Update: This offer is NO longer available. To see the latest credit card deals, click here.

I’m down to the wire with card offers I qualify to get. Especially with Chase. But their Avios-earning cards are in the few NOT subject to the 5/24 rule.

If you live in an American or Alaska hub (because you can use British Airways Avios points on both airlines) – you should have one of these cards. That includes peeps in Dallas, New York, Los Angeles, Chicago, Seattle, Portland… pretty much any place with lots of American or Alaska flights. Because on expensive routes, these points are the easiest way to save money.

Most everyone can apply. I got a Chase British Airways card in late 2017 – and definitely LOL/24.

More often in recent time, I’ve been redeeming Avios points. And when you sign up for a 100,000-point offer, you’re basically earning 6X points on the first $20,000 you spend within a year.

About the Chase British Airways 100,000 point deal

- Link: Chase British Airways card – Compare it here

You can earn:

- 50,000 British Airways Avios points after you spend $3,000 on purchases within the first 3 months from account opening

- An additional 25,000 British Airways Avios points after you spend $10,000 total on purchases within your first year from account opening

- A further 25,000 British Airways Avios points after you spend $20,000 total on purchases within your first year from account opening for a total of 100,000 bonus Avios

So you have to spend $20,000 within a year to unlock the full bonus of 100,000 British Airways Avios points. That’s ~$1,667 per month. If you’re not working on other minimum spending requirements, that’s not much non-bonus spending.

I’m $18,000 deep right now toward that requirement. And expect to get the final portion of the bonus next month.

Getting 6X points on all that spending is too good to pass up. Especially if you’re no longer spoiled for choice with other issuers.

In fact, I’ve been redeeming Avios on the regs lately. I’m in Dallas, so I have lots of American flights to choose from. But you can also use Avios points for Alaska flights (you have to call in to book, though). That combined network is huge.

Where can you fly?

- Link: Avios calculator

- Link: British Airways airline partners

British Airways partners with every airline in the Oneworld alliance, including:

- American

- Cathay Pacific

- Finnair

- JAL

- LAN/TAM

- Qantas

- Qatar

They also partner with Alaska.

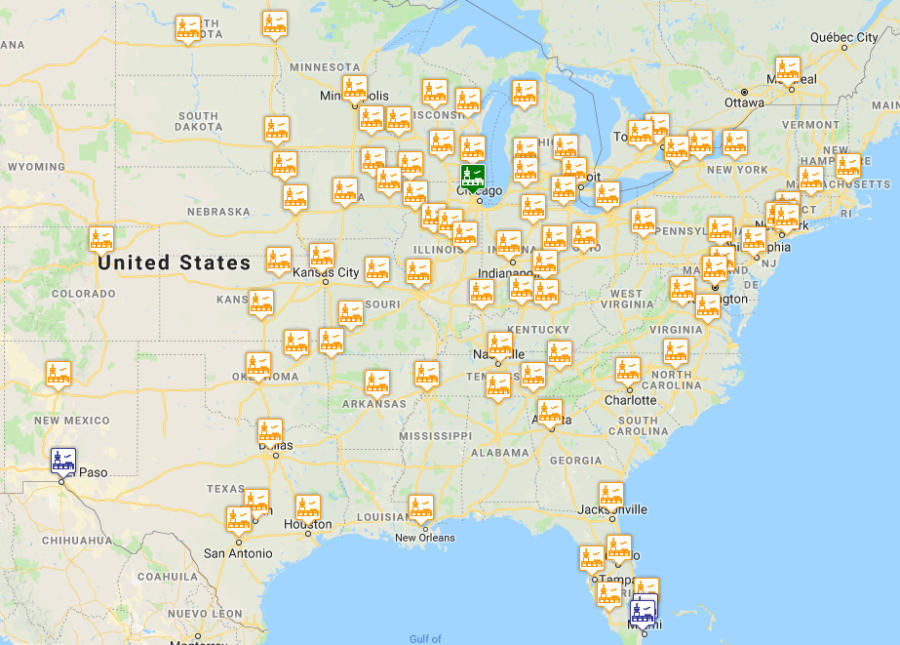

From Chicago, you can fly to nearly all of the East coast and much of the Southern and Central US for 7,500 points each way (yellow pins)

It’s easy to check where you can fly. Just enter your airport into this calculator to check.

You can use Avios points to fly:

- Under 1,151 miles each way within or to/from the US – 7,500 points each way in coach

- Under 651 miles each way outside the US – 4,500 points each way in coach

I booked Dallas to Orlando for FinCon 2018 this September. Seats were open on nearly every flight the days I wanted to fly out and back. So I snagged them to treat myself to the conference for only $5.60 each way, plus 7,500 Avios points. I continually find new ways to use them. It’s definitely one of my favorite points programs – it really shines for flights outside the US.

The opportunity to earn 6X points is worth it for most people.

