Also see:

Well, it’s been nearly a year since a $6 charge from Dollar Shave Club on an Amex card plunged my credit score over 100 points.

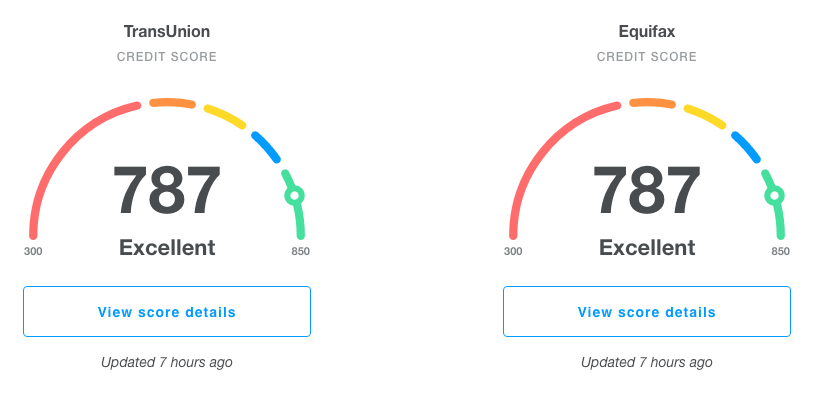

At the time, my credit score was 803 – the first time I’d ever gone over 800. I know it doesn’t intrinsically “matter,” because a score over 750 is as good as it gets. But I did have some pride at earning an above-800 score.

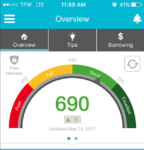

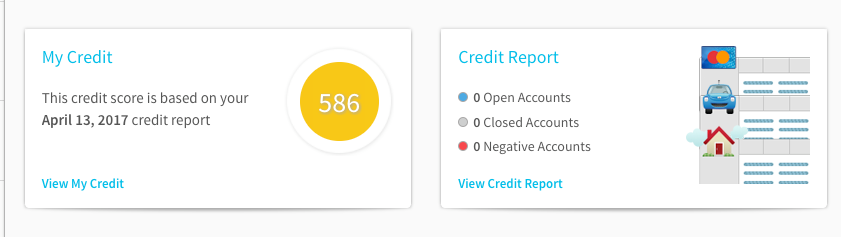

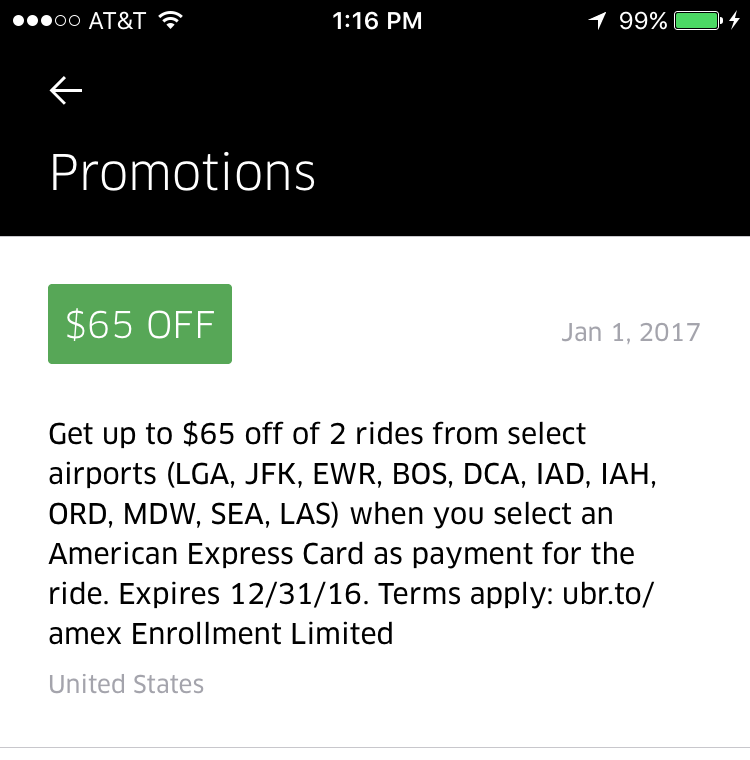

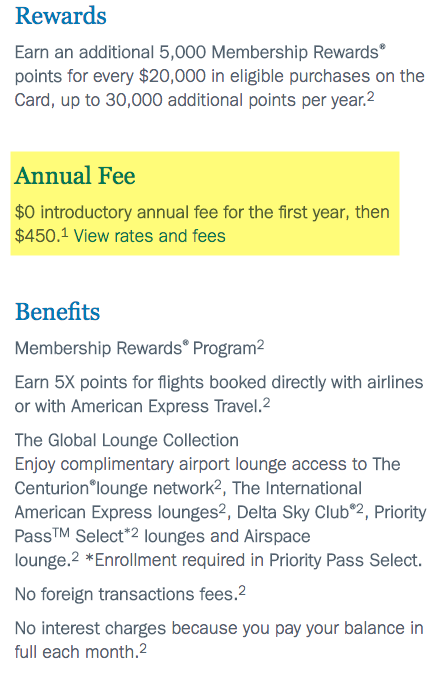

So I was pretty horrified when one stupid error brought me down to ~700. All the work I’d done to build my credit was instantly erased. And, Amex was totally clueless, unhelpful, and actually prolonged the repair process by saying they’d corrected it on their end when in actuality they hadn’t done anything.

I dragged my feet on filing a dispute with the 3 major credit bureaus because I knew it would be a slog – and it was. No sugar-coating that ish.

But, as of last month, my score is now above 780 across the board!

It’s not over 800 yet – I doubt that will happen any time soon – but I am happy my score is recovering. Here’s how it went down.