So this is pretty cool. The Citi Rewards+ card is a new card that:

- Earns 2X Citi ThankYou points at supermarkets and gas stations on up to $6,000 in spending per year (then 1X)

- Rounds up every purchase to the nearest 10 points (spend $2, earn 10 points, say)

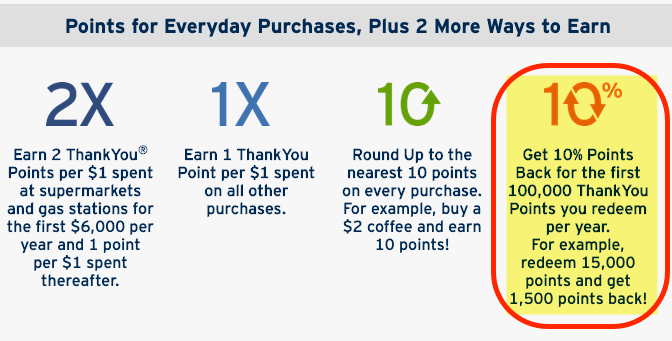

- Rebates 10% of your redeemed miles on up to 100,000 points per year

- Has NO annual fee

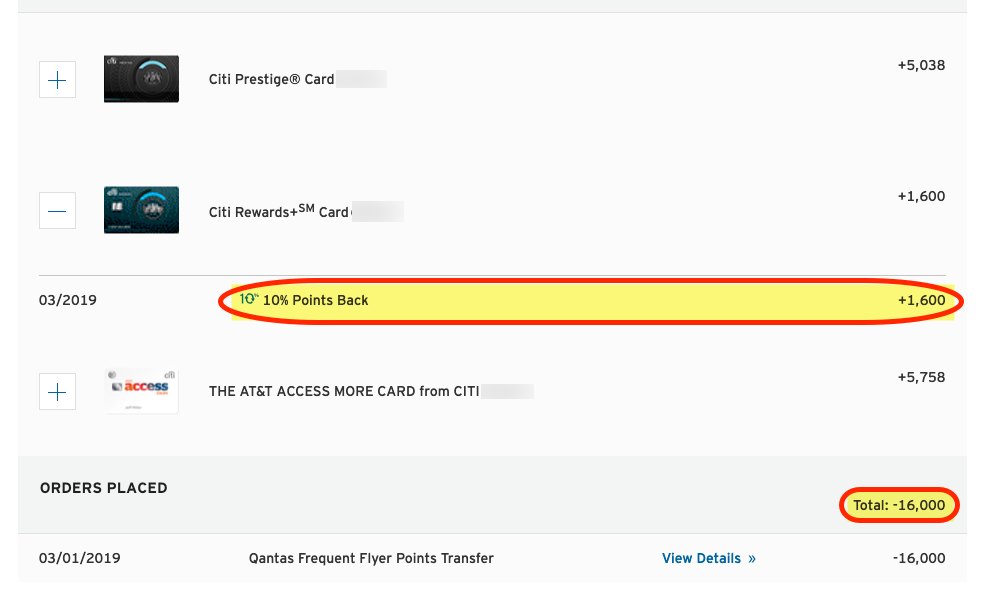

I product changed my old Citi Diamond Preferred to the Rewards+, and that was that. Until today, when I saw a random 1,600 ThankYou points in my account.

The only activity I’d had recently was transferring 16,000 Citi ThankYou points to Qantas. Then I realized – the Rewards+ card’s 10% rebate worked on the redeemed ThankYou points, even though I earned them with other ThankYou cards.

For a card that’s free to keep, that’s up to 10,000 points back in my account every year – and I value those for $200 at least. An as long as this works, I will 100% keep my Prestige card long-term.

This pairing is pretty awesome – and seems to work with any other ThankYou card and for any type of redemption (points transfer, travel booked directly, etc).

