Had to get this off my chest.

There’s always a lot of talk in the points and miles world about which cashback card is “the best.” The speculation is constant, rampant.

- Bank of America recently introduced a card where one could get 2.65 points per dollar so long as they dump $100,000 into an investment account.

- The Barclaycard Arrival always gets mentioned because it’s an effective 2.22% cashback on travel purchases.

- Citibank has a new one too: the Citi Double Cash card.

- Freedom gets a mention due to its rotating 5% categories, which yes, is a good deal, and yes you can cash it out (but keep them for Ultimate Rewards transfers!).

- Then there’s the Fidelity Investment Rewards Amex.

Why it’s the king

This card pioneered the cashback space. You get 2% cash back on every purchase, every time, period. No categories, no limits. 2% is obviously less than 2.65% or 2.22% (duh). But what everybody fails to mention, time and time again, is the fact that the money is automagically swept into a brokerage account.

This card pioneered the cashback space. You get 2% cash back on every purchase, every time, period. No categories, no limits. 2% is obviously less than 2.65% or 2.22% (duh). But what everybody fails to mention, time and time again, is the fact that the money is automagically swept into a brokerage account.

I always read the articles about this card to see if anyone will ever mention that. Why don’t they?

I have and use this card from time to time. Not always. Why?

I value travel experiences. I like to set a goal, save up points for the goal, and redeem. I have access to flights and hotels, thanks to points and miles, that I’d otherwise never be able to afford. But that’s when I’m focused on points. I have interim periods where I like to think about my future instead of the next trip (like now). And I’d rather have my free money working for me than coming back and getting spent.

I personally have my Fidelity Amex linked up to my Roth IRA. I selected a fund that has been holding steady at around 7-8% for a few years by now.

The benefits

The money I put into my Roth IRA from this card doesn’t actually come out of my pocket. It’s free money that comes from the card. I’m not taxed on it in any way. It’s literally free money.

I’m taking advantage of dollar cost averaging – again, for free. The market goes and up and down. There’s no good way to predict when is a good time to buy. Having automated investments over a long time period ensures you sometimes buy low and at other times buy high – but the average of those two extremes is the sweet spot. Whenever the money from the card gets swept into the account is always a random day and doesn’t take into account what the market is doing on a given day. I like that.

Because I put the money in a Roth IRA, I’ll never ever pay taxes on that money. With other cashback cards, I have to pay sales tax when I buy something. Or, at the very least, when it goes out, it’s gone. In my IRA, it’s there working for me all the time. The interest is compounding, and growing.

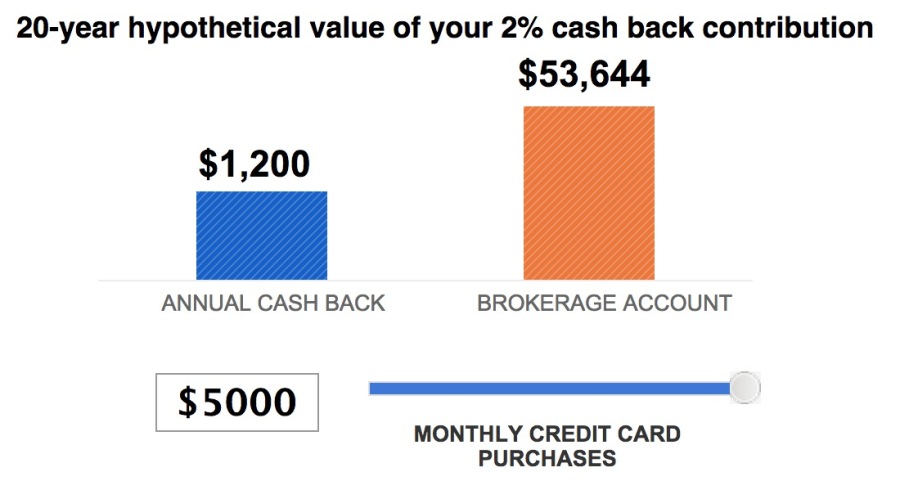

2% cashback today can be much more in 20 years. Much, much more.

