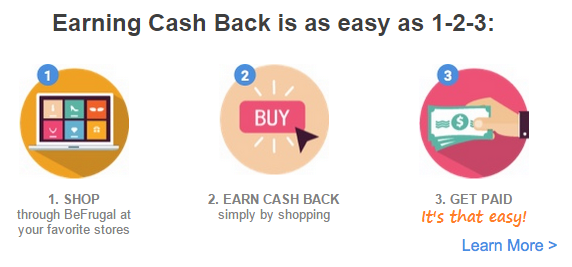

When you shop online, always always click through a shopping portal to earn extra points, miles, or cashback.

I personally use Cashback Monitor to find the best payouts before I shop anywhere.

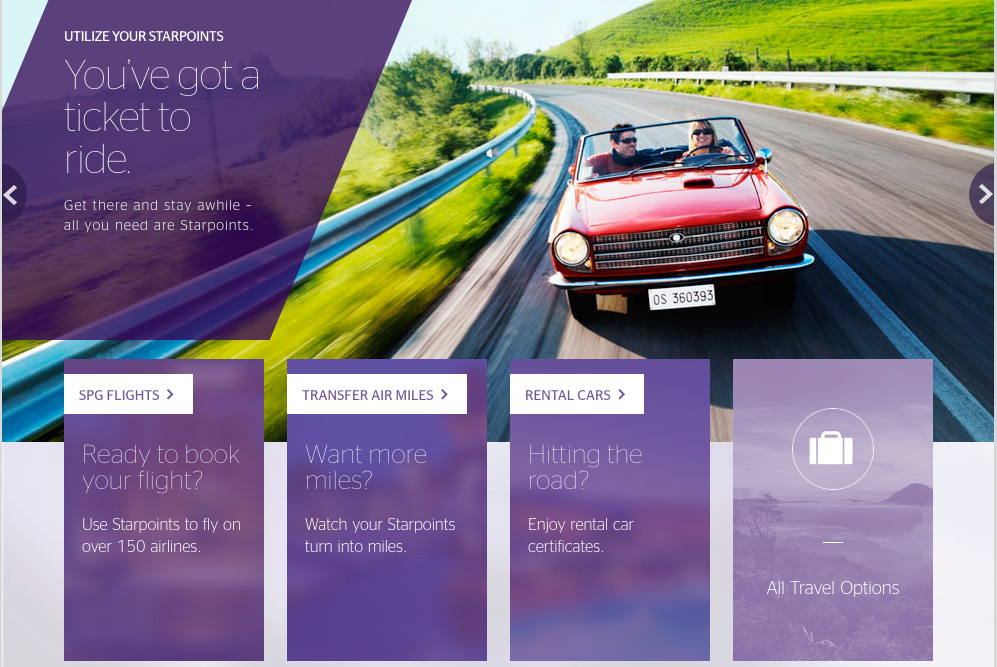

I usually like to earn Alaska miles or Chase Ultimate Rewards points for online shopping. But occasionally, cashback offers are simply too good to pass up.

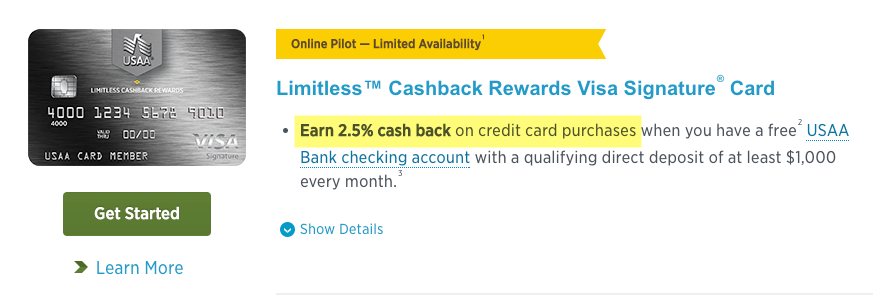

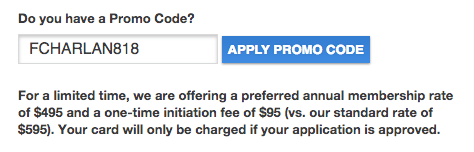

And competition is fierce. So much that they’ll sometimes give you free money to sign up and use their portals.

I thought I’d round up 3 cashback portals where the initial bonus might be worthwhile for a little shopping. And tell you what’s required to get the bonus AKA the cash in your hot little hand.

Note: I get cashback when you sign up for these portals, too. Thank you for using my links!

Get a shopping portal bonus

These bonuses are for NEW sign ups. If you’re an old-timer to points and miles, you likely already have accounts with all of these portals. In that case, check out my backlog of Every Single Out and Out post! 😉