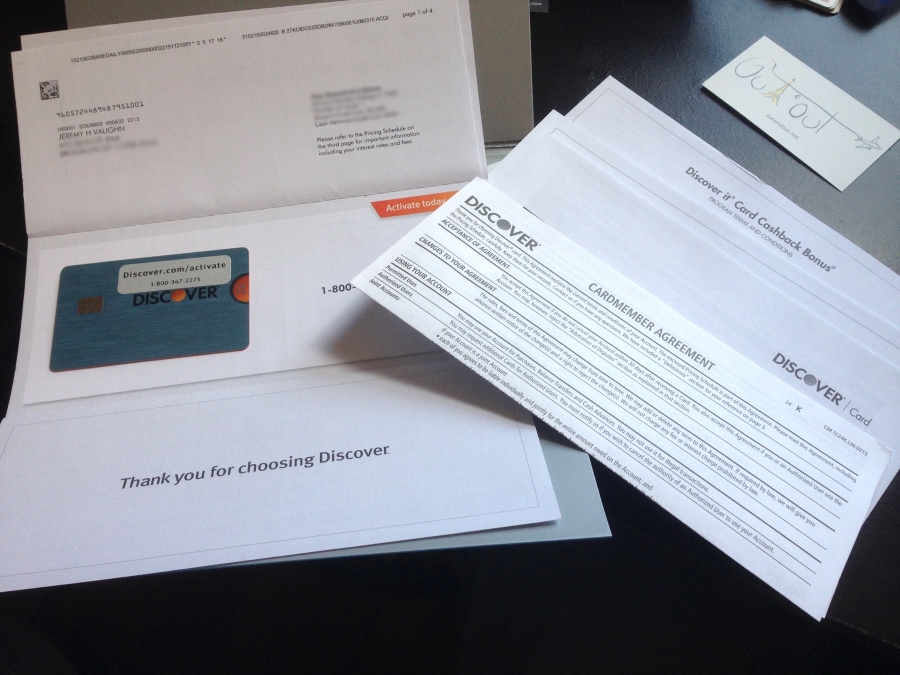

My new Discover It card came in the mail this week, in very nice packaging.

And I might have to change my tune now.

I’ve long heralded the Fidelity AMEX as the best cashback card.

But now I’ll refer to it as the best ongoing cashback card. Because, the 1st year at least, the Discover It has it beat by a mile.

I’ll still get great use out of the Discover It card the 2nd year, albeit much reduced.

The 1st year, this card is good for an easy $600, at least. And I’m even thinking this no annual fee card has the potential for over $1,000 back.

Getting the Discover It card

- Link: Discover It

Very cool card! Almost a wood grain texture – no info on the front (like the Chase Sapphire Preferred)

The Discover experience

This is my 1st Discover card, so I was interested to see how it all worked in application.

Getting the card, activating it, setting up the online profile, and downloading the mobile app were all seamless, focused, easy experiences.

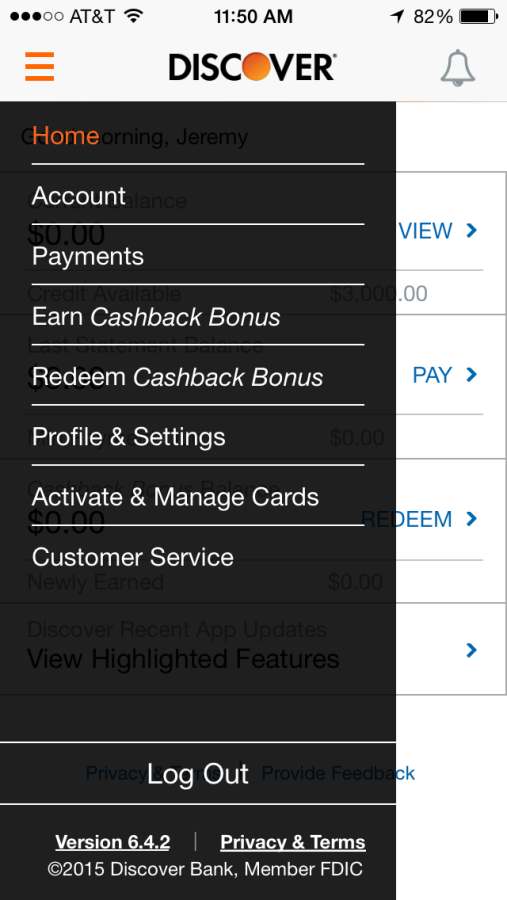

The mobile app, in particular, is very robust. You can activate your card, get to customer service, redeem cashback, make a payment, and sign up for promos (and quarterly cashback) right on your phone.

It’s a nicely designed and intuitive app – and the website is equally responsive.

So far, I’m enjoying the “rollout” of the new customer experience. I can see why people rave about Discover. It’s not clunky, and is focused on ease. I didn’t have to click more than 2 times to get to any part of the website or app. Very nice.

I won’t bank with them, though

Discover also offers checking and savings accounts, and you can link your Discover It rewards to them for instant cashback redemptions, which is a nice feature. Currently, the banking accounts are only available if you have a Discover credit card.

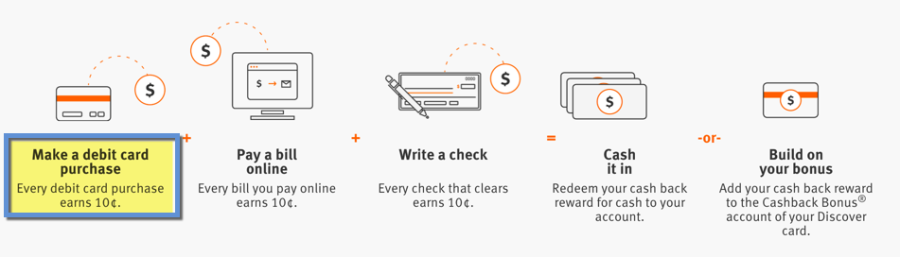

But you have to make 100 debit card transactions per month to get the advertised $120 cashback per year.

