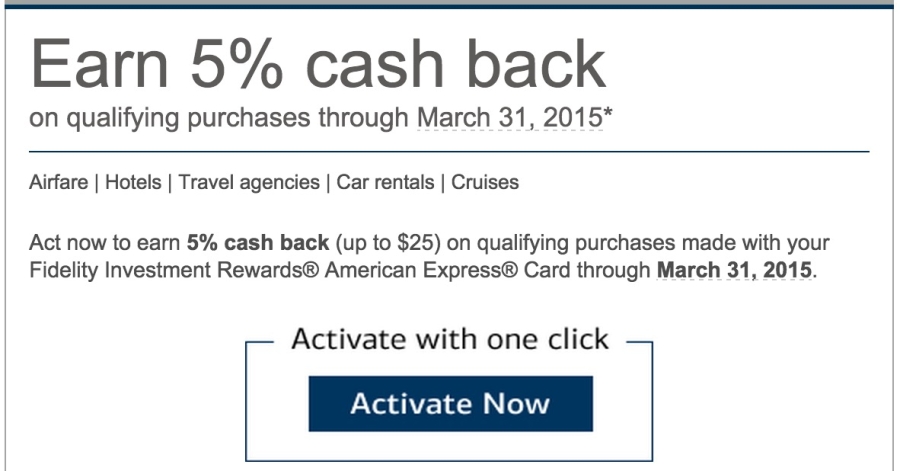

Who says the Fidelity American Express doesn’t ever have bonus offers?

Now, admittedly, this isn’t an earth-shattering bonus. It’s only offers a bonus for travel-related categories, and only up to $500 in spend until March 31st, 2015.

But, enrollment is easy (literally one click), and it seems like they’re targeting a lot of their cardholders for this.

A quick comparison

If I wanted to buy a $500 plane ticket (one of their categories) with this bonus, I’d get $25 cash back straight away.

If I put that same $500 on the Chase Sapphire Preferred Visa, I’d get 1,000 Ultimate Rewards points, which I value at $20. If I buy the plane ticket through the UR website, I’d get 1,500 Ultimate Rewards points, which I value at $30 – more than the $25 cash back I’d get from Fidelity.

However, as is always the case with this card in particular – do you want the plane ticket now or do you want to give the $25 over to the phenomenon of compound interest, which could turn into well over $25 when you ultimately withdraw it?

The compound interest earned in a brokerage account or IRA is the reason I call the Fidelity Amex the BEST card for earning back straight cash.

In any case, I’d probably go for the Ultimate Rewards points, or American miles, or some other points and miles currency, over this one – this time.

If this bonus was on, say, drugstore spend, or even any spend, I’d have already maxed it out before even writing this.

Bottom line

It’s nice to see FIA and the Fidelity Amex attempting to be competitive in an already saturated rewards-earning space. For me, it’s not enough, and the categories are ill-advised.

That being said, if you want to pocket the cash for whatever reason, go for it. It couldn’t be easier to sign up and earn the bonus.

Once this card gets officially switched over to Bank of America, I’m hoping bonuses like this will happen more regularly, so that’s the main reason this email was a pleasant surprise.

The other big reason to have this card if for their excellent WorldPoints shopping portal, which sometimes tops even Ultimate Rewards in terms of payout. That, non-bonus spend, and no annual fee make this one worthy of a slot in your wallet, even if you rarely use it.

Does anyone else have this card? If so, will you be taking advantage of this promo or wait it out to see what else they have planned?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Announcing Points Hub—points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Harlan,

I enjoy reading your posts. I think this a great and underrated card. Isn’t the Fidelity Amex dropping the bonus points portal this month ? I believe you mentioned that in a previous post. I’m hopeful they keep the bonus portal. Do you know of any other methods to earn additional points ?since they don’t have bonus categories.

Thanks.

Hey Nicholas! Thank you for reading!

The other ways to earn some extra bonus points are to load the Amex Serve card and to take full advantage of Amex Offers. It’s true, their portal is now gone. 🙁

Also just using the card for spend that wouldn’t earn bonus points with other cards is prime turf for this one.

Harlan,

Thank you for replying. I didn’t realize that this card is eligible for Amex offers since it’s through FIA card services. I’m looking forward to using this card as soon as it comes. I just wish there was an easier way to earn additional points other than the limited amex offers or serve. It still seems like a great card even for regular daily spending. Thanks again.

Of course!

They do have semi-regular promos, but I agree with you – I wish there were more opportunities to earn points. And yes, it is eligible for Amex offers and Small Biz Saturday.

I believe Bank of America is taking over this card pretty soon – perhaps they are in a transition phase right now. I hope to see more aggressive marketing and more points offers soon. Hold on to it as it’s no annual fee, and use it when you can. Definitely a card worth hanging on to.