If you plan on purchasing gifts online this holiday season, there are two major things to watch for: price drops and missed delivery dates.

Price drops are extremely common with the onslaught of Black Friday/Cyber Monday deals – and often there are even more as “the big day” draws near.

Trim is useful to:

- Track price changes on Amazon

- Set spending alerts

- Monitor your monthly subscriptions

- Get the best price on your cable/internet bill

And I wrote about Paribus waaaay back in May 2015. Not only has their service improved – it’s now completely free.

It’s helpful for tracking price drops at tons of merchants. And helps you get a little something if there’s a late delivery.

Both of these tools can save you money in the background while you go about your shopping. They’re even better when their powers combine.

Trim aims to help your overall financial life

- Link: Trim

Trim is a little worker bee that buzzes around to save you money on your subscriptions, internet bill, and Amazon shopping.

When you plug-in your bank accounts, it also tracks your transactions so you can see if anything’s amiss (fraud, overcharging, etc.). And can send you spending alerts for large purchases on upcoming bill due dates. It can text them to you or send them via Facebook Messenger – cool!

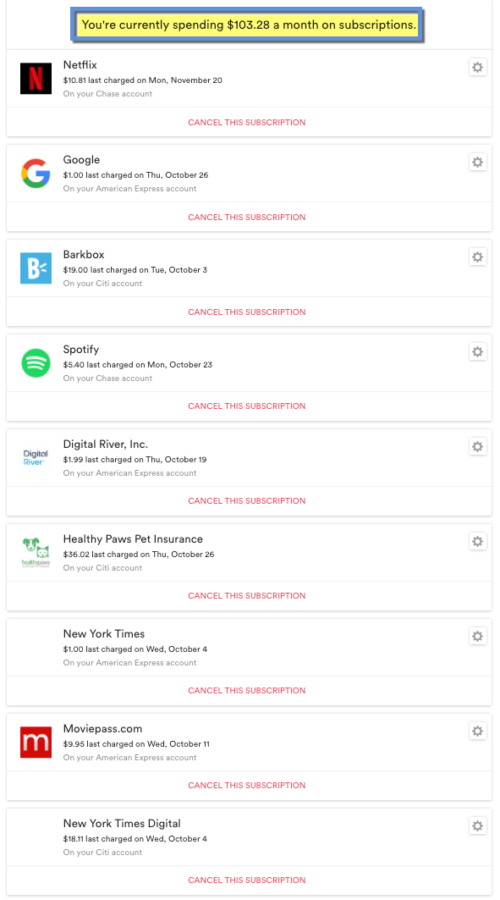

1. Subscription services

Trim scans for recurring monthly charges AKA subscription services. I’m spending ~$103 a month on various services.

Most of it is the ~$36 for my dog’s pet insurance and $19 a month for his BarkBox (which is an amazing deal if you have a pup or know someone who does – Fenwick LOVES his BarkBox and I love the high-quality toys and treats).

So that’s over half of it right there, just on my dog. Which is fine because… I love him. The rest is for MoviePass, Google Photos, Spotify, Netflix, and CrashPlan Pro. All things I use daily or often. And around $100 is right where I want to be for automatic charges.

Anyhoo, you can cancel any pesky subscriptions directly within Trim. (I already got rid of the New York Times subscription.) This is a super cool feature for seeing where you spend money each month – and how much.

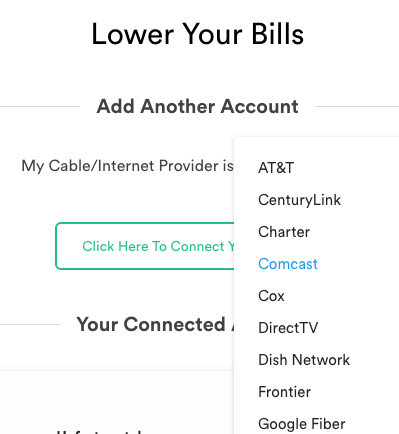

2. Save on cable/internet

This feature has helped me personally.

