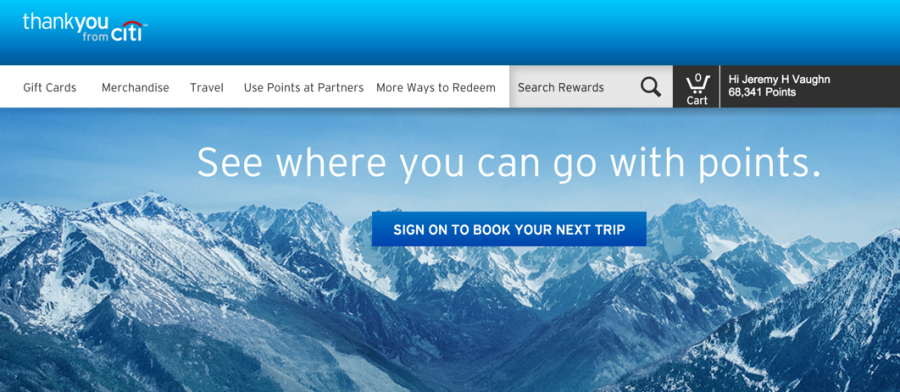

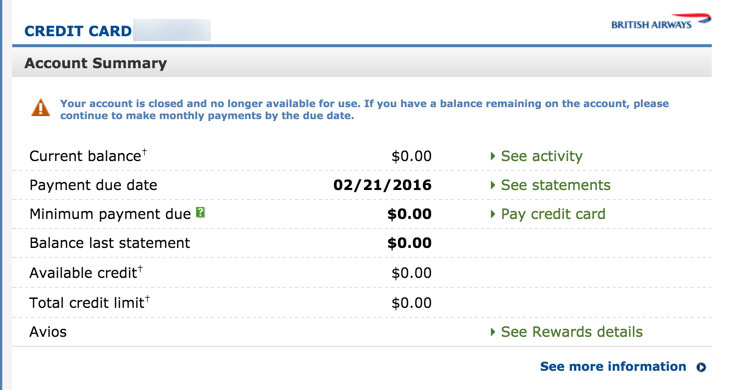

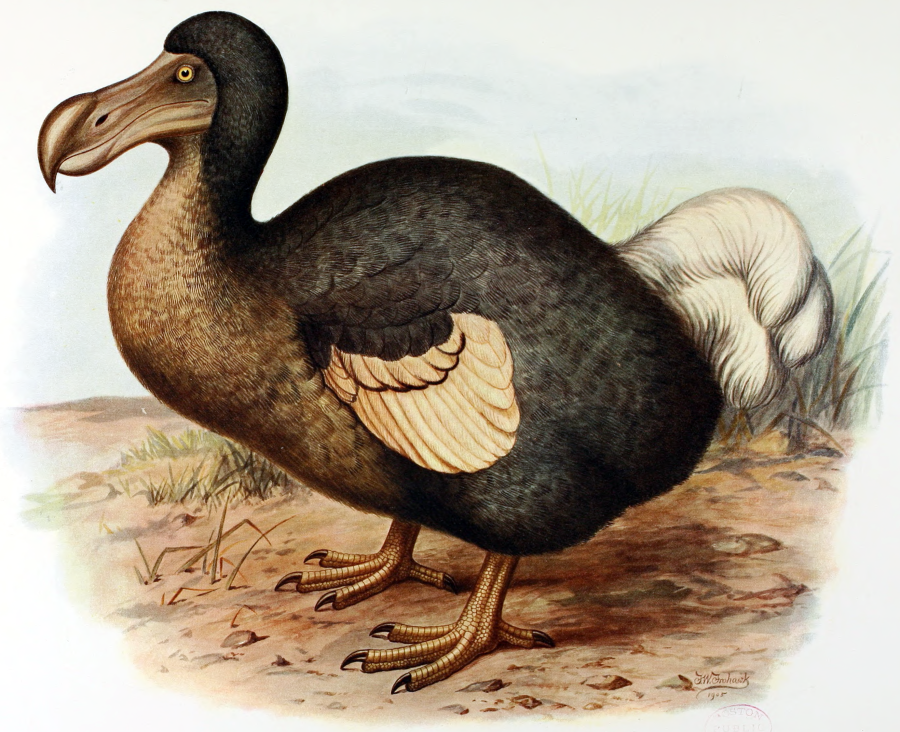

As I look out onto the barren fields where credit card crops once grew, I mourn the loss of Chase (with the 5/24 rule). Of Citi (when they shut down so many peeps’ accounts). And definitely of AMEX (1 bonus per lifetime? Um, OK). Barclays and Bank of America are both one-card wonders (Arrival for sign-up bonus and Alaska Visa, respectively).

I don’t know about you, but I’ve received a lot of terrible offers lately. Here are the best of the worst.