Lately, I’m concerned with helping my 24-year-old brother develop healthy financial habits. I didn’t take control of my financial life until I was nearly 30. And god I wish I could get back those early years. Why?

Compound interest is the most powerful force in the universe.

The earlier you start, the longer your money grows. It’s a simple concept. But so many peeps put off investing.

It’s perceived as complicated, overwhelming, and something to fear. The financial industry made sure you feel that way so you’ll overpay some bozo to manage your finances. Don’t get tricked. Get smart – and fast. Your financial future is an out-of-control emergency you can’t afford to sleep on.

It doesn’t matter where you start. Just as long as you do start.

Acorns is a micro-investing app that will fit the bill nicely. Here’s my review.

Why Acorns?

- Link: Sign-up for Acorns

To start investing with Acorns, you need at least $5 in your account. And when you sign-up with my link, you’ll get $5 to start investing!

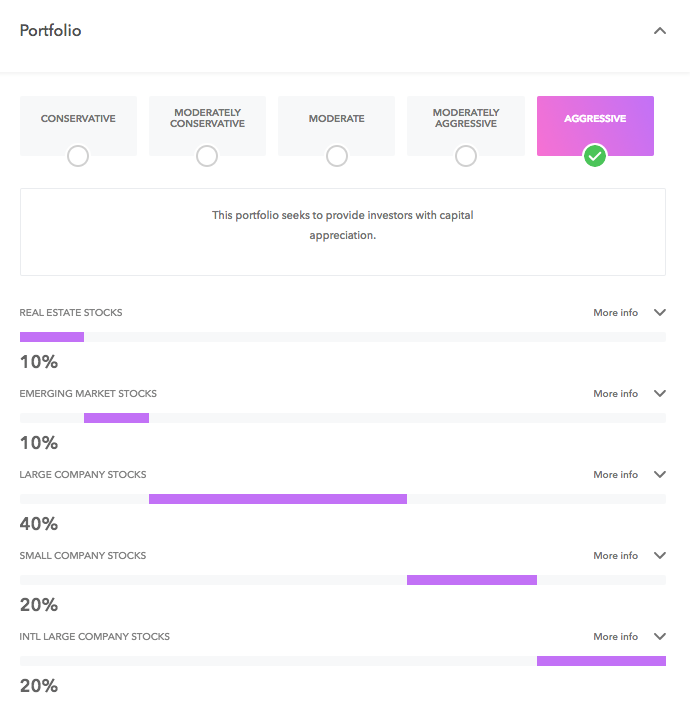

After you sign-up, you’ll get a recommendation based on your goals. These are directly tied to your risk tolerance – and you can change them any time.

In general, your risk tolerance should be higher the longer you plan to invest. So if your timeline is 10+ years – which it is you’re young and saving for retirement – you should go for the “Aggressive” option.

This mix is your portfolio. For example, the Aggressive mix (for the most growth) has:

- Vanguard REIT ETF (VNQ)

- Vanguard FTSE Emerging Markets (VWO)

- Vanguard S&P 500 ETF (VOO)

- Vanguard Small-Cap ETF (VB)

- Vanguard VEA ETF (VEA)

Vanguard index funds are widely regarded to be the best in the industry (though I prefer Fidelity). But that’s for another time. For now, you’re beginning. That’s the most important thing.

And that’s also the answer to “Why Acorns?”.

REALLY cool extras

As I dug deeper, I found a lot that made me really like Acorns. For one, they have a fantastic app. It looks great, it works, and it’s easy to use.

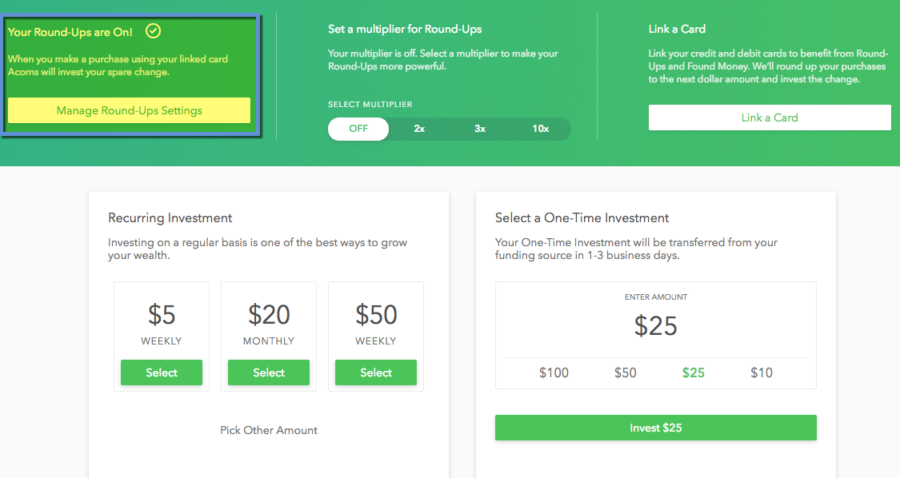

You can set one-time or recurring investments. I think most peeps can handle $5 a week. And I love the “Round-Ups” feature.