Holy crap, this new power-up to my Citi Prestige card is worth an extra 10,000 points per year. Officially keeping

When you combine the rebate with points transfer bonuses and 1.25 cents for travel – it gets all that much better.

Combine Citi Rewards+ with other ThankYou cards for up to 10,000 points back per year

It stings to lose the 10% mileage rebate on American Airlines cards. But in its place, you can get 10% back on up to 100,000 redeemed Citi ThankYou points. That’s a nice tradeoff.

If you have a Citi Rewards+ card, you can combine your ThankYou member accounts and trigger the rebate when you use miles earned from other Citi ThankYou cards, like:

- Citi Prestige

- Citi Premier

- AT&T Access More

You can theoretically link your accounts online, but it never works right. Your best bet is to call Citi and have them do it. When I called, they were able to instantly combine all my ThankYou points into one place.

The advantage is you get all the superpowers of each card in the pool. For example:

- 1.25 cents toward all travel booked through Citi if you have the Citi Premier

- 1.25 cents toward flights booked through Citi if you have Citi Prestige

- And now, 10% of your points back in your account, on up to 100,000 redeemed per year with Citi Rewards+

Citi Rewards+ is my Citi Prestige’s new BFF – but god, couldn’t they have chosen a different design?

Just note that once you combine your accounts, they can never be unlinked. But there’s not much of a downside to linking them.

A Citi agent had it done in 10 minutes

I converted a sock drawer card to the Citi Rewards+ because why not? But wasn’t expecting it to turn out this well.

Use any ThankYou card to earn points, get your Citi Rewards+ 10% rebate at statement close

I recently zeroed my ThankYou account to book my Hyatt Ziva Puerto Vallarta stay, so the points I transferred to Qantas were earned with my Prestige or AT&T Access More card. I haven’t spent a buck on the Rewards+ card.

All I’ve done recently is redeem 16K points – and got 1.6K points back

This makes me believe the 10% rebate will work when you redeem any ThankYou points, regardless of which card earned them.

I will happily collect up to 10,000 points back per year thanks to a card that’s free to keep

By linking your Rewards+ card to your other ThankYou cards, that’s good for up to 10,000 points back per year. At 2 cents each, that’s worth $200 each year.

And while I was planning to keep my Citi Prestige card anyway, having this new perk worth another $200 makes keeping it a no-brainer.

Get more from transfer bonuses and travel bookings

Right now, you get 25% more points when you transfer to Qantas through April 13th, 2019.

Niiiice

So if you transfer 8,000 points, you’d get:

- 10,000 Qantas miles

- 800 points back

Meaning you’re essentially exchanging 7,200 Citi ThankYou points for 10,000 Qantas miles.

And if you have Citi Prestige or Citi Premier, you can use your points for 1.25 each toward flights (and all travel with Premier).

So 10,000 Citi ThankYou points gets you $125 in travel, and you’d get 1,000 points back – making 900 points worth $125 toward travel, and closer to being worth 1.4 cents each.

Should you open a Rewards+ card to access this benefit?

However, if you have all the ThankYou cards you want, and aren’t concerned with 5/24, it’s got a sign-up bonus of 15,000 Citi ThankYou points after you spend $1,000 in purchases within 3 months of account opening – decent for a card with no annual fee.

Of course, you’ll get 10% of those points back, so it’s more like a 16,500 point bonus. 🤑

Alternately, if you have a Citi card you aren’t using, you can give ’em a ring and ask them to covert it to this one – which is what I did.

Just remember to combine your ThankYou accounts before you redeem any points to take advantage of the 10% rebate.

Bottom line

I’d say being able to use the 10% rebate for up to 10,000 Citi ThankYou points back in your account per year is THE reason to open the Citi Rewards+ card. There’s no annual fee, and comes with a nice sign-up bonus. (And thank you for using my links if you decide to apply!)

And while this isn’t earth-shattering, I easily value this perk at $200 – and it moves the needle to a solid “keep” for Citi Prestige as long as this lasts.

