There’s zero doubt Chase cards are the best to get first. Their products have high sign-up offers, excellent ongoing benefits, and strong category bonuses.

But… Chase shutdowns are increasing – even if you haven’t opened a Chase card in recent past. And, they have aspirations to use their 5/24 rule for ALL their cards. (Which is ridiculous, especially for the co-branded cards because you want people to actually get them, right?)

I just earned 100,000 British Airways Avios points on the Chase British Airways card. But between shutdowns and 5/24… I might be done with Chase for a while.

I regret not ever having the Chase Freedom Unlimited for everyday non-bonus spending. Although with my current cards, I should be good for lots of Chase Ultimate Rewards with organic spending.

Anyhoo, I’ve been thinking of card options if you’re helplessly over 5/24, or just don’t want to mess with Chase any more.

Here are the 7 best!

Best cards over 5/24 and/or done with Chase

Sorry, Chase. It’s not me, it’s you.

While I’ll 100% keep all my existing Chase cards, I have to accept it’s time to move away from new Chase applications. Luckily, there are worthwhile bonuses out there for us LOL/24 peeps.

1. Blue Business Plus Amex

- Link: Blue Business Plus Amex – learn more here

- Link: 3 Excellent Amex Small Business Card Welcome Offers – Which Is Best for You?

| Blue Business Plus Credit Card | 10,000 Amex Membership Rewards points |

|---|---|

| • 2X Amex Membership Rewards points on all purchases on up to $50,000 in spending per calendar year • No bonus categories to think about or activate and NO annual fee • Can transfer the points you earn to Amex travel partners |

| • $0 annual fee (See Rates & Fees | • $3,000 in eligible purchases on the Card within your first 3 months of Card Membership |

| • This is by far the best card for 2X points on all spending | • Learn more here |

I love this card. It earns 2X Amex Membership Rewards points on all purchases – up to $50,000 in spending per calendar year – all with NO annual fee.

I put all my non-bonus spending here.

It’s a small business card, so you need to have some sort of profit-seeking business. But it’s also free to have, and isn’t affected at all by 5/24 – it doesn’t count toward it, either.

Admittedly, I’d rather have Chase Ultimate Rewards points than Amex Membership Rewards points. But if beggars can’t be choosers, it’s still an easy (and free!) way to earn valuable transferrable points.

2. Capital One Venture & Spark cards

- Link: Capital One Venture Rewards – Learn more

- Link: Capital One Venture: A Solid 2X Card for Simple Rewards With No BS

| Capital One Venture Rewards Credit Card | 75,000 Venture miles (Worth $750 toward travel) |

|---|---|

| • Earn unlimited 2x miles on every purchase • Transfer your miles to 15+ travel loyalty programs |

| • $95 annual fee | • $4,000 on purchases within 3 months from account opening |

| It doesn't get much simpler to earn and redeem points than this | • Learn more here |

With either of these Capital One cards, you earn 2% cashback (2X miles) toward travel on every purchase – and you’ll pay a $95 annual fee on both cards, although it’s waived the first year. Plus, you’ll incur a credit check with all 3 reporting bureaus. So why consider these cards?

Keep in mind Capital One has their own approval standards. I was denied for the Spark card because of too many card accounts. But lots of peeps got approved, even at 18/24 in some cases.

Capital One’s approval criteria is iffy at best. But if you’re going for broke and don’t care about a credit pull, you have nothing to lose – and lots to gain.

3. CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

If you’ve opened OR closed a personal Citi AA card in the last 24 months, you can’t get another one. But, that rule doesn’t extend to the business card.

And that’s awesome because you can earn up to 60,000 American Airlines miles – enough for a ton of awesome reward flights – after meeting tiered minimum spending requirements:

- 50,000 American Airlines miles after making $3,000 in purchases in first 3 months

- 10,000 additional miles after making a total of $10,000 in purchases in first 12 months of account opening

Even better, opening this card won’t count toward your 5/24 status. You need to show some business income, but the $95 annual fee is waived the first year. An easy card to scoop up a huge amount of American Airlines miles. It doesn’t get higher than this.

4. Hilton Amex cards

- Link: Hilton Ascend Amex – learn more here

- Link: Hilton small biz Amex – learn more here

| Hilton Small Business Amex | 130,000 Hilton points |

|---|---|

| • 12X at Hilton • 6X at US gas stations, wireless phone service from US providers, US shipping purchases, US restaurants, flights, and select car rentals • 3X on other purchases • Hilton Gold elite status • Terms apply |

| • $95 annual fee (See Rates & Fees) | • $3,000 in eligible purchases in the first 3 months of Card Membership |

| • Does NOT count toward Chase 5/24 | • Learn more here |

Want to earn Hilton points? Why not? I detailed how you can easily get $700+ of value from 120,000 Hilton points.

Hilton is derided in the points community, but they’re my go-to. It’s case-by-case, as are all points redemptions. But maybe it’s time to give Hilton points a look – especially if you have a certain destination in mind.

The personal version (Surpass card) WILL count toward 5/24, but the small business version will NOT. And with both, you can earn a big amount of Hilton points with the welcome offer. If you’re over 5/24, go for it!

Concerned you won’t be able to earn the bonus? Amex now explicitly tells you during the application process whether or not you’ll earn it. So there’s no risk – even if you’ve had either card before.

