Very cool news from Fidelity. There are 4 new total market funds with ZERO management expenses and NO minimums to start investing.

Plus, they’ve slashed fees and minimums on several other funds.

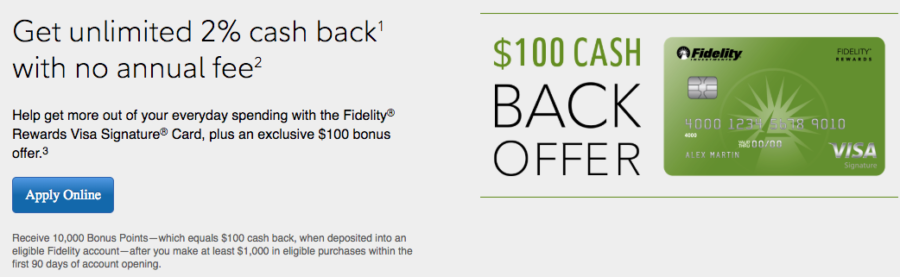

I wrote about the best IRA accounts and which banks let you start investing right away with a single $1. What’s cool with Fidelity is you can pair your IRA with the Fidelity Visa, which earns 2% cashback on every purchase. Then sweep the cashback rewards into one of these free index funds. The card is free to have – so it’s literally free money to invest into free funds.

Everyone should have an IRA account. Here’s more info on Fidelity’s new mutual funds.

Fidelity Zero index funds

Fidelity has 4 brand new index mutual funds:

- Fidelity ZERO Total Market Index Fund (FZROX)

- Fidelity ZERO International Index Fund (FZILX)

- Fidelity ZERO Large Cap Index Fund (FNILX)

- Fidelity ZERO Extended Market Index Fund (FZIPX))

They’ve also cut expense ratios on hundreds of other funds and removed transaction fees on others. Very, very cool.

If you earn free cashback rewards with the Fidelity Visa, and use them to purchase these free funds, you can invest in an IRA for free. With the traditional IRA, you get a tax break for contributing. Or with the Roth version, never pay any fees or taxes if you wait to withdraw.

First thing I noticed was both of these funds are for stocks. A total market index fund is a great core investment – it’s most of my portfolio. It would be awesome if there could be a free bond fund. Although, I don’t think that could really ever happen.

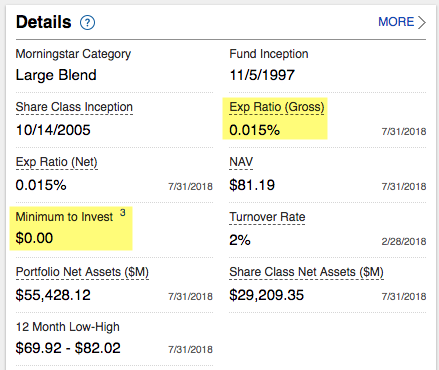

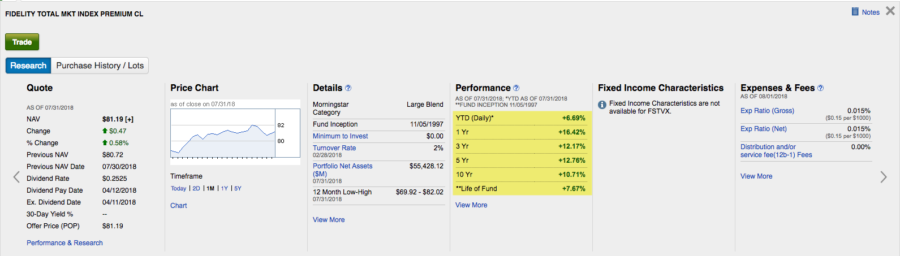

I’m currently heavily invested with the Fidelity Total Market Index Fund (FSTVX). Yesterday, the fee was 0.035%. Today it’s 0.015% – and the minimum to invest is completely gone.

The expense ratio is so close to zero now that I won’t sell off and buy into the new Total Market fund. But going forward, I will invest into the new Zero fund – and keep my Long-Term Treasury Bond index (FLBIX), now with .03% expense ratio and no minimums (very cheap for a bond fund).

