There are apps you can set up once – and then, if you want, never look at them again. Even better, these apps earn credits for gift cards, get you refunds, or award cashback for setting them up.

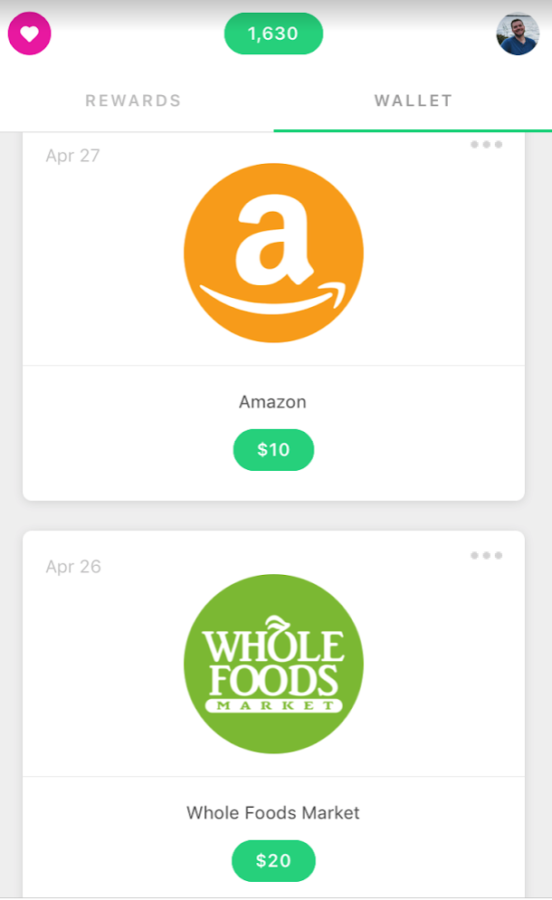

I turn Drop points into Whole Foods gift cards and get free groceries – just for keeping the app installed

I’ve gotten free groceries and Amazon gift cards, deposits into my checking account, and credits on my cards – all from having these apps on my phone.

Here’s an overview. And how they save you money without any ongoing effort.

5 best apps to save money

1. Drop

- Link: Get Drop

Drop was the app that got me into “set it and forget it” mode. Since November 2017, I’ve earned over $100 in Drop points, which you can redeem for gift cards to stores including:

- Amazon

- Whole Foods

- AMC

- iTunes

- Sephora

- Best Buy

When you sign up, you’ll pick 5 stores where you want to earn ongoing Drop points. I picked Uber, Starbucks, Whole Foods, Trader Joe’s, and Amazon.

After you plug-in your bank information, you’ll earn Drop points every time you spend at selected merchants. The app scans your purchases and awards points automatically.

1,000 Drop points = $1. And you can redeem for a gift card starting at the $5 mark (5,000 Drop points).

Plus, they have tons of promotional offers. I wrote about how I got $50 in gift cards for letting someone walk my dog. And other promotions have included 2X Drop points for Plastiq payments.

I earn a few hundred points here and there. Then peek in every once in a while to see how many accumulated. I’m always surprised at how many I have. But then again, I shop at Amazon a lot and grab the occasional coffee at Starbucks.

I love redeeming for Amazon and Whole Foods gift cards. They’re issued within minutes after you redeem.

Once you set up Drop, let the points roll in. You can check every so often to add more offers or see how many points you have from setting it up one time.

