I took the bait – so there’s my Sofi Money review. Everyone’s abuzz about SoFi’s cash management account, SoFi Money, because you get:

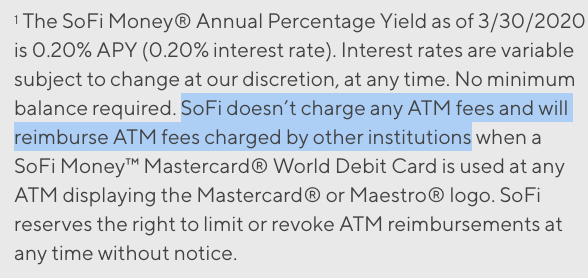

- Unlimited, free ATM use worldwide allowing you to use any ATM that accepts Visa for free AND they’ll reimburse any fees that Visa charges (!) – an amazing perk for travelers

- 0.2% APY on your balance

- No fees, no minimums

- Sub-accounts to save for your goals, and joint accounts for your S.O.

- Blazing fast sign-up – I had an account open in 2 to 3 minutes

- $75 bonus when you open an account and make two direct deposits of $500 each – and it posts within a day or two

Plus, when you refer someone who uses your sign-up link, you get $25. Get on the gravy train (and thank you for using my link to join)!

Because of these features, I’m considering making SoFi Money my everyday checking account, even though it’s online-only. For over a decade, I’ve banked with Chase and can’t remember the last time I visited a branch.

My Chase account and SoFi Money are both free to have (I have an old Chase account that’s no longer offered), so I’ll switch everything over to SoFi Money for a while and see how it goes. Nothing to lose and free ATMs + an easy-to-use site and app to gain.

SoFi is offering a $75 bonus for opening an account and making two $500+ direct deposits

While Fidelity, Schwab, and Aspiration all have no-fee accounts with free ATM withdrawals (I compared them here), none of them have an APY on the balance you carry or immediate ATM reimbursements (Fidelity refunds you within a few days, the others can take up to a month).

And while I’m wont to offer yet another bank account option, scoring $75 for a couple of minutes of work is nothing to turn down.

You can sign-up for a SoFi Money account here.

SoFi Money review – the ultimate free bank account, especially for travelers

I have a lot of checking accounts. They’re all free, and I got most of them because of a sign-up bonus. So my online banking presence is a scattered sea of orphaned debit cards from various plunderings.

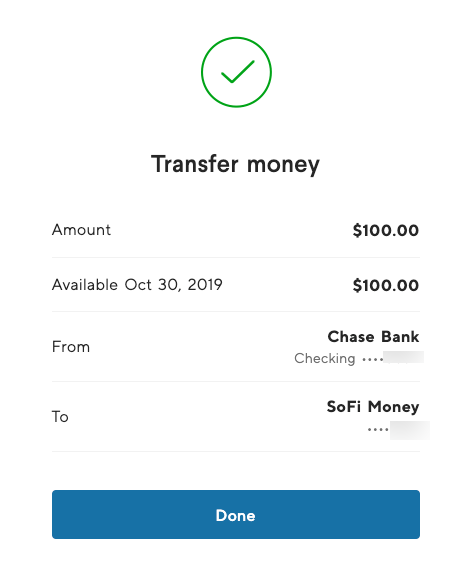

Because of this, I’m resistant to opening yet another account. But this one is different – I might actually use it as my go-to checking account. Plus there is no hard pull to open, and initial funding is super simple – you can link your existing bank as part of the sign-up. As long as you put in two direct deposits of $500 or more, your $75 bonus should post within a couple of days at most.

Open a SoFI Money account in a minute or two

In fact, I had the account open and ready to use within a couple of minutes. Account number, funding, username, the whole works. From a product standpoint, I admire the quick onboarding. 🤩

Couldn’t be simpler

I’ve been reading up about the account, and there’s really a lot to like. When I get the debit card next week, I’ll switch my direct deposit over and see how long things take to move in and out of the account.

From what I’ve heard, it’s top-notch, so I’m expecting a good experience. If all goes well, this might just become my new everyday checking account. I’ve been looking for a reason to dump Chase, and the extra interest and ability to use any ATM for free puts it over the edge for me.

