To start, the Blue Business Plus Amex is a small business card. But Amex is known to be generous with small business card approvals, so long as you have a for-profit venture, or are aiming to make a profit.

This card got instant “workhorse” classification. And it’s been a stalwart companion in my wallet since the day I got it.

When it launched in Summer 2017, there was a brief welcome offer for 20,000 Amex Membership Rewards points. But when that faded, it went to nothing.

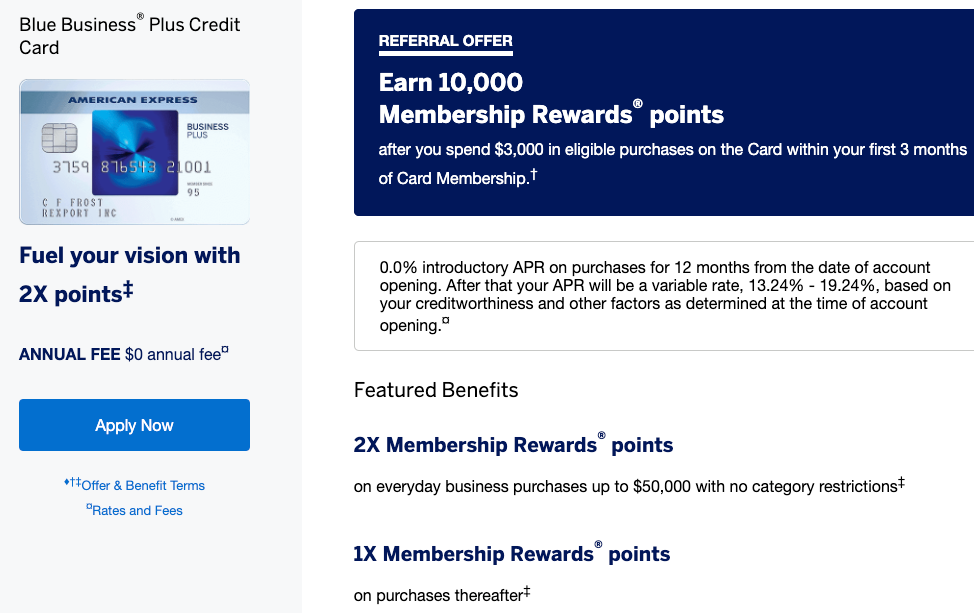

Now a welcome offer of 10,000 Amex Membership Rewards points is available. But I think this card is good enough to get even without a bonus!

About the Blue Business Plus Amex

- Link: Blue Business Plus Amex – learn more here

| Blue Business Plus Credit Card | 10,000 Amex Membership Rewards points |

|---|---|

| • 2X Amex Membership Rewards points on all purchases on up to $50,000 in spending per calendar year • No bonus categories to think about or activate and NO annual fee • Can transfer the points you earn to Amex travel partners |

| • $0 annual fee (See Rates & Fees | • $3,000 in eligible purchases on the Card within your first 3 months of Card Membership |

| • This is by far the best card for 2X points on all spending | • Learn more here |

The strength of this card is in its simplicity. You get 2X Amex Membership Rewards on the first $50,000 you spend per calendar year on the card. So it’s a great card for non-bonus spending – up to an extra 100,000 Amex Membership Rewards points per year.

There’s no annual fee – so it’s free to keep forever. Because it’s a small business card, it won’t show on your personal credit report – and therefore has no bearing on your Chase 5/24 status. And for that same reason, you need to have some quantifiable business income. But again, Amex is, in my experience, lax about this – as long as you can show something.

If you want to pick it up now, you can earn 10,000 Amex Membership Rewards points after spending $3,000 on purchases within the first 3 months account opening.

Offer details

I jumped on this card the second it came out. And use it for expenses that would earn 1 point per $1 on other cards (non-bonus categories).

I also consider it to be better than a 2% cashback card. That’s because I value each point at 2 cents each. So it’s like getting 4% back (or more!) after I transfer the points to an Amex travel partner.

