I wrote about Trim and Paribus to track price changes and get a refund from merchants. Now there’s Earny, which tracks price changes and uses price protection from many bank Visa and MasterCard credit cards – and files the claims for you automatically. In return, they take 25% of the bounty.

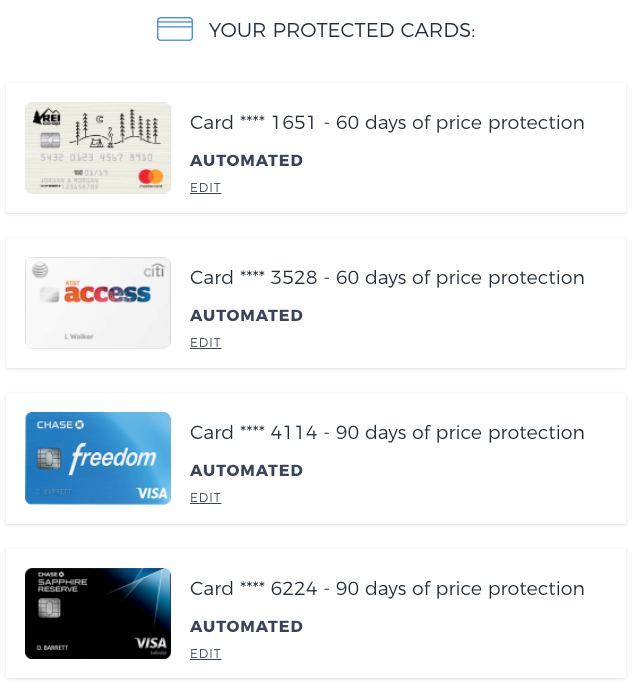

I shop online a lot with my Citi AT&T Access More card (no longer available although you can still product change to it). All Citi personal cards come with Citi Price Rewind, which puts the onus on you to file a claim if you find a lower price. But now Earny automates the work. After you link your cards, nothing else is required to file a claim when Earny finds a lower price.

If you shop online a lot, this could save you big bucks!

What’s Earny?

- Link: Earny

Much like Trim and Paribus, Earny wants access to your email to fully work – and your bank login details to get automated price protection. And you need to add your cards individually. Visa and MasterCard cards from these banks are supported:

Earny tracks the receipts in your inbox and matches the purchases to your cards. If there’s a price drop, Earny will automate the price refund difference with your bank – but only when you provide your bank login details. Otherwise, it will alert you a lower price was found – and you can file a claim on your own.

Which cards work?

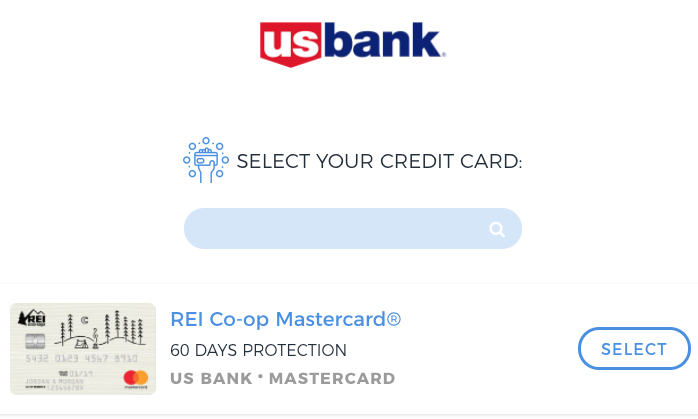

It’s important to note that every card from each bank is NOT supported. Or so they say.

I added my US Bank Altitude Reserve card and my US Bank login – it seemed to add the card, even though it’s a Visa?

