Right now, I have 3 ultra premium credit cards with annual fees of $400 and up:

- Chase Sapphire Reserve – $550

- Citi Prestige – $495 (though mine renewed at $450 for one more year)

- US Bank Altitude Reserve – $400

That’s $1,345 in annual fees! 😵

Still, I find myself wanting the Amex Platinum biz card ($595, but $450 through January 2019) and Amex Hilton Aspire ($450), both for vastly different reasons.

But I can’t justify getting another ultra premium card with a big annual fee. Am I capping out at 3?

I’m really considering downgrading my Chase Sapphire Reserve card. Getting a 4th – or 5th – would be overkill, wouldn’t it?

No way I’m dumping the best card for Costco shopping! All my high AF cards have a special utility

Here’s a rundown of the major cards with annual fees – and how I get value from them.

Ultra Premium Credit Cards – How Many Does One Need?

For a frequent traveler, those who spend a lot on travel, or want to travel more, a card with a gulp-inducing annual fee can actually make a lot of sense.

Between the perks, lounge access, higher earning rates, and annual credits, you can come out well ahead. Despite their similarities (Priority Pass membership, travel credits), there are enough differences to make each one worthwhile all on its own.

Which is how I would up with 3 of them.

1. Chase Sapphire Reserve

| Chase Sapphire Reserve® | 60,000 Chase Ultimate Rewards points |

|---|---|

| • 3X Chase Ultimate Rewards points per $1 spent on travel & dining • 1X Chase Ultimate Rewards points per $1 spent on all other purchases |

| • $550 annual fee | • $4,000 on purchases in the first 3 months from account opening |

| • Why this is my favorite card for travel and dining | • Compare it here |

For $550 a year, you get:

- $300 in annual travel credits

- 3X Chase Ultimate Rewards points on travel and dining

- Priority Pass Select membership for you and 2 guests

- 50% more value from points when you book travel through Chase (1.5 cents each)

- Primary car rental coverage at home and abroad

I used my Chase Sapphire Reserve travel credit to pay for a cheap hotel stay in Colorado Springs

The biggest perks are those last 2 points: points are worth 1.5 cents each toward travel booked through Chase, and you get primary car insurance. I don’t book travel through Chase a lot.

But I do use my Chase Freedom‘s quarterly 5X categories. At 1.5 cents per point, when I combine that with the Sapphire Reserve, that’s a 7.5% rebate toward travel, which is a great return (5 X 1.5).

And sure, I’ll use the $300 in travel credits – I can always load up my toll tag to drive on the Texas tollways. That’s something I’d have to pay anyway, so it brings the fee down to a more reasonable $150 a year.

And considering the primary car rental insurance has saved my butt before, I make sure I always have a card that has it. Combined with the other perks, it may as well be this one.

2. Citi Prestige

This lil puppy will have a $495 annual fee when it launches again later this month. But I was able to renew for $450 one last time.

It comes with:

- $250 in annual travel credits

- 5X Citi ThankYou points on airfare and dining

- Priority Pass Select membership for you and 2 guests or immediate family

- 4th night free on hotel stays (unlimited until September 2019, then capped at 2X per year)

- Primary car rental coverage abroad, secondary at home

- Citi Price Rewind, which saves me at least $100 per year

I’m gonna get my money’s worth with Citi Prestige in 2019, you betcha

I’m pleased with the new changes to Citi Prestige. Yes, even capping the 4th night free – I only used it once or twice per year anyway.

In fact, I’ve already used it to save $430 on an upcoming hotel stay. So that nearly covers my $450 annual fee for the year.

The 5X on airfare and dining is sweet, sweet gravy. I’m gonna jam on that so hard. 🤘

This is the version of Priority Pass I use the most, because it’s the most generous. You can bring in your immediate family, even if you have more than 2 people (space available, of course). That’s helpful for peeps who travel with kids or a big family.

I’ve already started using the $250 travel credit to cover taxes on award tickets.