Overall, I think the stock symbol says it all: Fidelity Zero ROX (FZROX)! 🤑

A few thoughts

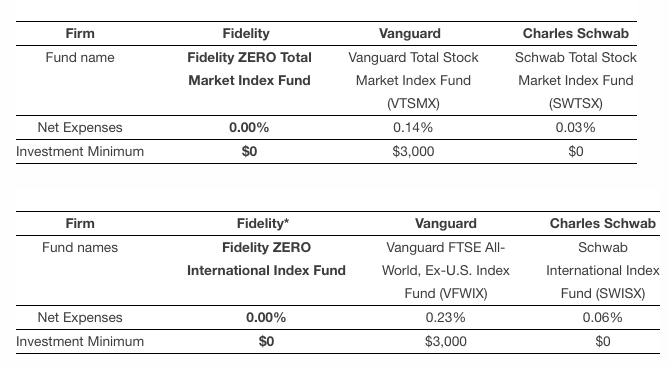

There’s a lot to unpack here. Fidelity pulled a huge punch. And no doubt, other firms will react.

Already, there’s a ton of discussion about the new funds on Reddit and the Bogleheads forum. I really like this comment from Reddit user ChekovsWorm:

Really interesting how this commissions and fees war is playing out between Vanguard, Fidelity, and Schwab. They’re not fighting on quite the same fronts.

Vanguard’s making all non-leveraged ETFs trade free but not lowering its cheap but not-cheapest expense ratios.

Schwab is pushing both its very big no-comm ETF marketplace and its lowest ETF index expense ratios, and its $1 minimums on index mutuals, $100 on other mutuals. And just a week or two ago started disclosing, and promoting, its price improvement on trades (something Fidelity has promoted and disclosed for years.)

Fidelity is hitting back at a slightly different angle that has aspects of what Schwab did last year, but outdoing them on it, while further undercutting Vanguard on index mutual fund expenses and minimums, but avoiding going head-to-head on ETF commissions.

Plus, Fidelity is creating a brand new index. What’s in that index, and the company percentages, will all be factors – so will securities lending. But the fact remains this will be a Total Market index that will let anyone with a single dollar touch a huge array of the most popular stocks.

Whatever ends up being indexed, I’m sure it’ll be way better than what Acorns and Stash offer – without any monthly fees.

Admittedly, Fidelity doesn’t have a cool, colorful app and its dated website isn’t sleek – you just kinda get used to it.

But with these new prices and minimums – literally nothing – this is a great chance to grow your money for free.

My current return on the Total Market fund is 11.25%. Of course, it’s dipped and peaked a lot lately. But overall, a return of over 10% is amazing. I’m curious to see how the new Zero funds will perform.

I love the Fidelity ecosystem

At this point, I have:

- My IRAs (and rollovers) with Fidelity

- Their fantastic Cash Management checking account

- The 2% cashback Fidelity Visa

Basically, they’re my bank. Which is kinda weird and cool.

I realize there are better cashback cards out there (the USAA Limitless card comes to mind, if you got it while it was around). But Fidelity does a good job of rewarding ongoing spending. I constantly get offers for bonus points – including one from this morning:

I can get 3% cashback after spending $150 (up to $20 in bonus points). Now that Costco only accepts Visa, I’ll def make a Costco run this month and score more for my IRA – and I’ll buy the new Zero Total Market index fund with it.

They make it worth my while to stick around. I’m a happy Fidelity customer – although I admit Vanguard and other banks have great advantages. I’m glad they all keep innovating. Why?

Well, as I always say: when banks compete, you win. 💰

Bottom line

- Link: Fidelity Zero index funds

- Link: Fidelity Visa

Well dang, now I have to say Fidelity might be the best place to start an IRA account. I’ve used them for years and have maxed mine many times. Most of that is in their Total Market index fund.

But now, I’ll have to give their new Fidelity ZERO Total Market Index Fund (FZROX) a try. This fund, and its international counterpart, have no expense fees or minimums to start investing. That’s a nice industry shakeup that will no doubt cause other firms to react.

Between this, the Cash Management checking account, and Fidelity Visa 2% cashback card, did Fidelity just become the best investment bank?

There’s already a lot of discussion going on about this, but the upshot is: anything that gets people saving and investing is good news. Fidelity is making it easier. And ultimately, that makes everyone a winner.

Will these new funds and changes make you give Fidelity another look?

Also see:

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I received a similar offer today, but your interpretation is not what is being given. AFTER spending $150, you will begin earning one extra point per dollar (3 per dollar instead of 2), a return of 3% for the next $2,000 in purchases, not 15%.

You are so right. I got too excited, ha! 😉 Updated – thanks for commenting!

