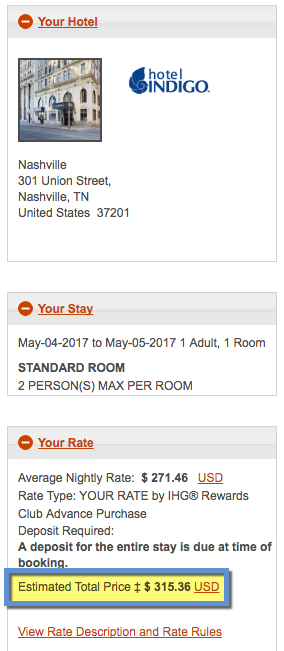

So, I’m shutting down my last New York Airbnb at the end of this month. This will effectively cut my final tie to that city – finally. I wanted to go for a night or two to turn in the cable box, return the keys, and officially wrap it up.

Of course, I thought about using hotel points because I really didn’t want to pay for it (although I could theoretically write off the expense). Then it occurred to me I had a free night from my Chase IHG card set to expire. Even better, I just earned another one for paying the second year’s $49 annual fee.

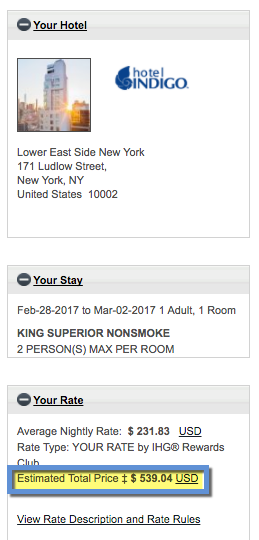

I used them for a ~$539 two-night stay at the Hotel Indigo Lower East Side New York for $0. Because the annual fee is waived the first year, I basically paid $49 – and got back a stay worth over $500.

Here’s why you might consider picking up the Chase IHG card. Even if you already have lots of other cards.

The Chase IHG card gives easy value year after year

- Link: Chase IHG – more information here

Right now, the current offer on the Chase IHG card:

| Chase IHG Premier | 150,000 IHG points |

|---|---|

| • Free award night worth up to 40,000 points each account anniversary • 4th night free on award stays with points • Platinum elite status with IHG • Earn up to 25 points per $1 on IHG hotel stays • Earn 2 points per $1 at gas stations, grocery stores, and restaurants |

| • $89 annual fee | • $3,000 on purchases in the first 3 months from account opening |

| • Compare it here |

The points are great, but the real value is in the perks. You get:

- A free night at eligible IHG hotel every year on your cardmember anniversary

- IHG Platinum elite status, which is completely worthless but gets you a few extra points on paid stays

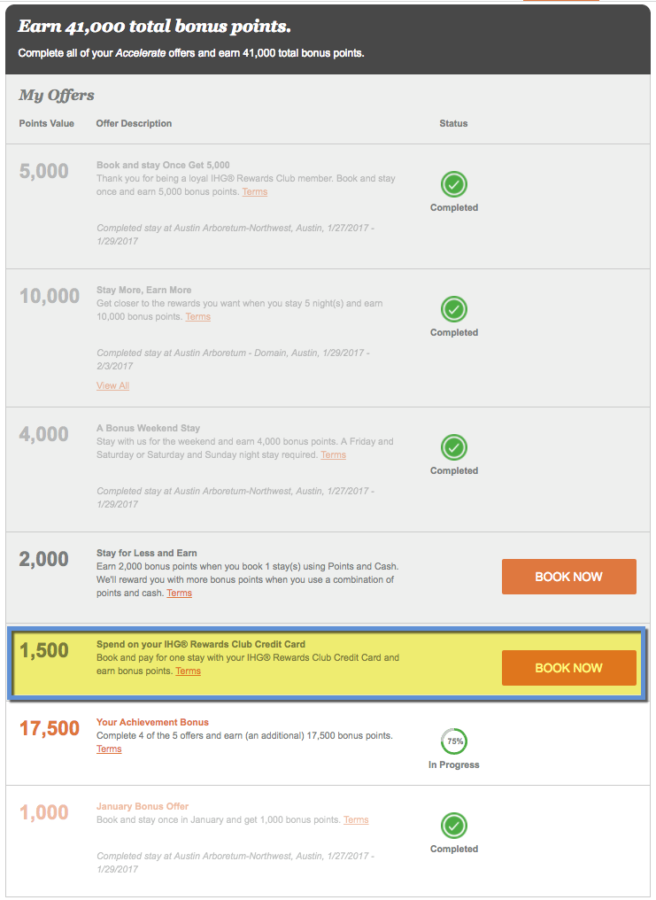

There’s also the “soft” benefit of using the card for a stay that’s been part of all my previous Accelerate offers.

But the real value is with the annual free night.

This 2-night stay that would’ve otherwise cost ~$539. The location is perfect – only 3 short blocks from where I need to be. Plus, I booked non-stop round-trip flights with Southwest points. So the entire trip will be completely free (except for food and cabs).