And you can use Earny to automate Price Rewind – which seriously saves me $100+ per year with the amount of shopping I do on Amazon. 📦

The only downside? Citi doesn’t have many useful transfer partners. That’s not entirely true – I have 5 that I like – but Amex and Chase have a better selection, especially for domestic carriers.

Still, 5X earning is industry best – and getting that kind of return for travel is something I can get excited about. So I’m actually really happy about keeping this card.

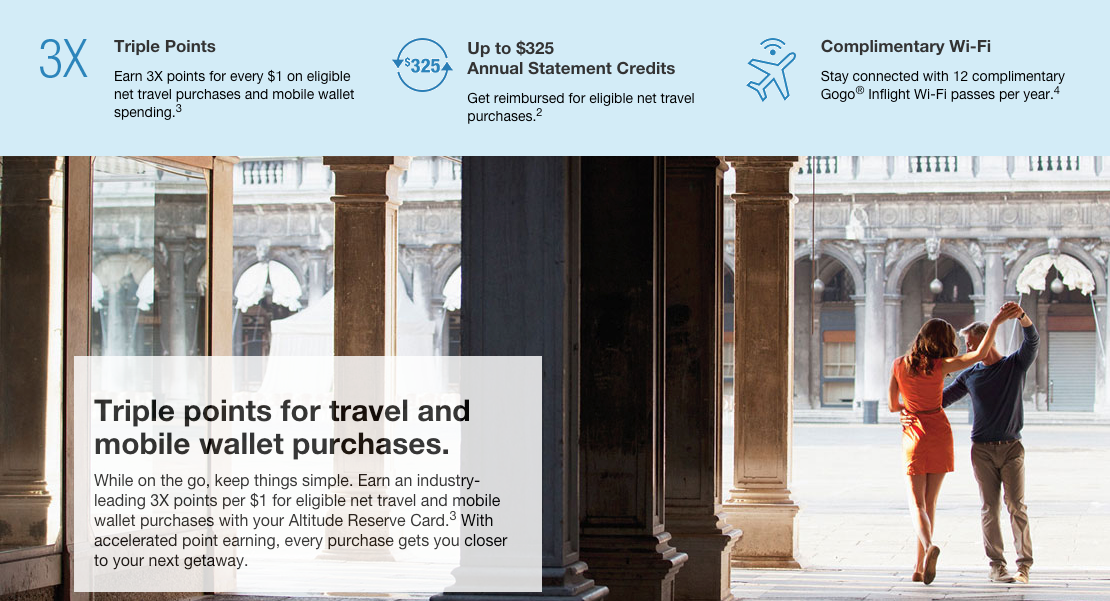

3. US Bank Altitude Reserve

This card is $400 a year. You get:

- 3X points on travel and mobile payments

- $325 in annual travel credits

- 12 Gogo inflight wifi passes

- 1.5 cents per point in value toward travel

- Real-time points redemptions for travel through text

I love this card’s benefits – kinda surprised me, actually

Looks average on the surface. You wouldn’t know this is the best card for shopping at Costco because the 3X on mobile payments means you get a 4.5% return toward travel purchases. And now very Costco accepts Apple Pay.

For a Costco-holic like me, that makes this card indispensable. I also use the $325 travel credit and a good portion of the 12 Gogo passes. In-flight internet is surprisingly expensive, and I like to work when I fly when possible.

LOVE redeeming rewards in real-time

The Real-Time Rewards option couldn’t be easier. The moment you charge something to the card, you get a text asking if you want to use your points. If you do, just text back “Redeem” and it is done. 🧞♂️

2019 is my first year using this card full-time at Costco, but I’m gonna see how it goes – and how many points I actually earn. But I have a feeling this card is a long-term keeper.

The cards I want

1. Amex Platinum biz card

| The Business Platinum® Card from American Express | Earn 100,000 Amex Membership Rewards points |

|---|---|

| • Get 35% of your redeemed points back from an airline of your choosing, and any First of Business Class flights you redeem points for • $200 annual airline incidental credit • 5X points on flights and prepaid hotels booked through AmexTravel.com • Access to the fantastic Centurion Lounges, Delta SkyClubs, and Priority Pass network • Enroll to get up to $179 back per year as a statement credit toward CLEAR membership • Terms Apply |

| • $595 annual fee (See Rates & Fees) | • Spend $15,000 on purchases within your first 3 months of Card Membership |

| • Learn more here. |

Through January 2019, the annual fee on this card is $450. In February 2019, that rises to $595 (!). So if I’m ever gonna get it, it has to be this month.