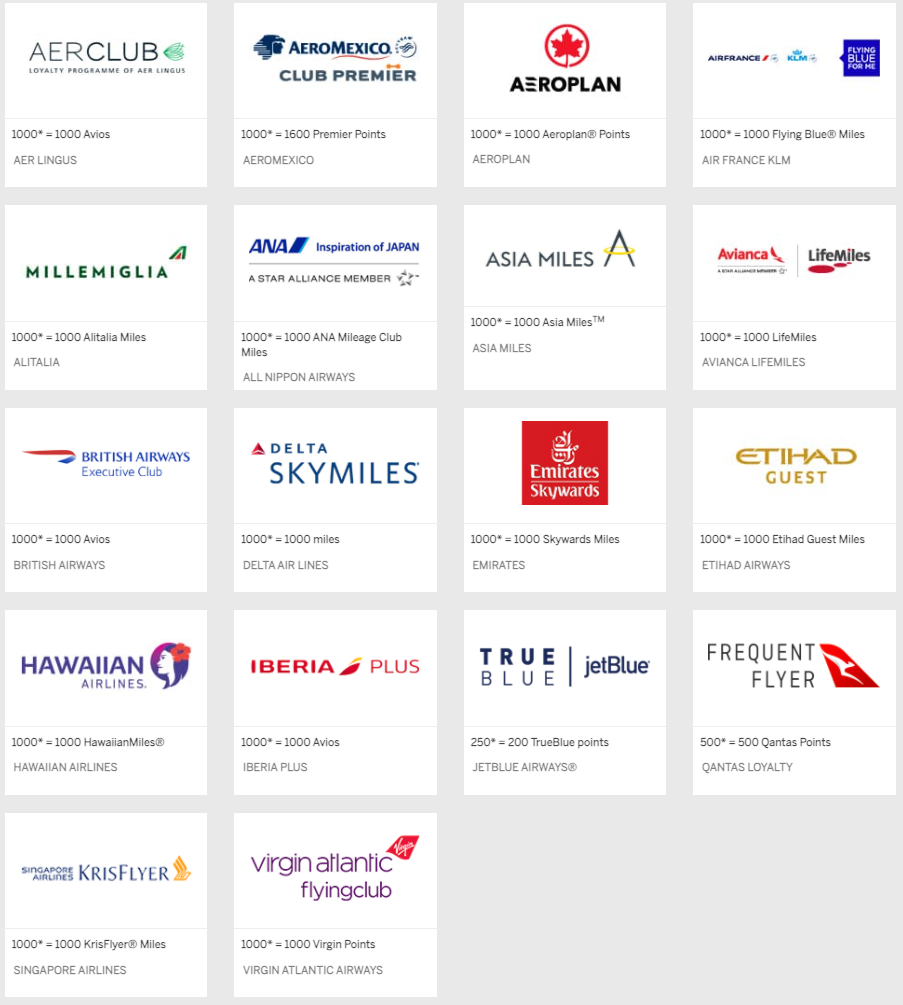

You can transfer Amex points to any of these 18 airlines, with many at a 1:1 ratio

This card will keep all your Amex Membership Rewards points alive should you choose to cancel another one that has a big fee, like the Amex Platinum Card ($550 annual fee) or Amex Premier Rewards Gold ($195 annual fee).

There’s also a quite long period with 0% APR – 15 months. Which could be good to help pay down some debt. Or float a charge for a sec.

Best uses of Amex Membership Rewards points

The best transfer partners are:

- British Airways – Hard to beat 7,500 points for short-haul coach flights under 1,151 miles. Those are some of the most expensive flights!

- Delta – When they have an award flash sale, you can actually get a good deal, as low as 5,000 miles each way. The points transfer instantly, so you can literally transfer them the second you find something good

- Flying Blue – 15,000 miles for a one-way to Hawaii from anywhere in the mainland US is hard to beat, although they are updating their award chart soon. Hope this one sticks around!

- Etihad – You can still book American Airlines awards at low prices. I booked an award on Brussels Airlines and had no issues doing so with a phone call

- Singapore – Fly round-trip in coach on United within North America for 25,000 miles. Or fly to Hawaii and back for 35,000 miles. I’ve also booked this award – amazing deal

Use the points you earn with the Blue Business Plus Amex to fly to Hawaii with Flying Blue, Singapore, or even Delta where there’s a promotion

Having a card that adds to the stash at a 2X rate with no annual fee is pretty sweet. I love watching the rewards roll in for purchases that ordinarily don’t earn bonus points.

My experience getting the Blue Business Plus Amex

I didn’t get a hard pull when I applied. Which is awesome. This is my 6th Amex credit card – so I may be at my limit (my others are SPG personal and biz, Hilton Surpass, and 2 no AF Hilton).

I was instantly approved… with a $2,000 credit limit, which isn’t much.

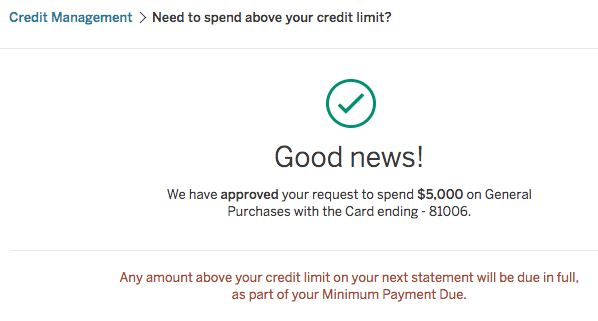

Luckily, this card has a feature where you can “spend above your credit limit.”

I checked what would happen for a $5,000 charge, and they said no problem. That’s good, because my Airbnb rents are more than $2,000 a month (which I can still pay with Plastiq). The hitch is, you must pay off the amount above your credit limit at the end of each billing cycle. Also not a problem – I do that anyway.

I could probably ask Amex to shift my credit lines around. But the application process was a total breeze.

Bottom line

- Link: Blue Business Plus Amex – learn more here

Amex is killing it with small business card offers right now. The Blue Business Plus is remarkable simply because it has one at all. But it’s such a trusty steed, I think it’s worth getting even without one. So earning 10,000 Amex Membership Rewards points is gravy.

NONE of these cards count toward your Chase 5/24 status and all are excellent welcome offers.

If you have the Blue Business Plus Amex, do you like it as much as I do?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I know this is a business card, and I could technically apply since I sell stuff on ebay or have a tiny web consulting business. But do you think I would be able to put the majority of my personal spend on this or that Amex would have issues with that? The only basic thing missing from this card is Return Protection.

The biggest thing with that, like you noted, is small business credit cards lack many of the consumer protections you’ll get with most personal credit cards. And in general, it’s a good idea to keep business and personal expenses separate. That said, I use the card for most of my spend that isn’t in a bonus category on other cards. 😉

Curious what your experience is if you do decide to transfer some credit limit to the new Blue Business Plus card. I tried twice this past year to move some credit from another card and they denied me both times saying they can’t do it in the first year of having the card, which really makes no sense. Tried to move my wife’s Blue for Business credit line to her Blue Business Plus as well and they told her the same thing last month.

I was curious too, so I just got off the phone with them. I haven’t had the card for a whole year (the card hasn’t even been out for a year, so no one has).

They moved $16,000 from my Starwood BUSINESS card to this card. Apparently you can only move credit limits between business accounts, NOT from a personal account to a business account, even if they are both CREDIT cards (I specifically asked about this).

In your wife’s case, it sounds like you just got a bad rep. I’d try again because I was able to do it now with no issues.