I’ve written how everyone with a Citi card should call at least once a year and check for a Citi retention offer – particularly if the card has an annual fee.

My Citi Prestige annual fee recently posted. I called, and no joy. This week, the fee on my beloved AT&T Access More card posted, so I called again.

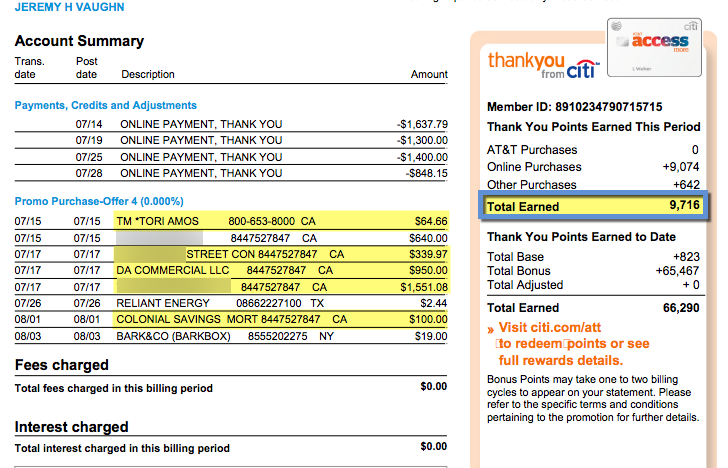

This time, I got my favorite retention offer so far: an extra 2X Citi ThankYou points on all spending, with a max of 35,000 points.

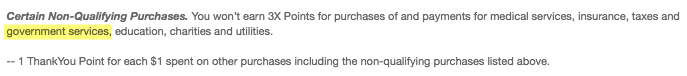

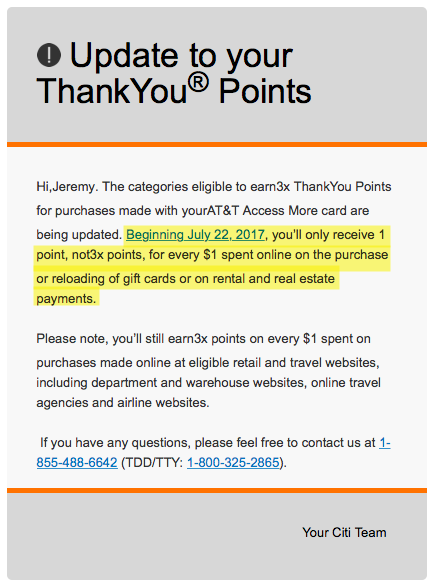

That breaks down to 3X points per $1 spent on up to $17,500 spent in non-bonus categories. And 5X points per $1 spent for online purchases (which are a bonus category with this card). Wow.

Gosh I love this card

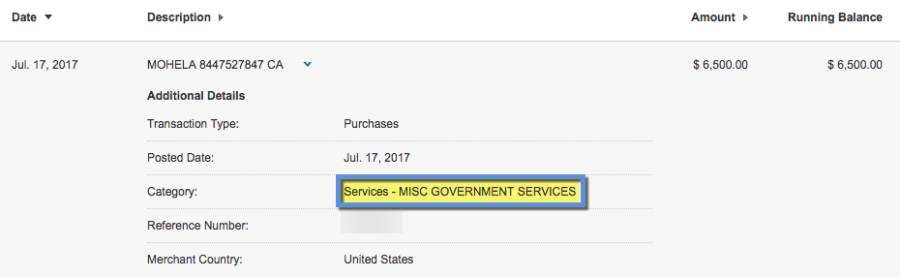

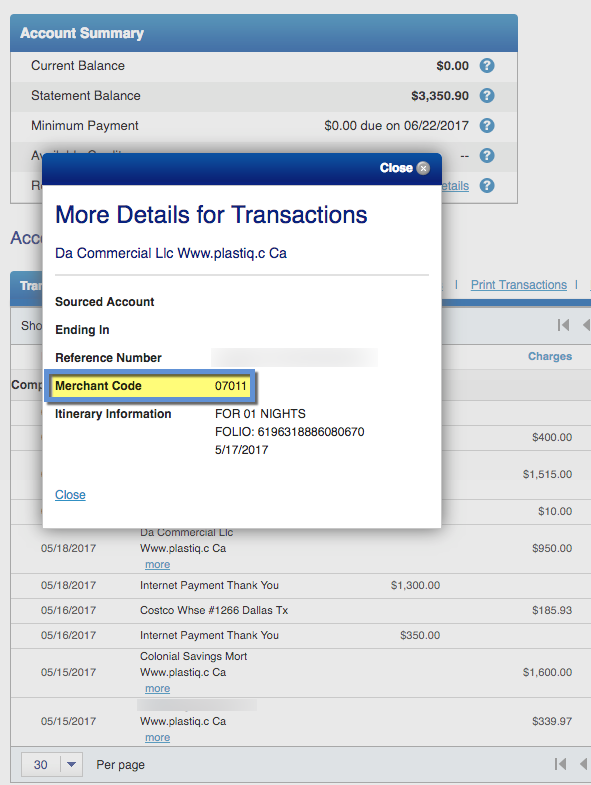

I immediately queued up mortgage, HOA, and car payments with Plastiq (because it’s a MasterCard, which you can use for those payments) and moved the card into my wallet – a place it hasn’t been for a looong time.

3X Citi ThankYou points for everyday spending is an awesome return. I value that at 6% assuming each point is worth 2 cents each.

Morever, earning an extra 35,000 ThankYou points is worth $700 to me by that same metric. AND this card earns an extra 10,000 Citi ThankYou points when you spend at least $10,000 in a cardmember year. Because this offer will also trigger that bonus, I value it for an additional $200.

So yes, this quick call recouped the card’s $95 annual fee nearly 10 times over. And is a great reminder why you should always always call Citi about retention offers.

Note: The Citi AT&T Access More card is no longer available. Nope, not even for product changes.