If your cable or internet bills increase, or if there’s a special offer, Trim goes to work to get you the best price for your area. Spectrum (formerly Time Warner) loooves to give a 12-month “intro” rate then jack it up after a year. Trim proactively caught this on my account and got the intro rate “extended” for me. Pretty cool that I didn’t have to track it or call Spectrum – Trim saved me money (and time!) automatically.

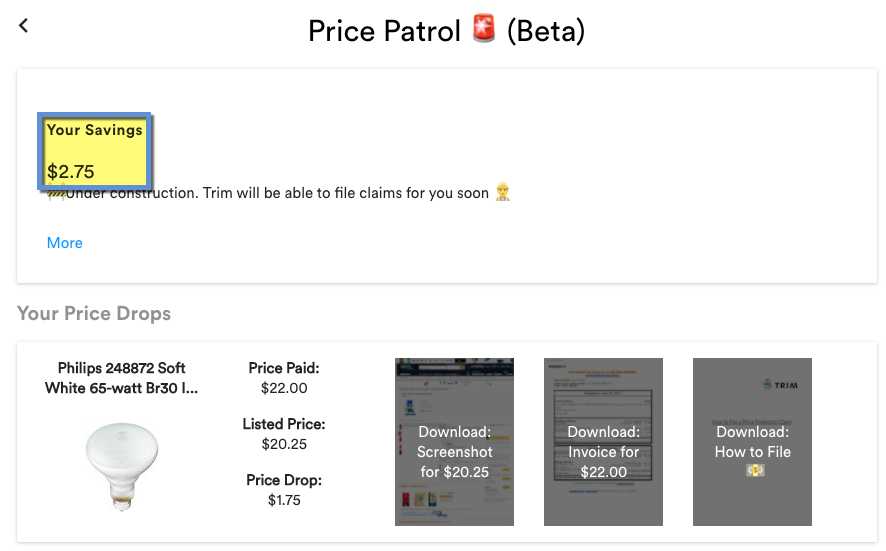

3. Track Amazon price drops

This is a “beta” feature. But if you have a credit card with price protection (most cards have this standard, but especially Amex and Citi cards), they’ll compile a screenshot of the price drop, your invoice, and a document on how to file. But you have to download them and submit the claim. Still, if you have a few of them, or if you see one for a lot of money, that’s extremely helpful.

Amazon has made it harder recently to request price adjustments, so they place the onus on the customer. And Trim makes that easier for you.

You get nothing back if you pay with an Amazon gift card and there’s a price drop. But lots of credit cards let you file for price protection – this could be a big win during a big holiday sale. Especially for larger purchases, like electronics or furniture.

Track price changes with Paribus

- Link: Paribus

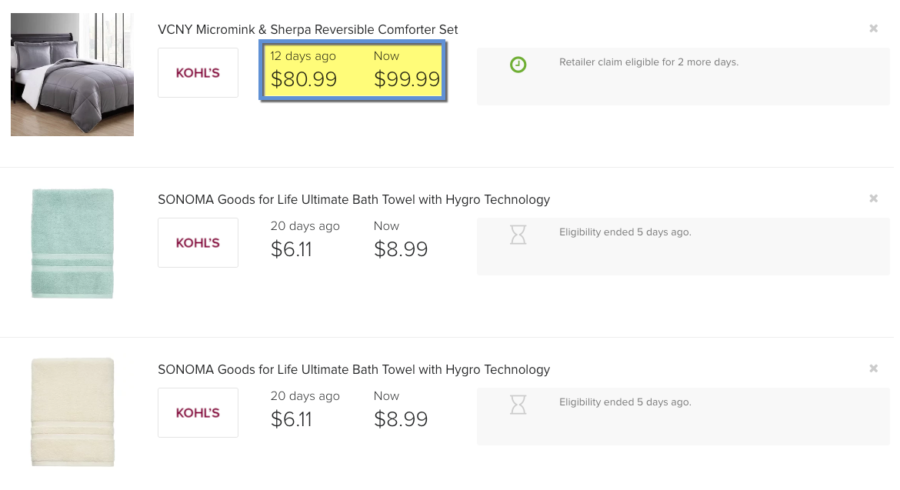

Paribus tracks a TON of merchants.

