Since Costco rolled out Apple Pay to all their stores, I’ve used my US Bank Altitude Reserve card to earn 3X points every time I shop there. That’s because this card earns triple points on mobile payments and travel purchases.

Each point is worth 1.5 cents toward travel (which you can redeem in real-time after they post!), so that’s like getting a 4.5% return on every shopping trip (3 X 1.5). With prices already low, this is an easy way to save even more.

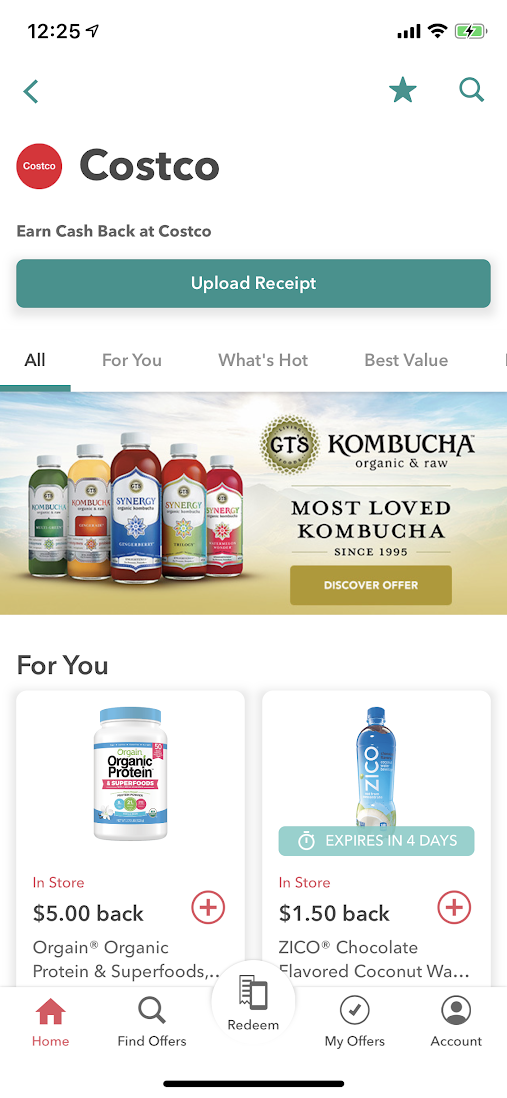

Plus, you can stack coupons through Ibotta for cashback when you buy certain items.

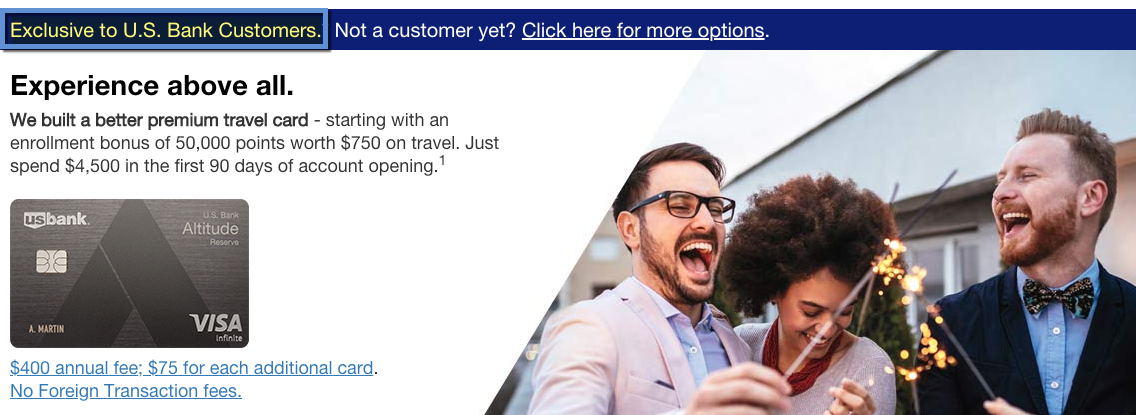

The card has a $400 annual fee, which easily pays for itself. The bigger issue is getting it in the first place – you need to have a “relationship” to even apply.

But there’s an easy and free workaround if you want to open this card.

Getting a 4.5% return on every shopping trip and mobile payment is awesome!

Here’s how to do it!

The easy way to get US Bank Altitude Reserve card approval

When you open the US Bank Altitude Reserve card, you’ll earn 50,000 points after you spend $4,500 in the first 90 days of account opening. Each point is worth 1.5 cents toward travel expenses, so you can get $750 worth of travel with this offer (50,000 X 1.5).

You also get:

- 3X points on travel and mobile payments

- $325 in annual travel credits

- 12 Gogo inflight wifi passes

- 1.5 cents per point in value toward travel

- Real-time points redemptions for travel through text

There’s a $400 annual fee. Between the travel credits, wifi passes (inflight internet is expensive!) and bonus categories, I’ve always come out ahead, even with the fee included.

