah, I did it. Thanks to everyone who commented and shared their experience with Merrill Edge last month.

I still have my Roth IRA with Fidelity, but moved my traditional IRA to Merrill Edge – and qualified for a new account bonus and the Platinum Honors tier in the Preferred Rewards program In one fell swoop. 💥

Pretty soon, I should see a $375 bonus and my rewards status updated. To join Preferred Rewards, I had to open a Bank of America checking account, so I sprang for the highest-tier Advantage Relationship account (which also has a $100 opening bonus) because it’s free with linked accounts.

Did itttt

Once my status is updated, I’ll likely apply for a new Bank of America credit card.

Notes about Merrill Edge

- You cannot buy FSKAX or FZROX

- VTSAX has a $20 fee to purchase

- You cannot buy fractional shares!!!

None of these are problems as I was able to keep my existing funds, but some of it was cash because my FZROX fund didn’t transfer over. That’s alright, I thought – I’ll just buy more FSKAX once it’s in the Merrill Edge account. But nope. So I bought ITOT instead, which is very similar. But still – I wanted to keep everything in FSKAX or VTI as much as possible.

So with that cash, I thought I could use all of it to buy ITOT. But again – nope. No fractional shares. What modern investment firm doesn’t have fractional shares? Merrill Edge, I guess.

I bought as much as I could, but still have $60 hanging around that I can’t really invest. It’s not a huge deal, but I’m used to buying fractional shares in whole-dollar amounts.

I did my rollover during the historic Texas snow. It stayed like this – and got so much worse – for the better part of a week

It’s fine because I don’t plan to contribute anything to the account for a while so the funds can literally just sit there – which is another reason I made the transfer. I understand Merrill Edge isn’t the best for day trading, options, and margins, but I’m not doing any of that. Just a buy and hold with my existing funds. And for that, it’s perfect.

For the purpose of unlocking extra benefits with Bank of America, it’s worth it. The transfer only took a few days. But I wouldn’t use them as a beginner.

For that, I’d recommend one of these brokerages, especially Acorns for absolute beginners or Fidelity if you know what funds you want to purchase (hint: FSKAX works nicely in an IRA).

Notes about Acorns

- Link: Sign-up for Acorns and get $5 free

- Link: 5 Reasons You Should Get Acorns for Micro-Investing (Even If You Have Other Accounts)

On the subject of Acorns, I recommend this account to everyone! Why?

Acorns Found Money, which is basically a shopping portal, although there are some card-linked offers that are useful.

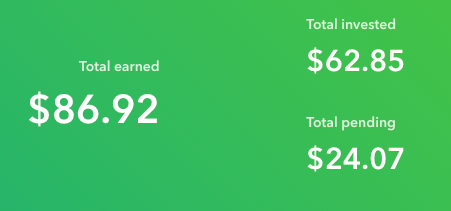

I’ve made great use of Acorns Found Money, especially lately

Over a few years, I’ve earned ~$87 in free money that’s automatically invested. Most of it has been through the card-linked partners, which requires no extra effort.

Free investments

This money earns dividends and continues to grow. It’s not much, but I consider it sort of “fun money.” I have it invested at the most aggressive level and it’s fun to see how it performs in the market. I’ve never actually put any money into Acorns aside from my $5 opening deposit. All the rest has been completely free, which is cool.

I use their taxable brokerage account, but they have IRAs and custodial accounts, too. But the Found Money pays for the account many times over and I recommend it if only for that reason alone.

February progress

This was the first month with my new 401k and because of how the dates fell, I got to contribute $2,500 within one month. How cool!

But, the markets took a beating this week and my current rate of return is currently -.20%. 😕

I’m on track to fully max out my 401k this year. I’ve already maxed out my Roth IRA for 2021.

The next focus is refilling my savings account to get it back up to $30,000. After that, I’ll put my effort into my taxable brokerage account – specifically, filling it up with FSKAX/VTI as much as possible. ✔️

It might be difficult with upcoming life changes in March and April, but that’s what I’ll do with anything extra.

Ouch

I intended on getting a head start on everything this month, but unexpectedly had to pay my $744 electric bill on top of an extra $400 in rent. So that ate into my progress.

Cheers! 🥃

But despite everything, I still saw my net worth rise to nearly $183,000.

By the numbers

Holy guacamole. It’s like it happened while I wasn’t looking. After hitting my first $100K, the growth is off like a rocket – even with the bad days factored in. 🚀

Here’s what moved:

| Current | Last month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| ASSETS | |||||

| 401k (contributions only) | $2,500 | xx | +$2,500 | $19,500 | |

| Overall investments | $152,644 | $143,742 | +$8,902 | As much as possible | |

| Savings | $20,494 | $19,916 | +$578 | $30,000 | |

| Net worth in Personal Capital | $182,610 | $172,966 | +$9,644 | $500,000 | Track your net worth with Personal Capital |

I love how simple and pared down my goals have become since I paid off my credit cards and car loan.

The 401k will take care of itself this year. Next up, it’ll be about making my next life transition, building up savings, and focusing on the taxable brokerage account. Simplicity. ⚡️

And all this with the storm as a backdrop. It’s been a surreal time where time feels like it’s moving so fast and so slow at the same time. I want to break this stasis.

February 2021 Freedom update bottom line

I’m kinda shocked at how much my net worth grew this month. It’s like it’s reached a level where the growth is more noticeable. It’s also much more reactive to shifts in the market. Any little move will send it up or down by thousands. I finally feel like I’m ahead with this $500,000 goal, as I edge into $200K territory.

A taxable brokerage account will be more of a strategy this year. I realized I won’t touch my retirement funds for many more years, but might like to live off dividends before then. Well, the retirement accounts are almost to a place where they’ll grow on their own as a natural function of compound interest. And now I can think about dividend income in the short-term. It’s a good, strong place to be. This month, I’m another percentage point closer to my goal.

My soul is stirring; I’m feeling restless lately. The next weeks will be focused on getting out of Dallas. This next Freedom update will come to you from a different city. I’ll make a new post about that soon! #excited

Until then, I hope everyone is doing well. Stay safe and scrappy out there! ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You’re gonna have to change your blog signature! Keep up the discipline, aspirations and diligence dude!

That would be the best thing ever! Thank you so much!

Keep up the good work/numbers

Thank you – will do!

I live in Houston. Yep, it’s been a rough month! Glad to hear you’re all good.

Glad you didn’t listen to people who said not to move to Merril. With Platinum Honors, the BOA Premium Rewards is, without a doubt, the top credit card on the planet, and will help you build wealth even more.

Good luck, and thanks for the updates.

Thanks for the note! Glad you’re doing OK over in Houston. That storm was craaaazy. I really didn’t think it would get as bad as it did.

And you hit the nail right on the head – that’s exactly the card I’m going for as soon as my new status kicks in. Maybe I’ll get two just for the bonuses and to spread across multiple spending categories.

And yes, I weighed the pros and cons of Merrill, but considering I can keep my current funds and have no plans to do anything with them but let them sit there, it seemed fine. Plus, I don’t make any fancy trades or anything like that, so I think I’ll be fine.

Thanks again for reading and commenting!