There are a lot of promotions out there right now. Due to coronavirus, many banks added bonus categories to their cards to encourage more use – which is great! The downside is it becomes easy to forget your other cards.

I often recommend downgrading cards with annual fees to their no-fee counterparts to preserve the credit line and history. Older accounts in particular can age your overall credit and lower your utilization rate, which can help your credit score.

But! Because these cards are free to keep, it’s easy to stick ’em in a drawer and forget about them. Like I just did with my US Bank Radisson Rewards Visa. 🤦🏻♂️

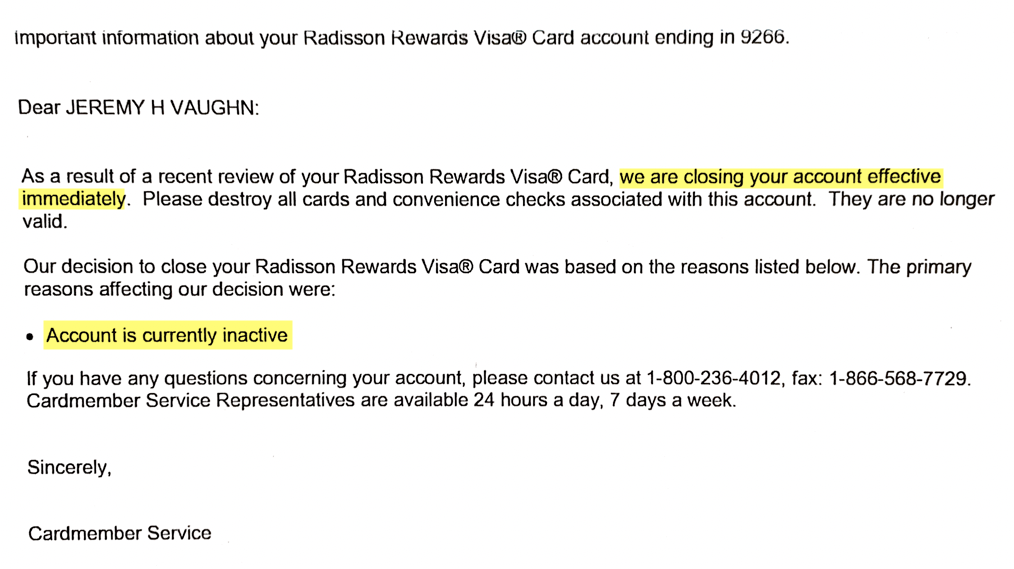

I got a letter in the mail saying my card was closed effective immediately and to destroy it because the account was inactive. Dang, US Bank – you know how to break up, don’t you? Give a guy a warning!

Goodbye, valiant soldier

So this is your reminder to use ALL your credit cards. Especially if you have a couple dozen floating around out there like me.

Use credit cards at least once a year

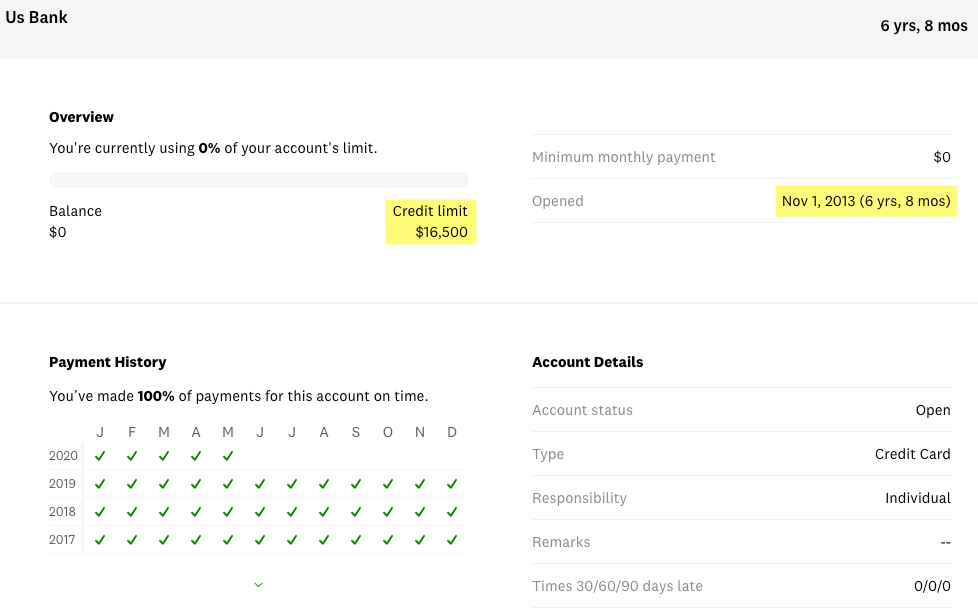

I’d had this particular card for nearly 7 years with a limit of $16,500. It’s a pretty old card for me. In the past, I’ve loaded a few bucks to my Amazon account and called it a year.