This card comes with:

- $200 in airline credits per year

- 5X Amex Membership Rewards points on airfare and travel booked through Amex

- 35% points rebate on an airline of your choice, and on all Business or First Class flights

- Priority Pass Select membership for you and 2 guests

- Centurion Lounge access

- Delta Sky Club access

- Hilton and Marriott Gold elite status

- Access to Amex Offers

- A 1-year membership to WeWork spaces, starting February 2019

- $200 in Dell credits, starting February 2019

What I value most from Amex Platinum cards is Centurion Lounge accessss

Now, I wouldn’t put a dime of spending on this card, except to trigger the annual credits. I’d rather have 5X on airfare with Citi Prestige – or even 3X with the Chase Sapphire Reserve – because of better travel protection.

By the numbers

What I really want is access to Centurion Lounges. Is that worth $595 a year?

It depends on how much you value each visit.

Say you think each visit is worth $25 for unlimited buffet, craft cocktails, fast wifi, and the occasional free spa treatment, and you visit 2X per month.

25 X 2 X 12 = $600.

Now consider you go more often, or bring guests, then the value goes up even more.

Even if this isn’t your valuation, at $450, you’re paying ~$38 per month to have this card (at $450 per year).

If you’re getting Hilton and/or Marriott Gold elite status from it, using Delta Sky Clubs, redeeming Amex Offers, or getting your airline credits in 2019 and again in 2020, you can come out waaaay ahead with this card. Not to mention the welcome bonus!

As much as the numbers work for me, I don’t know if I can swallow another steep credit card fee. Although I will seriously consider it.

At $595, it’s a total no-go for me. I can’t justify spending $600 for a card. For that, I’ll regale myself to “slumming it” in Priority Pass lounges. No more Centurion for this plebeian!

I will give it serious thought this month.

2. Amex Hilton Aspire

| Hilton Honors American Express Aspire Card | 150,000 Hilton points |

|---|---|

| |

| $450 annual fee | |

| • $4,000 in purchases on the Card within your first 3 months of Card Membership | |

| - 14X at Hilton - 7X on on flights, select car rentals, and US restaurants - 3X on other purchases | |

| - Hilton Diamond elite status - Free weekend night every cardmember year - $250 in resort credits and $250 toward airline incidentals each cardmember year - Free Priority Pass Select membership | Learn more here. Scroll to the bottom and click "View all cards with a referral offer" |

Here’s another card with a $450 annual fee.

Between the Hilton Diamond elite status, 14X points on Hilton stays, $250 at Hilton resorts, and $250 in airline credits, that’s… a lot. And as a Hilton fanboy? Even more!

Not to mention the free weekend night every year or the 150,000 point welcome offer. I could easily recoup the $450 annual fee in free breakfast and Executive Lounge visits alone. #hungry

I don’t need this card by any stretch (I guess I don’t need any of them, but it’s all relative). But just really really want it.

I’ve always had a good time at Hilton hotels

I’ll save this one for a time when I have a lot of Hilton stays coming up, or a good reason to make use of the perks.

Even still, another $450 annual fee? Something’s gotta give even though this card is a stellar deal with a huge value prop.

For now, I’m marking this one as “got my eye on you.” 🧿

What about premium airline cards?

American, Delta, and United all have $450 cards that get you a membership to their respective lounge networks.

As a free agent, this isn’t a consideration for me. But there’s the:

- Citi / AAdvantage Executive World Elite MasterCard for American Admirals Club lounge access

- Amex Delta Reserve for Delta Sky Club lounge access

- Chase United Club card for United Club lounge access

If I were loyal to one airline, this would definitely throw a wrench in my plans. But as it stands, I’m happy with the 3 I have – for now.

