A really cool promo with some very confusing wording is being offered to select US Bank Club Carlson Visa cardholders.

A really cool promo with some very confusing wording is being offered to select US Bank Club Carlson Visa cardholders.

It’s no secret that I love Club Carlson points. It’s probably my favorite hotel chain for collecting and redeeming points, alongside Hyatt. I use my Club Carlson Visa quite a bit – in fact, I’d argue that it’s one of the best cards for everyday, non-bonused spend as it earns 5 points per dollar on every purchase.

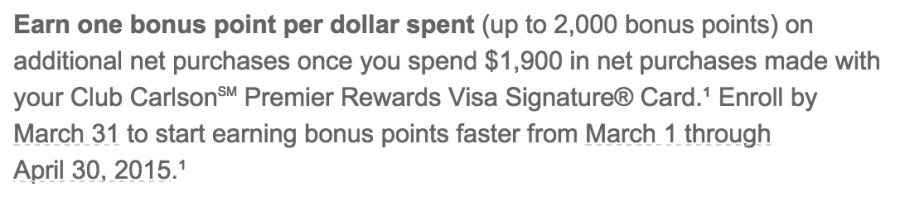

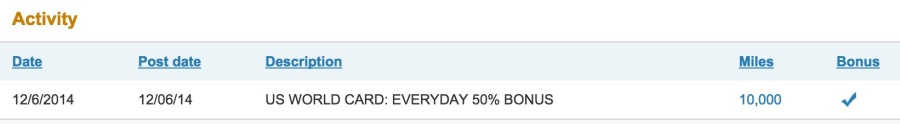

I use the card quite a bit already, so it’s not like I need to be incentivized to use it more, but all the same, I got targeted for a new promo where I can earn up to 2,000 bonus Gold points during March and April.

That’s nice and all, but you have to unravel some really squirrely language in the T&Cs:

OK, so here’s how I’m interpreting this (sorry, it’s been a really long day and my brain is mush):

You have to spend on the card $1,900 to “unlock” the bonus points. After that, the next $2,000 spent on the card will earn 6 points per dollar. And after that, you go back to the normal 5 points per dollar.

Is this right? Is it just me or is this some seriously roundabout wording?

Bottom line

I’m glad to see US Bank stepping up their offerings (and this is a great article about how to get a free checking account + $100 for putting $1,000 in a savings account with US Bank) and offering some bonus points, even to customers who regularly use the card.

Getting past the initial $1,900 shouldn’t be too hard, and then the other $2,000 will be pretty easy as well – but I won’t let this card touch my new, re-virginized Serve account. I’ve had luck buying PayPal cards with the Club Carlson Visa at CVS as well as using it for Evolve Money payments while they were accidentally free for a sec (and still are until tomorrow, presumably).

I’ve added a reminder in my Evernote account to switch out my cards on March 1st, as I’m focusing my spend on other cards right now.

Was anyone else targeted for this offer, or perhaps for another one? Would love to know if there are any variations on this promo.