Sads

Because it slipped my mind between moving, selling my old place, and the pandemic, I guess it’s been more than a year since I’ve used it. Oops.

It seems US Bank noticed too, because they sent me this:

You need to calm down

Like… wow. In the past when I’ve gotten these types of letters, they at least give you 30 days to use the account. But US Bank is NOT here to play. They will toss you off the boat and never look back!

This prompted me to do a card inventory and see what other cards could use some love. Because issuers are looking to cut risk everywhere they can right now.

Right, but who are you?

It also made me look at my Radisson account. Apparently I have ~18K points in there even though I haven’t stayed at a Radisson hotel since the 1930s… or was it the 1940s? Either way, it’s been an age.

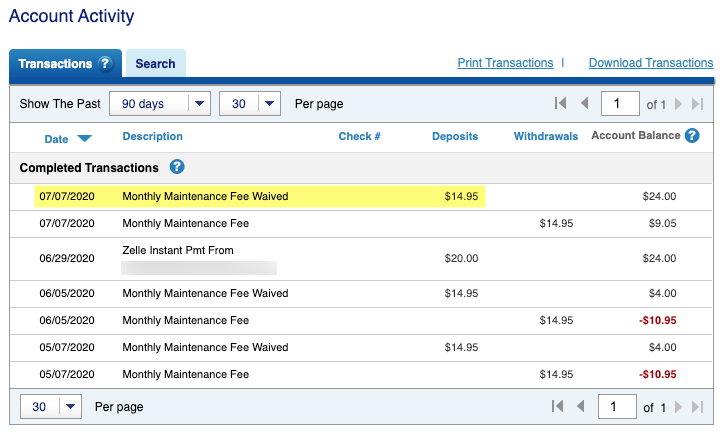

The other thing is I was getting a free checking account through US Bank that typically costs ~$15 a month. But if you have any US Bank credit card – even one with no fee – you can get it free. So this closure sort of frays my relationship with US Bank, unless I want to open another card with them in the next few weeks. And I kinda do want another Altitude Reserve card… which having the checking account opens the door for approval.

$15 a month for a checking account, are you kidding me?

I have until early August to decide what to do, as there’s no way I’m paying to keep a checking account when there are so many great free ones out there. And while I want to open new cards, I didn’t necessarily want to do it right now. Especially because I don’t think I’ll travel again in the near future. Yeah.

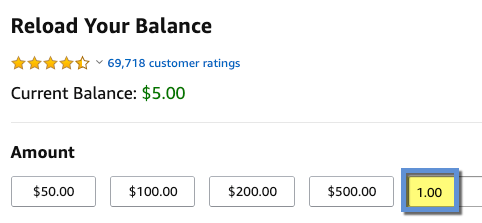

And to think… all of this could’ve been avoided if I’d slapped $1 on the card in the last year. The days are long, but the years are short.

Ways to spend on a card

Here’s what I’ve done in the past that has worked for me. First I round up all my physical cards. Put them in my wallet for a short spell and:

- Get a tank of gas with each one

- Use self-checkout at the grocery store and pay for items one by one (don’t do this if there’s a line, obvi)

- Get a car wash (which is my version of a spa day – seriously, I love car washes)

- Buy a snack at a gas station

Preferred method of keeping cards alive: charging $1 through Amazon

Or online at home you can:

- Load up your Amazon account ($1 minimum)

- Send a small amount to a friend via PayPal (even with a 3% fee, it could be worth paying a few cents on a small amount)

- Charge yourself a few bucks with Square

- Buy small dollar gift cards individually

- Load your coffee app with a small amount (Starbucks, Dunkin, Peet’s, even McDonalds – thanks for the tip, Boonie!)

There are lots of little ways to put spend on cards. Remember to take them back out of your wallet – and maybe set a calendar alert or note on your phone so you don’t forget in the future. 😉

Oh and remember to pay the card off, too. If you don’t log into those account often, it can be easy to forget. And you don’t want a $30 late free over a $1 charge (this has 100% happened to me lol).