2 more cards with Chase Avios 100K Offer

- Link: Chase Aer Lingus – Compare it here

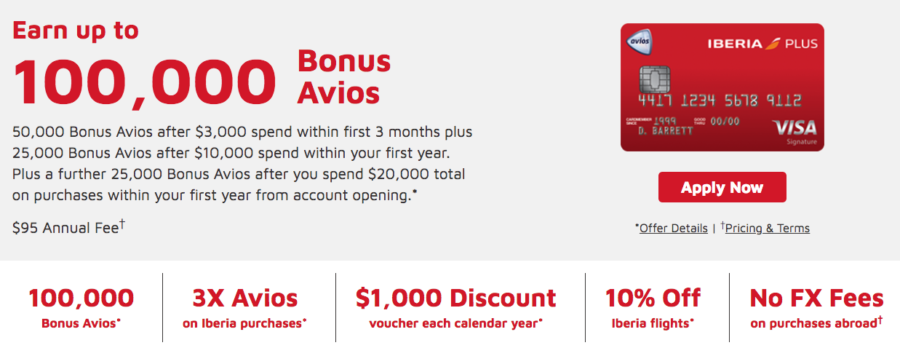

- Link: Chase Iberia – Compare it here

Chase has 3 credit cards that earn Avios points. In addition to the British Airways card, they also have Aer Lingus and Iberia cards. And you can easily transfer the points from one flavor of Avios to another. So you can transfer British Airways Avios to Aer Lingus or Iberia Avios (and vice versa).

When it comes to Avios, you can transfer between the 3 airlines in the program (British Airways, Aer Lingus, and Iberia)

These cards are also NOT under the 5/24 rule. And they have the exact same tiered minimum spending requirements to earn 100,000 Avios each.

So depending how many other accounts you have with Chase, you could keep the 6X points flowing for a very long time – depending on your spending habits.

Is it worth it with Plastiq?

- Link: Plastiq

You can pay most bills with these Visa cards via Plastiq, including:

- Rent

- Car notes

- Student loans

- Utilities

- Contractors

I’ve been using my Chase British Airways card to pay my Airbnb rents, HOA dues, car note, and electricity bills for the last 6 months or so with zero issues. Plastiq has a 2.5% fee to pay bills with a credit card.

For $20,000 in spending, you’d pay $500 in fees ($20,000 X 2.5%).

But, you’d earn 120,000 Avios points (100,000 sign-up bonus + 1 point per $1). Is it worth it to spend $500 for 120,000 Avios points?

I value that many points for $2,400 @ 2 cents each (120,000 X .02), so yes – definitely! Although you can often do much better than that with Avios points, depending on the route. If you need an easy way to get through all the spending, it could totally be worth it to use Plastiq to pay bills. Especially if you’re in the home stretch to finish it.

Bottom line

- British Airways card – Compare it here

- Aer Lingus card – Compare it here

- Iberia card – Compare it here

I love Avios points. You should get one of these cards if you:

- Live near American or Alaska hubs

- Are over 5/24

- Have specific uses in mind

- Want to pay bills via Plastiq and earn lots of points

- Are not meeting any other spending requirements right now

The required $20,000 in spending to unlock the full sign-up bonuses should keep you busy for a while. And earning 6X Avios points per $1 spent is a crazy good deal. I’m wrapping up the spending on the British Airways version right now. But considering you can transfer Avios between all 3 airlines with a few clicks, I will try to open another Avios card when I’m done (assuming these offers stick around for a bit and Chase will give me another card).

None of these cards are under 5/24. So if you’ve opened other cards recently, there’s not much to worry about aside from how many cards Chase will issue you. Of course, if you open one, it will count against your future 5/24 count.

These are offers for the rest of us – nearly everyone can apply, they’re great bonuses, and the points can be incredibly valuable. I’ll apply for another next month.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m too afraid to apply for any new Chase cards or even PC due to shutdown fears. So many reports lately.

Truth. I’m not worried as my apps have slowed down. Chances are if you know about the Chase shutdowns, you’ve been opening a lot of cards anyway and will want to avoid that possibility. I think I’m gonna try next month to get another Avios card. Not really worried about getting shut down – it’s been a while since I’ve opened a new card and I’d love to keep the points train flowing.

Of course, while it may be 6x points overall, the decisions you make are incremental. Is it a good choice to pick up the card for 50K Avios for US$3000 of spending in the first 3 months? Once someone is over 5/24, there aren’t many better choices. Confident of earning that, is it worth trying to reach US$7000 more of spending, for a 25K Avios bonus on top of the 7K Avios base earnings? Probably, if the $1000 per month was not a stretch, another $778 per month average will be possible, and worth it if AA or AS nonstops serve cities you want to travel to without much advance purchase. The last tier is a closer call: an additional US$10K of spending, for 25K additional bonus Avios and 10K base Avios. It’s a good deal, but not the slam-dunk that the first $10K was. The same $10K of spending on an Amex Blue card makes 20K AR points; with the 40% transfer bonus when it next comes around, that’s 28K Avios, without the sharp cliff at exactly $10K of spending (spend less, and give up 25K Avios; spend more, and the extra are unbonused).

You’re absolutely right. If you’re not meeting other minimum spending to earn other bonuses, it might be worth it. I’m hardly ever doing that any more, so it’s like gravy for me. Great analysis!

The way I would look at it is this: after you’ve earned the 75000 Avios at $10,000 spend you are earning 2.5 Avios (not 6) on the last $10,000 spend. Not as attractive as 6x.

Totally agree – especially if you are meeting other minimum spending. Seems like it would be 3.5 Avios, though, cuz you’ll also earn 1 point per $1 + get 25,000 more points. Not as attractive as 6X, but 3.5X is still a very good return.

I had no idea these weren’t under the 5/24 rule! Woo! Thank you! I’m adding this to the list to apply to in the near future. (Or rope my husband into applying it.) Avios have saved us so many times when we were in Asia.

Yassss! I might get the Iberia or Aer Lingus version next month. So so useful outside the US. Plus, I’m running out of cards I can actually get – so these will keep me busy for a while!