Also see: Rom’s Deals take on a retention offer

Oh man, I have so much to tell you guys about. The trip to Paris, BA lie-flat biz class, and thoughts about Amex, interest charges, and assorted travel fun. But first things first.

The sitch

I think I mentioned that I bought a couple of Amex gift cards via the Barclaycard RewardsBoost portal before. Anyway, I did. I bought two for $1,000 each. The first time, I paid $8.95 in shipping and activation fees, while the second time, I didn’t (I signed up for a 90-day trial of the premium shipping plan). Before buying, I made sure to click through the RewardsBoost portal given by my Arrivalcard. Then I waited for 8 weeks.

Nothing.

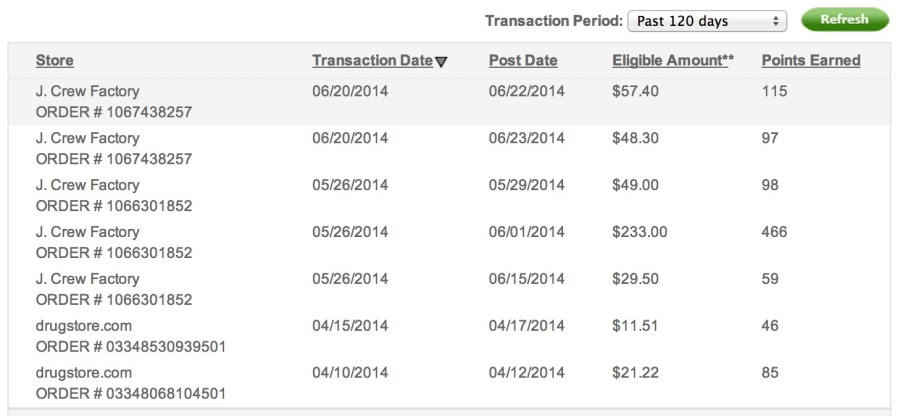

I bought other things through the portal too, from J. Crew and drugstore.com. Those all posted fine.

But I was still waiting on eight thousand points to post worth over $88 in travel redemptions (4x points x $2,000 of spend).

Then, somewhere along the line, I got hit with the $89 annual fee and was sent a new Arrival Plus World Elite MasterCard.

The “in”

After 8 weeks passed, I gave ol’ Barclays a WTF call. 8,000 points isn’t a ton of points, but it also ain’t nothin’. I gave them my Amex order numbers and the exact amounts of the purchases. They’ve promised to post the missing points in the next 7-10 days.

Then, right after, I mentioned how the annual fee had just hit and asked if there was any way I could continue evaluating the card fee-free due to the recent error and subsequent over-two-month wait in getting points posted.

At that point, I was transferred to a manager.

I explained that I’d been waiting for over 8 weeks on some points, had just received a new World Elite MasterCard, and was still a little on the fence about where to direct the bulk of my spend. I mentioned using the card recently on a trip to Paris, and how I would’ve normally given that spend to Chase instead.

The agent reviewed my account, reviewed my recent spend, and then really impressed me. She waived the $89 annual fee, said she’d personally follow up on the missing 8K points, and gave me an additional 5,000 points for the trouble. I had a moment where I was so impressed with the customer service that all I could say was “Wow.”

Why I think I was offered this

The “in” was the trouble with the portal points posting. BUT, I have been using the Arrivalcard for regular spend. Barclays is a bank that really values engagement with their products. I’ve had a card with them for over 7 years now (the ill-fated Icelandair MasterCard), and made sure to ramp up the spending on the Arrivalcard to demonstrate my willingness to have a banking relationship with them. Their motto is very literally “show me the money.”

Knowing this, I also think they would’ve said they couldn’t waive the fee had I not spent anything on the card in the previous six months. The points trouble was my “in” but the relationship was the kicker.

I really value that. I like knowing that they want my relationship and that they’ll take care of me for giving them my loyalty.

Bottom line

Barclays offered to fix their error, bounced me 5,000 points for the trouble, and waived the $89 annual fee on the new Arrivalcard World Elite MasterCard – just for making a phone call. They are a bank that looks for relationships with the customers, and in the end, I have to say I really respect them for the way they treated my (very minor) issue.

I’m super impressed by this level of customer service and will definitely be funneling some of my non-bonused spend through this card, especially in conjunction with their super lucrative RewardsBoost portal (and definitely when they offer 4x points on Amex gift cards).

Has anyone else gotten an offer like this? Or had any experiences with Barclays lately?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] how I sometimes score upgrades on an airline, get my flights changed for free with no notice, get retention offers on credit cards when others have reported not having success, or get awards changed to better routings without […]