2. Earny

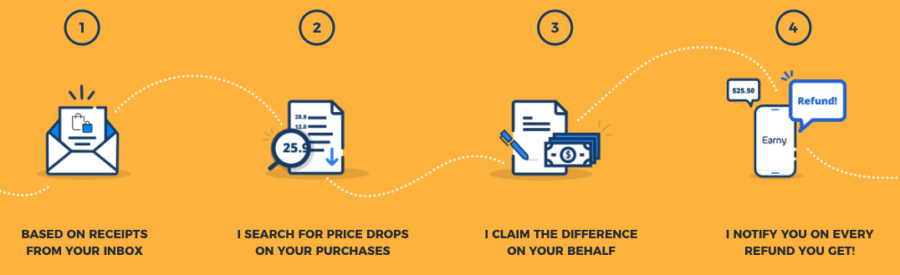

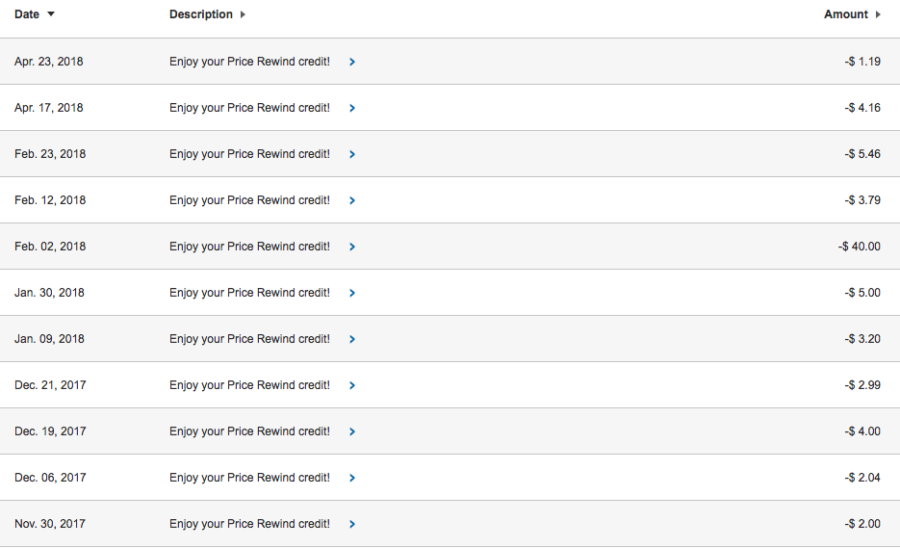

I wrote about how Earny works. If your Visa or MasterCard credit card offers price protection, Earny will detect price changes from receipts in your email inbox and file a claim – with NO effort required on your part.

Most major banks are supported.

Earny tracks purchases from:

- Amazon

- Best Buy

- Bloomingdale’s

- Carter’s

- Costco

- The Gap Group including Gap, Banana Republic, Old Navy, Athleta, and factory stores

- Home Depot

- J.Crew

- Jet

- Kohl’s

- Macy’s

- Newegg

- Nike

- Nordstrom

- Overstock

- Sears

- Staples

- Target

- Walmart

- Zappos

I plugged in my Citi AT&T Access More card because it earns 3X Citi ThankYou points for online shopping.

Since I set it up, I’ve gotten ~$74 back from random purchases – with zero effort. In return for Earny’s services, they take back 25% of whatever they save you. Considering it’s automated and money I would’ve never seen otherwise, that seems fair.

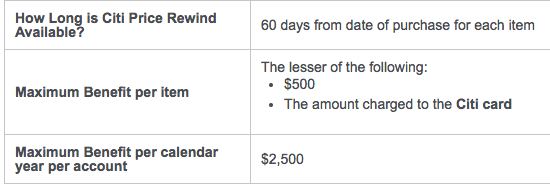

Moving forward, I’m putting the bulk on my shopping on Citi cards to take advantage of Citi Price Rewind, which comes with all their personal credit cards.

Citi puts the onus on you to register your purchases – but Earny also does that for you automatically.

The reason I switched to Citi cards is because Chase dropped price protection on all their cards. If you shop online a lot, Earny is a must-have.

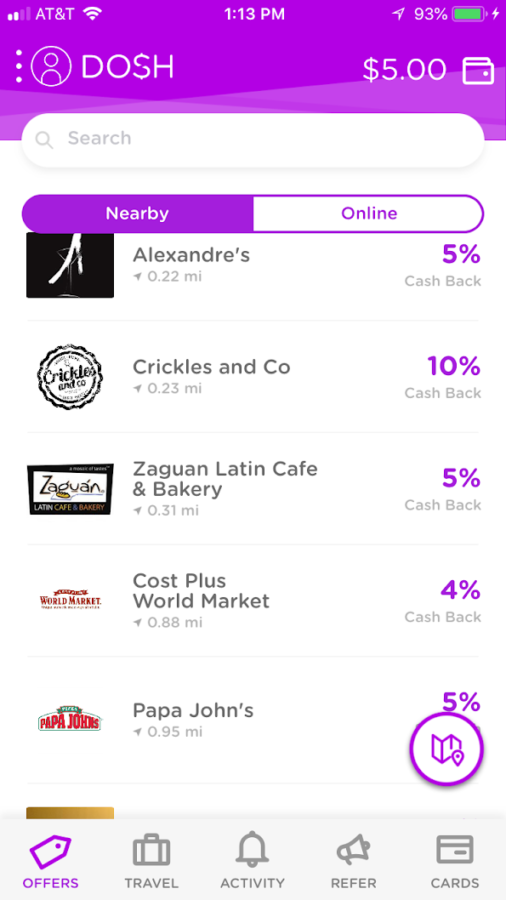

3. Dosh

- Link: Get Dosh

Dosh earns cashback at local restaurants and a few big box merchants (including Sam’s Club, Payless, World Market).

What’s cool is you can often double-dip and get miles from airline dining programs AND cashback from Dosh.