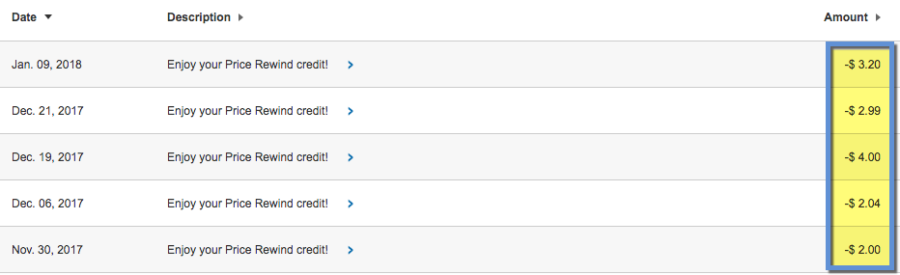

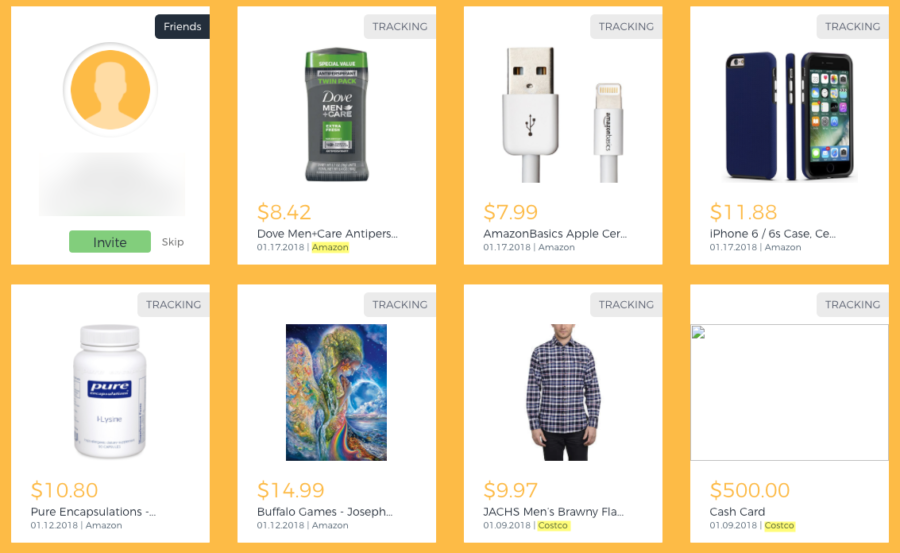

I don’t know if it will work for the price protection benefit. So it’s best to match the cards as closely as possible to what Earny shows. For my Citi price protection, Earny only showed the Citi AT&T Access card and I have the Citi AT&T Access More card. But it still worked like a charm! In fact, I have gotten several small refunds already:

It’s nothing major so far. A few bucks here and there. But considering it required no work on my part and already saved me ~$14 in the past month or so, it’s an easy win. I LOVE EASY WINS.

It also helps to offset the annual fee on the card, which is a huge added value. Even better if you have a no annual fee card. I imagine now would be a good time to sign up for Earny to take advantage of all the post-Christmas sales and price drops happening.

What else does Earny do?

Earny tracks your purchases from:

- Amazon

- Best Buy

- Bloomingdale’s

- Carter’s

- Costco

- The Gap Group including Gap, Banana Republic, Old Navy, Athleta, and the factory stores

- Home Depot

- J.Crew

- Jet

- Kohl’s

- Macy’s

- Newegg

- Nike

- Nordstrom

- Overstock

- Sears

- Staples

- Target

- Walmart

- Zappos

Note: You need to link your Amazon account separately.

Then, all your purchases appear in a grid, starting with the most recent items.

The automatic price protection is by far the coolest part. I love peeking at my Citi card account and seeing a Price Rewind credit for something I already bought!

Are there drawbacks?

Ja. Some peeps are uncomfy sharing their bank logins with 3rd-party services. Earny says:

Earny’s credit card security is handled by MasterCard’s trusted Simplify Commerce. He only works with the most secure and reliable companies to make sure your card information is protected. Earny also never stores your complete credit card information. Instead, he uses a MasterCard generated token to recognize and charge your card whenever he discovers a refund opportunity.

I’ve been using Earny for a few months and have only had a good experience getting back extra cash with zero effort. Ultimately, it’s up to you. Take a look at the FAQs and see how you feel before signing up.

Bottom line

- Link: Earny

If you recently shopped for Christmas gifts, now’s the perfect time to set up automatic price protection for sales and price drops with Earny. I’ve gotten a few bucks back pretty reliably every couple of weeks. So if you shop online a lot, it’s super easy to save cash on items you already bought.

I still recommend Trim and Paribus in addition to Earny to cover all your bases. Paribus in particular has earned me several free months of Amazon Prime. 🙂

But where those services work with the merchants, Earny works with your bank directly. They’re all completely free to use, and you’ll only pay if a lower price is found.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

How do you put a credit card that is not sponsered like a jcpenneys card or Discover. It only let you put in one.