That means when you link a card and a bank account, Acorns will round up every transaction to the next whole dollar – and transfer the difference into your investments.

So if your coffee is $2.15, Acorns will put $0.85 into your investment account. That doesn’t sound like much, but that’s the point. It all adds up, it’s easy, and you’re adding small amounts over time instead of huge lump sums. This is a lot more approachable and less daunting.

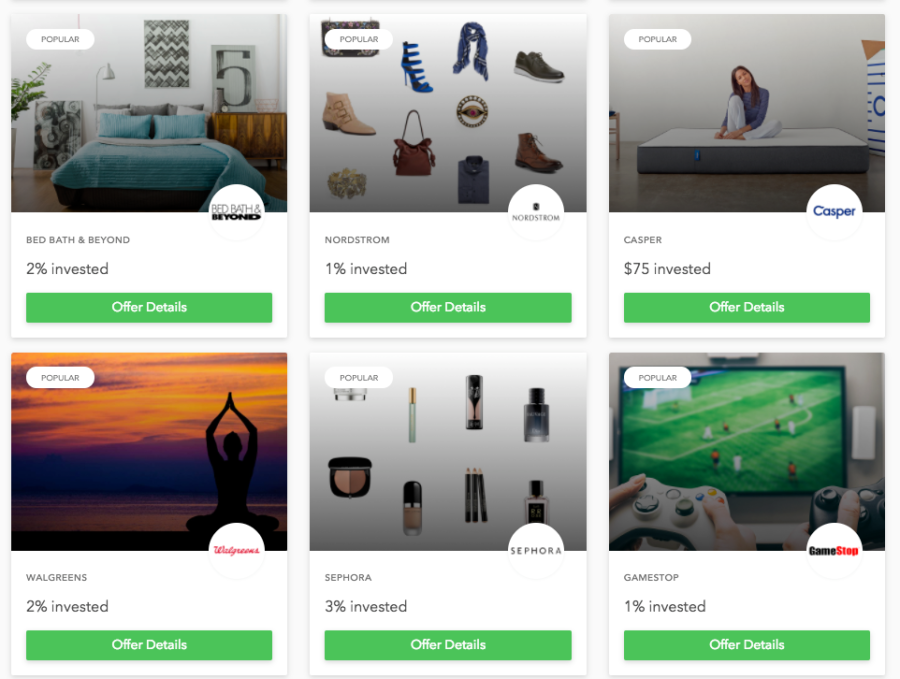

They also have what they call “Found Money.” It’s basically a shopping portal – but the cash back you earned is invested for you.

Now, I recommend checking Cashback Monitor to make sure you’re getting the best deal. But it’s hard to argue with the fact that you’ll earn compound interest for years on the money you earn. So I do like this option. In many cases, the payouts are quite good. But still, check other portals to be sure you’re getting a great deal, OK? 😉

What I really like about the app

“Knowledge is power.” Within the Acorns app, you’ll find a section called “Grow” that’s filled with simple, down-to-earth commentary on financial literacy. It’s intended to demystify investing for the masses and educate on its importance. And heck, that’s plenty good for me.

Investing should be empowering, not fear-inducing. A feeling of taking control instead of powerlessness. With clarity of purpose, not confusion. You are setting aside funds for future you! It’s SO important. Anything that illuminates that point is a winner in my book blog. 🙂

We NEED to talk about fees

- Link: Acorns FAQs

So here’s the thing. You have to pay to use Acorns.

The financial industry is full of fees, which is a huge reason peeps are so leery and weary of investing. And Acorns’ are inflated. But if you’re starting, they are worth it.

You’ll pay:

- $1 per month if your balance is under $5,000

- 0.25% per year if your balance is $5,000+

- Nothing for 4 years with a .edu email from date of registration

You’re likely just starting, so your fee will be a buck a month. If you invest $100 in a year, that’s $12 you’ll pay in fees, or 12%. In the financial world, that type of fee is criminal.