Cash out when you get $25 in your account – the money is transferred to your debit or credit card. Lots of restaurants offer 5% or 10% cashback. So depending on how often you dine out, you can get cash in your checking account or a credit on your card pretty fast.

Dosh is free to have and use. I don’t dine based on what’s on Dosh. But every once in a while, I’ll get a ping that I earned cashback for eating out, which is always a nice surprise. Plus you get $5 in your account just for signing up. Link your cards once and let the cash roll in. Set it and forget it.

4. Acorns

Acorns is a micro-investing service that charges $1 per month to manage your investments. They have built-in features like Round-Ups and Found Money that help you save, in addition to automatic transfers from your checking account.

- Round-Ups does just that – rounds up your purchases to the nearest dollar amount and sends it to your investment account

- Found Money is free money for linking a debit or credit card and spending at certain merchants

You just have to link your card once. Then, when you spend at partner merchants, you’ll get a deposit into your investment account.

So far, I have ~$800 saved, which is pretty cool. The idea is to invest for the future – and I have my portfolio set to Aggressive.

A few of Acorns’ Found Money partners

But you don’t have to select stocks. As part of the service, Acorns figures all that out for you.

It’s a fun account with a great app full of tools to help you learn and grow. Here’s $5 free when you download it and set it up.

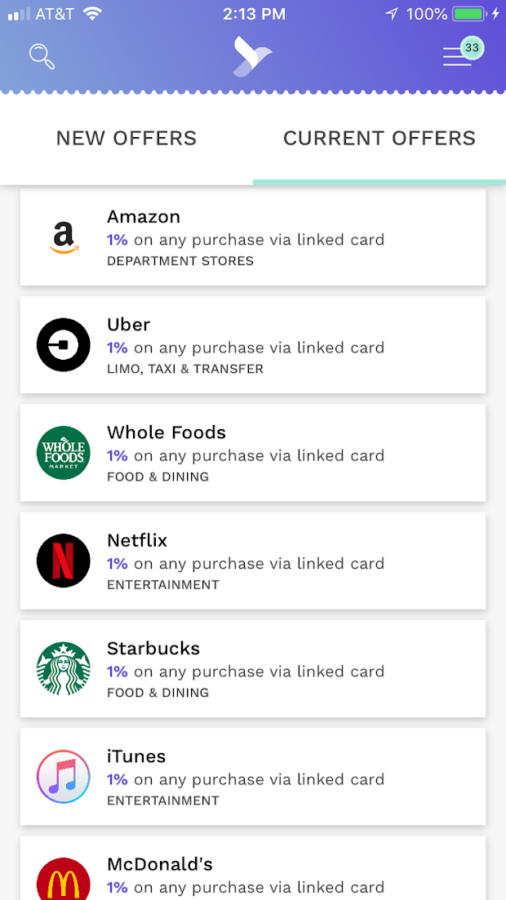

5. Spent

- Link: Get Spent

Spent works a lot like Drop – and lets you earn at many of the same merchants. But instead of gift cards, you redeem for cash to your PayPal account once you earn $20.

A big part of the app is the shopping portal. But you can add your cards to automatically earn 1% back at 10 merchants:

- Amazon

- Uber

- Whole Foods

- Netflix

- Starbucks

- iTunes

- McDonald’s

- Lowe’s

- Walgreens

- 7-Eleven

You can get 1% cashback from Netflix, Uber, Walgreens, and other popular stores after linking your cards, then let the points build. Plus, you get $10 for signing up, so you should reach the $20 cashout threshold pretty quickly.

The app is free to have and use. Free cash money for adding cards and offers to your account one time.

Bottom line

These 5 apps have gotten me free gift cards, credits from price protection, and cashback from normal spending. I didn’t go out of my way to earn any of it. Once you set them up, you don’t have to check again – earning rewards is effortless. And every little bit helps.

To that end, there’s no reason to turn down free cash, merchandise, or credits – unless the data collection piece bothers you. All you have to do is spend a few minutes setting up your accounts. Then never think about them again, except to see if you can redeem for rewards.

Drop in particular has great offers you can activate if you want – so I open that one most often (but you certainly don’t have to). I literally never look at Earny – just see the credits on my cards. There’s also no reason to ever check Spent or Dosh, except to redeem for cash.

And Acorns earns money and automatically invests it for you. How cool is that?!

Some apps (like Ibotta) require you to constantly interact. But these are easy and effortless.

Which is your fave? Are there other easy rewards apps you like better?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

[…] 4 apps to effortlessly save money and get discounts (set & forget!) – Harlan and I share a love of personal finance and finding simple, yet effective, ways to save money. When you can save automatically, that is even better! I’ve written about Dosh and Earny, but haven’t tried out the others. I’ll definitely be signing up. […]