The reason I booked this hotel and not a more expensive one is because it was going to expire next week. For me, it was use it or lose it. I’m glad I did, and saved some cash.

But you can push it to the limit and get some serious value if you don’t procrastinate like I did.

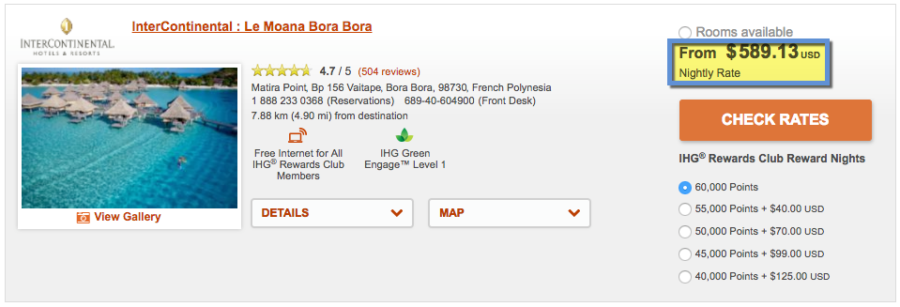

You could stay at the InterContinental Le Moana Bora Bora in a double bungalow and save yourself ~$696 on a night. Or double up like I did and get nearly $1,400 in value. I plugged in random dates in April 2017 and found lots of open rooms.

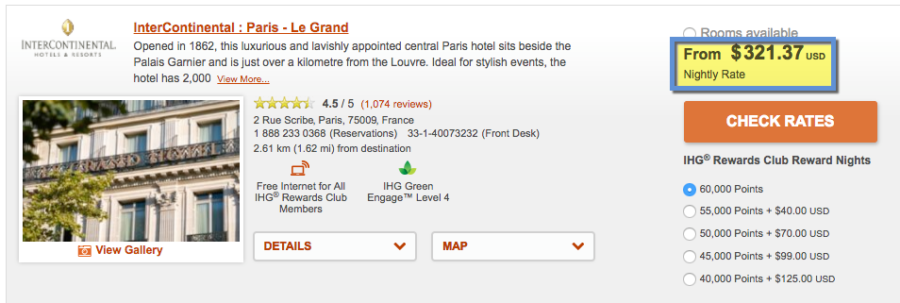

Or, something a bit easier… a night at the InterContinental Paris – Le Grand, where rooms are ~$321 in May 2017.

With a little planning, you could add a fun stop somewhere along your travels. Or burn it at the last minute on something you were going to pay for anyway.

This card is NOT under 5/24

If you’re scraping the bottom of the barrel like me, consider picking up this card. It’s one of the few NOT under 5/24 (the Hyatt card is too, incidentally).

I’m actually considering closing my Chase Hyatt card and getting it again for the sign-up bonus. Like the Chase IHG card, you get a free night every year on your cardmember anniversary, but you can only use it at Category 1 through 4 hotels – here’s my list of Hyatt Category 4 hotels where you can get outsized value.

For ongoing value, the Chase IHG card is better. The annual fee is lower ($49 vs. $75) and the free night doesn’t have restrictions. Basically, there’s no way in Hades I’m ever giving up this card.

Are there drawbacks?

You can use the free night anywhere. BUT. It’s just one night.

If you want multiple nights, you have to either pony up more points or pay out-of-pocket. To get around this, you can do what I did and save them up 2 years in a row – and then redeem them for 2 consecutive nights.

Or, there are plenty of situations where you could use 1 night, like:

- Fly into one city, stay the night, take the train to another city (Fly to Brussels, stay at the InterContinental Amstel Amsterdam for free, take the train to Paris)

- Use it for a special event, like watching the New Year’s Eve fireworks in Sydney like I did

- A romantic evening slash staycation

- An unexpected business trip where you’re in and out – or for an airport hotel when they cost a lot

- On a road trip, where you pop into an expensive city for the night (it always blows my mind how much Nashville hotels cost, for example)

Also, the free night is use it or lose it. So if you let it expire, it’s gone. There’s also no way to extend it. But you have a whole year to use it, so surely you can stay somewhere for an evening.

Bottom line

- Link: Chase IHG – more information here

I hate on IHG a lot. Their elite status is useless, they don’t give free breakfast if it’s not included with every room already, and their points proposition pales in comparison to Starwood, Hyatt, or even Hilton.

But I have a soft spot for IHG. The PointBreaks list is a quarterly endearment, they keep chugging along with the Accelerate offers, and my gosh, the Chase IHG card is totally worth having for that 1 free night per year.

From my one $49 annual fee, I got 2 free nights at the Hotel Indigo Lower East Side New York (which I’ll be sure to review). That was possible because the card is $0 the first year, and $49 the second year – so 2 nights in total for $49. Really, an amazing deal.

Just wanted to share my excitement – the thrill of chasing a deal is real, y’all.