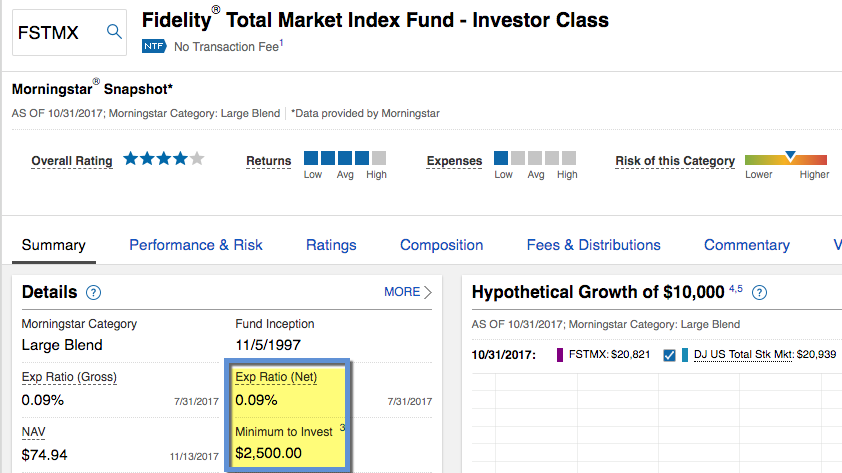

I pay 0.09% to invest in Fidelity’s Total Market Index Fund – that’s less than a tenth of a percent! But here’s the hitch: you have to start with $2,500. So there’s a huge barrier to entry. But don’t worry, you will get there.

You can always start with Acorns now and move your money later when you know more about investing. For what it is, $1 a month is pretty palatable, if only to access the excellent articles about financial education. And you’ll get $5 AKA 5 months free when you sign-up with this link.

So if you hate it 5 months from now, you can close your account with nothing lost. But friends of mine have and use the Acorns app constantly. And love seeing their balances grow over time.

Again, the most important thing is to begin. A $1 per month is a much lower barrier to entry than needing $2,500 to even start growing your money.

If you have more questions, they also have an excellent FAQ section.

Bottom line

- Link: Sign-up for Acorns

I told my brother and his girlfriend to sign-up for Acorns stat. And begin using the tools available in the app. It’s free to register, so you can poke around and see how you like it. And, if you’re comfortable, even start investing!

I’m not crazy about the fees. But I’m grateful they’re putting financial tools into the hands of people who need them and want to use them. And for that reason alone, Acorns is a great non-stressful stepping stone into the investing world.

Plus, the “Round-Ups,” “Found Money,” and “Grow” features are easily worth $1 a month. If you’ve wanted to invest but didn’t know where to begin, start here. Learn as you go. But by all means, get started right now!

If you have Acorns, what do you think of it? Has it shown you investing is actually pretty cool?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I HAD an Acorn account for about 6 months and while the concept was good and I ended up saving about $500, what caused me to cancel was a problem with the “found money” program.

I purchased an item through their “found money” portal. The deal was if you made a purchase then Acorn would add an additional $20 or so to your account because of the purchase you made. (Kind of like a shopping portal where you earn points)

The problem was that the portal merchant decided they didn’t want to continue the promo with Acorn and I ended up not getting my $20. Acorn wouldn’t honor the agreement as they said it was merchant’s responsibility to pay. I felt it was their promo so they should pay. They said no so I said see ya.

Aw, sorry to hear that! But now I’m curious – did you find another app that does something similar? If so, what did you move on to?

The RobinHood App charges no fees AFAIK. They recently made trading available through their web site as well.

I heard of that app. I will have to look into it. From what I understand, it’s more for trading stocks instead of buying and holding index funds, though – any opinion on the availability of funds offered? Thanks for the suggestion!

I’m not a subscriber but hear it is a good place for beginners. (I prefer Vanguard, and started with Motif recently as an experiment). No mutual funds but they do have ETFs:

https://support.robinhood.com/hc/en-us/articles/208650286-Available-Securities-on-Robinhood

Very cool. There are SO many options. Thanks again for adding this valuable information!

Hi. Two things. Firstly I’m curious why you prefer fidelity etf with 0.09% expense ratio versus VTI with 0.04% or SCHB with 0.03% and secondly Robinhood is basically a brokerage account so you can buy anything but not in fractional shares like how Acorns does I would guess.

My Fidelity fund’s expense ratio is .0035%:

https://fundresearch.fidelity.com/mutual-funds/summary/315911800

Cheaper than Vanguard, mostly in line with Schwab. I have the Fidelity Visa which kicks in a little money for free here and there. 🙂

And Robinhood doesn’t have IRAs – it’s just an investment account (which is fine if that’s all you want!):

https://support.robinhood.com/hc/en-us/articles/210216813-Account-Types

Would love to hear any more insights you have. Thank you for reading and commenting!