Especially because I shop a lot at Costco and often use mobile pay. No other card earns this return in these categories.

You must already be a US Bank customer to get this card

But the Altitude Reserve is “exclusive to US Bank customers” who have had an account for a minimum of 5 business days. They define that as:

Checking or Savings account, Certificate of Deposit, Mortgage, Home Equity Loan, Home Equity Line of Credit, Auto/Boat/RV Loan, Personal and Small Business Loans and Lines, Commercial Loan & Lease, Premier Lines, Private Banking account or U.S. Bank credit card.

The checking account and credit card are the easiest options.

You could always open the U.S. Bank Cash+ Visa (learn more here), which has NO annual fee – or another no fee card – keep it open 5 days, then apply for the Altitude Reserve. But you probably don’t want 2 new cards.

So checking account it is.

US Bank checking accounts are FREE when you have a US Bank credit card

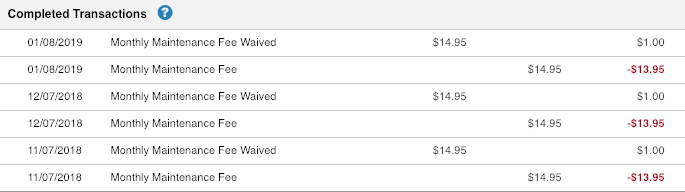

Typically, this checking account has a monthly maintenance fee of $14.95. I think that’s ridiculous, but having an US Bank credit card makes it free.

Open the checking account, let it sit for 5 business days, then apply for the Altitude Reserve

I’ve never used the account, personally. Although it’s actually a good checking account if you need one. I put $1 in the account to keep it active. And get the monthly maintenance fee waived.

You don’t have to use the account. Just put a little money in there to keep it open

So the easiest way to open the US Bank Altitude Reserve card would be to open this checking account, let it chill for 5 business days, then apply.

At that point, you will qualify to open the card and earn the sign-up bonus.

It’s not the most elegant solution, but it’s free and prevents you from opening 2 new credit cards (or taking out a loan).

The checking account waiver should kick in right away. At the very least, you might 1 month of maintenance fees – you could probably call and get it taken off – but I doubt that would happen. Worst case, you pay $15 for a month. Not so bad.

Ramp up your savings

- Link: Download Ibotta

- Link: Download Dosh

I highly recommend the Ibotta app for grocery shopping. All you do is activate offers on certain products and upload your receipt after you buy them.

And there are many featured items at Costco (and nearly every other grocery store). I’ve saved $100s in the years I’ve been using it.

Ibotta + Costco = more easy savings

And for shopping around town, I recommend the Dosh app. You just link your cards one time, then earn automatic cashback at participating retailers.

With both apps, you’ll get $5 free in your account if you use my links. ❤️

They’re an easy and free way to save on things you might plan to purchase anyway.

Bottom line

I’m gaga for my US Bank Altitude Reserve card, especially now that I can earn 3X points on Costco and mobile purchases, which equates to a 4.5% return toward travel.

Yes, the card has a steep $400 annual fee, but the perks easily make up for it. The other hurdle is you must have a prior relationship with US Bank (but only for 5 business days) to even apply.

That’s remedied when you open their Gold checking account, then apply for the card a business week later. The checking account will be free with the card, and will qualify you to apply for it. If you’re LOL/24 and looking for a new card offer, the 50,000 points you can earn are worth $750 toward travel.

And for saving on shopping in general, definitely check out Ibotta and Dosh. They’re an easy way to save more at Costco and on other regular purchases.

One final tip: when you check out at Costco (or anywhere), make sure to use a mobile payment – do NOT swipe your Altitude Reserve card or you’ll only earn 1X point. You must use your phone to pay to get the 3X.

Will you apply for the US Bank Altitude Reserve card? 🧿

Also see:

- 7 Tricks to Save EVERY Time You Shop at Costco

- 5 Apps to Effortlessly Save Money and Get Discounts (Set & Forget!)

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Maybe my math is bad but I don’t see how $325 in travel credits offsets $400 AF.

My family spends about $3k a year at Costco which barely offsets the Executive Membership AF premium. I’m betting that’s pretty typical. So I would get 2x bonus points worth $90 under your valuation. Does not appear to be a keeper past the signup bonus. CNB Crystal has much better perks

You’re right, the $325 travel credit only partially offsets the annual fee. I value the Gogo wifi passes for at least $10 each (though they usually cost much more) and use them fairly often. So that’s another $120. Plus you get 3X on all mobile payments – so the value of those points, combined with the other perks, offsets the annual fee.

You’d get 3X points at Costco. Spending $3K would get you $135 in travel ($3,000 X 3 X 1.5). And you could use it for other mobile payments throughout the year.

The CNB Crystal Infinite is a great deal, but the bank has very few branches and you can’t apply online – only in-branch. If you can get it, that’s great! The USB card has a much lower barrier to entry for many folks.

