Chase has 2 great no annual fee cards that pair nicely with premium Ultimate Rewards cards: Chase Freedom Flex℠ and Chase Freedom Unlimited®.

The Freedom Flex card earns 5X Chase Ultimate Rewards points in rotating quarterly categories on up to $1,500 per quarter in combined spending. The Freedom Unlimited earns 1.5X Chase Ultimate Rewards points on all purchases with no cap.

Lots of peeps ask which is better. To which I always answer: it depends on how much you like the bonus categories. But there’s a longer answer beyond that: how much to you plan to spend on the card each year?

Let’s talk about the break even point and which is better for your finances.

Chase Freedom Flex℠ Vs Chase Freedom Unlimited®

The most important thing to know about the Freedom Flex card is the bonus categories. They rotate every 3 months. And you can earn 5X points on up to $1,500 in spending per quarter across all the categories, when you activate the bonus.

So the question becomes: are the bonus categories useful to you?

Chase Freedom Flex℠ has 5X bonus categories

- Link: Chase Freedom Flex℠

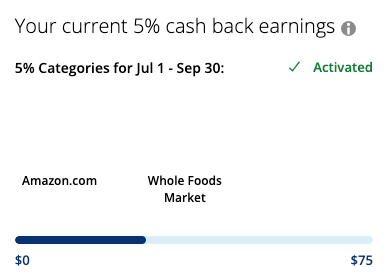

In 2020, Q3 bonus categories were Whole Foods and Amazon. For Q4, they will be Walmart and PayPal.

At Whole Foods, I got 5X last quarter look forward to Q4 for PayPal especially

I took advantage of Q3 by using my Freedom Flex for weekly groceries and for all my Amazon purchases. But – I typically shop at Whole Foods because they have the best produce and their prices are actually comparable to Kroger in my area (Dallas).

I’m a staunch fan of the Freedom cards and the word staunch

Next quarter, I’ll focus on PayPal to check out for online shopping whenever possible.

Chase makes it easy to track your 5X spending

We don’t know what 2021 categories will be yet, but past quarters have included:

- Gas stations

- Grocery stores

- Amazon

- Walmart

- Department stores

- Wholesale clubs

- Commuter transportation

- Movie theaters

So you never know what’ll pop up! If you spend the full $1,500 each quarter ($500 per month) and activate the bonus, you’d earn 7,500 Chase Ultimate Rewards points (or $75 cashback).

That’s 30,000 Chase Ultimate Rewards points (or $300 cashback) per year. Not a bad return for a card with no annual fee.

The rest

Beyond that, you earn:

- 5X Chase Ultimate Rewards points on travel booked through Chase

- 3X Chase Ultimate Rewards points on dining at restaurants

- 3X Chase Ultimate Rewards points at drugstores

- 1X Chase Ultimate Rewards points on all other purchases

Earn 3X Chase points on the margarita of your dreams

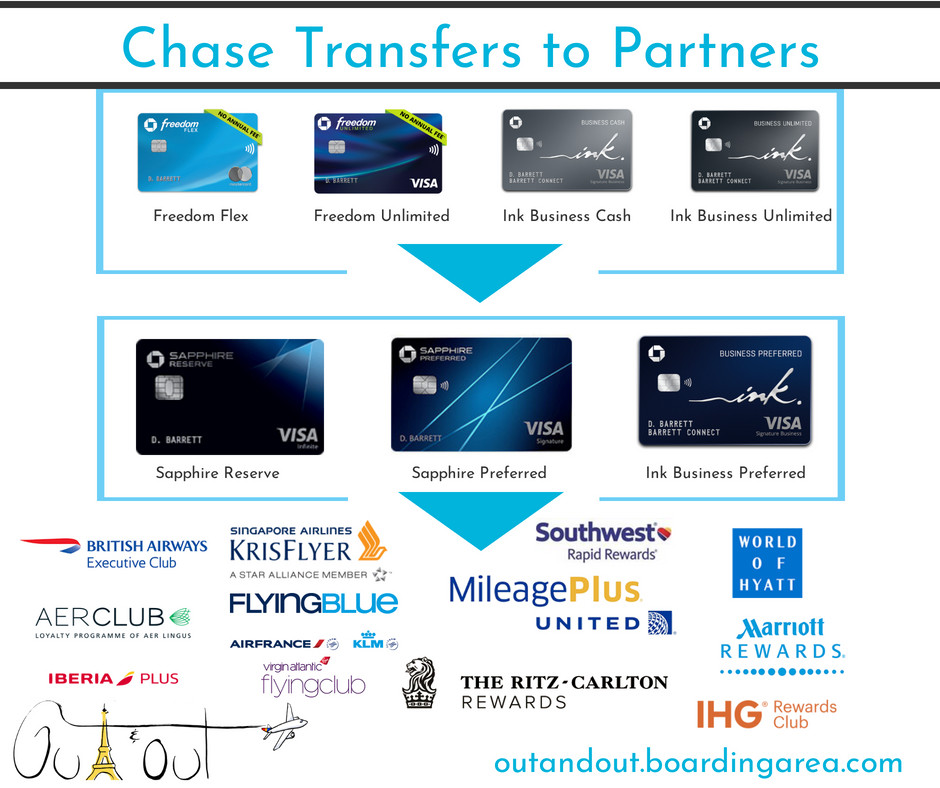

When you pair the Freedom Flex with a premium Chase card that allows transfers to travel partners (Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card), you can combine all your points – and then book award flights and hotel nights.