Have you gotten outsized value from the Chase IHG card’s free night? How much did you save?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’ve always been amazed by Nashville hotel prices too!

Yeah! Like… WTF?!

HI Harlan,

I’m curious how you used two of the free nights if they expire after one year?

The first was set to expire on 2/18. The second was put into my account on 2/6. So I had 12 days of overlap and used them both!

Aren’t the free nights only after each anniversary, so you would have had to pay the $49 twice to get 2 free nights?

Also, it’s a little silly to say you got $500 + value – you can get perfectly reasonably hotels in that area for $100-150 per night, so it’s more like you got $250 value for $98

Yes, but the 1st year is $0. So I only paid one $49 annual fee (for the second year) to get 2 free nights.

This particular hotel is literally 3 blocks from where I need to be. There are probably cheaper hotels in the area, but I simply couldn’t beat this location, so it worked out perfectly.

Also, I don’t know of any IHG hotels in Manhattan for $100 a night…

No offense but I cringe whenever I read this kind of logic, which in my opinion is misapplied. If Harlan could have couch surfed on a buddy’s sofa for free, then did he get no value for those $49? Last week I was in Mexico for work and my boss took me out for a steak dinner. My share came to about $40. Had I not done that I would have gone across the street for some grilled chicken and a beer for about $6. Did I get a free $40 meal or a $6 one? Bottom line, he spent $49 for a $500 room so he got $500 value. What he would have spent had he not done that does not affect the realized value.

In this case, I probably would’ve spent that amount, yes, because I have to take the trip and it’s not optional.

I also picked a mid-range price which is what I usually go for. And Manhattan isn’t exactly known for amazing deals. So yes, I do consider this booking as having saved about $500.

No need to worry about offense. The great thing about this hobby is that everyone sees value a different way. I don’t always agree with every logic myself, but if the other person is pleased with their arrangement, then, I think, good for them. Live and let live.

Nice job hitting the sweet spot to use two cert’s my friend.

I’m all about extracting the most value possible! It doesn’t always work out, but I lucked out this time around. 🙂

Thank you for reading and commenting!

I do not want to call it bragging and ego patting but you (bloggers) are spoiling things for us (users) in the long run. Your post almost forces IHG and Chase to increase the annual fee to $79 and enforce category restrictions. I have been in this business since 1990 and am very upser with this credit card bragging.

I have done crazy things in terms of redemptions but those are only for my family and friends who keep saying: “Too much work.”

I wouldn’t say IHG Platinum is completely worthless. Maybe not that valuable. Normally, I only stay at Hiltons, but stayed at a Hotel Indigo on points this weekend. For being a Platinum member (through the card), we received a welcome cocktail and a 2 pm checkout (which we really needed). Not a huge deal, but I think better to have some sort of status when staying somewhere even if just to avoid getting the crappy room overlooking the AC unit.

All good points!

I mostly had in mind Hilton’s mid-tier (Gold) elite status, which gets you free breakfast and sometimes upgrade to the Club floor.

IHG doesn’t give free breakfast, even for its highest-tier status members. And I am all about that free breakfast!

Yeah, you just can’t beat this card with a stick. Every year, the Free Night saves me at least $150.00. This past year it saved me $280.00. (I used my one Free Night at the Chicago Intercontinental- right there on the Magnificent Mile.) I’ve had the card four or five years….I would estimate I’ve gotten around/about $700-800 worth of free nights with it.

We used our free nights (wife also has a card) at the Crowne Plaza Amsterdam. Excellent location. Nights were $300+/night, so we saved over $600 for those two nights. Amsterdam is an awesome city, but it’s not cheap for hotels.

Can you get a 2nd IHG card from Chase? Citi lets you do this with their Hilton card.

You know, I’m not sure – but I’m leaning toward “I don’t think so.”

I’ve always heard the strategy is to cancel & reapply rather than have 2 concurrently. Product changes are the exception – but for co-brands, I think it’s one at a time.

And that’s awesome about the Amsterdam hotel! I’ll be in AMS this May as part of my Brussels trip. It’ll be my first time there. Can’t wait!

What cities are you doing? We’ve done a bunch in that area.

Well, I fly into and out of BRU. And I have a week. What’s in the middle is all TBD.

But I’d love to take the train to Amsterdam. And I’ve always wanted to visit Prague. Also heard good things about Bruges.

I will start a serious itinerary late March/early April so at this point, open to ideas! 🙂

I’ll email you tomorrow, otherwise this will get clogged up real quick.

Perf, I’m all ears!

I don’t believe we get a Free night for the first year. We get the first Free anniversary night on payment of annual fee at the end of first year. So, not sure how you booked 2 free nights using certificates. Or was it actually at the end of 2nd year, that you were able to use the 2 certs together. Which makes sense- but would mean 2 annual fees paid.

End of the 2nd year, but I haven’t paid the second AF yet. I expect it’ll be on my statement in a couple of weeks.