Bottom line

I’m feeling 3 ultra premium credit cards is plenty for me. I like them all very much, use their perks often or enough to justify the fees, and plan to keep them long-term.

But ah, as the fee rises on a card, so do the perks. Which is why I’m considering the Amex Platinum biz card (learn more here) and Amex Hilton Aspire card (learn more here).

The former has a $450 this month only, then increases to $595 in February 2019. And the latter, well, I just really want it cuz I like Hilton stays. 😬

All that said, I think I’m capping out at 3. Unless something changes in the next month or so – 3 is enough. I could always make room by downgrading the Chase Sapphire Reserve but that would sting. And the other 2 are total keepers, too.

Not mention I still have lots of other cards with (smaller) annual fees! It might be time for a major credit card overhaul.

How many cards with $400+ annual fees is too much? How many is just right?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

The CSR travel credit is not $300 any longer but $291. Personally, I would close CSR after i transfer some points to Hyatt and keep the Citi prestige for its better dining and travel rewards.

I see what you mean. I’m considering a downgrade – will have to make a list and go through them one by one. I just like Chase’s travel partners more than Citi’s. Losing regular Hyatt points would be a bit of a blow. Need to assess.

Thanks for the food for thought!

How did you get your USB Altitude? Did you have a banking relationship with USB? Other CC’s? How old were those CC’s?

Great question! I had the Club Carlson card from forever ago, which I downgraded to the no annual fee version. So I’d had that for a while to establish my “relationship” with them.

The good thing is you can easily open a checking account with US Bank – and then wait 5 days to open the Altitude Reserve card. Having the credit card makes the checking account completely free. I keep $1 in my account so they won’t close it (I signed up when there was a $200 bonus to open a new checking account). This is an easy free workaround if you want to get it. I highly recommend this card!

Harlan,

I value the CSR more than the US Bank Altitude Reserve. If you want to transfer your UR to partners, you need a card with a fee, such as Chase Ink Preferred, Chase Ink Plus, Sapphire Preferred, or Sapphire Reserve. The math is pretty easy on Preferred vs. Reserve. If you spend the whole $300 per year, which I believe almost everyone with the card does, then the AF difference is $55. That means if CSR is your primary travel/dining card, you only need to spend $5500/year to make it worth it. This excludes all the other benefits of the card.

If you aren’t using this, because you have Citi Prestige, it gets more complicated. The other problem is valuation of Chase Ultimate Rewards vs. Citi Thank You points. I definitely value my UR > TYP. Citi has made some improvements, but with Hyatt, United, and SW, I think Chase wins. If you have an Ink Preferred/Plus and put everything on your Citi Prestige, I’d definitely downgrade to freedom/freedom unlimited. You can always upgrade later if the Prestige fee isn’t worth it for you down the road.

Depending on how much you travel, I’d check out the 100k offer from Amex Platinum (personal). If you travel a fair amount, it’s pretty easy to get the $550 out of the card. $200 airline credit, $200 uber credit (can be used with uber eats), + $100 Saks credit.

My list of High end cards currently is Amex Platinum (which I may downgrade to Gold or Green when the fee comes due, because I don’t travel as much), CNB Crystal Visa Infinite (easily worth the fee with travel credits), and Citi Prestige. I’ve been locked out of Sapphire Reserve because of 5/24. I do have Ink Preferred. However, with the increased earning on Prestige I don’t feel so left out. Another good dining card is Amex Hilton Ascend/Business because of the respectable earnings on restaurants 6 pts/$ (3%) + free night when you spend $15k/year. If places don’t Amex, you could always fall back on BoA Premium Rewards (up to 3.5% on dining/travel). Of course if BoA adds travel partners, as they are rumored to, that will likely become my everything card, or at least close to it (Not groceries).

Is there any word yet as to the bonus points for signing up for the new Prestige CC? Also is the Prestige $250.00 travel credit a calendar year credit or a cardmember year credit?

Nothing *yet*. But my spidey sense says any day now.

The travel credit resets after the close of your December statement. So it’s possible to get it 2X in a calendar year if you time it just right.

Very eager to see what the sign-up offer will be – if anything!