Thanks for reading and commenting! 🙂

I’ve got the blue business plus and the Ink unlimited, as well as the preferred platinum B of A premium rewards. So I have a lot of high earning ordinary spend cards. Yet I still put 13k on the card this past year which easily made up for the $75 effective annual fee. I also will have used 9/12 Gogo passes allotted to me. So for me, renewing was an easy decision. But I’ll reassess as always every year when the AF comes due.

Absolutely, Steve! Best way to do it! If a card becomes no longer useful, it’s out. I agree with you, I’ll keep it for as long as it’s useful. So far, I’m getting my money’s worth. And the Costco shopping is a nice cherry on top.

You have a lot of good rewards cards. Keep rocking and rolling. Thank you for sharing your thoughts!

Do you know if they allow ppl to open checking accounts with a NYC address?

I tried to open one online (denied) and in branch and in CA last year when I was on a trip and they also didn’t allow me to open it.

With the Amex Gold now offering 4x (and the Citi Prestige now at 5x), I didn’t really feel like I was really missing out on much.

Hey Danny! It should be possible. I’m in Texas and there are NO US Bank branches in the entire state. I was able to open it with no issues. Perhaps try again and call if you run into trouble?

The 4X and 5X with those cards are on dining, but the 3X with USB Altitude Reserve is for mobile payments (and travel). So it could still be a worthwhile bonus category, depending on your spending patterns. I’d say try one more time, and if it doesn’t work, you have some great cards already anyway.

It’s really 4.5X effective mobile spend as you can book any fully refundable flight with points and then cancel. Refund goes back as cash to card, not to points. That’s why this card is truly unique.

😉

@ Mike Lynch

Looking to apply for the card, but hesitant as I hear there are minimums for real time rewards and the portal is not great. If I could get cashback via refundable flight, that would make the card well worthwhile.

Is it possible to do a product upgrade from a same brand usbank card? If so, will there be a hard pull with USBANK, I don’t really care about the signup bonus.

You know, I’m not sure. My guess is maybe because I was able to downgrade my Club Carlson card. There was no hard pull when I did that. It’s 100% worth a call. Make sure the agent confirms there will be no hard pull. If you try it, I’d love to know if you were successful!

I tried repeatedly a month ago and it’s not possible to upgrade any card to an Altitude Reserve as it’s considered a separate class of product.

Never had a hard pull when product changing between US Bank cards. When I called it was still possible to product change any non co-brand e.g. FlexPerks to Cash+.

Whats your Dosh referral code? I want to give you credit when I sign up.

Hey Mac! It’s “HARLANVAUGHN1” – thank you so much for asking ahead. That’s incredibly thoughtful and I really appreciate it. I really like using the Dosh app!

Once the $325 travel credits are used up, can the points also be used for Uber and Lyft charges too?

Yes! As long as the charges are over the minimum threshold amount that you set – $10 is the minimum for most categories, including Uber and Lyft. I have used it for Uber rides before – even works when you add money to your account for future rides.

Does the Walmart Pay app also get 3x points?

I don’t think so. US Bank says: ““Mobile wallet” is defined as the method of paying for a transaction by use of a mobile device (in-store, in-app or online) and includes ApplePay®, Samsung Pay, Google Pay™, Microsoft Wallet.”

So it sounds like it’s only for those 4 services. At least that’s my interpretation.

I think US bank has a thing if you have a good credit score you get a free checking account. That’s what I have! https://www.usbank.com/bank-accounts/checking-accounts/credit-score-checking-account.html

How cool is that?! Thank you so much for sharing this, Josh!

No problem!

This is a good card in all the ways Harlan said above. I would just like to point out the Bank of America Cash Rewards card, which should be available nationwide, gets 2% on warehouse stores. It’s a Visa card, so it can be used at Costco as well. If you have a BoA checking account, you get an extra 10% for 2.2% total. If you keep money with BoA or Merrill Edge/Lynch, you can get a bonus of 25-75%. (This is instead of the 10%, you don’t get both.) If you have the Preferred Rewards top tier of 75%, you then get 3.5% (2 * 1.75) at warehouse stores up to $2500/quarter. BoA has upped their sign-up bonus on this card to $200 when you spend $500 in 90 days. It has no annual fee. If you get 2.2% from Cash Rewards at Costco, the extra bonus on US Altitude Reserve is 2.3%. If you take a $75 AF ($400-$325 travel credit), you have to spend $75/.023 = $3260.87/year on the card to make it worth the fee. If you are at the top tier bonus of 75%, then it’d be $75/.01 (4.5%-3.5%) = $7500/year.

You can decide what’s in your best interest. I haven’t been overly tempted to get this card because I have cards like BoA Cash Rewards, Premium Rewards, OBC, and Citi Prestige.

How did you get approved for a checking account while living in Texas? I live in Houston, TX and they denied me due to location.

Hmmm, I have no idea! This was a couple of years ago by now, so maybe they were more lenient back then. But yeah, didn’t have any issues opening the account online.