Here’s how to set it up. Paribus will contact the merchant on your behalf to request a price adjustment. Except for Amazon, as mentioned earlier (which is where Trim comes in).

Most merchants issue the price difference back to your original payment method.

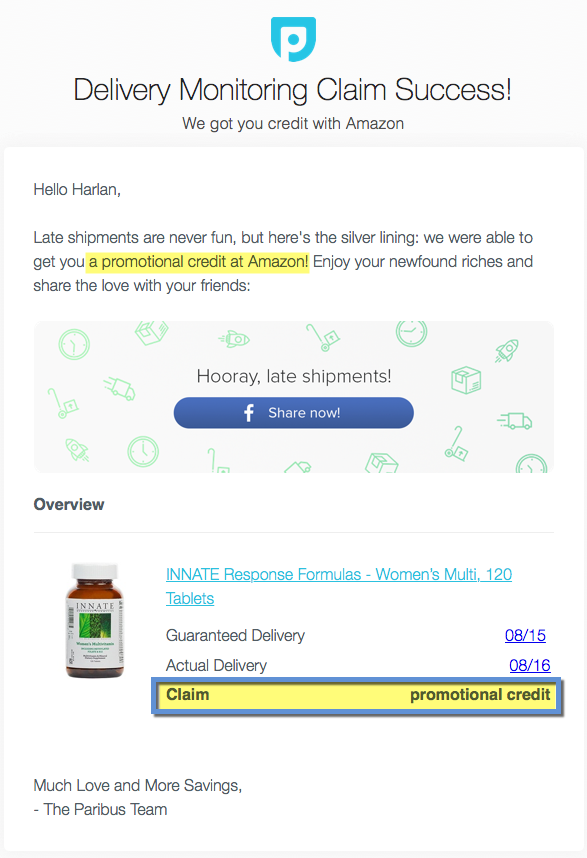

BUT. It’s still gold for Amazon.

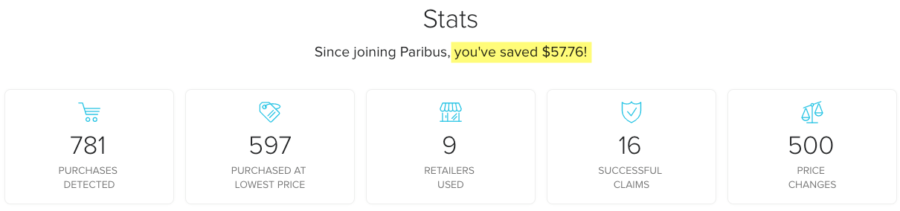

I’ve also gotten random credits to my cards when Paribus found lower prices. I’m pretty handy with finding the best deals and using promotion codes, but ~$58 in savings has returned to me thanks to Paribus.

And with holiday sales coming up, this is the ace in your hand for saving even more money when you shop.

Bottom line

Trim and Paribus are handy (free!) tools for saving money when you shop online. Between the two of them, they’ll track price changes at lots of popular merchants. And can save you time by filing price adjustment or late delivery claims on your behalf.

Trim takes things a step further by tracking monthly subscriptions and keeping an eye on your cable/internet bill. It can also send you account alerts via text or Facebook.

I have personally benefitted from both of these services. I don’t login a lot – rather, they’re “set it and forget it.” With the holidays coming up, save as much money and time as you can. Money is always good to save and time – wow – that’s a huge one when you’re running around every day.

If you’ve used either, do you recommend them? Are there other tools to track price changes I missed?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] the deals out there this year! Don’t forget to get Trim and Paribus to track price drops and missed deliveries, […]