ONE HUNDRED.

You “can” earn $10 a month ($120 a year), but you’ll have to have 100 transactions per month (!) to get it

I’m sure it’s a nice account and all, but I’m just fine with my Fidelity Cash Management Account with NO ATM fees, and none of that hassle.

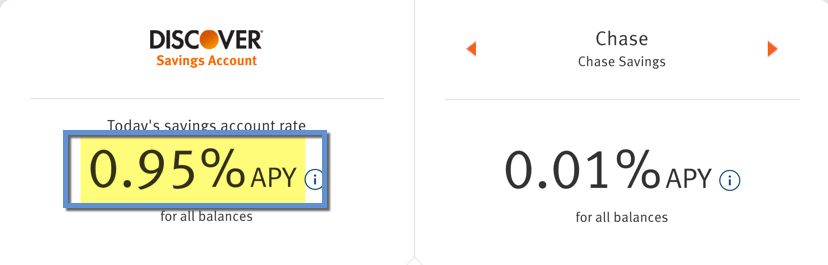

The savings account is pretty good is you need one though, and also links up to the cashback rewards.

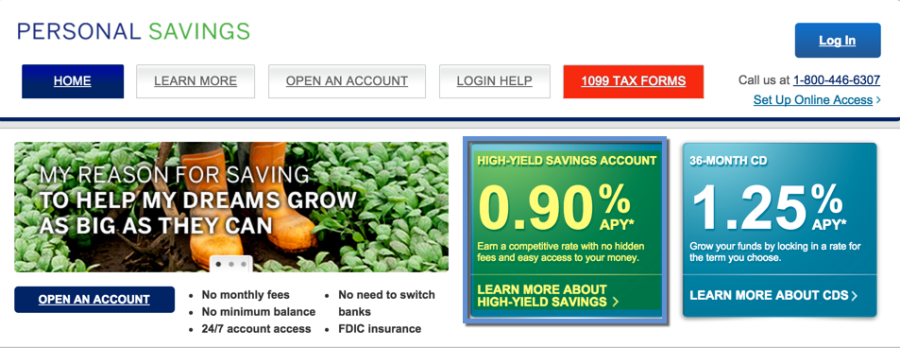

I’ll stick to my AMEX Personal Savings account, though.

I like that is DOES NOT easily link up to my other accounts. It keeps the savings saved, and I like it that way.

The APY is .90% instead of .95%.

With a $5,000 account balance, the difference in the rates would earn you an extra $3 over the course of a year. Not earth-shattering, or worth the hassle of switching, unless you want to easily “bank” the cashback rewards (which could be very substantial!).

And a good option if you need an online savings account – everyone should have one!

After the 1st year

Back to Discover It…

“It” turns into a pumpkin after 12 months.

The 5% cashback in quarterly categories and 1% on everything else… is exactly like the Chase Freedom card, whose points (Ultimate Rewards transferred to Chase Sapphire) I value more.

BUT. I will use this card to maximize the categories – as they do NOT overlap with the Chase Freedom’s schedule, which is nice. Or if they happen to over, great! Once I max out Chase Freedom, I can fall back on Discover It for 5% back.

And 1% cashback… no. I’ll go back to my lagan love, the Fidelity AMEX. 2% cashback there.

Discover It will be a nice fling for the next year.

Bottom line

Holy smokes! I’m newly obsessed with “Discovering” It.

If you don’t have this card and want to pick one up, I highly recommend doing so!

I’m looking forward to maximizing this card for all it’s worth… and I’m gunning to get $1,000 in cashback, just from the excellent shopping portal alone.

If you sign up now, you’ll also get 10% cashback from Amazon.com until the end of the quarter (which ends September 30th – and so does the double cashback promo for new cardmembers!).

I’ve spoken to a few friends who have the card and all of them have found personalized ways to get value. Considering it has no annual fee and no foreign transaction fees, you have little to lose. And everyone should have a no annual fee card anyway!

Let me know if I missed any ways to maximize cashback on the Discover It card… or if there’s anything to watch out for!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hey Harlan,

I’m really debating on getting this card but I have one question. I’ll be living mostly in Vancouver, Canada over the next year and even though I know there’s no foreign transaction fees, I want to know how acceptable it is above the border. Any idea? Even if it doesn’t work too well up there, I will definitely be taking advantage of the online shopping portal.

Thanks for the help.

Probably similar to the acceptance here. You won’t have many issues at bigger merchants, or grocery stores, but small businesses may not accept it (like AMEX).

Like you said, it’s great for online shopping. The more I walk around, the more I’m noticing the little Discover logo… right under Visa, MasterCard, and AMEX.

I think you’ll be fine.

Thanks =]

You’re welcome! 🙂

I have the Discover It card, and I’m obsessed with it too.. However, you HAVE to use your Discover card when shopping through the Discover Deals portal in order to get the cashback bonus. You cannot use another credit card, and I doubt you can use 100% gift cards.

It depends on the merchant. I’ve used gift cards and still earned the bonus. Others not.

But in general, you should use your Discover card when you click through Discover Deals. They’ve cracked down on that recently.

I usually don’t mind because the portal bonus gets doubled too, which makes it worth using anyhow.