Update: This offer is no longer available. Check here for the best current credit card offers!

Today is the last day to get the newly-launched Capital One Venture X card’s incredible early spend bonus! After many rejections from Capital One, I finally got approved for this one – here’s my tip on how to check your approval odds.

For most people wanting a premium travel rewards card, it doesn’t get much better than this one.

The welcome offer is incredibly strong, the rewards earning rates are excellent, and the card’s ongoing benefits justify the $395 annual fee year after year.

Capital One is building their own network of airport lounges and doing great things with their transfer partners. And their version of the Priority Pass includes restaurants in airports (something the Amex version of Priority Pass does NOT).

The Capital One Venture X 100K offer is one of the best in recent memory

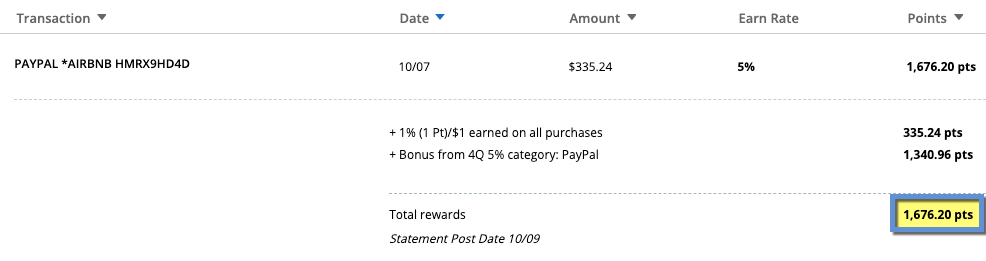

I love earning a flat 2x miles on all purchases without having to think about category bonuses. But the Capital One Venture X does earn 10x miles on hotels and rental cars and 5x miles on flights booked through Capital One.

If you’ve had your eye on this one, this is the last call. We don’t know what the new offer will be, but it’ll likely be inferior.