Say I spend $5,000 per month on the card, my IRA earns me 7%, and I keep up this pattern for 20 years.

In 20 years, I’d have myself a cool ~$54K. And that’s in addition to what I add from my other post-tax money.

In 20 years, I’d have myself a cool ~$54K. And that’s in addition to what I add from my other post-tax money.

Sure, some Avios can get me $20,000 trips to Paris for free, but 70-year-old me is going to really enjoy the extra money that will come tax-free just as much.

That’s why I mix in some spend on this card, just to give my (future) self a little boost here and there. I don’t be 70 for another 40 years, and assuming a constant 7% return in addition to what else I’m investing… that could be a nice amount of cash. MUCH more than the “2%” that went in for free just from running money through a credit card.

Weighing it all

Do I have and use the Barclaycard Arrival? Yes.

Do I have and use other points-earning card. Yes, all the time.

And do I use the Fidelity Amex, too? Yes.

I like having all kinds of currency. Points, miles, and even actual money. I mix it up depending on what I want at the time and what my life is like when I’m transferring money around.

If I want to think about a trip to Europe, maybe I’ll focus spend on my Club Carlson Visa. If I want Avios, the Chase Sapphire Preferred or British Airways Visa. If I want to offset a bunch of booking fees, the Barclaycard Arrival. And when everything is doing its thing, then the Fidelity Amex.

But I don’t overthink it. I set a goal and reassess once the goal is reached. No more or less.

The bonus in all this

The other thing that no one mentions is that the Fidelity Amex gives you access to the Worldpoints shopping portal, and that it actually has really good payouts.

If you spend $1,000 on the Fidelity Amex and click through the portal to a store that is offering 5 points per dollar, you’re getting back 7 points per dollar, or $70. Tax free (or deferred), free money that goes directly into an account that utilizes dollar cost averaging and compound interest. This is why the Fidelity Amex is THE BEST cashback credit card.

Bottom line

All the cashback cards have their place, but it must be said, once and for all, which one is truly the best. In terms of actual cash earned, it’s this one.

With no annual fee, no cap on rewards, and a really no BS flat earning rate, this one is a card that you can get and keep forever.

Anyone have any thoughts on the matter? I’m open to revising my opinion if someone knows something I don’t. Would love to have a dialogue about this topic, as it’s really not discussed a lot.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

On paper, this appears to be an excellent card. My experience actually using the card has been horrible.

I have been a loyal American Express and Fidelity customer for years. The Fidelity Investment Rewards credit card is a disgrace to those two great brands.

We constantly (several times a week) have our card declined at local establishments such as grocery stores that we shop at all the time. Calls with customer service have been fruitless. Long hold times and clueless reps and supervisors who don’t or can’t resolve the issue. We’ve replaced our card numbers 3 times at a very big inconvenience. It’s really not worth it to do business with them.

Just know that you are not getting Amex or Fidelity systems/service. You’re getting lowest common denominator Bank of America reps and websites and in the long run you will be frustrated.

We’re done with them.

Oh wow. My experience has been on the complete opposite side of the spectrum. I use the card for manufactured spend, small purchases, online shopping, etc. and have never had any issue.

I also have used the WorldPoints shopping portal many times and everything has posted just as it should. And the transfer from the FIA card to Fidelity IRA is super fast and easy.

Sorry to hear you have had such a bad experience with them – but thank you for alerting us to be on the lookout for these things, and for reading.

Was going to apply for this card and start loading it to serve. But then i came upon this. http://www.bloomberg.com/news/articles/2015-08-26/fidelity-said-to-consider-dropping-amex-bofa-as-card-partners I might not be able to load to serve later if they change from Amex to something else.

I saw that! It won’t happen any time soon, at least a year if not longer, so I’m gonna get as much out of it while I still can!