5. Had to remove because of compliance rulez :/

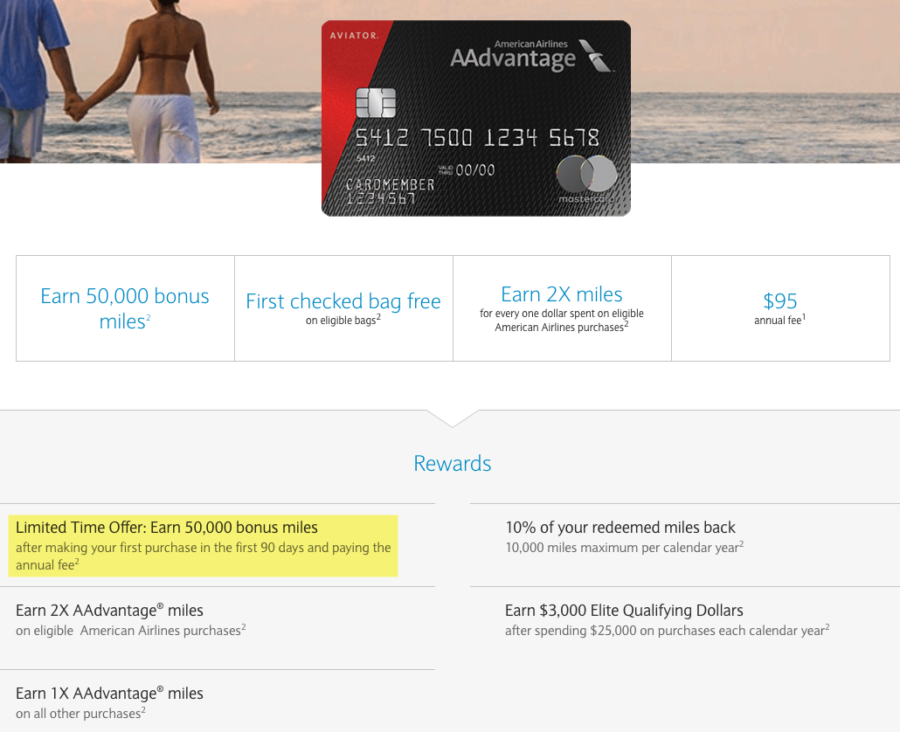

6. Barclays American Airlines cards

If you haven’t had these cards, what are you waiting for? All you have to do is make a single purchase and get 50,000 American Airlines miles. Anyone can swing that as a minimum spending requirement!

The only drawback? Barclays is a conservative bank. And will only give you one, maybe 2 cards per year. So once you fill your Barclays slot, that’s it for a while.

That’s not a huge concern because most of their cards are pretty terrible. But they have a Wyndham, JetBlue, and Arrival card that are all decent, depending on your travel goals. I’d personally rather have = American Airlines miles, but totally get if you’re holding out for the 60,000 Arrival point bonus on the revamped Arrival Plus card.

In any regard, if you’re over 5/24, you can get a new Barclays bonus once (or sometimes twice) a year. Might as well go for it – no matter which one you choose.

Bottom line

There’s hope beyond Chase cards if you’re over 5/24. I recommend:

- Blue Business Plus Amex – learn more here – 10,000 Amex Membership Rewards points

- Capital One Venture Rewards – learn more or Capital One Spark Cash for Business – learn more – $500 toward travel

- CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® – Up to 60,000 American Airlines miles

- Hilton Surpass Amex – learn more here or Hilton small biz Amex – learn more here – for Hilton points

- Barclays AA Aviator Red card or Barclays AA Aviator small business card – 50,000 American Airlines miles

That’s 5 different banks with 6+ very different cards. Pick the one that’s most valuable to you, or one you haven’t had before.

The small business cards on this list do NOT count toward your 5/24 status. So if you’re hoping to fall under, there are options for that, too.

I’m done with Chase for the foreseeable future, as are many others. But that doesn’t mean the points & miles have to stop rolling in. On the contrary – there are still many worthwhile bonuses.

So these are my top 7! Will you pick up one of them? Or do you have another in mind for your next round of points?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m lol/24 but decided to risk the ritz Carlton card. Approval went fine….hoping no unhappy surprises!

I’m way on the fence about the new Hyatt card, but think I’m gonna give up the ghost. I haven’t opened a ton of new cards lately but don’t wanna risk losing all my Chase cards over one welcome offer. So torn!

What about Citi Premier? 50k points, first year AF waived. 3x travel/gas and 2x dining. I think this should be #1 for those who haven’t opened/closed a TYP card in last 24 months.

Yes! That’s another great one to add! Especially if you haven’t opened or closed any other ThankYou cards in the past 2 years.

http://o1.qnsr.com/cgi/r?;n=203;c=1651878/485404/223057;s=7273;x=2560;f=201803051527210;u=j;z=TIMESTAMP;src=639570

I already have BOFA Alaska card. Can I get another one or do/should I cancel existing one before applying for second? If cancelling existing one, what is recommended period to apply again after closing card?

If you want to keep it for any reason, reduce the credit limit to $5,000. Otherwise you can cancel. I’ve canceled and reapplied all within minutes and gotten approved again. They’ve gotten tighter, especially on the personal side. To be on the safe side, I’d wait at least 3 or so days before getting a new one after canceling.

Your photo of the American Express blue card is maybe the best photo of the see thru AmEx cards I’ve ever seen. The translucence is notoriously hard to photograph well.

Thank you, Joseph! That’s very nice of you to say.

“If you’ve opened OR closed a personal Citi AA card in the last 24 months, you can’t get another one. But, that rule doesn’t extend to the business card.” Citi business cards do still have the 24 month bonus restrictions, don’t they? Are you just saying that having a recent bonus from he personal card won’t prevent you from getting a bonus on the business card?

Yes, exactly. And vice versa, too.

Thank you for adding clarity to Citi’s rules!