It might be worth opening just for this, if you have all the ThankYou cards you want and aren’t concerned with 5/24. Or you can convert another Citi card to this one.

The magic is in the linking of ThankYou accounts – make sure to call and request to combine them into one central account.

I was pleased as punch to see those extra points in my account – and yes, the rebated points are transferable to airline partners.

Neat development, and a nice side effect for my Citi Prestige card.

What do you think – does this make ThankYou points more appealing?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

How much time passed from the switch to Rewards+ and your transfer to Qantas? I switched my Preferred for this very reason, but the 10% never posted. I made the switch, waited about a week, then transferred some points. To Qantas, a week before the bonus offer started.

You’ll get the points rebate when your Rewards+ statement closes. Mine just closed, and that’s when the points posted. It’s not instant.

Thanks for confirming, I was wondering about this. I have Prestige (but not for long after 4NF is nerfed), Premier (not for long as well), and Rewards+. Do you know if you have to have a premium card in order to transfer to partners (like with Chase)?

Yes, you need to keep either the Prestige or Premier to retain ability to transfer points to airline partners.

Might be worthwhile to keep one or the other.

Excellent article and data point, Harlan! I had searched and couldn’t find an answer to this question – whether the Rewards+ rebate applies to TYP redemptions of points earned on *all* cards (assuming TY accounts are combined), or just if the TYPs were earned on the Rewards+ card. So I set up this very experiment by PC’ing a Citi AA Platinum card over to Rewards+. I wrote about this on Feb 28. I haven’t gotten to the end of the experiment yet. Very nice to have this positive data point! Great minds think alike – and apparently yours thinks faster than mine 🙂

Ah how cool! I didn’t even intend to set up an experiment. Just one of those moments where I was like huh, what happened there? Then realized… wow, that’s awesome!

Really pleased with this. Thank you for reading and commenting, Craig!

For others, here’s Craig’s post about his experience with product changing to the Rewards+ card: https://www.middleagemiles.com/2019/02/28/citi-aa-platinum-product-change-options-we-chose-thankyou-rewards/

Really appreciate the link, Harlan! And congrats on the article catching fire! It’s a very good find, and kudos for sharing with the points-and-miles community.

I love your blog more and more. I only wish I had read this before redeeming 75,000 TY points this week! I have to tell you, I needed to redeem Amex MR points, Jetblue points, Hawaiian Airlines points and Citi Thank You points this week to pull together three trips… two to Florida and 1 to Hawaii. With Amex, I had to pay excise fees several times to transfer to airline partners and it took me awhile to transfer to this partner and that partner. It was kind of convoluted because I was pulling points and miles from both my mother’s and my husband’s accounts all over the place. I was surprised how much I appreciated the simplicity of Citi. It was such a pleasure. Need a hotel here? Use TY points (at a discount even). Need a few airline miles to top something up? Transfer TY points. Need more than you have? Transfer from both mom’s account and husband’s account. And nothing cost me a dime! SO easy. That ease of use was really selling me on keeping the Premier but I really didn’t want one more card with an annual fee. Now you bring up this new card, not on my radar, that would justify actually keeping it because it would pay for the annual fee and then some. Will definitely use your link to sign up for the Rewards+ when I’m ready.:)

What a cool story! I love cobbling together award trips. It feels like solving a big, fun puzzle lol.

Honestly, I’m using Citi TY points more and more – maybe even the most – these days. Ease of earning and redeeming is a huge factor. I wish transfers to partners were instant – that’s the biggest limitation to the program.

Even still, getting back 10,000 points by simply throwing a no-annual-fee card in the mix is that little nudge I needed to keep the Prestige card open. Really hoping this trick lasts.

Thank you so much for reading and commenting. I really appreciate it.

And your trips to Florida and Hawaii sound like they’ll be amazing! Hope you have so much fun!