Use credit cards – bottom line

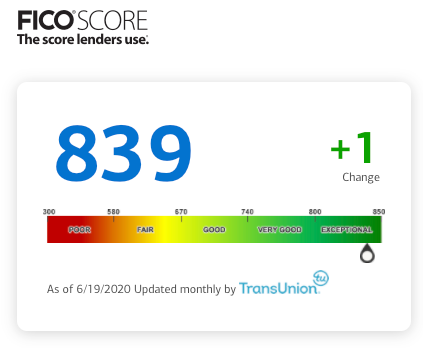

I love having older cards with big limits and no annual fees. They’re an anchor of my credit and a big reason my credit score is over 800. And I totally messed up and lost a good one because I was too busy chasing pandemic bonus categories on other cards.

Please don’t go down

What makes it worse is it only takes two minutes to put a $1 charge on a card – and I didn’t do it.

So don’t be like me. Pull all your cards out. If it’s been a while since you’ve used them, give them some attention. Banks are being extra cautious about credit lines right now – so use ’em or lose ’em.

I’m resisting the urge to end this post with “Thanks for coming to my TED talk.” So I’m gonna go before I do that. That’s my message for today. May all beings be happy. ✨

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

The other side of that argument is that I have had cards cancelled due to inactivity and I have reapplied several years later due to a better bonus, and they have approved me! I’m not saying that all (or even most) banks do that, but I have had some success with it.

Ah yes! Excellent point! I’d prefer that to happen before the five-year mark. After I’ve had a card for 5+ years, I definitely want to keep it for the credit score benefits.

Thanks for adding that!

Good reason to close that US Bank checking account.

…Or open a new Altitude Reserve card! 😉

The checking account has been free since I opened it for a bonus, so there was no harm in keeping it. I’m definitely not paying for it in the future though. Not for $15 a month. But yeah if I close it, that severs my entire relationship with US Bank. Something to ponder.

This tends to happen to me with store credit cards, I opened it to get that additional percentage off than I never return…SMH! Another thing you can do is load your coffee app if you drink Starbucks, Dunkin, Peet’s, even McDonalds!

Excellent tip! I’m going to add that to the post – thanks Boonie!

They straight up cancelled card usually you get a warning!

Right! Dumped me like a bad habit! smdh 🙁

I recommend supporting creators on Patreon.

You can charge $1 monthly automatically to as many different creators as you need.

This is an AMAZING idea!!! I love this so much and didn’t know it was an option. Thank you for sharing!

This is why I was disappointed Amazon discontinued their allowance program, but that patreon idea great

https://www.usbank.com/bank-accounts/checking-accounts/credit-score-checking-account.html

You’re welcome 🙂

Oooh, looking into this now. Thank you!

Holy crap – it worked! This is an amazing tip. I might have to write about this. Thanks again!

Citi did this to me recently too. No warning, nothing. Just closed my over decade old account because I hadn’t used it in the past 12 months. I was pissed and called them to see if I could get reinstated. They said the only way to do so was to authorize a hard inquiry, to which I said no.

I called US Bank to see if they could reopen it since it hadn’t been 30 days and they said nope, it’s already closed. The account number, credit line, history – gone. I have a feeling banks are looking for ways to eliminate unused credit lines right now, which they perceive as unnecessary risk in case someone decides to pull out an old card and max it out.

Thanks for the heads up about Citi – I def a couple of their cards I could throw a few swipes on.

Citi used to reopen within 30 days, but they’re not, whether Visa/MC, or store cards. We recently lost a few here. Comenity and Synchrony are also closing accounts and simply telling people to reapply. In one case, there was a promotional purchase on the Synchrony card, with payments for six months, but they literally closed the account after twelve statements without a purchase. It’s frustrating when these cards start taking actions like this when we’re also dealing with Chase 5/24, let alone the impact to the AAoA.

@harlan Thank you for this post! This has happened to me before with AA/Citi cards too. US Bank is one of the toughest to get approved even with excellent credit; if you already have one or more of their cards & don’t use them, they will deny you for further credit. Thanks for the reminder!

Thanks for reading and commenting – hopefully it prevents someone else from getting their accounts closed, too.

Kohl’s closed my account for inactivity, and Chase has cut most of my CLs in half. Gotta go through my Mint accounts and put some small spend on dormant cards.

Good idea! Kohl’s closed my card too. 🙁 But my Chase CLs are still intact. I made a point to use each of the cards recently. I’ve seen more cuts in the last month so it definitely can’t hurt.