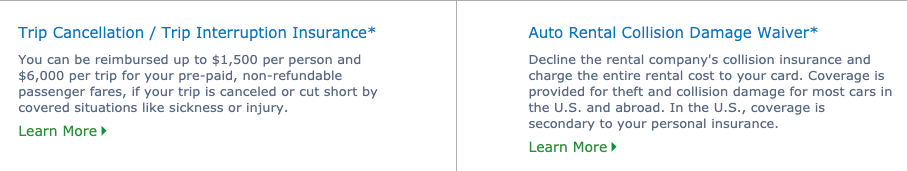

This coverage is lackluster compared to other premium cards

I personally wouldn’t book travel through Chase with this card if you have a card that offers better travel protection. If you don’t, then definitely use this one! This is especially true for car rentals. Other cards offer primary rental insurance. This one offers secondary insurance in the US but primary coverage overseas. And booking hotel rooms through a travel portal typically disqualifies you from earning elite status credit and getting elite status benefits – so I wouldn’t book hotels through Chase.

But for dining and drugstores – this card is an easy win! Especially considering there’s NO annual fee. While I’d love to see a category for groceries and/or gas, the bonus categories here are strong and broad enough to keep this card in your wallet full-time – and moreso when there’s a good 5X quarterly bonus category.

Freedom Flex is a World Elite MasterCard

Kinda cool, but Freedom Flex is a World Elite MasterCard. That means you can NOT use it at Costco stores, but can take advantage of other benefits, like:

- Ability to make mortgage and car payments via Plastiq (although the new fee makes it usually not worthwhile)

- $10 Lyft credit per month for five rides taken in a calendar month

- 5% rewards at Boxed.com

- Free ShopRunner membership for two-day free shipping at many retailers

- Cell phone insurance, up to $800 per claim/$1,000 per year in protection from theft or damage when you use the card to pay your bill

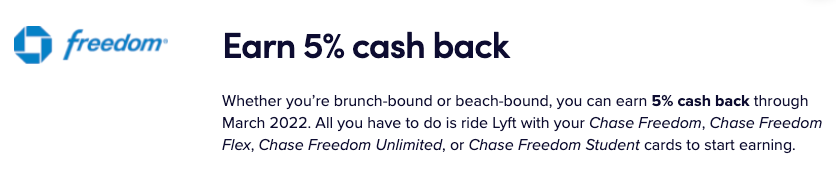

Stack stack

I love the Lyft benefit, especially because you can stack it with a promotion to earn 5X points on Lyft rides through March 31, 2025! To be clear, the 5X offer is available on the Freedom Unlimited too, but you wouldn’t get the benefit of the $10 monthly credit from having a World Elite MasterCard.

So these things are minor, but nice to have with a no-annual-fee card.

Chase Freedom Unlimited® requires NO thinking

- Link: Chase Freedom Unlimited®

This cards earns 1.5X on all purchases. Full stop – that’s it.

If you don’t want to think about bonus categories or activating them, this card might be the way to go.

But if you’re torn whether to get this one or the Freedom Flex, the number to know is $20,000.

That’s how much you’d need to spend to earn 30,000 Chase Ultimate Rewards points with this card ($20,000 X 1.5). And 30,000 points is how many you’d earn if you fully maxed out the Freedom Flex bonus categories every quarter.

It sounds like a lot. But it divides out to ~$1,667 per month in spending.

If you’re using the card for everything, it’s fairly easy to hit that target. Although I personally use other cards for bonus categories and my Blue Business Plus Amex for non-bonus spending.

Realistically, I wouldn’t use the card for that much spending. But you might – especially if it’s your first or only card.

The rest

Like the Freedom Flex, this card also earns:

- 5X Chase Ultimate Rewards points on travel booked through Chase

- 3X Chase Ultimate Rewards points on dining at restaurants

- 3X Chase Ultimate Rewards points at drugstores

And I have the same notes and observations as stated above.

Chase Freedom Flex℠ Vs Chase Freedom Unlimited®: which is better for you?

To earn 30,000 Chase Ultimate Rewards points, you’d need to spend:

- $6,000 per year with Freedom Flex ($6,000 X 5), or $500 per month

- $20,000 per year with Freedom Unlimited (20,000 X 1.5), or ~$1,667 per month

If you like Freedom Flex bonus categories, you get a lot more points for much less spending.

And if you spend a decent amount per month and don’t want to think about bonus categories, go for the Freedom Unlimited.