Loves it

Not that I expect to earn much interest. I keep my checking account funds low because I treat it as a clearing house. Money arrives, then I set about distributing it to various places – IRA, savings accounts, and paying off my credit cards in full.

Though you could use SoFi Money as a savings account. The APY is decent. But I like having my savings completely separate, and I earn slightly more with my current savings account (Citi Accelerate). The functionality exists (they call them “Vaults” – think of them as separate envelopes), so that’s super handy.

Even still, I believe every dollar should have a job, and even if I only earn a few cents of interest on my balance, I won’t say no to it.

Are there downsides?

There are some things to be aware of.

First, SoFi Money isn’t FDIC insured. Instead, they sweep your money to partner banks where it IS FDIC insured. But because of that, you get a much higher limit (insurance on up to $1.5M vs $250,000 with most banks).

As I said earlier, I use my checking accounts as clearing houses and keep my balances low. I keep maybe $100 in there at any given time. So this isn’t an issue for me. But something to keep in mind.

Next, there are no physical branches. To get money into your account, you can do direct deposit, transfer from another account, or deposit checks through your phone. There’s no way to deposit cash.

Again, not an issue for most – I don’t even carry cash these daze – but something to know.

Finally, there are no wire transfers. So if you save up for say, a down payment on a home, and the mortgage officer tells you to wire your funds before closing… you’d have to transfer to another account, then wire it from there. But, wire transfers are on the roadmap for Q4 2019, so hopefully this becomes a moot point pretty fast.

Truly free ATMs worldwide

Truly free!

Even if the MasterCard network adds any fees (typically 1%), SoFi will reimburse those too. This feature alone puts it head and shoulders above any other checking account option out there right now. No other account has:

- FREE ATM use worldwide, including Visa fees

- Instant ATM fee reimbursement (others take a couple of days or even a full month at most)

- No fees or minimums

I wouldn’t hesitate to recommend this account to anyone. Plus, an easy $75 bonus for opening and making two direct deposits of $500 each. 🤑

Sofi money review bottom line

There are a lot of checking accounts out there. But SoFi Money might be the very best, especially for travelers and those who don’t care about physical branches. When you sign-up and make two direct deposits of $500 each, you’ll get a $75 bonus – and the account only takes a few minutes to set up.

That’s super cool, but the other features make the account worth keeping and using, including 0.2% APY on your balance, free ATM withdrawals, and no fees or minimums to think about. Add to that a slick app and UX, and you’ve got yourself a mighty fine checking account.

For me, this is straw that’s breaking Chase’s back (assuming Chase is a camel). I’m gonna use this account as my go-to checking account and see how it goes. Then I’ll add to this Sofi Money review.

Don’t forget you get $25 when you refer your account. No idea how long this promotion will stick around, so sign-up while you can. Seriously, it’s super fast and you’ll have your $25 bonus in a day or two. And you can start referring to your posse.

For those that have this account already, how’s your experience been? And is there anything else you want to see in your ideal cash management account?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m actually on the exact same boat as you. Just opened an account and I’m considering transferring most of my funds from chase to use this as my new debit account. The no ATM fees is amazing.

Not sure if you allow us to post our own referral links, if not then feel free to delete, otherwise thank you for allowing me to post mine.

https://www.sofi.com/share/money/2733029/

Let me know what you discover! I don’t pay any fees to have my Chase account, and have been using other cards when I travel abroad. But having one account I can use for everything would be awesome – this might just be the one!

Thank you for reading and commenting!

Ugh, that 1% forex on foreign ATM withdrawals is JUST the one thing to make it not what I want to replace everything. Interbank rate or GTFO.

1.8% for checking is pretty good though.

Really? I see it as so minor that it’s not a make or break. $1 per $100, but then all other fees are reimbursed. Interbank would be awesome, but I don’t see Visa changing their ways any time soon. And the other features more than make up for the times I’d withdraw cash overseas.

Just curious – who are you using now for banking/checking? Thanks for adding your thoughts and for reading!

I use a combination of credit union and Fidelity Cash Management when I need to grab cash overseas.

Word. I’ve been using Fidelity and Aspiration, but all things equal, I could definitely make the switch to SoFi. Thank you for the info!