My offer Wasn’t so good, spend $1600 to earn an extra point, up to 2000 points or $20.

Sometimes mine are lame, too. About 50/50 luck here.

Actually, this makes Merrill/BoA even better if you have Platinum or Platinum Honors. The No AF Travel Rewards card gets 1.5 pts/$ * 50-75% bonus, which is 2.25 – 2.625% everywhere. There’s the option for the Premium Rewards has a $95 fee, but you get a $100 airline credit and 2 pts/$ on travel/dining, which means 3-3.5% for Platinum/Platinum Honors. Both tiers get free trades. I mention this because you can buy the fidelity funds with your Merrill Edge account. I think Harlan is advocating the Fidelity environment (and for good reason). However, based on Merrill/BoA’s structure, this just makes it stronger. Of course, the giant caveat is that you need 50k+ to obtain Platinum status, and 100k for Platinum Honors. You can use your IRA or taxable account to achieve that balance though.

That’s an excellent point, Jeremy. And I almost have enough to qualify for the Platinum Honors tier – might seriously look into it.

Even with the bonus categories, I don’t know if I could give up 3X Chase Ultimate Rewards points with my Sapphire Reserve card for travel and dining. I value those at 2 cents each, so that’s like a 6% return toward travel (for me). But the 2.6% cashback sure beats a flat 2%. I’d say it’s not worth it to get 2.25% unless you spend a LOT on the card. But 2.6% is more tempting. And like you said, the biggest hurdle to clear is having $100K with Merrill. Def worth a think. Until I hit that mark, I’m good with the Fidelity interface. Thank you so much for adding this angle – it’s definitely worth it for some. Appreciate your insight.

Interesting. I have been a Fidelity Rewards card holder for years and have never received a promo offer. I just confirmed that I am signed up to receive promo offers via email. This is the CC that I use for nearly everything, including all my monthly bills that can be paid via CC. Now I wonder how many promo $ I have missed out on.

It might be worth it to call them and ask if they have any promotions for you! I’ve earned several hundred extra dollars over the years with these promotions – but admittedly, they’re all I use the card for!

Thanks for the article! I have many similarities to your situation including the Fidelity rewards card and currently investing in the Fidelity Total Market Fund FSTVX. I noticed you mentioned that you won’t bother to move your current investment over to the new “free” fund. I’m just curious why- there is no fee to make that change within your IRA, right?

Yes, you’re right. My only resistance is about going all-in to a brand-new fund without any history. I have no issue with putting new funds into it and seeing how it goes for a year or so – if it’s similar to FSTVX, I would def consider switching over to it as my go-to. I just wanna watch if for a while and see what it does, what the securities are, and all that good stuff.

And yup, sounds like our strategies are pretty dang similar! 🙂

What international fund are you in? I’ve been DCA-ing into FSIVX for years, but am considering DCA-ing into the new 0%er intl fund FZILX starting in August 2018 now. Not sure. The bogleheads skeptical thread said the two 0%er funds are too new, don’t know how tax-efficient they’ll be (turnover rate%), etc. I’m uncertain about buying into a fund that’s less than a year old.

I’m with you on the uncertainty. But I’d def be down to put some cash in the funds and see how they do for a year. I actually don’t have any international stocks – just Total Market (U.S.) funds. I’ve heard that with a long term (20+ year) horizon, international funds could actually top U.S.-based funds – I just never put anything into them. This might actually be a great opportunity to dip a toe in. Food for thought to be sure!

Hello, Harlan. I recently opened a Fidelity account. I’ll be putting money aside for my retirement. Thank you for your analysis of the zero-expense index funds.

I have one more question for you. Is it, however, really worth it? I’m seeing similar funds with very low expenses that cover the same stock basket. I was reading this thread https://usefidelity.com/t/fidelity-zero-fee-funds-here-are-the-pros-and-cons/145, and some people pointed out that it’s just a marketing ploy by Fidelity to gain more customers.

Would you put your retirement savings in a no-fee fund, in your opinion? TIA!

Hello, Harlan. I recently opened a Fidelity account. I’ll be putting money aside for my retirement. Thank you for your analysis of the zero-expense index funds.

I have one more question for you. Is it, however, really worth it? I’m seeing similar funds with very low expenses that cover the same stock basket. I was reading this thread https://moneygif.com/, and some people pointed out that it’s just a marketing ploy by Fidelity to gain more customers.

Would you put your retirement savings in a no-fee fund, in your opinion? TIA!

Reply