For this reason, I tell most of my friends to spring for the Freedom Flex. Chase makes it easy to activate the bonus and track your purchases. Plus, when you’re ready, you’ll have a nice stash of Ultimate Rewards points to pair with another card. And that unlocks the ability to transfer your points 1:1 to Chase’s outstanding travel partners, like Southwest, Hyatt, and British Airways (all personal faves).

Pair Chase cards to earn even more points

The Freedom Flex is a good starter card for that reason. Whereas if you had the Freedom Unlimited, you’d have to spend a lot more to earn as many points.

Because the regular bonus categories are the same, the other big distinction is: do you want to earn 1X or 1.5X points per $1 spent? With Freedom Flex, you earn 1X point outside of the quarterly categories. And with Freedom Unlimited, that 1.5X points earning is… unlimited.

So, quarterly 5X categories – yes or no? And 1X or 1.5X points on regular spending?

If cashback is your goal, choose neither

Both cards are advertised as cashback cards. But their power lies in pairing them with another Chase card to access travel partners. Which, yes, requires you to get another Chase card. It’s a good points ecosystem to get associated with.

Some peeps don’t want 2 cards or to think about combining points and transferring them. And for them, I’d say there are better cashback cards if you’re not interested in pairing.

And multiple 2% cashback cards are better than Freedom Unlimited’s 1.5%.

Both cards are part of a long-term strategy

The Freedom Flex and Freedom Unlimited cards are stepping stones toward a bigger points strategy: that you’ll eventually pair them with a premium Ultimate Rewards card.

And both are an excellent place if you want to:

- Ease into the world of miles & points

- Avoid annual fees

- Earn rewards on all your spending

- Build your credit profile

- Begin a relationship with Chase

I’ve had my Chase Freedom for 18+ years by now. And I’ll keep it forever because it has no annual fee. It’s literally a free way to age all the other accounts on my credit profile, which helps boost my credit score.

These cards are also relatively easier to get approved for if you have a limited credit profile. Plus, once you have a card with Chase, it gives you leverage for another one in the future.

For all these reasons, either card is a great place to start building your credit and travel goals. Plus, you can always switch from one to the other after a year.

I use Chase Ultimate Rewards points for free or cheap travel constantly (or I used to pre-Covid, sigh). I spent 3 nights in San Francisco for free thanks to Chase points transferred to Hyatt – which I earned across all my Chase cards. So it’s good to get your points balance growing while starting your other goals at the same time.

Keep in mind, you can NOT get most Chase cards (including these), if you’ve opened 5+ cards in the last 24 months – this is called the 5/24 rule. If you’re starting out, that shouldn’t be an issue. But something to note.

Chase Freedom Flex℠ Vs Chase Freedom Unlimited® bottom line

- Link: Chase Freedom Flex℠

- Link: Chase Freedom Unlimited®

The number to know is $20,000. If you spend more than that per year, the Freedom Unlimited would earn you more points – that’s also assuming you’ll activate and max out Freedom Flex’s bonus categories each quarter.

The Freedom Flex requires much less spending for the most possible bonus points: only $500 per month compared with ~$1,667 on the Freedom Unlimited.

But ultimately, the best one for you depends how much you like the quarterly bonus categories. Typically, they’re super useful and easy to use. Past quarters included grocery stores, Amazon, wholesale clubs, and restaurants.

And both cards should be part of a longer-term goal for credit building or cheap travel. Obviously, both of those are great!

Finally, if your goal is just cashback, choose neither. There are better cashback cards in the world.

Lower spending and a good introduction to points is why I typically steer my friends and family to Chase Freedom Flex. But considering both cards don’t have an annual fee, you really can’t go wrong either way.

Which card do you like better? Do you find Freedom Flex’s bonus categories easy to use?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

This is a rather untimely post, considering the rumors about Chase possibly ending the ability to transfer UR from no-AF to AF cards. This would make the Chase Freedom Unlimited a completely worthless 1.5% cashback card, and the Chase Freedom of only marginal value, on par with Discover or Citi Dividend. You are doing your readers a disservice pumping these cards at this time without even mentioning this risk.

Agree with your assessment. But it’s a big “IF” slash rumor right now. And I assume Chase will give a heads up because peeps will be waiting for their statements to close.

Worst case, move your points to another card when and if the news breaks. And if it does happen, you still have a free card to help age your other accounts. Good deals come and go – but for now, either of these cards still pair great with other premium Chase cards. I’ll switch my strategy when changes are actually announced. Until that happens, I’m gonna earn as many points as I can!

Thanks for sharing your thoughts!

Per DOC, Chase Rep confirmed no changes to transfers planed at this time

Nice look clean shaven Harlan.

As far as Chase, they change the rules w/o any notice: IHG free night, 5/24, etc so I don’t ever recommendation Chase bank.

Thank you! 🙂

I think the recent IHG changes had more to do with IHG than with Chase. That’s usually the case with co-branded cards. But yeah, those changes were pretty bad. I think we’d get more notice with Chase’s own (Ultimate Rewards) cards.