Yeah, the CU I use has a 2% interest rate on a balance up to 15k, free ATM withdrawals inside the US.

BUT

You need to use the debit card 12x a month (I just use Apple Pay linked to the debit card throughout the month for some small purchases- not a big deal, the 2% interest on balances EASILY beats not getting @% cash back on $50-100 in purchases, and I feel my risk of getting the account drained is low if I am using Apple Pay on top) to go along with billpay/direct deposit.

AND

There’s a 1% fee on international transactions that includes ATM withdrawals.

Their credit card is weaksauce, though, and so are their savings accounts for interest.

All told my CU makes an OK base account for my master account, but a One True Account™ solution for me isn’t quite there yet- I would want reasonable interest on a cash balance, no international forex, a debit card for ATM with fees rebated, easy billpay.

If SoFi DOES allow ATM withdrawals without the charge (as mentioned below), though… that’s pretty much what I want.

Hey! Just wanted to follow up here – they’ve made it official per the T&Cs:

“SoFi doesn’t charge any ATM fees and will reimburse ATM fees charged by other institutions when a SoFi Money® Visa® Debit Card is used at any ATM displaying the Visa®, Plus®, or NYCE® logo and will also reimburse any foreign exchange fees charged by Visa. SoFi reserves the right to limit or revoke its fee reimbursement policy at any time without notice.”

It’s point number 2 at the bottom of the share link: https://outandout.boardingarea.com/sofimoney

For the record, there have been data points that 1% foreign transaction fee only applies to debit charges and not to ATM withdrawals. Will find out for myself in a few days wether that is 100% true. Thank you for allowing us to post our links!

Here is the Money (banking account) link

https://www.sofi.com/share/money/2728575/

I heard a data point from someone who used Fidelity, Schwab, and SoFi to withdraw the same amount and it was converted the same across the board to USD. So I suspect this is correct – it’s just that so many people get caught up on that 1% fee (which I think is negligible) that I had to mention it. Would love a followup on this if you remember – thank you, Alex!

I do too much travel where cash > “Sorry, we don’t accept AMEX” is a reality where I travel. That means that I’d be looking at non-trivial amounts of money being given away at the ATM (and I travel to Thailand enough that Fidelity refunding the government ATM surcharge is meaningful).

But if SoFi’s verbiage means just debit card transactions vs. ATM withdrawals, I’m there.

Per the Sofi website: “Please note, though SoFi doesn’t charge foreign transaction fees, there is a foreign exchange fee of 1% charged by Visa that is not waived.”

In contrast, there is no such language with Schwab. Instead, as part of their bold upfront marketing, they proclaim no foreign transaction fees. I use the Schwab debit card and in fact can personally attest that I have never been charged a foreign transaction or exchange fee when traveling. I am not as blase about this as the author and find a 1% fee significant that makes Schwab superior to Sofi as I just have a higher degree of confidence that the no foreign fees will in fact be applied. Schwab customer service and proven long term track record of no fees trumps Sofi in my opinion. Great article from the author here that highlights the benefit of carrying a fee free ATM card for traveling instead of relying on foreign exchange places.

– Admitted Schwab fan boy

Hey Steve! This just got added to the terms and conditions:

“SoFi doesn’t charge any ATM fees and will reimburse ATM fees charged by other institutions when a SoFi Money® Visa® Debit Card is used at any ATM displaying the Visa®, Plus®, or NYCE® logo and will also reimburse any foreign exchange fees charged by Visa. SoFi reserves the right to limit or revoke its fee reimbursement policy at any time without notice.”

You can see it here as point number 2 at the bottom: https://outandout.boardingarea.com/sofimoney

Hi Harlan I just used your referral link. Hope I’ll get the $50 bonus.

Thank you so much, Len. You should see the bonus in a day or two. I opened my account over the weekend, and it posted on the second business day. Thank you again, I really appreciate it!

Thanks for your blog; have been reading/enjoying it for awhile! Have been thinking of opening this account for a bit now, so I’m going ahead today and will be using your link!

Thank you so much for reading all this time and checking out the account – I really hope you like it! Such a nice compliment. Thanks again.